Hosted Private Branch Exchange Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 15.20 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

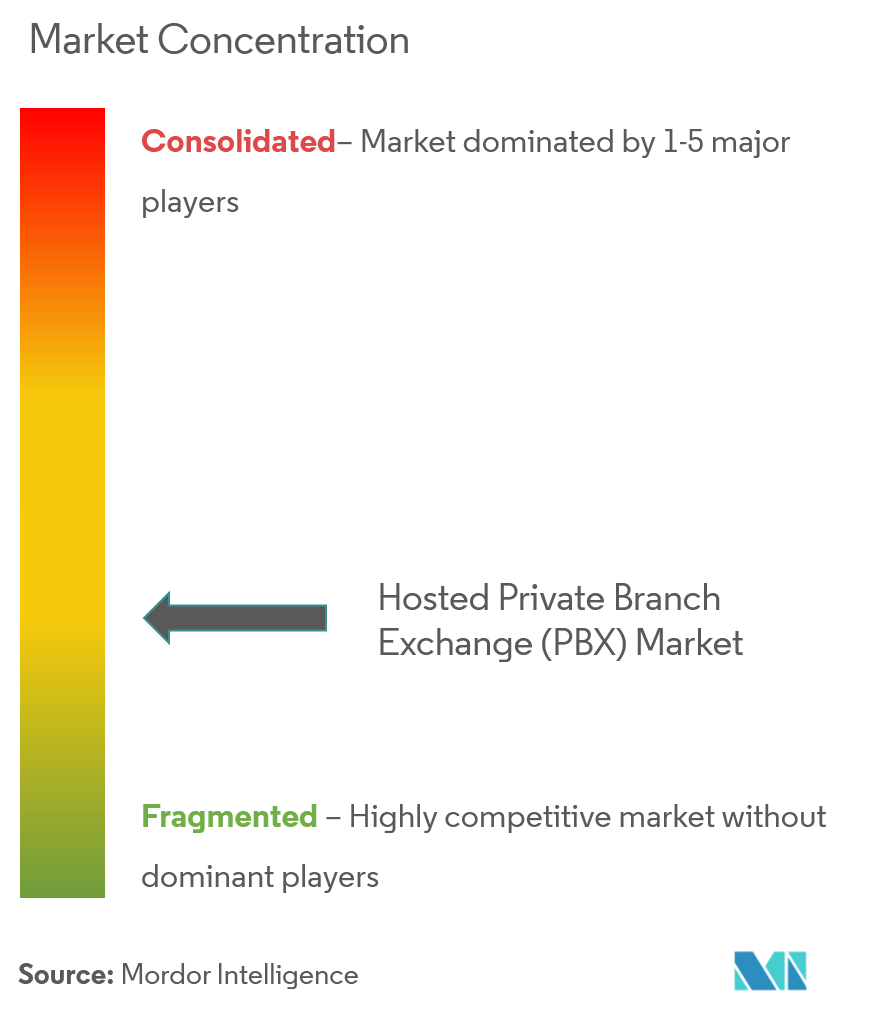

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Hosted Private Branch Exchange Market Analysis

The hosted Private Branch Exchange (PBX) market is expected to register a CAGR of 15.2% during the forecast period of (2021 - 2026). Unlike a traditional PBX, which requires a large investment and ongoing maintenance and training, a hosted PBX is a cloud-based PBX system accessible via an IP network and thus extends the benefits associated with the cloud services.

- The rising adoption of cloud technology has significantly boosted the adoption rate of hosted PBX. With the added compliance benefits, in addition to scalability, that the cloud provides, the adoption of PBX has been increased substantially by the users.

- There has been a huge rise in demand for efficient mobility at the enterprise level. Hosted PBX solves this problem to a large extent. It provides businesses with the ability to manage their phone systems via a user-friendly control panel.

- Security and privacy concerns have always stopped enterprises from adopting cloud technology. Thus, this also acts as a major restraint for the adoption of hosted PBX technology due to its dependence on the cloud.

- At the time of the COVID-19 pandemic across the world, the market for hosted private branch exchange has shown a significant rise. For instance, in April 2020, ThinkTel, a division of Distributel, announced its hosted PBX unified communications offering called MaX UC, in partnership with Metaswitch. ThinkTel has been providing a fully managed hosted PBX solution since 2010 and announced the evolution of its unified communications suite.

Hosted Private Branch Exchange Market Trends

This section covers the major market trends shaping the Hosted Private Branch Exchange Market according to our research experts:

Owing to Increased Consumer Focus BFSI is Expected to Hold Significant Market Share

- Banks are currently engaged with huge amounts of Feedback calls, EMI reminders via SMS and calls, document verification, etc. on a daily basis. The awareness about the products plays a big role in this industry and thus they have to be notified on a regular basis. All the activities can all be automated with the help of hosted Private Branch Exchange (PBX) to reduce manual efforts.

- The outcome of the global financial crisis has seen major changes in the global banking system. Regulatory norms have tightened across global markets, customer experience is becoming the real differentiator in banking, and global capital flows have changed direction moving towards emerging markets. With an increasing number of complaints, the banks have to focus on customer retention in order to succeed.

- To cater to this fast-paced environment, the financial industry needs to usher in transformational changes through modernization of their products, services, and processes. They must increase efficiencies, make business operations transparent, and gain customer trust and loyalty. It is no longer enough to offer simple and automated services. To build loyalty and drive profitability, financial organizations must anticipate customer needs and offer an engaging user experience.

