Indonesia Food Sweetener Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 4.50 % |

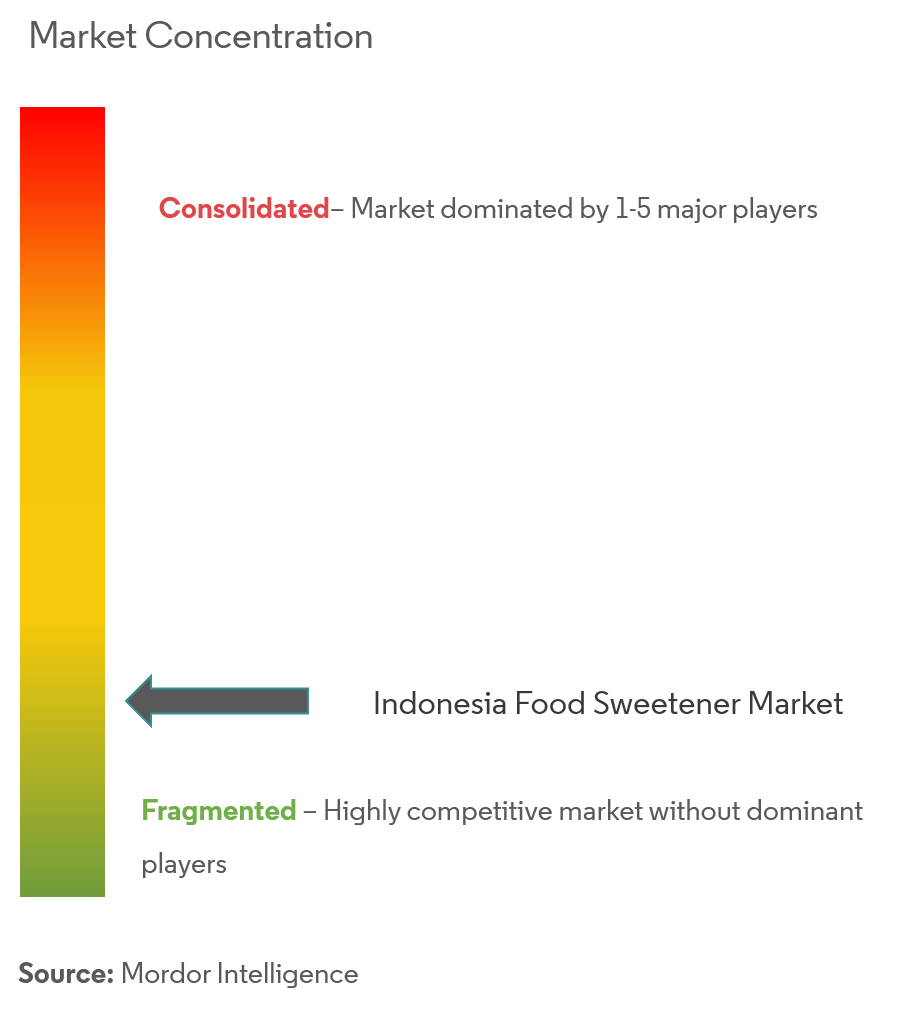

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Indonesia Food Sweetener Market Analysis

The Indonesia food sweetener market is expected to register a CAGR of 4.5% during the forecast period (2020- 2025).

- An increasing demand for natural, non-caloric sweetener is the primary factor driving the Indonesian sweetener market. Another vital factor is the growing consumption of processed food products.

-

However, the fluctuating cost of sweeteners restrains the market. Moreover, stringent regulations concerned with sweeteners affect the market. The application of sugar substitutes in nutrition and sports drinks provides further opportunity for the market.

-

Growing obese population and increasing health awareness have boosted the demand for natural, non-caloric sweeteners.

Indonesia Food Sweetener Market Trends

This section covers the major market trends shaping the Indonesia Food Sweetener Market according to our research experts:

