India Automotive Heat Exchanger Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 12.25 % |

Major Players

*Disclaimer: Major Players sorted in no particular order |

India Automotive Heat Exchanger Market Analysis

The India Automotive Heat Exchanger Market (henceforth referred to as the market studied) is anticipated to register a CAGR of about 12.25% during the forecast period (2019 – 2024).

- Currently, the production of automotive heat exchangers is nearly stagnant in India, although, the market is expected to grow at a rapid pace during the forecast period, due to the growth in sales of passengers vehicles and changes in the vehicle emission norms in the country, which demands fuel efficiency

- The popular trend of engine downsizing in the Indian market is expected to create new opportunities for the manufacturers and suppliers of heat exchangers, as it may entail complexities in the design of heat exchangers.

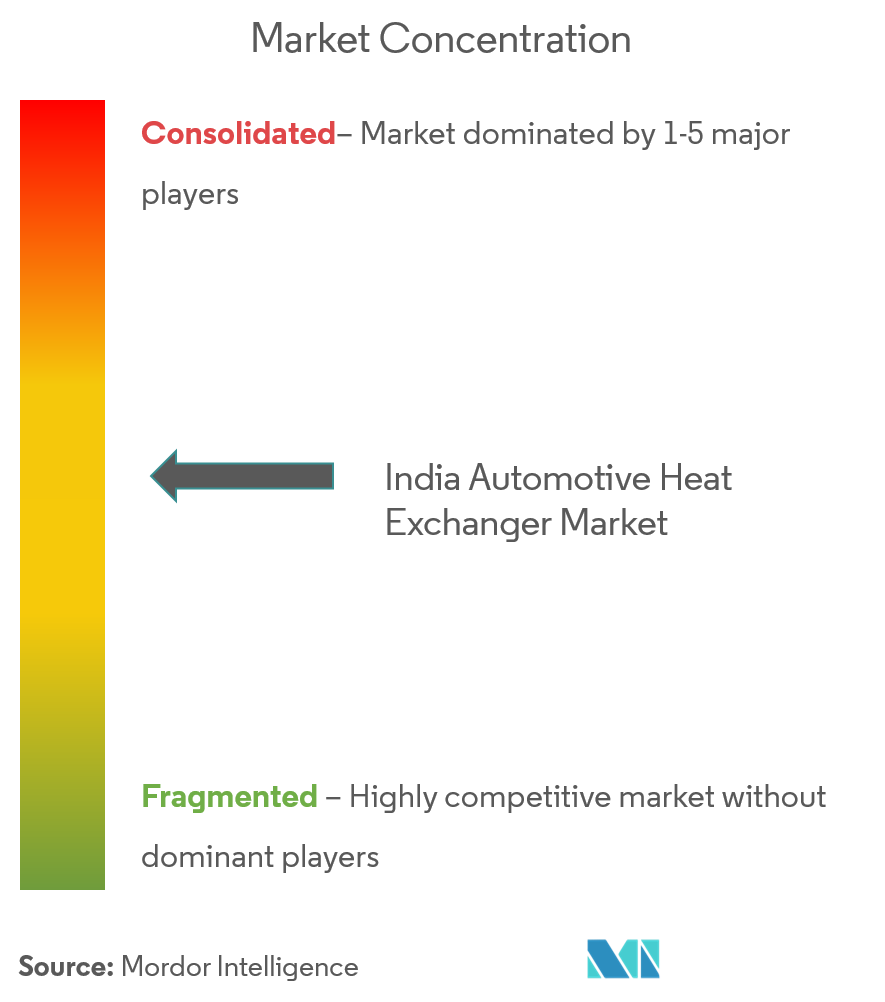

- The competition in the market has intensified, due to the entry of vendors offering products at a low price. Manufacturers from neighboring countries, such as China, have made considerable evolution in making the pricing of heat exchangers more competitive. The domestic vendors in the country provide cost-effective products with limited features and functionalities.

