Household Refrigerators & Freezers Market Size

| Study Period | 2020 - 2029 |

| Market Size (2024) | USD 121.28 Billion |

| Market Size (2029) | USD 154.34 Billion |

| CAGR (2024 - 2029) | 4.93 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Household Refrigerators and Freezers Market Analysis

The Household Refrigerators And Freezers Market size is estimated at USD 121.28 billion in 2024, and is expected to reach USD 154.34 billion by 2029, growing at a CAGR of 4.93% during the forecast period (2024-2029).

The market for household fridges and freezers is a constantly evolving and important segment of the consumer appliance industry. Appliances are essential for the preservation of food and drinks, which offer a sense of convenience and efficiency in today's homes.

Several trends and developments have occurred in the market in recent years. Due to increasing environmental awareness and the need to reduce electricity consumption, there has been a growing demand for energy-efficient refrigerators and freezers. To meet these requirements, manufacturers are focusing on developing eco-friendly refrigerants and technology and integrating smart technologies in refrigerators and freezers. Smart features such as temperature control, remote monitoring, and compatibility with virtual assistants offer convenience and enhance the user experience.

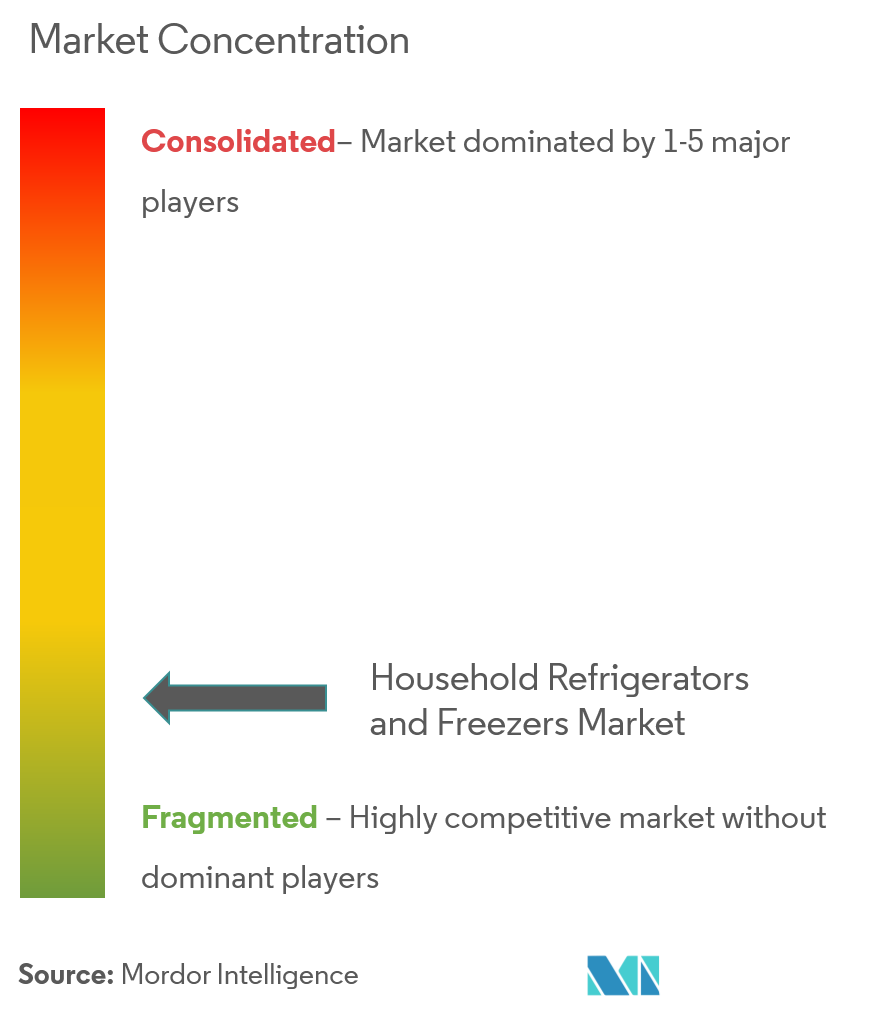

The market is marked by high competition, as numerous manufacturers offer diverse products. This competition has led to design, functionality, and feature innovations, benefiting consumers with more choices and advanced technologies.

