Hermetic Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 8.10 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

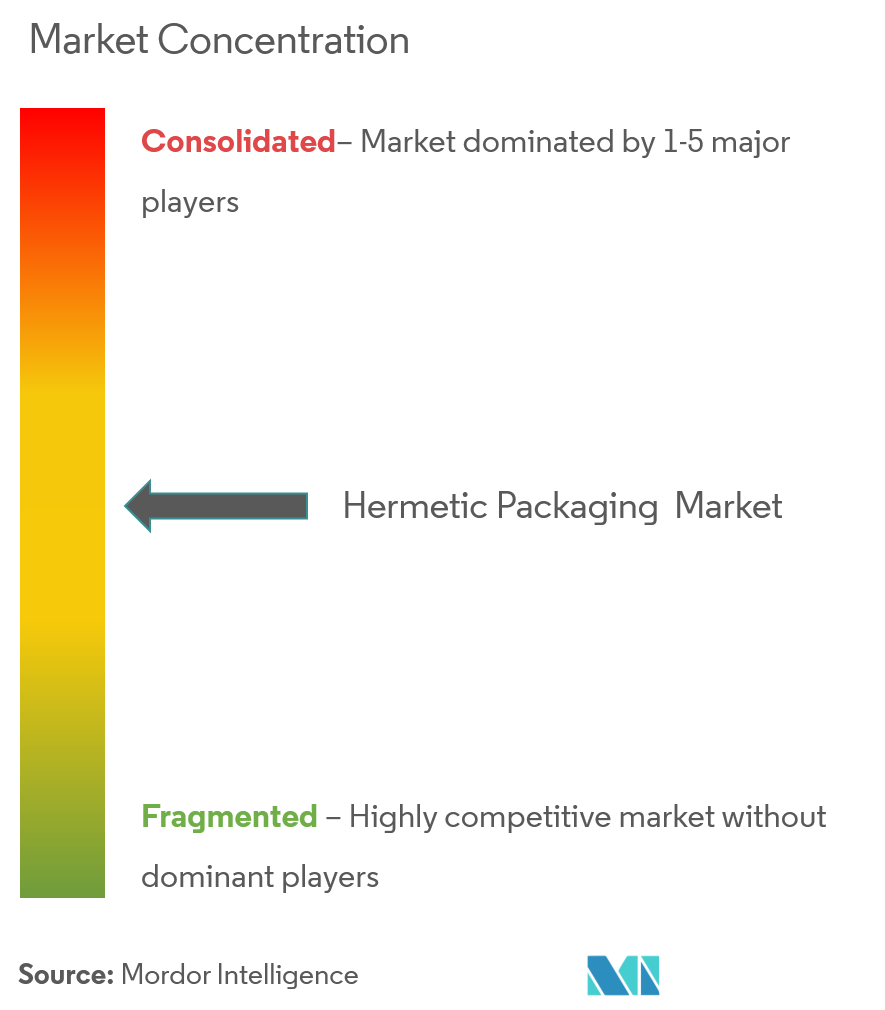

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Hermetic Packaging Market Analysis

The Global Hermetic Packaging Market was valued at USD 3.41 billion in 2020, and it is expected to reach USD 5.31 billion by 2026, at an estimated CAGR of 8.1%, from 2021 to 2026. The hermetic packaging market is among the industries that are affected by the Covid-19 pandemic. According to the Semiconductor Industry Association, after the Q4 of 2020, the semiconductor industry started recovery. Despite logistical challenges related to the coronavirus, semiconductor facilities located in Asia-Pacific continued to function normally with high-capacity rates. Moreover, in various countries, such as South Korea, most semiconductor operations continued uninterrupted, and chip exports grew by 9.4% in February 2020.

- Hermetic packaging is a requirement for all applications where electronic components must be protected from corrosive environments to ensure acceptable service life. Extremely high reliability is required for space electronics, often utilizing hermetic packages. Metal packages with glass to metal seals are the common solution for low to medium power levels. Due to poor thermal conductivity and limited electric conductivity of metals used in standard hermetic packages, direct bond copper solutions have been developed.

