Hard Coatings Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| CAGR | 8.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

Major Players*Disclaimer: Major Players sorted in no particular order |

Hard Coatings Market Analysis

The market for hard coatings is expected to grow at a CAGR of more than 8% during the forecast period. Major factors driving the market studied are rapidly growing demand from healthcare sectors and increasing usage of hard coatings in developing nations.

- On the flip side, the high capital requirement is likely to hinder the market over the forecast period.

- Asia-Pacific dominated the market across the globe with the largest consumption from countries such as China and India.

Hard Coatings Market Trends

This section covers the major market trends shaping the Hard Coatings Market according to our research experts:

Optics Segment to Dominate the Market

- The optical industry is one of the major users of hard coatings. Usually, lenses and other optical components use soft coatings, but with the development of high performing techniques, such as hard coating, the use of soft coating becomes obsolete.

- Hard coating provides numerous advantages over soft coating. Hard coatings remain constant for several years after continuous use, while soft coated lenses and optical components show change over time. Hard coatings are scratch resistant, durable, anti refractive, and anti-fog, and increase longevity.

- The major countries contributing to the revenue of the spectacle lenses market included the United States, Germany, France, Italy, the United Kingdom, Spain, Netherland, Canada, etc.

- In 2018, the revenue from spectacle lenses in the United States, Germany, France, Italy, United Kingdom was about USD 12,187.75 million, USD 5104.58 million, USD 4393.27 million, USD 3528.32 million, and USD 3020.38 million respectively.

- Aforementioned factors are likely to increase the demand for hard coatings market in the forecast period.

United States to Dominate the North America Region

- Hard coatings in the United States are used in many industries, such as buildings and construction, automotive, general manufacturing, transportation, etc.

- In buildings and construction industry, hard coatings can be used for interior or external decorative purposes. The demand for various resistance coatings, such as scratch, electrical, hardness, and wear is, in turn, increasing the demand for the market studied.

- Furthermore, the United States is the second-largest producer and seller of commercial vehicles and cars. With the increase in electrical vehicles production in the United States, the demand for hard coatings is likely to increase.

- The growing awareness regarding the benefits of using hard coatings and the increasing demand for hard coatings for decorative coatings, cuttings tools, etc., are anticipated to encourage the growth of the United States market throughout the forecast period.

