Market Trends of India Automotive Sunroof Industry

This section covers the major market trends shaping the India Automotive Sunroof Market according to our research experts:

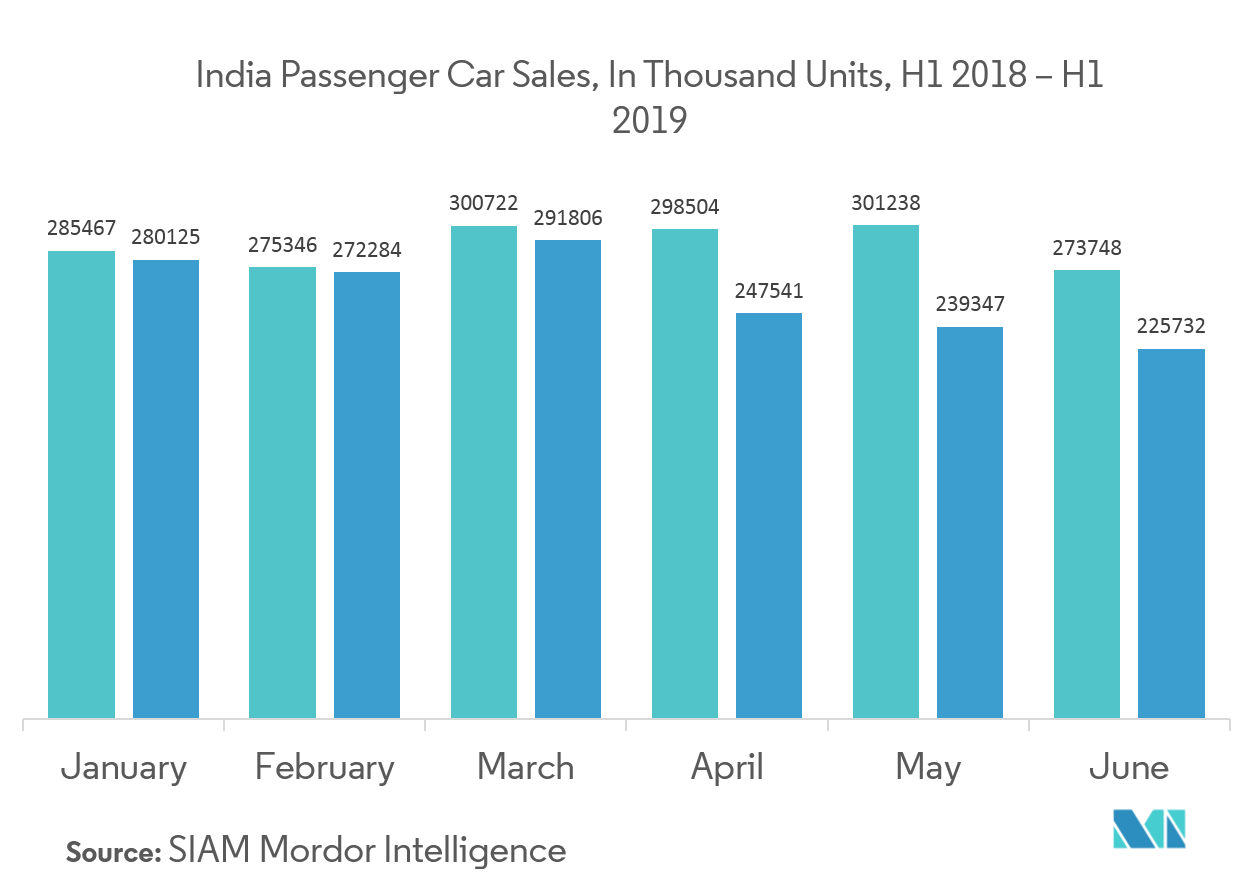

Decreasing Passenger Car Vehicles During H1 2019

Passenger car sales in India constitute to about 66% of the automotive industry followed by utility vehicles and vans. For the very first time in almost two decades, the passenger car sales in the country has witnessed a huge slump during Jan 2019 – June 2019.

During the first quarter of FY2020, the passenger vehicle segment has registered a 18.42% decline in sales accounting to 712,620 units as compared to 873,490 units sold during Q1 2018.

Leading automakers such as Maruti Suzuki, Hyundai, Tata Motors, Honda and Mahindra had decreased sales during this period. Manufacturers are forced to cut productions to adjust the demand by managing inventory.

There are several factors due to the decrease in sales, but primarily due to general elections, low finance availability, decline in rural demand and increase in insurance costs. Automakers have focused on inventory correction starting from March 2019.

In addition to this, the auto industry is currently undergoing new emission and safety norms. The government of India has made mandate that all the vehicles sold from April 2020 should comply the BS-VI emission norms and vehicle manufactured from April 2018 have Driver Side Airbag, Driver & Passenger Seat belt reminder and Reverse Parking Sensors.

As a result of inventory correction methodologies adopted by OEMs, the retail numbers have increased slightly (although observing a decline of 1.93%) during April to June this year as compared to 2018.