- Electronic plastic packages can survive 20 years in clean environments at lower temperatures. The same can fail in a few days in a corroding atmosphere at higher temperatures or higher pressure. The protection of encapsulated electronics is important for the permittivity of gases of the materials used for packaging. The difference of gas permittivity span over orders of magnitude for plastics on the side and glass/ceramic and metals on the other side.

- Further, hermetic packaging technologies that prevent internal components from reacting with oxygen or moisture in the air are critical for numerous microscale technologies, including sensors, batteries, super-capacitors, energy harvesters, and other energy systems. Creating suitable packaging strategies for these microscale technologies is of growing importance as the markets for these devices continue to increase.

- The micro battery market, for example, is expected to grow nearly five times between 2019 and 2025 as a result of electric vehicles, a new Internet of Things (IoT), and medical devices. Still, current hermetic packaging technologies limit micro battery energy densities to a fraction of macroscale batteries. One reason for the divergent energy densities of micro-and macroscale batteries is that widely used macroscale hermetic packaging technologies cannot be directly applied to micro-batteries as the packaging dominates the volume and mass of the internal components.

Hermetic Packaging Market Trends

This section covers the major market trends shaping the Hermetic Packaging Market according to our research experts:

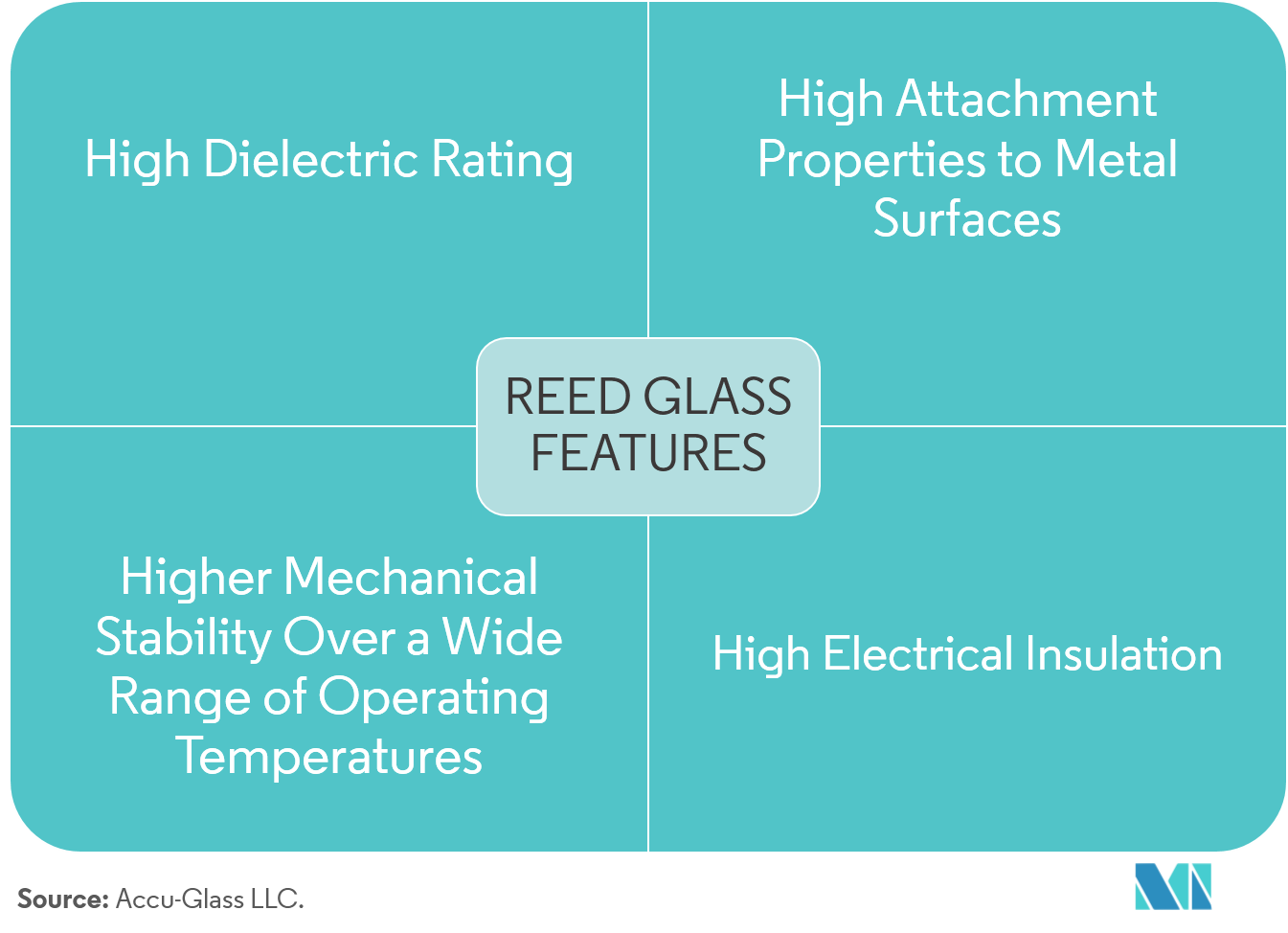

Reed Glass is Expected to Hold Significant Share

- Reed Glasses provide Highly reliable encapsulation of reed switches over millions of switching cycles.

- The numerous electronic applications involve using Glass tubes where some discrete electronic components demand protection, isolation, or being sealed. However, the function of this glass many a time is to insulate passive components electrically, or it functions as a hermetic seal.

- Reed glass has found its applications in the centralized locking systems of automobiles, as switches in hot water boilers or as belt sensors. The reed switches, without any mechanical influence from the outside, opens and closes the electrical circuits.

- Contact is established when a weak magnetic field presses two metal contact blades together inside a thin glass tube. A reed switch, when in resting-state, does not require power which makes this important for the devices consuming very little power.

- As they possess no mechanical control, reed switches can handle millions of make-and-break cycles without any wear.

- The metal blades should be free of dust and hermetically sealed inside the glass tubes with inert gas with high tolerances to ensure functionality.

North America is Expected to Hold the Largest Share

