High Density Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 12.00 % |

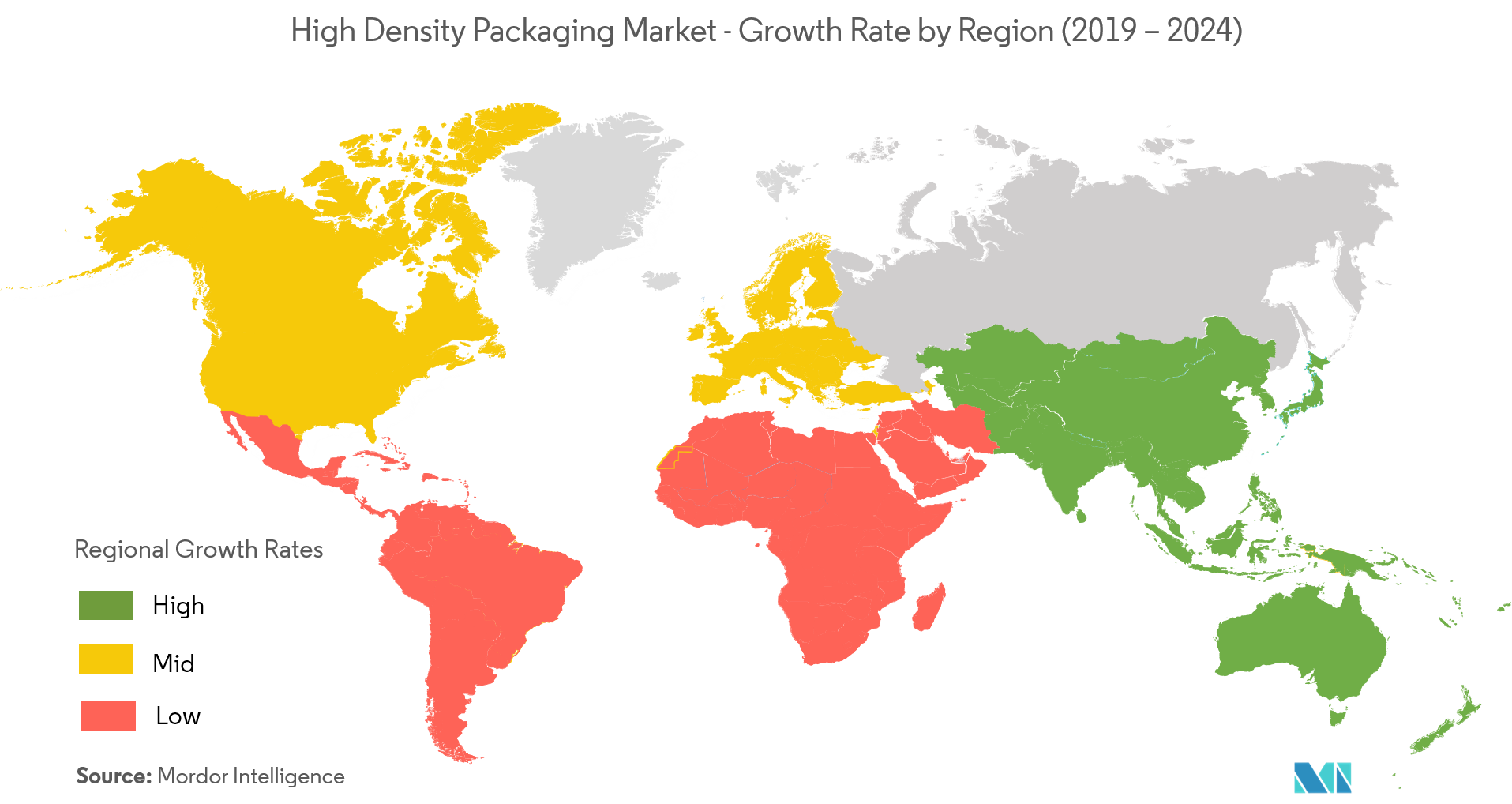

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

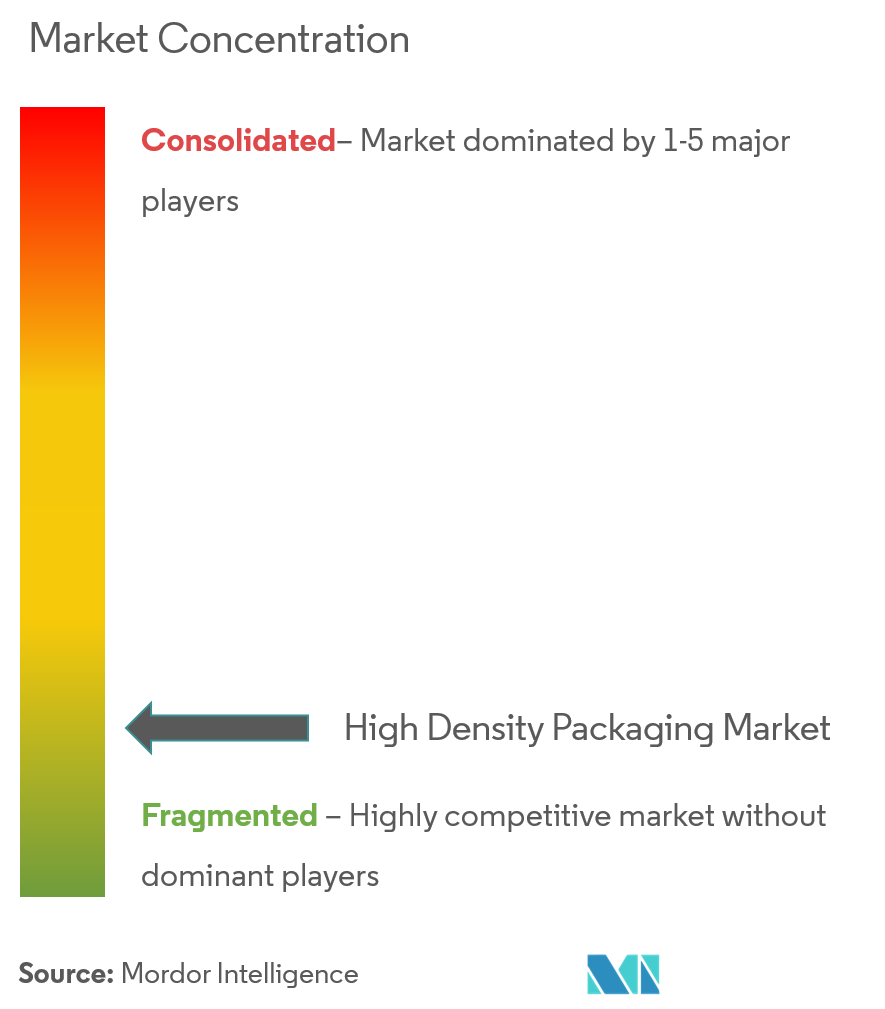

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

High Density Packaging Market Analysis

The high-density packaging market is estimated to register a cagr of 12% over the forecast period of 2021 - 2026. The growing advancement in consumer electronic products will drive the market in the forecast period.

- Consumer electronic devices are readily available in different kinds of high-density package types like MCM, MCP, SIP, 3D - TSV. The high-density packaging market has drawn the greatest attention in the investment community. The change in the consumer preference for the latest technology and constant innovations by major players for electronic devices has generated an immense market demand for the high-density packaging market.

- Since most populations are shifting more towards connected devices, so an increase in the Internet of Things (IoT) will lead to the growth of high-density packaging. An increase in the demand for consumer wearable goods, smartphones, and home appliances will act as a positive impact on this industry.

- For Instance, Amkor offers more than 3000 types of packaging solutions inclusive of high-density packaging applications such as automotive, stacked die, MEMS, TSV, and 3D Packaging.

- The favorable government regulations in developing countries will drive the market in the forecast period. However, high initial investment might hinder the market.

High Density Packaging Market Trends

This section covers the major market trends shaping the High Density Packaging Market according to our research experts:

High Application in Consumer Electronics Segment to Augment the Market Growth

- The electronics market constantly demands higher power dissipation, faster speeds, and higher pin counts, along with smaller footprints and lower profiles. The miniaturization and integration of high density semiconductor packaing have given rise to smaller, lighter, and more portable devices, like tablets, smartphones, and the emerging IoT devices.