- With hosted PBX, there is no need to buy expensive hardware and software, pay for installation, and manage the system. A user simply pays a monthly fee and enjoys all of the benefits of the service. For a bank with fewer than 300 lines, hosted PBX can provide with a multitude of features and benefits. For instance, a hosted PBX system is much less expensive than a traditional on-site system.

Asia Pacific Expected to Witness Major Market Growth over the Forecast Period

- With the increasing millennials engaging in the culture of startups, Hosted Private Branch Exchange (PBX) is projected to act as a game changer for the varied business requirements. With low disposable income, the small and medium scale business in nations emerging economies such as India does not have a chunk of money to invest in new upcoming technologies.

- With the help of Hosted PBX, the business owner does not need to make a large upfront investment by purchasing an office telephone system and there is no need to maintain it. With a Hosted PBX solution the office telephone system is operated and maintained by your provider.

- As businesses in India and China are focussing on expansion, they need solutions to facilitate their requirements. With the implementation of Hosted PBX, employees can work from anywhere when their office phone system is virtual. The business can have employees working from home, other offices, mobile phones, and even overseas.

Hosted Private Branch Exchange Industry Overview

The hosted Private Branch Exchange (PBX) market consists of several players. In terms of market share, none of the players currently dominate the market. Due to the lucrative benefits that this market provides, new players are entering in large amount and thus, the market is getting fragmented. The players are heavily focussing on product innovation and expansion in order to gain a competitive advantage.

Sept 2020- Atlantech Online announced that they have lit Anthem Row with fiber. The tenants on 700 K Street, NW and 800 K Street, can now enjoy high speed Internet bandwidth at very affordable prices. Atlantech's Hosted PBX Service service can utilized by tenants adding on to the legacy of the company.

Oct 2020- The comoany Vonage partnered with Hacktoberfest to encourage and celebrate contributions to the Open Source community. The company plans to help my giving access to their libraries, code snippets and demos all on GitHub.

Hosted Private Branch Exchange Market Leaders

-

Exotel Techcom Pvt. Ltd.

-

Vonage

-

RingCentral Inc.

-

Atlantech Online Inc.

-

3CX

*Disclaimer: Major Players sorted in no particular order

Hosted Private Branch Exchange Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of the COVID -19 on the Industry Ecosystem (Short -term as well as long -term Impact)

5. MARKET DYNAMICS

-

5.1 Market Drivers

- 5.1.1 Rising Adoption of Cloud -based Solutions across Enterprises

- 5.1.2 Rising Demand of Efficient Mobility at Enterprise Level

-

5.2 Market Restraints

- 5.2.1 Increased Security and Privacy Concerns

- 5.3 Industry Stakeholder Analysis

6. MARKET SEGMENTATION

-

6.1 By Offering

- 6.1.1 Solution

- 6.1.2 Services

-

6.2 By End -user Industry

- 6.2.1 BFSI

- 6.2.2 Manufacturing

- 6.2.3 Retail

- 6.2.4 Healthcare

- 6.2.5 Government

- 6.2.6 Other End-user Industries

-

6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles*

- 7.1.1 Mitel Networks Corp

- 7.1.2 Avaya Inc

- 7.1.3 Amazon Web Services (Amazon.com, Inc.)

- 7.1.4 Microsoft Corporation

- 7.1.5 3CX

- 7.1.6 Exotel Techcom Pvt. Ltd

- 7.1.7 Vonage

- 7.1.8 RingCentral Inc

- 7.1.9 Atlantech Online Inc.

- 7.1.10 Clearly Core Inc.

- 7.1.11 OnePipe Telecom

- 7.1.12 Zaplee Inc.

- 7.1.13 G12 Communications LLC

- 7.1.14 Yeastar Information Technology Co. Ltd

8. INVESTMENT ANALYSIS

9. FUTURE OF THE MARKET

** Subject To AvailablityHosted Private Branch Exchange Industry Segmentation

Rather than being responsible for hardware, software, training, maintenance, and more, a hosted Private Branch Exchange (PBX) provider takes care of it all. In addition to being completely managed off-site, resulting in no IT or installation costs, a hosted PBX system also provides businesses with the ability to manage their phone systems via a user-friendly control panel. For these reasons and more, hosted PBX systems are becoming increasingly popular solutions for today’s growing small to medium-sized business owners.

| By Offering | Solution |

| Services | |

| By End -user Industry | BFSI |

| Manufacturing | |

| Retail | |

| Healthcare | |

| Government | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Latin America | |

| Middle East and Africa |

Hosted Private Branch Exchange Market Research FAQs

What is the current Hosted Private Branch Exchange (PBX) Market size?

The Hosted Private Branch Exchange (PBX) Market is projected to register a CAGR of 15.20% during the forecast period (2024-2029)

Who are the key players in Hosted Private Branch Exchange (PBX) Market?

Exotel Techcom Pvt. Ltd., Vonage, RingCentral Inc., Atlantech Online Inc. and 3CX are the major companies operating in the Hosted Private Branch Exchange (PBX) Market.

Which is the fastest growing region in Hosted Private Branch Exchange (PBX) Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Hosted Private Branch Exchange (PBX) Market?

In 2024, the North America accounts for the largest market share in Hosted Private Branch Exchange (PBX) Market.

What years does this Hosted Private Branch Exchange (PBX) Market cover?

The report covers the Hosted Private Branch Exchange (PBX) Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Hosted Private Branch Exchange (PBX) Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Hosted Private Branch Exchange (PBX) Industry Report

Statistics for the 2024 Hosted Private Branch Exchange (PBX) market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Hosted Private Branch Exchange (PBX) analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.