India Automotive Heat Exchanger Market Trends

This section covers the major market trends shaping the India Automotive Heat Exchanger Market according to our research experts:

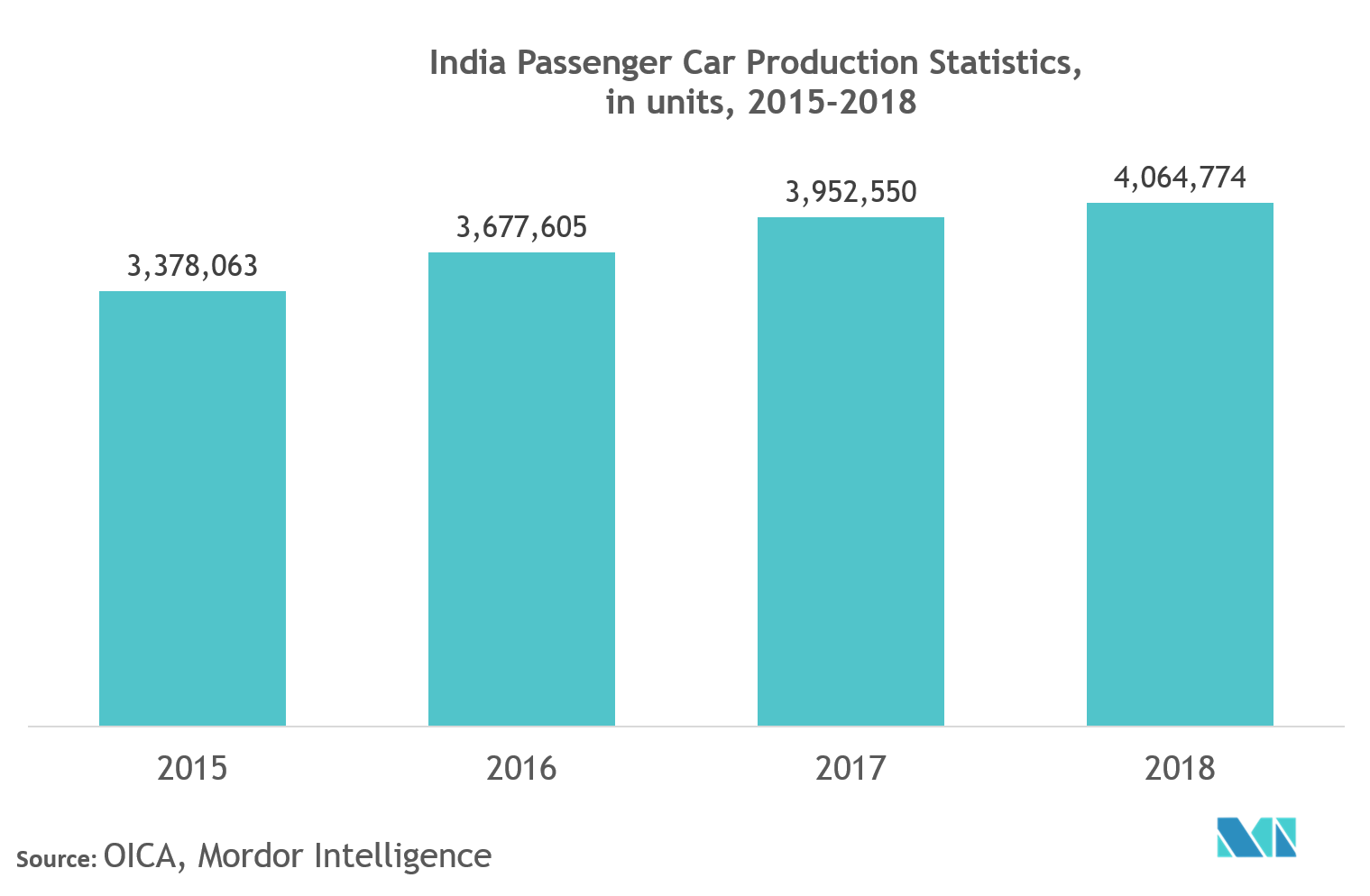

Growing Vehicle Production and Aftermarket Demand Driving the Heat Exchanger Market in the Country

The market would primarily be driven by the growth of passenger cars and LCV sales in the country. The growth expected in the overall automotive vehicle market in India would be one of the main drivers generating growth of the automatic heat exchanger market in the country.

