India Construction Equipment Rental Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 5.10 % |

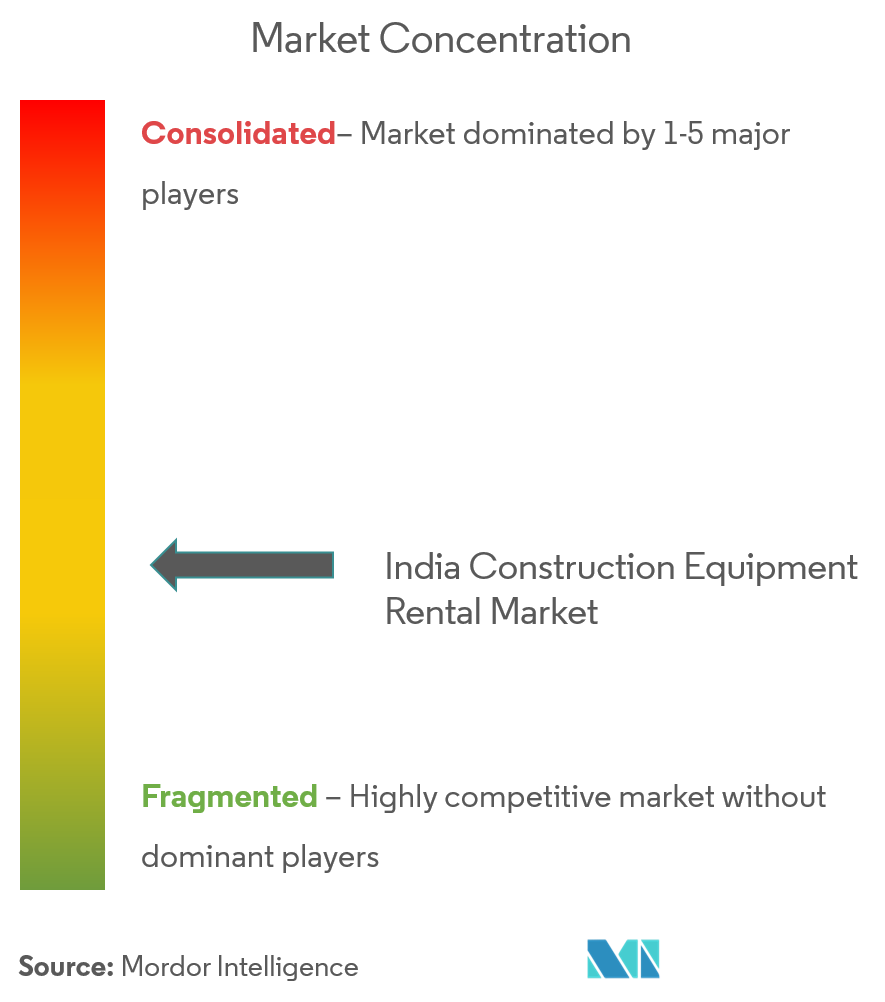

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

India Construction Equipment Rental Market Analysis

The India construction equipment rental market (henceforth referred to as the market studied) is anticipated to register a CAGR of about 5.1 % during the forecast period (2020 - 2025).

- The increasing focus on infrastructure and development of automation in the construction and manufacturing processes had a significant impact on the market growth. The road construction machinery market has witnessed significant growth in the recent past, owing to the increased road development programs undertaken by the central and state government.

- The renting or leasing of construction equipment has been on the rise, owing to the equipment cost and the cost of the maintenance process. Apart from the cost, there are also other benefits associated with renting the construction equipment. Rental companies provide the machinery, along with the required professional machine operators and drivers, included in the rent.

- For short-term construction application, renting a machinery has been preferable than a purchase among construction contractors, as renting allows optimum utilization of the machinery.

- India has nearly 1,263 construction projects in progress across various sectors, such as power, road, railways, telecom, and shipping. Additionally, the growing demand for office space in tier 1 and 2 cities is anticipated to continue to increase the demand for rental construction equipment in the country during the forecast period.

India Construction Equipment Rental Market Trends

This section covers the major market trends shaping the India Construction Equipment Rental Market according to our research experts:

Growing Investment in The Construction Industry

Growing investments in the infrastructure sector and other strategic initiatives of the government are expected to boost the construction sector in the country.

- The construction sector in India has been growing rapidly with an increase in investments by the government.

- The Indian government's ‘Housing for All by 2022’ is also a major game changer for the industry.

- The growth of commercial real estate has been driven largely by service sectors, especially IT-ITeS.

Prime Minister Narendra Modi announced the launch of Smart Cities Mission, two years ago, with an aim of developing 100 sustainable and inclusive cities across India.

