Inductive and LVDT Sensor Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 10.00 % |

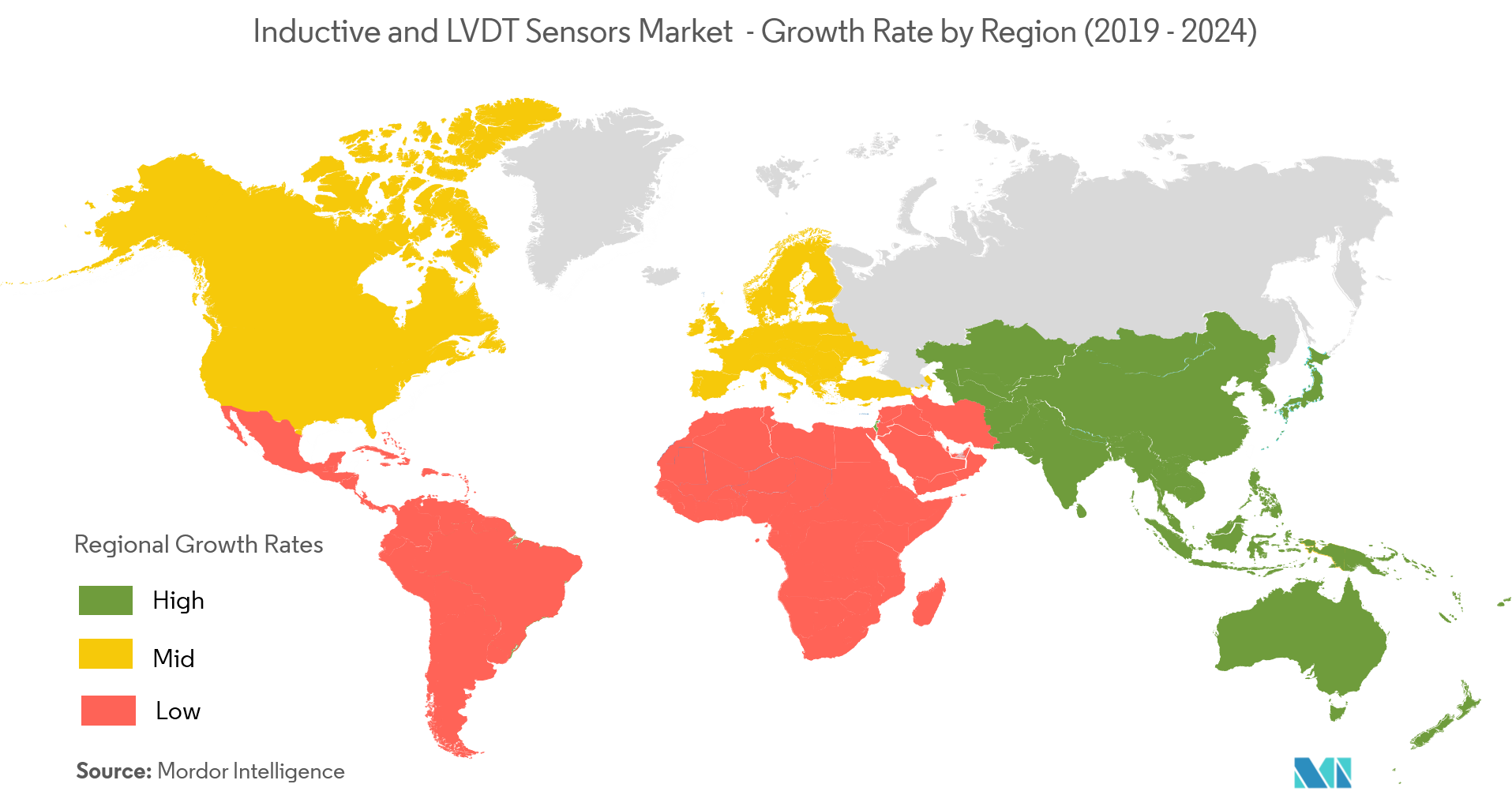

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Inductive and LVDT Sensor Market Analysis

The inductive and LVDT sensors market is expected to grow at a CAGR of 10% over the forecast period (2021 - 2026). The increase in demand for applications in the automobile and transportation industries is projected to drive the market in the forecast period.

- The current market scenario indicates significant growth in the usage of inductive and LVDT sensors across a diverse field of applications, such as proximity warning systems, automobile parking systems, and monitoring and measurement systems, among others.

- Factors, such as technological improvement in automotive security and infotainment systems, along with the rising trends towards factory process automation, are expected to drive the LVDT market. However, with the advent of non-contact displacement sensors (NCDT) and thereof, switching from contact to non-contact position sensing in developing economies.

- For the food and beverage industry, these sensors have become a preferable choice as the industry is highly regulated due to safety purpose. The growing food and beverage market is expected to augment the market growth over the forecast period.

