Hardware as-a Service Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 93.65 Billion |

| Market Size (2029) | USD 330.82 Billion |

| CAGR (2024 - 2029) | 28.71 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Hardware as-a Service Market Analysis

The Hardware-as-a-Service Market size is estimated at USD 93.65 billion in 2024, and is expected to reach USD 330.82 billion by 2029, growing at a CAGR of 28.71% during the forecast period (2024-2029).

The increasing need to adopt new IT solutions, increased digitization, increasing investment of small and large-scale enterprises in HaaS hardware and services, technical advancements and product innovation, and increasing load on cloud infrastructure are significant factors influencing the growth of the HaaS market.

- The Haas model is becoming popular for companies searching for new ways to service clients in a cutthroat market to acquire technology with little strain on their financial operations. The Haas approach is more cost-effective when it comes to firms that constantly repair or upgrade their gear. This service offers inexpensive managed solutions and includes maintenance and support as part of the leasing agreement. The hardware installation at the customer's location is agreed upon between the client and managed service provider (MSP), for which the client either pays a monthly charge for the service.

- The hardware as a service (HaaS) market is anticipated to develop as cloud platform penetration increases. The solutions are highly affordable, making them appropriate for small businesses. As a result, it will aid in expanding the worldwide HaaS (hardware as a service) sector.

- On-demand services (XaaS) are replacing ownership in several industries. As data storage servers and active computing gear make up a remotely provided service for consumers, cloud computing services also draw more investment in the sector under study.

- A fundamental barrier to the adoption of the HaaS model and a constraint on its expansion is a lack of understanding of the advantages provided by the hardware-as-a-service approach. As they are unaware of the advantages like lowering the cost of updating, maintaining, and replacing hardware, businesses in developing nations like India, China, Brazil, and Indonesia are less likely to adopt this service model.

- With the outbreak of COVID-19, service firms, particularly, have embraced the work-from-home culture. This has led to a spike in demand for laptops, mainly leased ones of every kind. But, with the complete disruption of the supply chain and production activities, there is a massive mismatch between the demand and supply of hardware components and a need for more in the market. With the situation normal in the coming few quarters, HaaS is expected to grow as it mitigates the risk of a complete business shutdown during unforeseen circumstances like the Covid-19 pandemic.

Hardware as-a Service Market Trends

Retail/Wholesale Sector Holds Largest Share in the Market

- The adoption of HaaS varies from industry to industry. Among all organizations, retail/wholesale organizations are found to have adopted the HaaS model to a more significant extent, followed by Education and Financial services sector. Retail/wholesale organizations have hundreds or thousands of stores spread worldwide, making it difficult for internal IT teams to service more remote areas.

- Spiceworks surveyed more than 1,100 IT decision-makers in organizations across North America and Europe to understand the penetration of the hardware-as-service model in the workplace. The survey showed that around 31% of retail/wholesale organizations already use the HaaS model (one or more types of devices). An additional 7% of the remaining retail businesses plan to adopt HaaS within the next two years. Part replacement, hardware support, and troubleshooting are some of this model's most commonly used services.

- During the pandemic, the retail sector was one of the deemed essential businesses in many countries that were allowed to stay open when other industries had to shut their doors. Due to the growing need for numerous hardware systems among retailers, wholesalers, supermarkets, and department stores, this industry is predicted to hold a significant position.

- The retail sector has seen a lot of investments and developments recently. Retail tech companies supporting the retail industry with services such as digital ledgers, inventory management, payments solutions, and logistics and fulfillment tools enhance the need for HaaS services.

Demand from Asia-Pacific is expected to Drive the Growth

- Asia is home to some of the fastest-growing economies, such as India and China. A large IT and Telecommunication industry workforce and many enterprises are expected to boost the demand for the hardware-as-a-service model.

- Furthermore, several life sciences and retail organizations, the rising number of small and medium-sized enterprises, and the increasing awareness of HaaS are expected to drive the market over the forecast period.

- With many small or mid-sized businesses in China, Taiwan, South Korea, India, and Japan, the Asia-Pacific region is expected to experience the highest growth rate during the forecast period since the HaaS model is a cost-effective method for optimal utilization of information technology hardware. Moreover, the region enjoys the presence of several significant vendors in the hardware market, thus driving the demand for HaaS.

- Hardware-as-a-service enables timely upgrade and maintenance of hardware and software, allowing companies to reduce IT burdens; moreover, it helps avoid technological obsolescence, ultimately enhancing productivity.

- Implementing hardware-as-a-service in the IT and telecommunication industries helps companies reduce IT budgets by providing reasonable rates for renting hardware, decreasing downtime, and adequately managing devices by giving security and software services.