The growth of the automotive aftermarket is one of the major factors driving the growth of the market studied. With the increase in globalization, there is increased competition among automotive heat exchanger manufacturers across the country to manufacture best-in-class products that have increased functional competency.

Additionally, there is increased competition among automotive heat exchanger vendors to gain the maximum possible share of this market. For instance, the demand for automotive radiators (which are heat exchangers used for cooling internal combustion engines) would significantly generate a demand in the aftermarket, in turn, driving the demand of automotive heat exchangers in the aftermarket segment.

Another factor which is driving the market is increase in road congestion and vehicle traffic on the Indian roads requires driving vehicles at lower gears and higher engine revolutions (rpm), leading to engines heating up at a faster rate. Such a scenario would result in overheating of the engine. An automotive heat exchanger would help to increase the engine efficiency by reducing the engine heat.

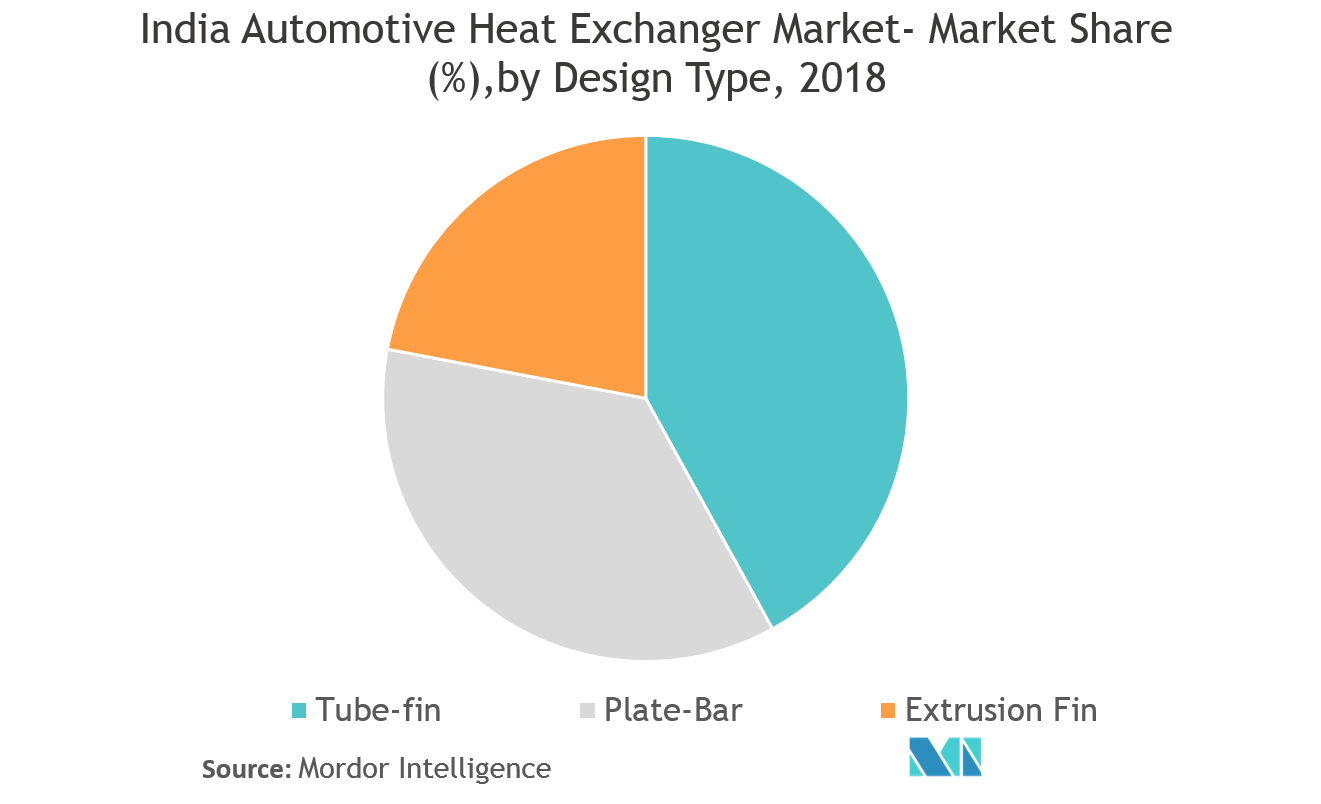

Tube-Fin Design is likely to Dominate the Automotive Heat-Exchanger Market

The tube fins are the most commonly used type of heat exchangers in automobiles. Heat exchangers, which are being used in the modern automobiles, are multiport extruded tubes that are assembled with fins for enhancing the heat exchange phenomenon.