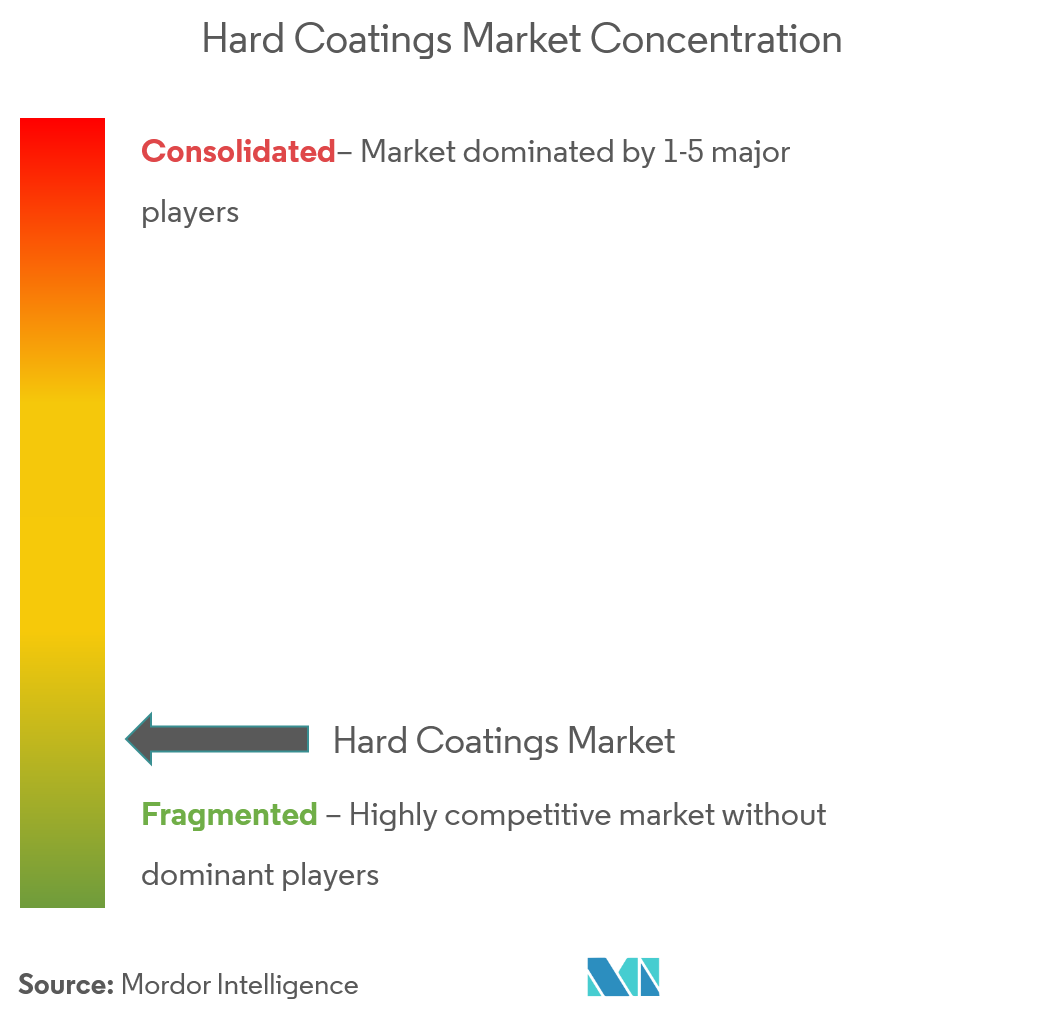

Hard Coatings Industry Overview

The hard coating market is fragmented. Some of the major companies dominating the market studied for its products, services, and continuous product developments are OC Oerlikon Management AG, IHI Ionbond AG, CemeCon, IHI Hauzer BV, and Sulzer Ltd, among others.

Hard Coatings Market Leaders

-

OC Oerlikon Management AG

-

IHI Ionbond AG

-

CemeCon

-

IHI Hauzer BV

-

Sulzer Ltd.

*Disclaimer: Major Players sorted in no particular order

Hard Coatings Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

-

4.1 Drivers

- 4.1.1 Rapidly Growing Demand from Healthcare Sectors

- 4.1.2 Increasing Usage of Hard Coatings in Developing Nations

-

4.2 Restraints

- 4.2.1 High Capital Requirement

- 4.3 Industry Value-Chain Analysis

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5. MARKET SEGMENTATION

-

5.1 Material Type

- 5.1.1 Carbon-based

- 5.1.2 Oxides

- 5.1.3 Nitrides

- 5.1.4 Carbides

- 5.1.5 Other Materials

-

5.2 Technique

- 5.2.1 PVD (Physical Vapor Deposition)

- 5.2.2 CVD (Chemical Vapor Deposition)

-

5.3 Application

- 5.3.1 Cutting tools

- 5.3.2 Decorative Coatings

- 5.3.3 Optics

- 5.3.4 Gears and Bearings

- 5.3.5 Other Applications

-

5.4 End-user Industry

- 5.4.1 Building and Construction

- 5.4.2 General manufacturing

- 5.4.3 Automotive

- 5.4.4 Transportation

- 5.4.5 Industrial

- 5.4.6 Other End-user Industries

-

5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East & Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**

- 6.3 Strategies Adopted by Leading Players

-

6.4 Company Profiles

- 6.4.1 ASB Industries, Inc.

- 6.4.2 Carl Zeiss AG

- 6.4.3 CemeCon

- 6.4.4 DhakeIndustries

- 6.4.5 DIARC-Technology Oy

- 6.4.6 Duralar Technologies.

- 6.4.7 Exxene Corporation

- 6.4.8 Gencoa Ltd

- 6.4.9 Hardcoatings, Inc.

- 6.4.10 IHI Hauzer BV

- 6.4.11 IHI Ionbond AG

- 6.4.12 Kobe Steel, Ltd

- 6.4.13 MBI Coatings

- 6.4.14 Momentive

- 6.4.15 OC Oerlikon Management AG

- 6.4.16 Platit AG

- 6.4.17 SDC Technologies, Inc

- 6.4.18 Sulzer Ltd

- 6.4.19 Ultra Optics

- 6.4.20 Voestalpine Eifeler Group

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityHard Coatings Industry Segmentation

The hard coatings market report include:

| Material Type | Carbon-based | |

| Oxides | ||

| Nitrides | ||

| Carbides | ||

| Other Materials | ||

| Technique | PVD (Physical Vapor Deposition) | |

| CVD (Chemical Vapor Deposition) | ||

| Application | Cutting tools | |

| Decorative Coatings | ||

| Optics | ||

| Gears and Bearings | ||

| Other Applications | ||

| End-user Industry | Building and Construction | |

| General manufacturing | ||

| Automotive | ||

| Transportation | ||

| Industrial | ||

| Other End-user Industries | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| Italy | ||

| France | ||

| Rest of Europe | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East & Africa | Saudi Arabia |

| South Africa | ||

| Rest of Middle East & Africa |

Hard Coatings Market Research FAQs

What is the current Hard Coatings Market size?

The Hard Coatings Market is projected to register a CAGR of greater than 8% during the forecast period (2024-2029)

Who are the key players in Hard Coatings Market?

OC Oerlikon Management AG, IHI Ionbond AG, CemeCon, IHI Hauzer BV and Sulzer Ltd. are the major companies operating in the Hard Coatings Market.

Which is the fastest growing region in Hard Coatings Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Hard Coatings Market?

In 2024, the Asia Pacific accounts for the largest market share in Hard Coatings Market.

What years does this Hard Coatings Market cover?

The report covers the Hard Coatings Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Hard Coatings Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Hard Coatings Industry Report

Statistics for the 2024 Hard Coatings market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Hard Coatings analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.