- Moreover, the rapid development of safety and security systems, in addition to the developments in driving assistance systems, as well as electric vehicles, stimulate the demand for inductive & LVDT sensors. Low switching costs, along with a large number of suppliers, moderate the bargaining power of buyers in the inductive & LVDT sensors market. However, the presence of numerous manufacturers, lack of technology differentiation and high initial costs is causing participants to compete as commodity manufacturers.

Inductive and LVDT Sensor Market Trends

This section covers the major market trends shaping the Inductive & LVDT Sensor Market according to our research experts:

Applications in Aerospace & Defence to Create a Huge Demand for Inductive and LVDT Sensors

- The application of LVDTs in aerospace is profound in engines, flight controls, nose wheel steering and pilot control for continuous monitoring. In primary or secondary flight control - flap, slat and spoiler position feedback can be taken by LVDTs to detect mechanism positions within flight control actuation systems. For aircraft with multiple slats or flaps, it is imperative to ensure that all panels work in sync.

- Also, the LVDT sensors position data support helps direct flight control actuation systems, thereby contributing to the proper execution of pilot inputs to the controls. The data is also used to provide feedback to the pilot, and the flight computer is used in other aircraft system logic. Also, it is used to detect positions of engine linkages or valve functional states. These sensors may be used on engine linkages and many types of aerospace valves to identify positions of engine linkages or valve states.

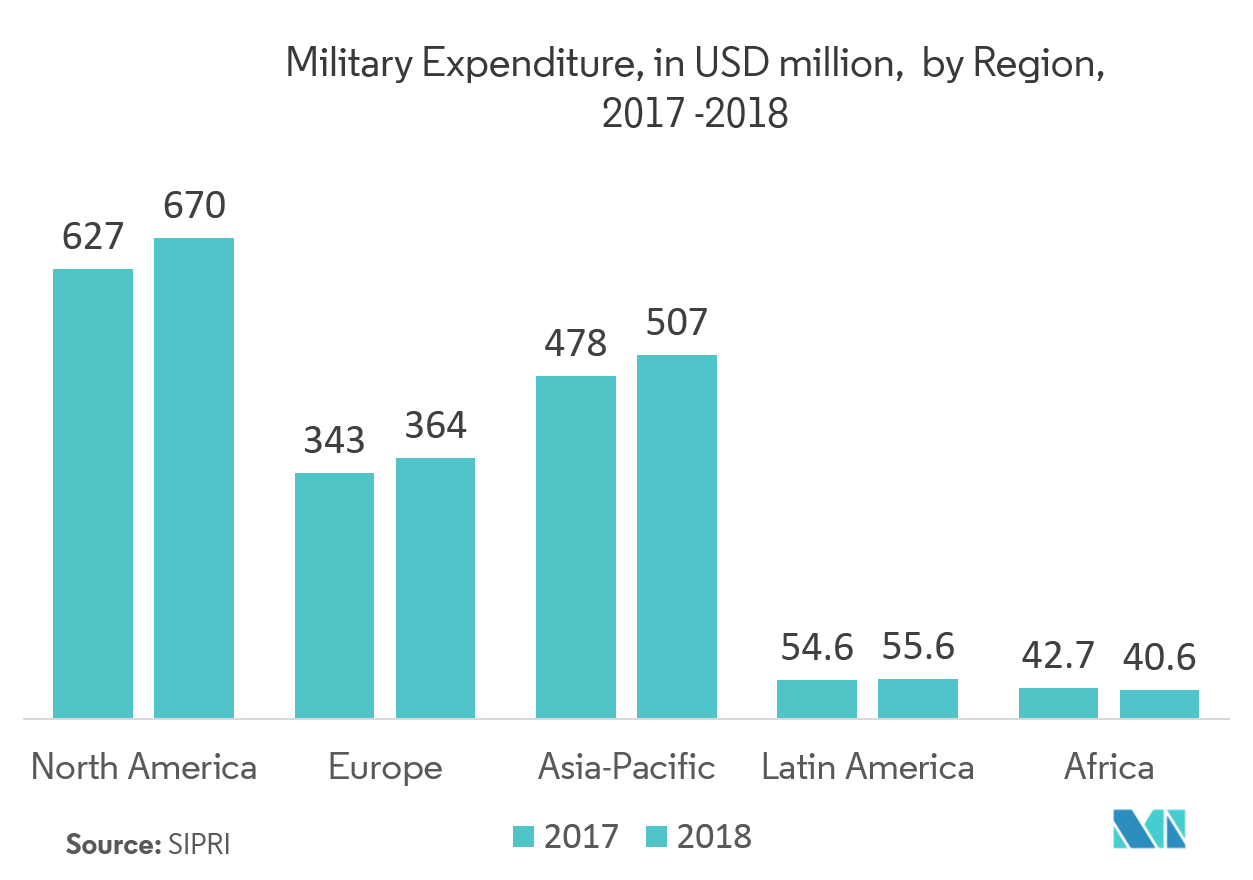

- The rising global tensions have led to the growing expenditure for defense products in North America, Europe, Asia-Pacific, Africa & Latin America, which influence the growth of the defense budgets in the respective regions.