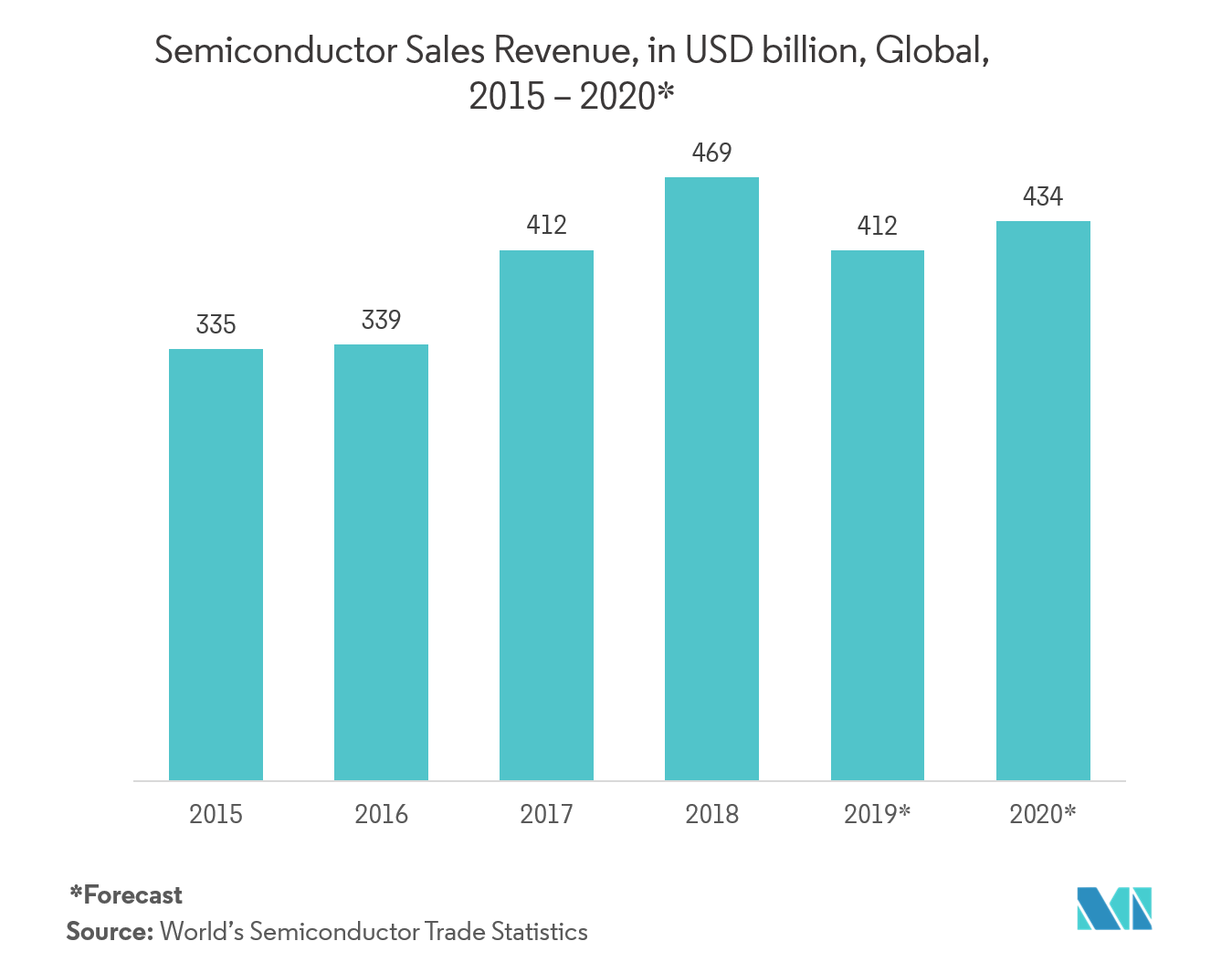

- According to the Semiconductor Industry Association, the global sales of the semiconductor have increased by 13.7% with USD 468 billion in 2018. The industries have reported the highest sales revenue and shipment 1 trillion units.

- However, according to world semiconductor trade statistics, the demand has decreased in 2019 due to the weaker pricings of ICs, there will still be an increase in demand from 2020 due to consumer electronic products. For instance, the United States has witnessed consistent growth in smartphone sales. With this trend likely to continue, it is poised to drive the high density packaging market in the forecast period into other regions as well.

Asia-Pacific to Witness the Highest Growth in High Density Packaging Market

- Asia-Pacific is expected to grow at a healthy rate, being a major revenue-generating region during the forecast period, primarily owing to the growing population and the customer-side demand. Prominent high density packaging companies present in the region are fueling the demand for high density packaging in the market.