However, the political stability of the re-elected government, road and infrastructure development projects in pipeline, shift towards BS-VI are expected to increase the passenger car sales over the next few years. Also, new players such as Kia and Morris Garage already planned the product lineup for Indian market and PSA Group planning to enter the market are also expected to contribute to the growth in passenger car sales.

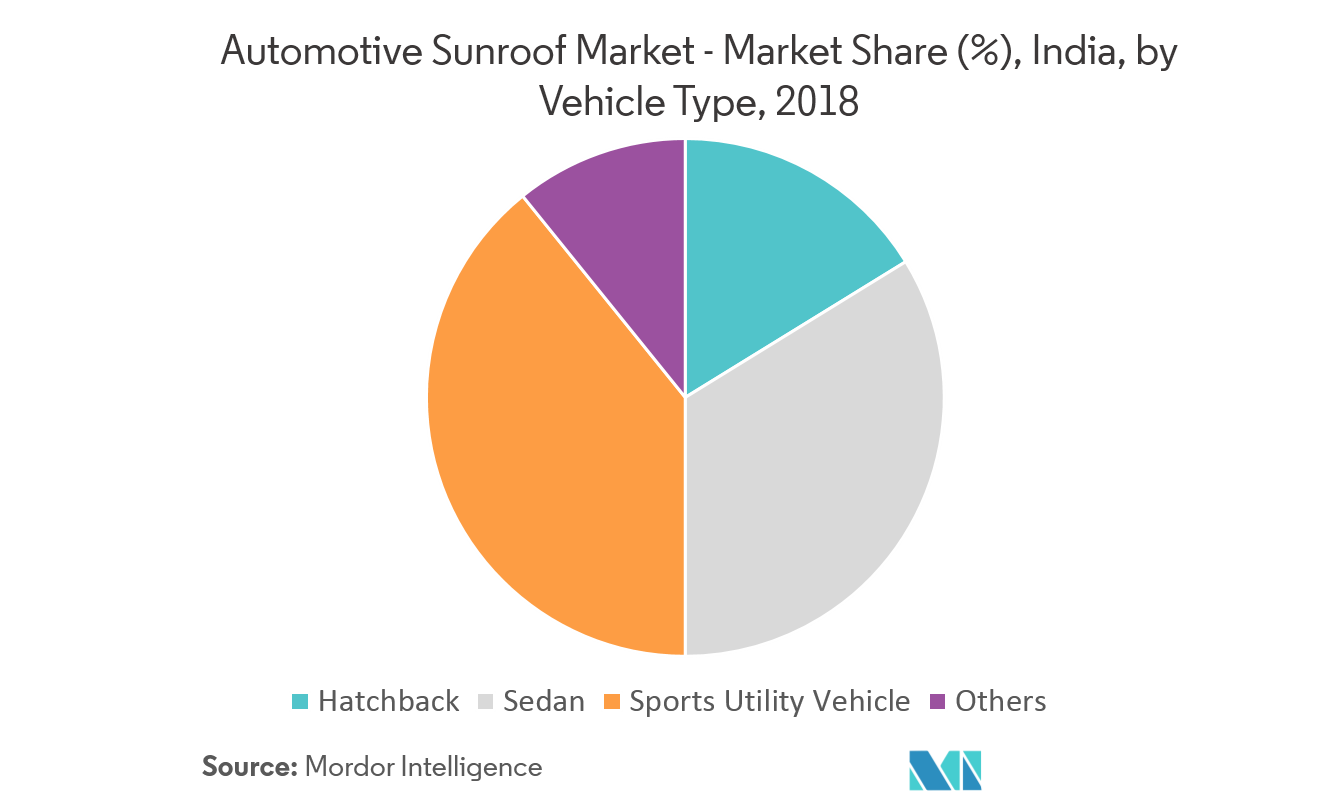

OEMs Providing Sunroof as Standard

Being home to the world’s largest youth population and high rate of automotive aftermarket customization trends among automotive enthusiasts, the market for automotive sunroof is highly prolific in India. India has emerged as an automotive manufacturing hub for the western automotive giants. Large population, large number of white collar public, higher spending rates on luxury cars are some of the major driving factors for the sunroof market in the country.

Over the past five years, the sales of sedan, luxury and premium cars in the country grew exponentially, opening up the market for the sunroof industry. Unlike in the western world, even C-segment sedans in the country are being introduced with optional sunroof variants.

Recently, Hyundai announced its offering of sunroof for the Creta, Verna, Elantra, and Tucson models. Honda made an inbuilt sunroof available for its C-segment Sedan City. Volkswagen and Skoda are offering sunroof as a standard for their premium sedans, Passat and Superb, respectively. Big companies, such as Audi, BMW, Mercedes, Jaguar, and Volvo are offering sunroof as optional for entry segment sedans and as a standard for high-end models.

Automakers are making sunroof a standard offering, which is a clear indication of higher demand for sunroof systems in the country. It is estimated that over 25% of the population now prefers to own a car with sunroof, rather than one without. Aftermarket installation of sunroofs is on the rise in the country.

The market is quite small at present; however, this is expected to change during the forecast period. The popularity for sunroofs in the country is poised to grow exponentially with higher consumer luxury spending, burgeoning economy, and large population in the country.