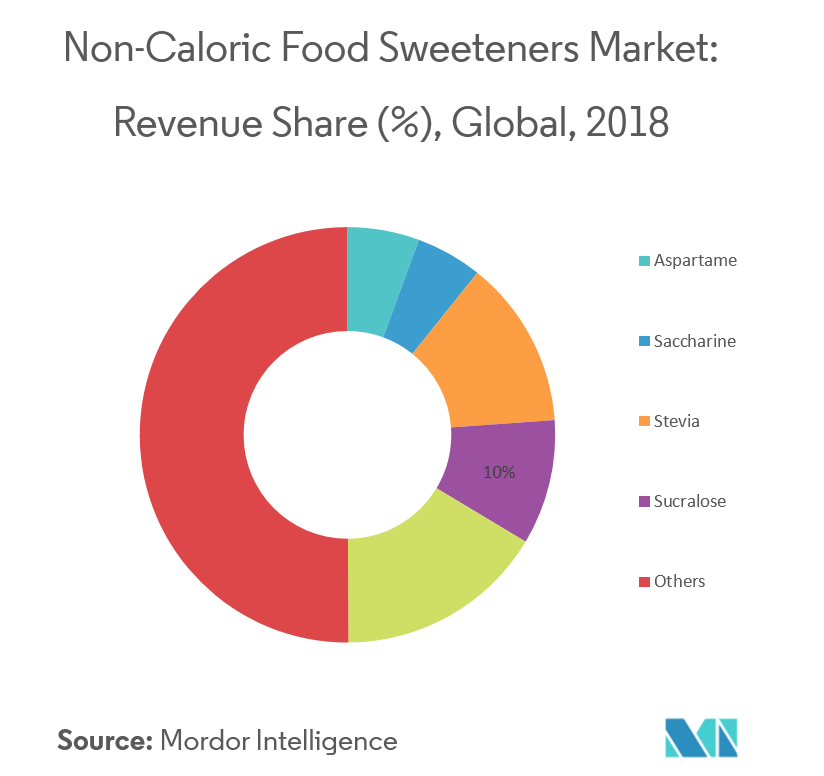

Increased Demand For Non-Caloric Sweeteners

Growing obese population and increasing health awareness have boosted the demand for natural, non-caloric sweeteners. Although caloric sugar still holds the major share of the food sweeteners market, health-consciousness among consumers is driving the demand for safer options like natural, non-caloric products. Non-caloric or low-caloric sweeteners are healthy food choices. The advantages rendered by the non-caloric sweeteners have led to an increased consumer demand. The major non-caloric sweeteners are acesulfame-K, aspartame, cyclamate, saccharin, sucralose, and stevia. Though some sweeteners are banned owing to their health effects, there are various sweeteners prevalent in the market. Companies are innovating food products, especially from the beverages industry.