Household Refrigerators and Freezers Market Trends

Increase in Demand for Online Sales in the Market

- A significant increase in online sales demand, due to several factors, has taken place in the market for refrigerators and freezers. This includes a wide range of products, ease of comparing prices, convenience of buying online, and features. Due to the convenience and flexibility of purchasing household appliances such as refrigerators and freezers, consumers are increasing their use of internet shopping portals. Online retailers generally provide detailed product information, customer reviews, and comparison tools to enable consumers to make educated decisions from their homes.

- The trend is that manufacturers and retailers in the household refrigerators and freezers market are increasing their online presence, enhancing their e-commerce platforms, and offering promotions and discounts to attract online customers. Consequently, it is expected that in the years to come, online sales of household refrigerators and freezers will continue to grow. This would further shape the market's development.

North America Accounts for the Largest Market Share

- North America holds a prominent position in the household refrigerators and freezers market. It is attributed to several factors, including high disposable income, a strong emphasis on convenience and technological advancements, and a mature consumer appliance market.

- Additionally, the region's large population and high rate of urbanization contribute to the significant demand for household refrigerators and freezers. The key market players and a well-established distribution network also play a crucial role in North America's dominance in the market. Furthermore, the increasing popularity of smart home equipment and the growing adoption of energy-efficient appliances fuel the region's demand for advanced refrigerators and freezers. During the forecasting period, North America is expected to continue leading the household refrigerators and freezers market.

Household Refrigerators and Freezers Industry Overview

The household refrigerators and freezers market is fragmented with many players. Companies invest in research and development to create energy-efficient, technologically advanced, and aesthetically pleasing products. This may include features like smart connectivity, improved cooling performance, and enhanced storage options. Small companies focus on specific market segments, competing through product depth and superior customer service. The key players include Haier Group Corporation, Dacor Inc., Philips Electronics, Whirlpool Corporation, and Robert Bosch GmbH.

Household Refrigerators & Freezers Market Leaders

-

Haier Group Corporation

-

Dacor Inc.

-

Philips Electronics

-

Whirlpool Corporation

-

Robert Bosch GmbH

*Disclaimer: Major Players sorted in no particular order

Household Refrigerators and Freezers Market News

- May 2023: Entergy Corporation launched a new recycling program targeting residential customers to simplify replacing old refrigerators or freezers. This initiative offers a convenient way to dispose of and recycle energy-inefficient appliances, ultimately helping to reduce energy costs.

- January 2023: SAMSUNG unveiled its 2023 lineup of Side-by-Side Refrigerators, manufactured entirely in India and customized to meet the preferences of the Indian market.

- September 2022: LG Electronics (LG) introduced its innovative MoodUP refrigerator with color-changing LED door panels at IFA 2022. This product boasts door panels that may change colors and a built-in speaker for playing music.

Household Refrigerators & Freezers Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Rising Awareness Regarding Energy Conservation

- 4.2.2 Advancements in Refrigerator and Freezer Technology

-

4.3 Market Restraints

- 4.3.1 Extended Replacement Cycles

- 4.3.2 Consumers are Frequently Sensitive to Prices

-

4.4 Market Opportunities

- 4.4.1 Kitchen Renovations and Upgrades

- 4.4.2 Growth in E-commerce and Online Shopping

- 4.5 Value Chain Analysis

-

4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID 19 on the Market

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Top-freezer Refrigerators

- 5.1.2 Bottom-freezer Refrigerators

- 5.1.3 Side-by-Side Refrigerators

- 5.1.4 French Door Refrigerators

-

5.2 By Distribution Channel

- 5.2.1 Multi-branded Stores

- 5.2.2 Specialty Stores

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

- 5.3 By Geography

-

5.4 North America

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

- 5.4.4 Rest of North America

-

5.5 Europe

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Russia

- 5.5.5 Italy

- 5.5.6 Spain

- 5.5.7 Rest of Europe

-

5.6 Asia-Pacific

- 5.6.1 India

- 5.6.2 China

- 5.6.3 Japan

- 5.6.4 Australia

- 5.6.5 Rest of Asia-Pacific

-

5.7 South America

- 5.7.1 Brazil

- 5.7.2 Argentina

- 5.7.3 Rest of South America

-

5.8 Middle East & Africa

- 5.8.1 United Arab Emirates

- 5.8.2 South Africa

- 5.8.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

-

6.2 Company Profiles

- 6.2.1 Haier Group Corporation

- 6.2.2 Dacor Inc.

