High Performance Coatings Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

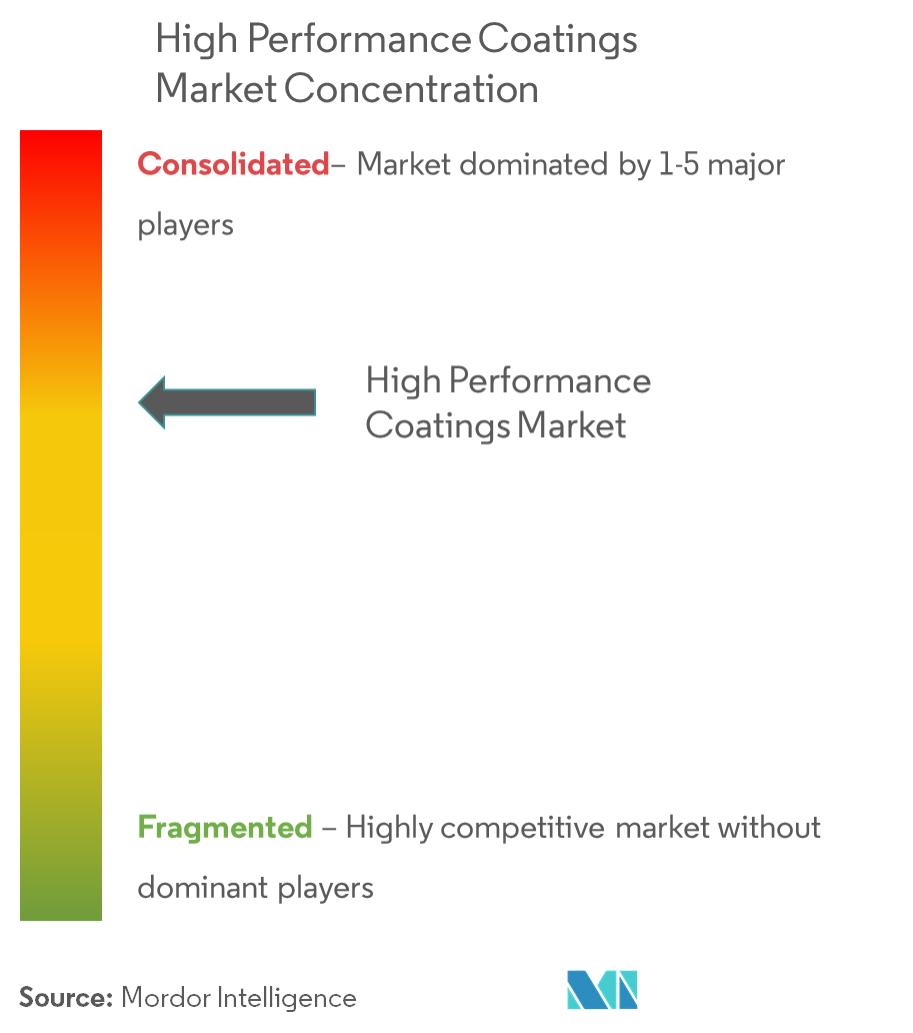

| Market Concentration | High |

Major Players*Disclaimer: Major Players sorted in no particular order |

High Performance Coatings Market Analysis

The high performance coatings market is expected to grow at a CAGR of over 5% during the forecast period. One of the major factorsdriving the market studied includes increasing construction activities in the United States and Asia-Pacific. Solvent-based adhesives are being phased out to reduce VOC emissions;this isexpected to significantly hinder the growth of the market studied.

- Asia-Pacific is expected to dominate the global market during the forecast period.

- By end-user industry, the building and construction industry is expected to witness the highest demand for high performance coating during the forecast period.

High Performance Coatings Market Trends

This section covers the major market trends shaping the High Performance Coatings Market according to our research experts:

Growing Demand from Building & Construction Industry

- High performance coatings provide the following qualities, such as exceptional corrosion protection, abrasion resistance and high resistance to impact, excellent chemical and thermal resistance, extreme durability and strength, and it also contributes to the aesthetics as well.

- The global construction sector is expected to expand in real terms, by an annual average of 3.2% in the coming decade, to a nominal value of more than USD 6.0 trillion.

- The rapid increase in population, in regions of developing nations, is expected to give a rise in demand for residential construction, which, in turn, augments the usage of high performance coatings.

- The key areas of expected growth are social infrastructure, schools, hospitals, government accommodation, water, defense infrastructure, and water resources.

- In the non-residential construction, the major growth was witnessed in healthcare, commercial, and office buildings. The investment in transportation, communication, and power infrastructure has also witnessed growth in the forecast period. All these factors are expected to improve the demand for the studied market.

China to Dominate the Demand in Asia-Pacific Region

- China is expected to dominate the high performance coatings market in Asia-Pacific and is also likely to witness the fastest growing demand.