Hardware as-a Service Industry Overview

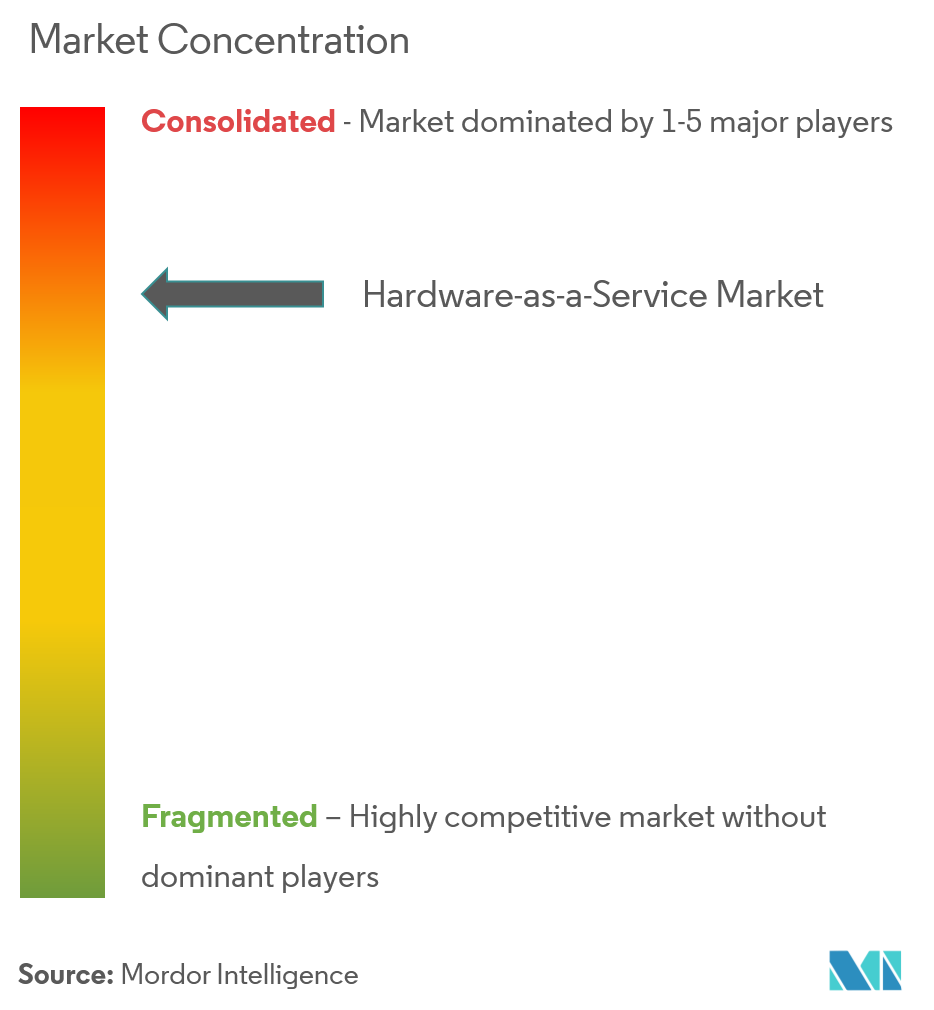

Few players with their product offerings currently dominate the HaaS market, and the global market is expected to be consolidated. Navitas Lease Corporation, FUSE3 Communications, Ingram Micro Inc., Design Data Systems Inc., Phoenix NAP LLC, Machado Consulting, Managed IT Solutions, Fujitsu Ltd, Lenovo Group Ltd, Amazon.com Inc., and Dell Inc. are some of the major players present in the market studied. Industry tech giants such as Google, IBM, and Microsoft also offer these services collaborating with startups to compete in this as-a-service market.

In September 2022, Ingram Micro Inc. reported that its digital experience platform ecosystem has launched on schedule in its two major markets, the United States and Germany, and it confirmed that the global "go live" schedule for the rest of the globe is early 2023. Participants saw the technology in use and learned that the Xvantage initial deployment is now taking place across Latin America.

In April 2022, Ingram Micro India won the distribution agreement with Digitate. Ignio from Digitate supports the transition from traditional IT operations to autonomous IT operations, providing better business outcomes, increased resilience, agility, and greater customer service. To assist end-to-end autonomous enterprises that leverage cutting-edge Machine Learning (ML) and Artificial Intelligence (AI) capabilities to deliver contextual intelligence to IT operations, Ingram Micro India will offer Digitate's whole portfolio.

Hardware as-a Service Market Leaders

-

FUSE3 Communications

-

Managed IT Solutions

-

Ingram Micro

-

Machado Consulting

-

Navitas Credit Corp

*Disclaimer: Major Players sorted in no particular order

Hardware as-a Service Market News

- Sept 2022: Vertiv, a global provider of critical digital and continuity solutions, announced that it had expanded its go-to-market relationship with Ingram Micro Inc., a global technology business leader, to cover Singapore, Malaysia, and Thailand to sell Vertiv's enhanced suite of edge-ready products and comprehensive portfolio of IT technologies and services. This includes Vertiv's Geist rack power distribution units (rPDU), Liebert uninterruptible power supplies (UPS), Liebert rack cooling systems, and dedicated software and services for regional partners and customers.