- The increased government spending on the aerospace and defense sector by the government in the region is expected to boost the hermetic packaging market over the forecast period. Also, the aviation industry fuels the demand for hermetic packaging owing to its reliance on new aircraft, thereby strengthening the hermetic packaging industry. In 2020, the US military expenditure reached an estimated USD 778 billion, representing an increase of 4.4 % over 2019. (source: SIPRI).

- The increased consumer spending in consumer electronics, coupled with the increased penetration of smart communication devices like smartphones, is expected to fuel the demand for hermetic packaging over the forecast period. Based on the projected retail sales for 2021, consumer electronics retail sales in the United States reached USD 442 billion. Smartphones were the products accounting for the largest retail revenue within the consumer electronics sector, comprising USD 79 billion in 2020. (source: Consumer Technology Association).

- Apart from this, the United States is home to some of the world's major automotive players, investing in electric vehicles and in the self-driving potential of cars, which demand high-performance ICs. Approximately 17.5 million advanced driver assistance systems (ADAS) were manufactured in the United States alone during 2016. By 2021, that number is expected to increase by about 1.5 million units. (source: AMETEK). The automotive industry uses hermetic to ensure sensor functionality in rollover devices and airbag equipment. Hence, with the increasing airbag equipment, the market would potentially demand hermetic packaging.

- This is one of the major factors to drive the demand for the semiconductor silicon wafers market. For instance, in December 2020, Group14 Technologies, a global provider of silicon-carbon composite materials for lithium-ion applications, secured USD 17 million in Series B funding led by SK materials.

Hermetic Packaging Industry Overview

The competitive rivalry in the hermetic packaging market is quite high owing to the presence of some key players such as Schott AG, SGA technologies, Kyocera and many more. Their ability to continually innovate their products and services has allowed them to gain a competitive advantage over other players. Through strategic partnerships, mergers & acquisitions and research and development activities the players are able to attain a strong foothold in the market.

- April 2020 - The NanoRetina announced successful preliminary results for its NR600 Artificial Retina Device using SCHOTT Primoceler's glass laser bonding technology. NanoRetina has taken a monumental step forward in establishing its retinal implant that could represent an answer to degenerative vision loss. SCHOTT Primoceler's hermetic glass wafer micro bonding was used for the ultra-miniature, all-glass encapsulation of the device.

