High Power LED Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 4.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

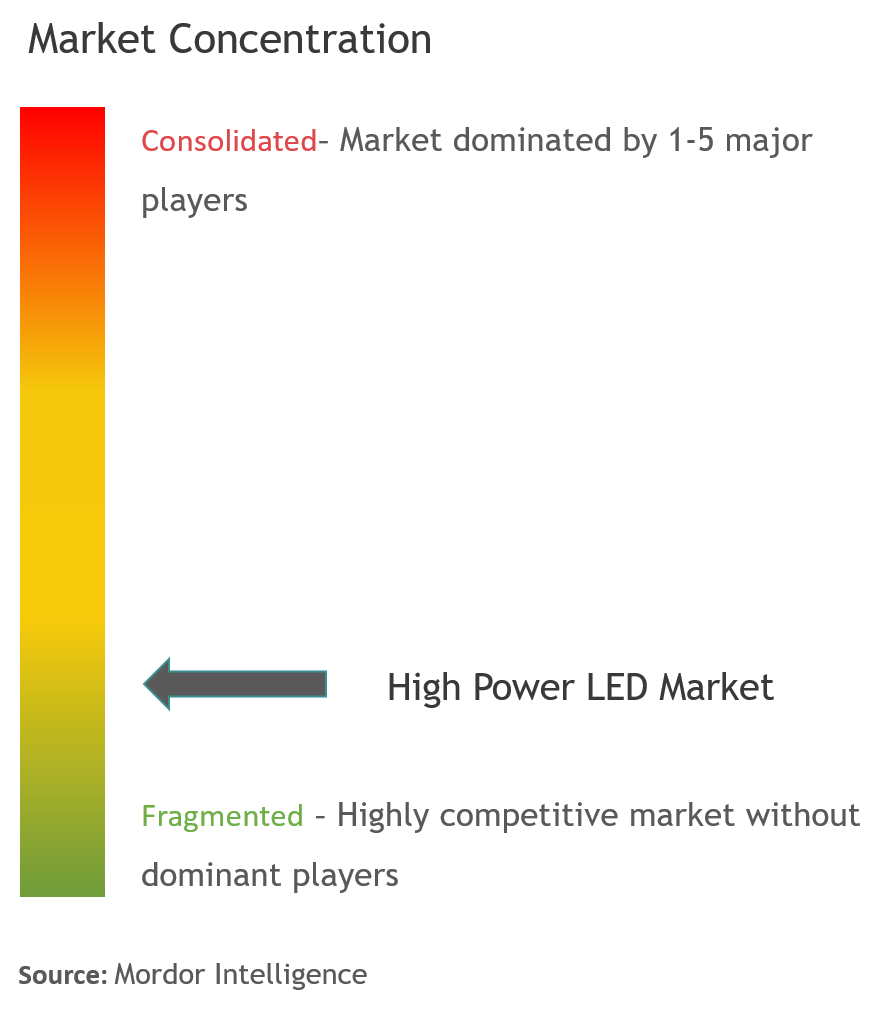

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

High Power LED Market Analysis

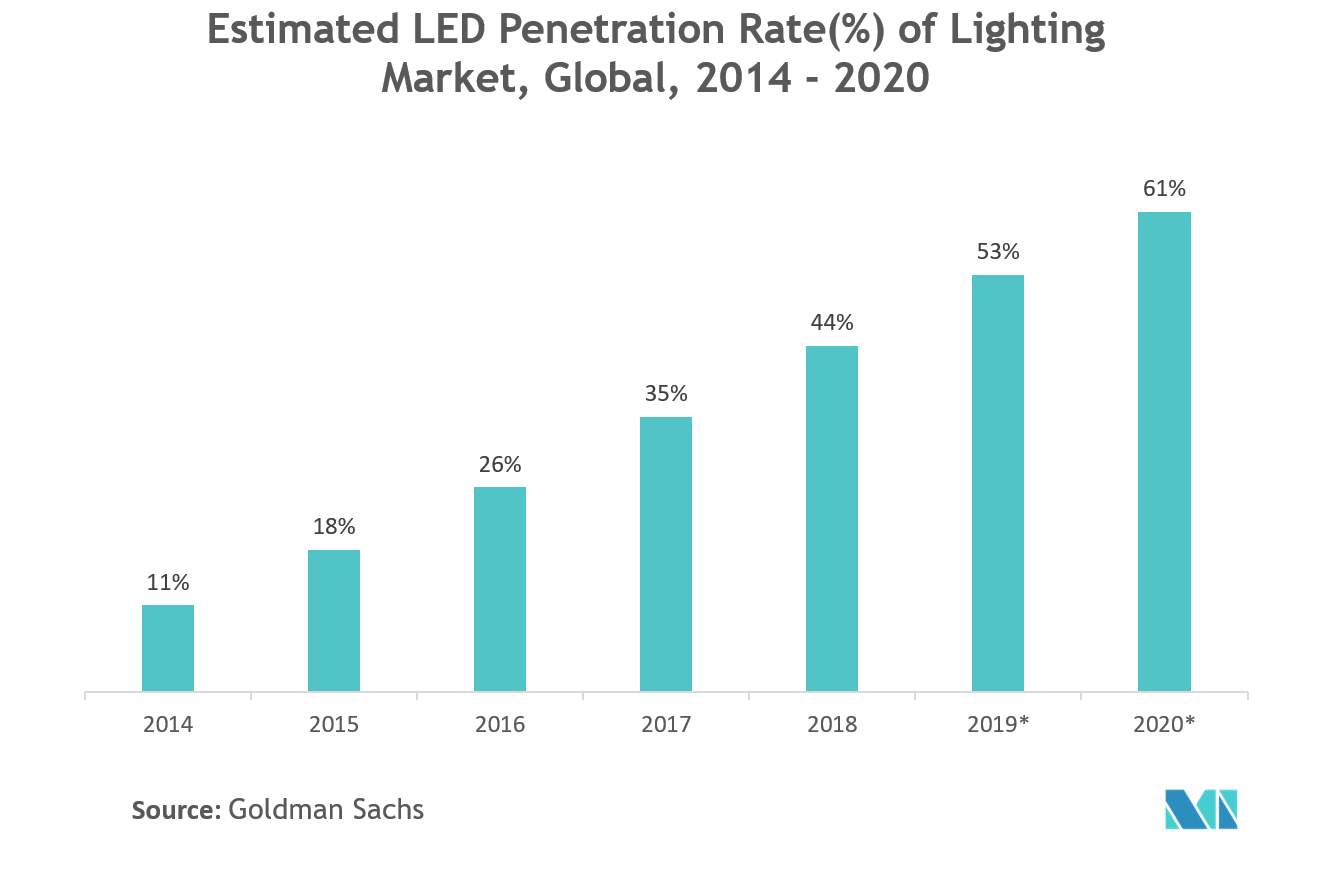

The high power led market is expected to register a CAGR of over 4% over the forecast period (2021 - 2026). In the past decade, the LED industry has witnessed massive investments from several companies which have led to the emergence of innovative LED technologies.

- Growing adoption of energy-efficient products, along with rising government focus toward energy-saving, is fueling the demand for energy-efficient lighting sources, such as high power LEDs, which is boosting the growth of the high power LED market. The use of high-power LEDs enhance energy efficiency and also provide high brightness.

- Additionally, the government of developed economies such as UK and US and emerging economies like India and China, are engaging in the promotion of LED lighting products by providing the tax incentives and subsidies on these products.

- Moreover, High-power LEDs are advantageous in general lighting and automotive applications as they work efficiently for long operating hours at low maintenance costs. Owing to these advantages, local authorities of countries, such as the USA, India, China, and Australia, have commenced projects to replace their conventional lighting lamps used in outdoor lighting with LEDs.

- For Instance, According to the US Department of Energy, Los Angeles had completed a citywide street lighting replacement program and installed over 215,000 LED streetlights (saving about USD 9 million in annual energy costs). Additionally, Barcelona (Spain) deployed more than 3,000 smart streetlights based on the LED technology, which gather information about pollution, humidity, noise, and the overall environment.

- The small size, long-life & continuous usage, less power consumption & low voltage, and increasing high brightness application are the other factors driving the growth of the High Power LED market.

High Power LED Market Trends

This section covers the major market trends shaping the High Power LED Market according to our research experts:

Increasing Adoption of High Power LED in Automotive Lighting Boosting the Market's Growth

- With the introduction of high power LEDs, there has been considerable innovation in the automotive lighting industry. LED's has the advantage of being much brighter and smaller than the traditional lamps.

- The growing demand for high power LED lights in automotive interior and exterior applications, such as fog lights, position lights, headlights, ambient lighting, and dashboard lights is boosting the automotive application. The volume of high-power LEDs used for this application has been growing each year.

- The shift to high power LEDs brings better lighting to car owners. LEDs represent an automotive visual revolution, an enhancement in technology which brings increased safe driving factor.

- For instance, LED play an essential role in digital lighting solutions, where the vehicle lighting is directly connected to active safety systems. Under digital lighting, the entire lighting system is connected to the other systems of the vehicle such as vision systems, navigation, and emergency safety functions which enable the situation where there is level of autonomy achieved while driving.