- Aug 2022: Berlin-based FinTech company Topi raised USD 45 million to support the expanding hardware-as-a-service trend. With the help of this investment, businesses may now offer their clients subscription-based services for computers, displays, cell phones, printers, and other devices.

Hardware as-a Service Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

-

4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Assessment of the impact of COVID-19 on the Market

-

4.6 Market Drivers

- 4.6.1 Growing Deployment of Cloud Platform

- 4.6.2 Increase attraction of Investments

-

4.7 Market Challenges

- 4.7.1 Lack of Awareness of benefits from HaaS Model

5. MARKET SEGMENTATION

-

5.1 By Offering

- 5.1.1 Hardware Model

- 5.1.1.1 Platform-as-a-Service

- 5.1.1.2 Desktop/PC-as-a-Service

- 5.1.1.3 Infrastructure-as-a-Service

- 5.1.1.4 Device-as-a-Service

- 5.1.2 Professional Services

-

5.2 By End-User Industry

- 5.2.1 Retail/Wholesale

- 5.2.2 Education

- 5.2.3 BFSI

- 5.2.4 Manufacturing

- 5.2.5 Healthcare

- 5.2.6 IT and Telecommunication

- 5.2.7 Other End-User Industries

-

5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Navitas Lease Corporation

- 6.1.2 FUSE3 Communications

- 6.1.3 Ingram Micro Inc.

- 6.1.4 Design Data Systems, Inc.

- 6.1.5 Phoenix NAP, LLC

- 6.1.6 Machado Consulting

- 6.1.7 Managed IT Solutions

- 6.1.8 Fujitsu Ltd.

- 6.1.9 Lenovo Group Ltd.

- 6.1.10 Dell Inc.

- 6.1.11 Microsoft Corporation

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityHardware as-a Service Industry Segmentation

Hardware belonging to a managed service provider (MSP) is deployed at a customer's location as part of the hardware-as-a-service (HaaS) procurement model, comparable to leasing or licensing. A service level agreement (SLA) outlines the obligations of both parties.

The Hardware-as-a-Service (HaaS) Market is segmented by Offering (Hardware Model and Professional Services), End-user Industry (Retail/Wholesale, Education, BFSI, Manufacturing, Healthcare, and IT and Telecommunication), and Geography. The market sizes and forecasts are provided in terms of value in USD for all the above segments.

| By Offering | Hardware Model | Platform-as-a-Service |

| Desktop/PC-as-a-Service | ||

| Infrastructure-as-a-Service | ||

| Device-as-a-Service | ||

| By Offering | Professional Services | |

| By End-User Industry | Retail/Wholesale | |

| Education | ||

| BFSI | ||

| Manufacturing | ||

| Healthcare | ||

| IT and Telecommunication | ||

| Other End-User Industries | ||

| By Geography | North America | United States |

| Canada | ||

| By Geography | Europe | Germany |

| France | ||

| United Kingdom | ||

| Rest of Europe | ||

| By Geography | Asia Pacific | India |

| China | ||

| Japan | ||

| Rest of Asia Pacific | ||

| By Geography | Rest of the World |

Hardware as-a Service Market Research FAQs

How big is the Hardware-as-a-Service (HaaS) Market?

The Hardware-as-a-Service (HaaS) Market size is expected to reach USD 93.65 billion in 2024 and grow at a CAGR of 28.71% to reach USD 330.82 billion by 2029.

What is the current Hardware-as-a-Service (HaaS) Market size?

In 2024, the Hardware-as-a-Service (HaaS) Market size is expected to reach USD 93.65 billion.

Who are the key players in Hardware-as-a-Service (HaaS) Market?

FUSE3 Communications, Managed IT Solutions, Ingram Micro, Machado Consulting and Navitas Credit Corp are the major companies operating in the Hardware-as-a-Service (HaaS) Market.

Which is the fastest growing region in Hardware-as-a-Service (HaaS) Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Hardware-as-a-Service (HaaS) Market?

In 2024, the North America accounts for the largest market share in Hardware-as-a-Service (HaaS) Market.

What years does this Hardware-as-a-Service (HaaS) Market cover, and what was the market size in 2023?

In 2023, the Hardware-as-a-Service (HaaS) Market size was estimated at USD 72.76 billion. The report covers the Hardware-as-a-Service (HaaS) Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Hardware-as-a-Service (HaaS) Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Hardware as-a Service Industry Report

Statistics for the 2024 Hardware as-a Service market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Hardware as-a Service analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.