- The market is estimated to witness a healthy growth over the assessment period, due to rising construction activities, along with the high adoption rate from various end-user industries such as, industrial, and aerospace & defense sector.

- In China, the housing authorities of Hong Kong have launched various measures to push-start the construction of low-cost housing.

- Additionally, the government has rolled out massive construction plans, including making provision for the movement of 250 million people to its new megacities over the next ten years, despite efforts to rebalance its economy to a more service-oriented form. This is likely to boost the demand for high performance coatings in the country.

- China is aiming high in the aerospace business. Its focus is on both commercial aircraft, as well as fighter jets. Over the next 20 years, both the European and the American aerospace giants forecast that China would become their biggest single market, due to the demand for new aircraft by Chinese airlines, which are keen to meet the rising middle classes’ desire for air travel.

- Furthermore, countries such as India and Japan have also been contributing to the growth of the market studied. Overall, the demand for high performance coatings is expected to increase in the during the forecast period.

High Performance Coatings Industry Overview

The high performance coatings market is partly consolidated in nature. Some of the major players of the market studied include, PPG Industries Inc., Akzo Nobel NV, Hempel Group, Daikin Industries Ltd, and Sherwin-Williams Company, among others.

High Performance Coatings Market Leaders

-

PPG Industries Inc.

-

Akzo Nobel NV

-

Daikin Industries Ltd.

-

Hempel Group

-

The Sherwin-Williams Company

*Disclaimer: Major Players sorted in no particular order

High Performance Coatings Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

-

4.1 Drivers

- 4.1.1 Increasing Construction Activities in the United States and Asia-Pacific

- 4.1.2 Other Drivers

-

4.2 Restraints

- 4.2.1 Solvent-based Adhesives are being Phased Out to Reduce VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Threat of Substitute Products and Services

- 4.4.3 Threat of New Entrants

- 4.4.4 Bargaining Power of Consumers

- 4.4.5 Degree of Competition

- 4.5 Environmental Regulations

5. MARKET SEGMENTATION

-

5.1 Type

- 5.1.1 Epoxy

- 5.1.2 Silicon

- 5.1.3 Polyester

- 5.1.4 Acrylic

- 5.1.5 Alkyd

- 5.1.6 Polyurethane

- 5.1.7 Fluoropolymer

- 5.1.8 Other Types (Polyether Sulfone (PES), Vinyl-Ester, etc.)

-

5.2 Coating Technology

- 5.2.1 Solvent-based

- 5.2.2 Water-based

- 5.2.3 Powder-based

-

5.3 End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Automotive and Transportation

- 5.3.3 Industrial

- 5.3.4 Aerospace & Defense

- 5.3.5 Marine

- 5.3.6 Other End- user Industries

-

5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**

- 6.3 Strategies Adopted by Leading Players

-

6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Daikin Industries Ltd

- 6.4.3 PPG Industries Inc.

- 6.4.4 Kansai Nerolac Paints Limited

- 6.4.5 Metal Coatings Corp.

- 6.4.6 Toefco Engineered Coating Systems Inc.

- 6.4.7 Endura Coatings LLC

- 6.4.8 Beckers Group

- 6.4.9 Nippon Paint Holdings Co. Ltd

- 6.4.10 The Sherwin-Williams Company

- 6.4.11 AFT Fluorotec Ltd

- 6.4.12 The Chemours Company

- 6.4.13 Hempel Group

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityHigh Performance Coatings Industry Segmentation

The global high performance coatings market includes:

| Type | Epoxy | |

| Silicon | ||

| Polyester | ||

| Acrylic | ||

| Alkyd | ||

| Polyurethane | ||

| Fluoropolymer | ||

| Other Types (Polyether Sulfone (PES), Vinyl-Ester, etc.) | ||

| Coating Technology | Solvent-based | |

| Water-based | ||

| Powder-based | ||

| End-user Industry | Building and Construction | |

| Automotive and Transportation | ||

| Industrial | ||

| Aerospace & Defense | ||

| Marine | ||

| Other End- user Industries | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| Italy | ||

| France | ||

| Rest of Europe | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East & Africa | Saudi Arabia |

| South Africa | ||

| Rest of Middle East & Africa |

High Performance Coatings Market Research FAQs

What is the current High Performance Coatings Market size?

The High Performance Coatings Market is projected to register a CAGR of greater than 5% during the forecast period (2024-2029)

Who are the key players in High Performance Coatings Market?

PPG Industries Inc., Akzo Nobel NV, Daikin Industries Ltd., Hempel Group and The Sherwin-Williams Company are the major companies operating in the High Performance Coatings Market.

Which is the fastest growing region in High Performance Coatings Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in High Performance Coatings Market?

In 2024, the Asia Pacific accounts for the largest market share in High Performance Coatings Market.

What years does this High Performance Coatings Market cover?

The report covers the High Performance Coatings Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the High Performance Coatings Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

High Performance Coatings Industry Report

Statistics for the 2024 High Performance Coatings market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. High Performance Coatings analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.