- 99 cities were identified, and the central government recently added nine more to the list.

- With an investment of over INR 2 trillion being dedicated to the project, the government needs to tap into cost-effective and innovative operational models in real estate construction.

The increasing investments in the residential and commercial sectors, along with strategic initiatives by the Indian government, are expected to boost the construction sector in the country.

Cranes Are Likely to Dominate The Construction Equipment Rental Market

The cranes are expected to lead the construction equipment rental market as Rental cranes are available in different types and are majorly classified as, crawler cranes, all terrain cranes, rough terrain cranes, tower cranes, and truck-mounted cranes. Among them, crawler cranes, all terrain cranes, tower cranes, and truck-mounted cranes have been majorly adopted in the construction sector, while rough terrain cranes have covered a limited demand in construction and major demand in mining sector.

With the stark rise in affordable housing and smart city projects by the Indian government (Pradhanmantri Awaas Yojna and Mukhyamantri Awaas Yojna), the demand for tower cranes has been continually increasing.

- Owing to the high cost of these cranes, the demand for rental cranes has been increasing.

Big corporates, like L&T, Shapoorji, and Tata Projects, have begun to take cranes on rentals instead of procurement of new equipment.

India Construction Equipment Rental Industry Overview

The India construction equipment rental market is majorly dominated by few players such as iQuippo, Volvo Construction Equipment, ACE Cranes, ABC Infra Equipment Pvt Ltd., Sanghvi Movers Limited (SML), All India Crane Hiring Co., Jainex Group amongst others.

The companies are expanding their presence and buying new machinery for providing these machineries on rent. For instance,

- Volvo Construction Equipment strengthened its presence in the Indian retail sector, with the addition of a dealer in Rajasthan. The operations of this dealership is head quartered in Udaipur, with initial branch offices in Bhilwara, Rajnagar, Jodhpur, and Barmer.

- JNK Lifter, crane rental company based in Mumbai, took delivery of a new LTM 1250-5.1 mobile crane at theLiebherrstand at the Bauma Conexpo India construction machinery trade show.

India Construction Equipment Rental Market Leaders

-

Volvo Construction Equipment

-

IQUIPPO

-

All India Crane Hiring Co.,

-

ABC Infra Equipment Pvt Ltd.,

-

Sanghvi Movers Limited (SML)

*Disclaimer: Major Players sorted in no particular order

India Construction Equipment Rental Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Vehicle

- 5.1.1 Earth Moving Equipment

- 5.1.1.1 Backhoe

- 5.1.1.2 Loaders

- 5.1.1.3 Excavators

- 5.1.1.4 Other Earth Moving Equipment's

- 5.1.2 Material Handling

- 5.1.2.1 Cranes

- 5.1.2.2 Dump Trucks

-

5.2 By Drive

- 5.2.1 IC Engine

- 5.2.2 Hybrid Drive

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

-

6.2 Company Profiles

- 6.2.1 Volvo Construction Equipment

- 6.2.2 IQUIPPO

- 6.2.3 Jainex Group

- 6.2.4 All India Crane Hiring Co.,

- 6.2.5 ACE Cranes

- 6.2.6 ABC Infra Equipment Pvt Ltd.,

- 6.2.7 Sanghvi Movers Limited (SML)

- 6.2.8 JCB India Limited

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityIndia Construction Equipment Rental Industry Segmentation

The India construction equipment rental market is segmented by vehicle type (Earth Moving Equipment, Material Handling), and by drive type (IC Engine and Hybrid Drive)

| By Vehicle | Earth Moving Equipment | Backhoe |

| Loaders | ||

| Excavators | ||

| Other Earth Moving Equipment's | ||

| By Vehicle | Material Handling | Cranes |

| Dump Trucks | ||

| By Drive | IC Engine | |

| Hybrid Drive |

India Construction Equipment Rental Market Research FAQs

What is the current India Construction Equipment Rental Market size?

The India Construction Equipment Rental Market is projected to register a CAGR of 5.10% during the forecast period (2024-2029)

Who are the key players in India Construction Equipment Rental Market?

Volvo Construction Equipment, IQUIPPO, All India Crane Hiring Co.,, ABC Infra Equipment Pvt Ltd., and Sanghvi Movers Limited (SML) are the major companies operating in the India Construction Equipment Rental Market.

What years does this India Construction Equipment Rental Market cover?

The report covers the India Construction Equipment Rental Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the India Construction Equipment Rental Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

India Construction Equipment Rental Industry Report

Statistics for the 2024 India Construction Equipment Rental market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. India Construction Equipment Rental analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.