Hemp Protein Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 15.20 % |

| Fastest Growing Market | Europe |

| Largest Market | North America |

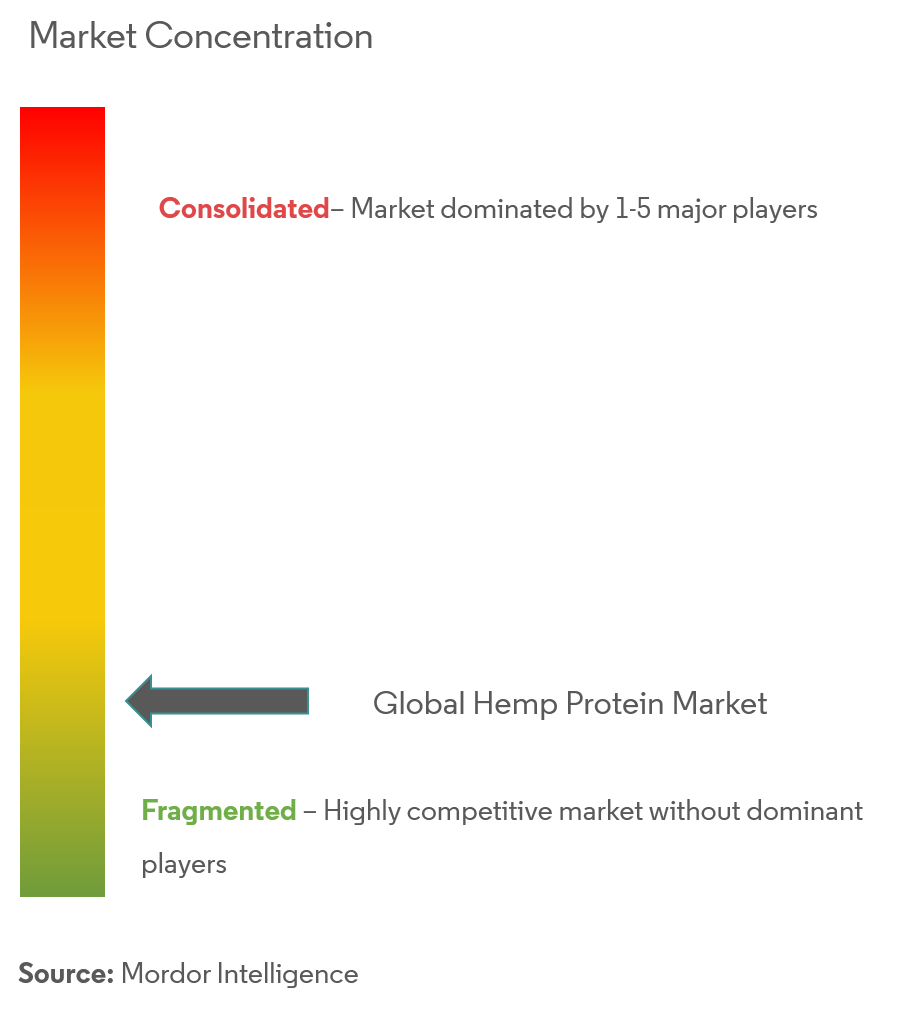

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Hemp Protein Market Analysis

The global hemp protein market is projected to grow at a CAGR of 15.2% during the forecasted period 2019-2024.

- Hemp has many special characteristics that makes it different in the plant industry. One of them is,Its DNA structure is closely aligned with human DNA and hence, as a food source, it nourishes the body in a perfect proportion.

- Hemp is naturally gluten free, non GMO, free of trypsin inhibitors, and virtually free of any form of residual chemicals. Hemp protein is highly nutritious and easily digested.

- Hemp protein is the industrial by- product of hemp seeds.

- The hemp protein in powdered form is having high demand as compared to the liquid form due to increased shelf life, convenience, and other associated factors.