- 6.2.3 Dover Corporation

- 6.2.4 Godrej Industries

- 6.2.5 AB Electrolux

- 6.2.6 LG Electronics

- 6.2.7 Panasonic Corporation

- 6.2.8 Philips Electronics

- 6.2.9 Robert Bosch GmbH

- 6.2.10 Samsung Electronics

- 6.2.11 The Whirlpool Corporation

- 6.2.12 Kenmore*

- *List Not Exhaustive

7. MARKET FUTURE TRENDS

8. DISCLAIMER AND ABOUT US

** Subject To AvailablityHousehold Refrigerators and Freezers Industry Segmentation

A household refrigerator is primarily used for food storage and protecting food from contamination. The household refrigerators and freezers market size forecast is segmented by type, distribution channel, and geography. By type, the market is segmented into top-freezer refrigerators, bottom-freezer refrigerators, side-by-side refrigerators, and French door refrigerators. By distribution channel, the market is segmented into multi-branded stores, specialty stores, online, and other distribution channels (local dealers). By geography, the market is segmented into North America, South America, Europe, Asia-Pacific, the Middle East & Africa. The report offers the market size in value terms in USD for all the abovementioned segments.

| By Type | Top-freezer Refrigerators |

| Bottom-freezer Refrigerators | |

| Side-by-Side Refrigerators | |

| French Door Refrigerators | |

| By Distribution Channel | Multi-branded Stores |

| Specialty Stores | |

| Online | |

| Other Distribution Channels | |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America | |

| Europe | United Kingdom |

| Germany | |

| France | |

| Russia | |

| Italy | |

| Spain | |

| Rest of Europe | |

| Asia-Pacific | India |

| China | |

| Japan | |

| Australia | |

| Rest of Asia-Pacific | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Middle East & Africa | United Arab Emirates |

| South Africa | |

| Rest of Middle East & Africa |

Household Refrigerators & Freezers Market Research FAQs

How big is the Household Refrigerators And Freezers Market?

The Household Refrigerators And Freezers Market size is expected to reach USD 121.28 billion in 2024 and grow at a CAGR of 4.93% to reach USD 154.34 billion by 2029.

What is the current Household Refrigerators And Freezers Market size?

In 2024, the Household Refrigerators And Freezers Market size is expected to reach USD 121.28 billion.

Who are the key players in Household Refrigerators And Freezers Market?

Haier Group Corporation, Dacor Inc., Philips Electronics, Whirlpool Corporation and Robert Bosch GmbH are the major companies operating in the Household Refrigerators And Freezers Market.

Which is the fastest growing region in Household Refrigerators And Freezers Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Household Refrigerators And Freezers Market?

In 2024, the North America accounts for the largest market share in Household Refrigerators And Freezers Market.

What years does this Household Refrigerators And Freezers Market cover, and what was the market size in 2023?

In 2023, the Household Refrigerators And Freezers Market size was estimated at USD 115.30 billion. The report covers the Household Refrigerators And Freezers Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Household Refrigerators And Freezers Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Household Refrigerators and Freezers Industry Report

The report covers global refrigerator market trends and is segmented by type, including top-freezer refrigerators, bottom-freezer refrigerators, side-by-side refrigerators, French door refrigerators, and other types. It also examines distribution channels such as multi-branded stores, specialty stores, online, and other distribution channels. The report offers the market size in value terms in USD for all the aforementioned segments.

Statistics for the household refrigerators and freezers market share, size, and revenue growth rate are provided. This analysis includes a market forecast outlook and historical overview. Additionally, the report provides insights into industry research, industry statistics, and industry trends.

The report delves into market data, market forecast, market growth, market leaders, market outlook, market overview, market predictions, market review, market segmentation, and market value. It also includes a report example and a report PDF.

Research companies have contributed to this comprehensive industry analysis, providing valuable industry information, industry outlook, industry reports, industry sales, industry size, and industry statistics. The market trends and market size are crucial for understanding the dynamics of the global market.

Overall, this report serves as a crucial resource for understanding the current state and future projections of the household refrigerators and freezers market, offering a detailed market forecast and industry overview.