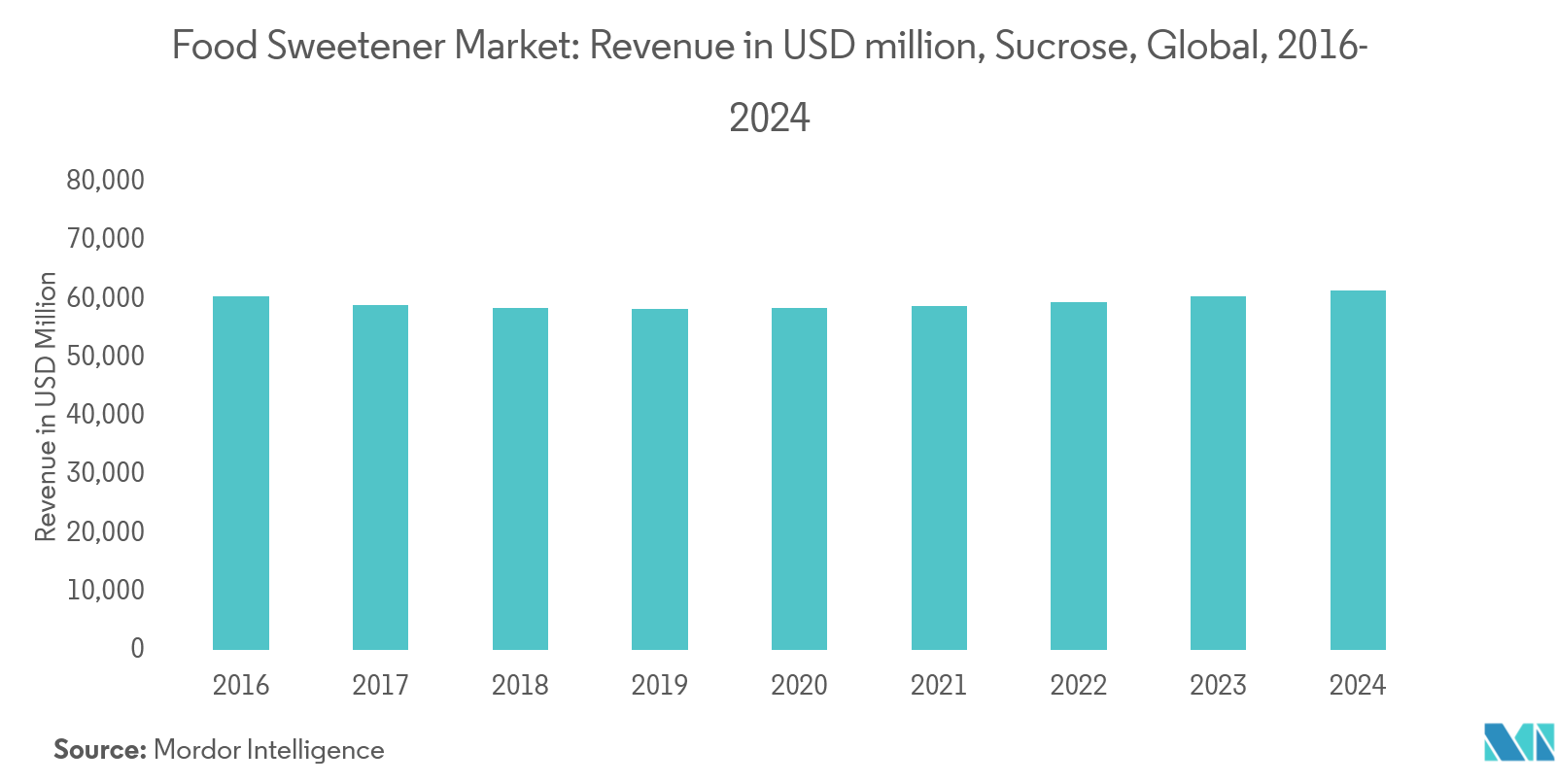

Sucrose Is The Mostly Sugar Type

The significant amount of imported sugar into Indonesia serves the highlight the scale of demand for the commodity, which places Indonesia among the world’s largest buyers, by volume, particularly for the country’s food & beverage manufacturing sector. Indonesia produces white plantation sugar from sugarcane, which is primarily produced for direct human consumption. Indonesia also produces refined sugar from imported raw sugar which is used for processing by the food & beverage industries. Indonesian regulations prohibit the distribution of refined sugar produced from imported raw sugar to retail markets for direct human consumption.

Indonesia Food Sweetener Industry Overview

Indonesia food sweetener market is a fragmented market with the presence of various small and major players. Players are introducing more products into their shelf to expand the portfolio and their presence in the market. Players are mainly focusing on non-calorie and natural sweeteners in order to attract the customers especially the health conscious population.

Indonesia Food Sweetener Market Leaders

-

Cargill

-

Sungai Budi Group (SBG)

-

PureCircle

-

JL. RAYA SINGAPARNA KM

-

Stevia Corp

*Disclaimer: Major Players sorted in no particular order

Indonesia Food Sweetener Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables and Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Sucrose (Common Sugar)

- 5.1.2 Starch Sweeteners and Sugar Alcohols

- 5.1.2.1 Dextrose

- 5.1.2.2 High Fructose Corn Syrup (HFCS)

- 5.1.2.3 Maltodextrin

- 5.1.2.4 Sorbitol

- 5.1.2.5 Others

- 5.1.3 High Intensity Sweeteners (HIS)

- 5.1.3.1 Sucralose

- 5.1.3.2 Aspartame

- 5.1.3.3 Stevia

- 5.1.3.4 Others

-

5.2 By Application

- 5.2.1 Bakery and Confectionery

- 5.2.2 Dairy and Desserts

- 5.2.3 Beverages

- 5.2.4 Meat and Meat Products

- 5.2.5 Soups, Sauces and Dressings

- 5.2.6 Others

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Position Analysis

-

6.3 Company Profiles

- 6.3.1 Cargill, Incorporated

- 6.3.2 Stevia Corp

- 6.3.3 Sungai Budi Group (SBG)

- 6.3.4 JL. RAYA SINGAPARNA KM

- 6.3.5 PT. Batang Alum Industrie

- 6.3.6 PT. INDESSO AROMA

- 6.3.7 PureCircle

- 6.3.8 PT Barentz

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityIndonesia Food Sweetener Industry Segmentation

The Indonesia food sweetener market is segmented by Type into Sucrose, Starch Sweeteners and Sugar Alcohols and High Intensity Sweeteners. By Application basis the market is segmented into Bakery and Confectionery, Dairy and Desserts, Meat and Meat Products, Soups, Sauces and Dressings and Others.

| By Type | Sucrose (Common Sugar) | |

| Starch Sweeteners and Sugar Alcohols | Dextrose | |

| High Fructose Corn Syrup (HFCS) | ||

| Maltodextrin | ||

| Sorbitol | ||

| Others | ||

| High Intensity Sweeteners (HIS) | Sucralose | |

| Aspartame | ||

| Stevia | ||

| Others | ||

| By Application | Bakery and Confectionery | |

| Dairy and Desserts | ||

| Beverages | ||

| Meat and Meat Products | ||

| Soups, Sauces and Dressings | ||

| Others |

Indonesia Food Sweetener Market Research FAQs

What is the current Indonesia Food Sweetener Market size?

The Indonesia Food Sweetener Market is projected to register a CAGR of 4.5% during the forecast period (2024-2029)

Who are the key players in Indonesia Food Sweetener Market?

Cargill, Sungai Budi Group (SBG), PureCircle, JL. RAYA SINGAPARNA KM and Stevia Corp are the major companies operating in the Indonesia Food Sweetener Market.

What years does this Indonesia Food Sweetener Market cover?

The report covers the Indonesia Food Sweetener Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Indonesia Food Sweetener Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Indonesia Food Sweetener Industry Report

Statistics for the 2024 Indonesia Food Sweetener market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Indonesia Food Sweetener analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.