Hermetic Packaging Market Leaders

-

Schott AG

-

Ametek.Inc.

-

Micross Components Inc.

-

Materion Corporation

-

Teledyne Technologies Incorporated

*Disclaimer: Major Players sorted in no particular order

Hermetic Packaging Market News

- May 2021 - AMETEK MOCON, launched a new analytical instrument to measure the oxygen transmission rate (OTR) of whole packages at ambient environmental conditions. The OX-TRAN 2/48 offers high-capacity testing with eight cells. Four of the cells are for testing OTR and the other four are used for conditioning packages so that they spend less time in the test.

- May 2021 - Micross Components, Inc. & Avalanche Technology, two leading companies of the domain have partnered to Offer the Smallest and Lowest Power Hi-Rel Non-Volatile Memory for Aerospace Applications.

Hermetic Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increasing Need to Protect Highly Sensitive Electronic Components

-

4.3 Market Restraints

- 4.3.1 Strict Rules and Regulations Regarding Packaging Materials

-

4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

-

4.5 Technology Snapshot

- 4.5.1 Glass to Metal Sealing (GTMS)

- 4.5.2 Ceramics to Metal Sealing (CERTMS)

- 4.5.3 Glass Micro Bonding

- 4.6 Assessment of the COVID-19 Impact on the Market

5. MARKET SEGMENTATION

-

5.1 Type

- 5.1.1 Passivation Glass

- 5.1.2 Reed Glass

- 5.1.3 Transponder Glass

-

5.2 End-user Industry

- 5.2.1 Petrochemical

- 5.2.2 Aerospace and Defense

- 5.2.3 Automotive Industry

- 5.2.4 Healthcare

- 5.2.5 Consumer Electronics

- 5.2.6 Other End-user Industry

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 South Korea

- 5.3.3.4 India

- 5.3.3.5 Rest of Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles*

- 6.1.1 Schott AG

- 6.1.2 Ametek Inc.

- 6.1.3 Kyocera Corporation

- 6.1.4 Micross Components Inc.

- 6.1.5 Willow Technologies Ltd.

- 6.1.6 SGA Technologies limited

- 6.1.7 CompleteHermetics

- 6.1.8 Special Hermetics products Inc.

- 6.1.9 Materion Corporation

- 6.1.10 Teledyne Technologies Incorporated

- 6.1.11 Egide SA

7. INVESTMENT ANALYSIS

8. FUTURE OF THE MARKET

** Subject To AvailablityHermetic Packaging Industry Segmentation

A Hermetic Seal is any type of sealing that makes a given object airtight (preventing the passage of air, oxygen, or other gases). The term originally applied to airtight glass containers, but as technology advanced it applied to a larger category of materials, including rubber and plastics. The market study comprises type, end users. and country-specific analyses.

| Type | Passivation Glass | |

| Reed Glass | ||

| Transponder Glass | ||

| End-user Industry | Petrochemical | |

| Aerospace and Defense | ||

| Automotive Industry | ||

| Healthcare | ||

| Consumer Electronics | ||

| Other End-user Industry | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Spain | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| South Korea | ||

| India | ||

| Rest of Asia Pacific | ||

| Geography | Latin America | |

| Middle East and Africa |

Hermetic Packaging Market Research FAQs

What is the current Hermetic Packaging Market size?

The Hermetic Packaging Market is projected to register a CAGR of 8.10% during the forecast period (2024-2029)

Who are the key players in Hermetic Packaging Market?

Schott AG, Ametek.Inc., Micross Components Inc., Materion Corporation and Teledyne Technologies Incorporated are the major companies operating in the Hermetic Packaging Market.

Which is the fastest growing region in Hermetic Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Hermetic Packaging Market?

In 2024, the North America accounts for the largest market share in Hermetic Packaging Market.

What years does this Hermetic Packaging Market cover?

The report covers the Hermetic Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Hermetic Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Hermetic Packaging Industry Report

Statistics for the 2024 Hermetic Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Hermetic Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.