- This lighting technology will display information to the driver on the road itself as well as provide other users with information about the intended movements of the vehicle. This technology will eventually be used for autonomous driving and connected transportation.

- LEDs are used widely in both standard and luxury automobiles. Even commercial vehicles have leveraged this automotive lighting technology for the high levels of efficiency it offers.

- Moreover, as automotive lighting systems become more intelligent, demand for the high efficacy and unsurpassed reliability of the highest grade LED components is expected to grow over the forecast period.

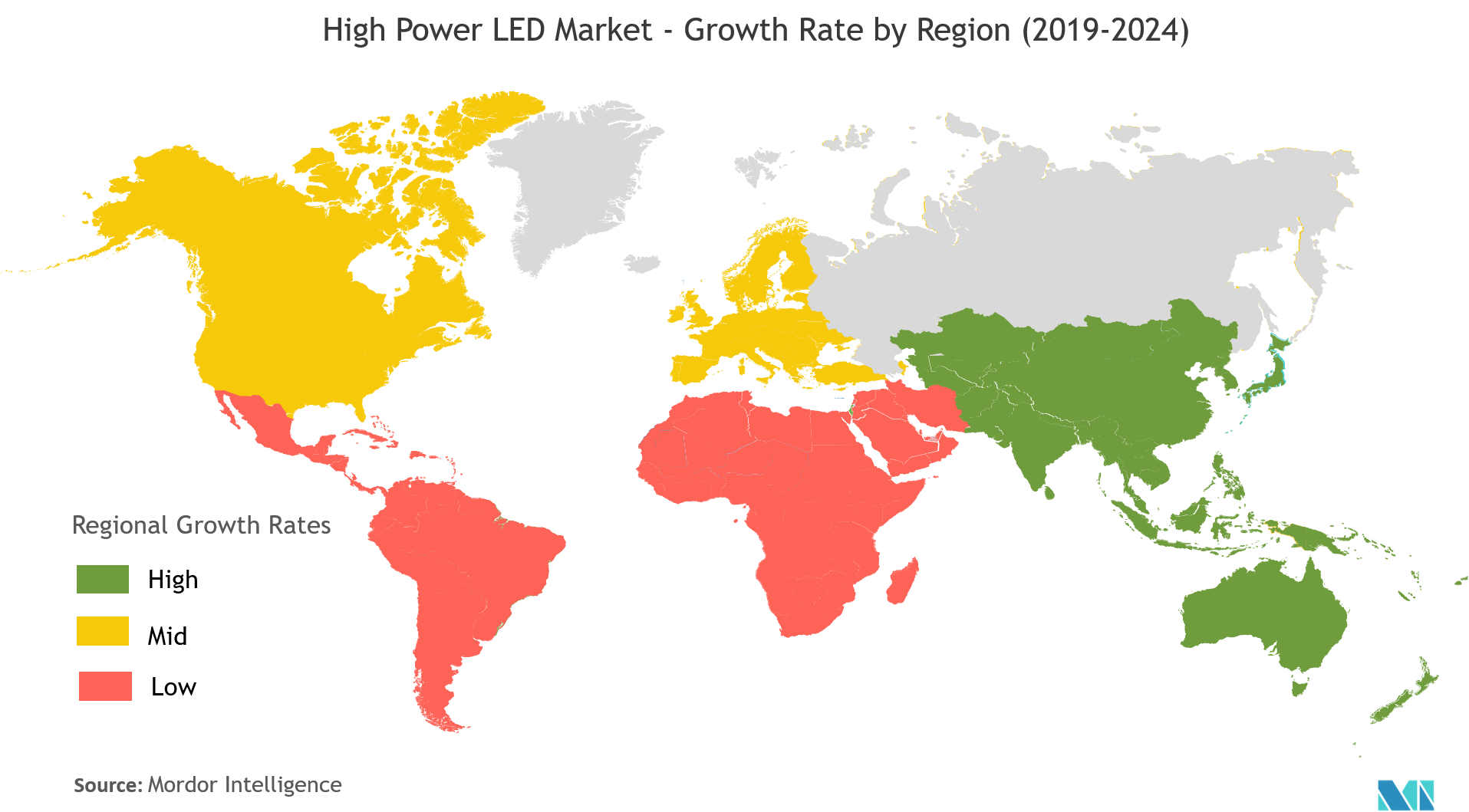

Asia-Pacific is Expected to Witness the Highest Growth Rate

- Asia-Pacific is expected to witness highest growth rate owing to the growing adoption of high power LED lights in general lighting applications, mainly in India and China.