- Moreover, China is the largest growing economy with a large population, and according to statistics from China’s semiconductor association, the import of IC is increasing for the consecutive year from 2014.

- Furthermore, the Chinese government has employed a multi-pronged strategy to support domestic IC industry development in order to achieve the goal of becoming the global leader in all primary IC industrial supply chain segments by 2030. This growth in the semiconductor IC industry in the region is anticipated to stimulate the high density packaging demand.

High Density Packaging Industry Overview

The High density packaging market is fragmented due to the presence of major players in the marketlikeToshiba Corporation,Fujitsu Ltd.,Hitachi, Ltd.,IBM Corporation, SPIL, Micro Technology and others, are the key players in the market without any dominating player.

- Jan2019 -Red Hat stockholders voted to approve the merger with IBM. The transaction is subject to customary closing conditions, including regulatory reviews and is expected to close in the second half of 2019. IBMannounced its intent to acquire all of the outstanding shares of Red Hat, Inc. The combination of Red Hat’s vast portfolio of open-source technologies, innovative cloud development platform and developer community, combined with IBM’s innovative hybrid cloud technology, industry expertise, and commitment to data, trust, and security, will deliver the hybrid cloud capabilities required to address the next chapter of cloud implementations.

- Jul 2018-Amkor Technology, Inc.an advance provider of outsourcedsemiconductor packaging services, declared that with the partnership ofMentor to release Amkor’s SmartPackagePackage AssemblyDesign Kit, the first in the industry to support Mentor’s High-Density Packaging design method and tools;can now be done in association with Mentor’s software to produce fresh, accelerated and detailed confirmation results of advanced packages required forInternet-of-Things, automotive, and artificial intelligence applications.

High Density Packaging Market Leaders

-

Toshiba Corporation

-

IBM Corporation

-

Fujitsu Ltd.

-

Hitachi, Ltd.

-

Mentor - a Siemens Business

*Disclaimer: Major Players sorted in no particular order

High Density Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Growing Advancements in Consumer Electronic Products

- 4.3.2 Favourable Government Policies and Regulations in Developing Countries

-

4.4 Market Restraints

- 4.4.1 High Initial Investment and Increasing Complexity of IC Designs

- 4.5 Value Chain / Supply Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Packaging Technique

- 5.1.1 MCM

- 5.1.2 MCP

- 5.1.3 SIP

- 5.1.4 3D - TSV

-

5.2 By Application

- 5.2.1 Consumer Electronics

- 5.2.2 Aerospace & Defence

- 5.2.3 Medical Devices

- 5.2.4 IT & Telecom

- 5.2.5 Automotive

- 5.2.6 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Toshiba Corporation

- 6.1.2 IBM Corporation

- 6.1.3 Amkor Technology

- 6.1.4 Fujitsu Ltd.

- 6.1.5 Siliconware Precision Industries

- 6.1.6 Hitachi, Ltd.

- 6.1.7 Samsung Group

- 6.1.8 Micron Technology

- 6.1.9 STMicroelectronics

- 6.1.10 NXP Semiconductors N.V.

- 6.1.11 Mentor - a Siemens Business

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityHigh Density Packaging Industry Segmentation

Advanced Packaging is arrangingcomplicated IC chipsvia a variety of high density packaging techniques like MCM, MCP, SIP, and others. The major applications are in consumer electronics devices, IT & Telecom, automotive, medical devices, and others.

| By Packaging Technique | MCM |

| MCP | |

| SIP | |

| 3D - TSV | |

| By Application | Consumer Electronics |

| Aerospace & Defence | |

| Medical Devices | |

| IT & Telecom | |

| Automotive | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East and Africa |

High Density Packaging Market Research FAQs

What is the current High Density Packaging Market size?

The High Density Packaging Market is projected to register a CAGR of 12% during the forecast period (2024-2029)

Who are the key players in High Density Packaging Market?

Toshiba Corporation, IBM Corporation, Fujitsu Ltd., Hitachi, Ltd. and Mentor - a Siemens Business are the major companies operating in the High Density Packaging Market.

Which is the fastest growing region in High Density Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in High Density Packaging Market?

In 2024, the North America accounts for the largest market share in High Density Packaging Market.

What years does this High Density Packaging Market cover?

The report covers the High Density Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the High Density Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

High Density Packaging Industry Report

Statistics for the 2024 High Density Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. High Density Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.