Hemp Protein Market Trends

This section covers the major market trends shaping the Hemp Protein Market according to our research experts:

Increased Demand for High Quality, Plant Based and Safe Protein Source

Animal based proteins has been undergoing various controversies during the past years, regarding the carcinogenicity regarding the red meat and the antibiotic residues found in meat. The emerging trend of veganism has also helped in rising the revenue of the market. In addition minimally processed and chemical-free consumption patterns has also opened an oppprtunity for the market. Studies has also shown that consuming plant based protein can help in reducing the risk of diseases such as cardiovascular diseases and cancer. Moreover it has various other benefits such as immune-system booster, weight suppressant, and its ability to lower blood pressure and cholesterol. Additionally hemp protein has the highest percentage of protein as total weight, thus it can be considered as a suitable substitute for animal protein.

North America Emerges as Major Market for Hemp Protein

The United States is leading market for hemp protein in the North American region. The major advancement for hemp industry in the United States came in 2014 with the passage of the US Farm Bill that allowed states to conduct hemp pilot programs. However the federal government permission is still the mandatory requirement. Since hemp is also from the same species of plant, Cannabis sativa, as marijuana, its production in the United States is restricted. The ease of regulations will provide further impetus to overall hemp protein market in the United States. JD Farms is one of the major and the first legal hemp farm in New York.

Hemp Protein Industry Overview

Global hemp protein market is a fragmented market with the presence of various players. Leading manufacturers in the hemp protein market focus to leverage opportunities posed by emerging economies like India and China to expand their revenue base. Companies are increasingly incorporating hemp protein in their products like nutrition bars, tortilla chips, pretzels, and beer.

Hemp Protein Market Leaders

-

North American Hemp & Grain Co. Ltd

-

Aurora Cannabis (Hempco Food and Fiber Inc.)

-

Navitas LLC

-

Hemp Oil Canada Inc

*Disclaimer: Major Players sorted in no particular order

Hemp Protein Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Source

- 5.1.1 Organic

- 5.1.2 Conventional

-

5.2 By Application

- 5.2.1 Functional Food

- 5.2.2 Functional Beverge

- 5.2.3 Dietary Supplements

- 5.2.4 Pharmaceuticals

- 5.2.5 Personal Care

- 5.2.6 Other Industrial uses

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of MEA

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Hemp Oil Canada Inc

- 6.4.2 Navitas LLC

- 6.4.3 North American Hemp & Grain Co. Ltd

- 6.4.4 Aurora Cannabis (Hempco Food and Fiber Inc.)

- 6.4.5 Fresh Hemp Foods Ltd. (Manitoba Harvest Hemp Foods)

- 6.4.6 Naturally Splendid Enterprises Ltd.

- 6.4.7 GFR Ingredients Ltd.

- 6.4.8 Green Source Organics

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityHemp Protein Industry Segmentation

Global hemp protein market is segmented by source into organic ad conventional;by application into functional food, functional beverage, dietary supplements, pharmaceutical, personal care and other industrial uses.Also, the study provides an analysis of the functional flour market in the emerging and established markets across the globe, including North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

| By Source | Organic | |

| Conventional | ||

| By Application | Functional Food | |

| Functional Beverge | ||

| Dietary Supplements | ||

| Pharmaceuticals | ||

| Personal Care | ||

| Other Industrial uses | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Russia | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | India |

| China | ||

| Japan | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East & Africa | South Africa |

| Saudi Arabia | ||

| Rest of MEA |

Hemp Protein Market Research FAQs

What is the current Global Hemp Protein Market size?

The Global Hemp Protein Market is projected to register a CAGR of 15.20% during the forecast period (2024-2029)

Who are the key players in Global Hemp Protein Market?

North American Hemp & Grain Co. Ltd, Aurora Cannabis (Hempco Food and Fiber Inc.), Navitas LLC and Hemp Oil Canada Inc are the major companies operating in the Global Hemp Protein Market.

Which is the fastest growing region in Global Hemp Protein Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Global Hemp Protein Market?

In 2024, the North America accounts for the largest market share in Global Hemp Protein Market.

What years does this Global Hemp Protein Market cover?

The report covers the Global Hemp Protein Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Global Hemp Protein Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Hemp Protein Industry Report

Statistics for the 2024 Hemp Protein market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Hemp Protein analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.