- In India, the government has implemented a series of policies and programs to support the development of LED lighting industry, among which the most important is SLNP (Street Light National Program)which is an initiative to 21 million streetlights with LED.

- According to yo the Power Minister of India, India is expected to be the first country in the world to use LEDs for all lighting needs by 2019, which would help the nation save over INR 40,000 crore a year.

- In China, the National Development and Reform Commission (NDRC), and the Ministry of Finance (MOF) have taken several measures to administer subsidies for proliferating LED lighting products.

- The Japanese government's long term goals incorporate the lighting projects and infrastructure related to the 2020 Olympics. Thus, the construction of numerous public buildings, general buildings, transportation, and gymnasiums is continually going on. The government plans to introduce LED lighting in these projects to attract international attention.

- Additionally, many Japanese LED lighting manufacturers demonstrated high power LED bay lights, billboard lights, and four-meter LED tubes at Lighting Japan 2015. The country is witnessing a strong demand for high power LED luminaires, which are capable of assisting commercial applications in saving long term costs.

- Furthermore, various smart city development projects are in the pipeline in countries such as China and India, which are anticipated to generate demand for high power LED lights. For instance, China aims to encourage 100 new smart cities from 2016 to 2020 to lead the country's urban planning and development. According to a report released by the Indian Minister of Urban and Housing Affairs, 148 projects have been completed until January 2018 under India's Smart Cities Mission.

High Power LED Industry Overview

The high power LED market is competitive and fragmented, with the presence of a large number of global and regional players. The players are focusing on new product development strategies to strengthen their product portfolio and also increase customer acquisition.

- August 2019 - Lumileds, a global vendor in innovative lighting solutions, announced the LUXEON 5050 Square LES (Light Emitting Surface) LED, a square, multi-die emitter that offers industry-leading flux and efficacy for directional lighting applications. The LUXEON 5050 Square builds on the legacy of the LUXEON 5050 Round emitter as the go-to solution for downlights and streetlights, while boosting flux by 25% and providing the highest efficacy of any 5050 packages on the market.

- August 2019 - LG Innotek announced that the company has developed "Nexlide-HD (High Definition)", flexible three-dimensional lighting for cars which emits bright and uniform light from five directions. It is an automotive lighting module made by attaching a number of LED packages to the thin substrate.

High Power LED Market Leaders

-

Koninklijke Philips N.V.

-

Lumileds Holding B.V.

-

OSRAM Opto Semiconductors GmbH

-

Cree Inc.

-

Samsung Electronics Co. Ltd.

*Disclaimer: Major Players sorted in no particular order

High Power LED Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Growing Awareness Regarding Implementation of Energy-Efficient Systems

- 4.2.2 Increasing Applications of High Power LED's

-

4.3 Market Restraints

- 4.3.1 High Initial Cost

- 4.4 Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Application

- 5.1.1 Automotive Lighting

- 5.1.2 General Lighting

- 5.1.3 Backlighting

- 5.1.4 Other Applications

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 South Korea

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 Latin America

- 5.2.4.2 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 OSRAM Opto Semiconductors GmbH

- 6.1.2 Lumileds Holding B.V.

- 6.1.3 Broadcom Inc.

- 6.1.4 Samsung Electronics Co Ltd

- 6.1.5 Cree Inc.

- 6.1.6 LG Innotek Co. Ltd.

- 6.1.7 Everlight Electronics Co. Ltd.

- 6.1.8 Koninklijke Philips N.V.

- 6.1.9 Seoul Semiconductor Co. Ltd.

- 6.1.10 Moritex Corporation

- 6.1.11 Plessey Semiconductors Ltd.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityHigh Power LED Industry Segmentation

High power LEDs are increasingly used for lighting applications. High power LEDs are one type of LED which has higher power and brightness and are more costly comparing to the small power LED. High power LEDs currently are widely applied in automobile lights, general lighting, lighting fixtures, etc.

| By Application | Automotive Lighting | |

| General Lighting | ||

| Backlighting | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle-East & Africa |

High Power LED Market Research FAQs

What is the current High Power LED Market size?

The High Power LED Market is projected to register a CAGR of 4% during the forecast period (2024-2029)

Who are the key players in High Power LED Market?

Koninklijke Philips N.V., Lumileds Holding B.V., OSRAM Opto Semiconductors GmbH, Cree Inc. and Samsung Electronics Co. Ltd. are the major companies operating in the High Power LED Market.

Which is the fastest growing region in High Power LED Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in High Power LED Market?

In 2024, the North America accounts for the largest market share in High Power LED Market.

What years does this High Power LED Market cover?

The report covers the High Power LED Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the High Power LED Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

High Power LED Industry Report

Statistics for the 2024 High Power LED market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. High Power LED analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.