Though brazing operation is an expensive method to manufacture a tube-fin heat exchanger, the improved performance characteristics and other benefits of reduced weight and power consumption, enhanced portability, durability, etc., are driving manufacturers to opt for this method. A radiator with better performance characteristics is expected to help keep the engine temperature low, thereby, increasing its performance efficiency

With increasing environmental concerns and the quest for cars with minimal carbon footprint, the requirement of better heat exchangers, in terms of weight, portability, and performance, has increased. This has driven the manufacturers to shift from the copper material to the lighter and better aluminum to manufacture heat exchangers.

India Automotive Heat Exchanger Industry Overview

The India Automotive Heat Exchangers Market is dominated by Industry players such as Denso, Climetal, Valeo, Nippon Light Metals, and among others. The market for others is flooded with small players most of which are present in the country. The market, flooded with these small and medium players, makes the aftermarket very competitive.

India Automotive Heat Exchanger Market Leaders

-

Valeo SA

-

Denso Corporation

-

Mahle Gmbh

-

Modine Manufacturing

-

Nippon Light Metals

*Disclaimer: Major Players sorted in no particular order

India Automotive Heat Exchanger Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Application

- 5.1.1 Radiators

- 5.1.2 Oil Coolers

- 5.1.3 Intercoolers

- 5.1.4 Air Conditioning and Condenser

- 5.1.5 Exhaust Gas Heat Exchanger

-

5.2 By Design

- 5.2.1 Tube/Fin

- 5.2.2 Plate-Bar

- 5.2.3 Extrusion Fin

-

5.3 By Vehicle

- 5.3.1 Electric Vehicle

- 5.3.2 Conventional Vehicle (ICE)

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

-

6.2 Company Profiles*

- 6.2.1 Valeo SA

- 6.2.2 AKG Thermal Systems

- 6.2.3 Climetal S.L.

- 6.2.4 Denso Corporation

- 6.2.5 HRS Process Systems

- 6.2.6 Mahle Gmbh

- 6.2.7 Modine Manufacturing

- 6.2.8 Nippon Light Metals

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityIndia Automotive Heat Exchanger Industry Segmentation

The India Automotive Heat Exchanger Market is segmented by application type (Radiators, Oil Coolers, Intercoolers, Air Conditioning and Condenser, and Exhaust Gas Heat Exchanger), by design type (Tube/Fin, Plate-Bar and Extrusion Fin) and Vehicle type (Electric Vehicle and Conventional Vehicle (ICE))

| By Application | Radiators |

| Oil Coolers | |

| Intercoolers | |

| Air Conditioning and Condenser | |

| Exhaust Gas Heat Exchanger | |

| By Design | Tube/Fin |

| Plate-Bar | |

| Extrusion Fin | |

| By Vehicle | Electric Vehicle |

| Conventional Vehicle (ICE) |

India Automotive Heat Exchanger Market Research FAQs

What is the current India Automotive Heat Exchanger Market size?

The India Automotive Heat Exchanger Market is projected to register a CAGR of 12.25% during the forecast period (2024-2029)

Who are the key players in India Automotive Heat Exchanger Market?

Valeo SA, Denso Corporation, Mahle Gmbh, Modine Manufacturing and Nippon Light Metals are the major companies operating in the India Automotive Heat Exchanger Market.

What years does this India Automotive Heat Exchanger Market cover?

The report covers the India Automotive Heat Exchanger Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the India Automotive Heat Exchanger Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

India Automotive Heat Exchanger Industry Report

Statistics for the 2024 India Automotive Heat Exchanger market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. India Automotive Heat Exchanger analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.