- The GDP growth, relatively lower crude oil prices and strong passenger travel demand, particularly in the Middle East & African and the Asia-Pacific regions, likely drive commercial aerospace sector growth. The overall growth in the aerospace and defense industry and a number of listed applications is imperative that the market for LVDT sensors is set to a poised growth during the forecast period.

North America Account for Significant Market Share

- North America dominates the Inductive and LVDT Sensors Market because they are widely used in applications, such as automation, aircraft, power turbines, satellites, hydraulics, nuclear reactors, and many others, which are already booming in the region.

- Some of the major strategies being followed by the companies (in the region) in the inductive and LVDT market are new product launches and acquisitions that are expected to help in expanding their geographical reach, along with widening their product offerings. The competition level in this region is expected to be intense because of numerous market players fighting to gain more share of the market.

- The low switching costs, along with a large number of suppliers, moderates the bargaining power of buyers in the region. Easy access to the distribution channels and the absence of substitutes increases the threat of new entrants in this market.

- Expertise in end-user vertical markets and customer service are also expected to play an essential role in ensuring market success in the region. However, the presence of numerous manufacturers and lack of technology differentiation is causing participants to compete as commodity manufacturers. Hence will drive the Inductive and LVDT sensor market in the region.

Inductive and LVDT Sensor Industry Overview

The major players include RDP Electrosense, Inc., IFM effector, Inc., Micro-Epsilon, Trans-Tek, Inc.,Kenyence Corporation, Brunswick Instrument, LLC, OMEGA Engineering, Inc., Ametek Solartron Metrology, and TE Connectivity Ltd, among others. There is major competition among major players, therefore market concentration will be low.

- November 2018 - Keyence launched a new wide-area 3D measurement system VR-5000. The VR Series is able to measure across 30 mm in just one second, with a maximum measurement range of 200 mm x 100 mm. The VR Series includes a cross-sectional profile measurement menu with tools for measuring height, width, angle, radius, etc.

Inductive and LVDT Sensor Market Leaders

-

TE Connectivity Ltd

-

Ifm electronic

-

OMEGA Engineering Inc.

-

RDP Electrosense Inc.

-

Keyence Corporation

*Disclaimer: Major Players sorted in no particular order

Inductive and LVDT Sensor Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increase in Demand for Applications in Automobile and Transportation Industries

- 4.3.2 Rising Demand for Industrial Automation

-

4.4 Market Restraints

- 4.4.1 High Initial Setup Costs

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 DC Operated LVDT Sensor

- 5.1.2 AC Operated LVDT Sensor

- 5.1.3 Digital I/O LVDT Sensor

- 5.1.4 Other Types

-

5.2 By Product

- 5.2.1 XLT

- 5.2.2 LVDT Gaging Sensor

- 5.2.3 LVDT Displacement/Position Sensor

- 5.2.4 Other Products

-

5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Consumer Electronics

- 5.3.4 Medical and Healthcare

- 5.3.5 Energy and Power

- 5.3.6 Oil and Gas

- 5.3.7 Other Applications

-

5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 RDP Electrosense Inc.

- 6.1.2 Micro-Epsilon Group

- 6.1.3 Trans-Tek Inc.

- 6.1.4 Keyence Corporation

- 6.1.5 Comptrol Incorporated

- 6.1.6 Brunswick Instrument LLC

- 6.1.7 OMEGA Engineering Inc.

- 6.1.8 Ametek Solartron Metrology

- 6.1.9 TE Connectivity Ltd.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityInductive and LVDT Sensor Industry Segmentation

Sensors are considered as the eyes and ears of a technical system. An LVDT is an electromechanical sensor that converts mechanical motion or vibrations, specifically rectilinear motion into a variable electrical voltage, current or signals. Since it is the type of transformer, it works only on AC while inductive sensors are proximity sensors that indicate if anything comes in the proximity of it. Both inductive sensors and LVDT sensors work on eddy current effect yet are distinguished with the accuracy and output offered by them. Inductive proximity sensors generally give the output in binary.

| By Type | DC Operated LVDT Sensor |

| AC Operated LVDT Sensor | |

| Digital I/O LVDT Sensor | |

| Other Types | |

| By Product | XLT |

| LVDT Gaging Sensor | |

| LVDT Displacement/Position Sensor | |

| Other Products | |

| By Application | Automotive |

| Aerospace and Defense | |

| Consumer Electronics | |

| Medical and Healthcare | |

| Energy and Power | |

| Oil and Gas | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Inductive and LVDT Sensor Market Research FAQs

What is the current Inductive and LVDT Sensors Market size?

The Inductive and LVDT Sensors Market is projected to register a CAGR of 10% during the forecast period (2024-2029)

Who are the key players in Inductive and LVDT Sensors Market?

TE Connectivity Ltd, Ifm electronic, OMEGA Engineering Inc., RDP Electrosense Inc. and Keyence Corporation are the major companies operating in the Inductive and LVDT Sensors Market.

Which is the fastest growing region in Inductive and LVDT Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Inductive and LVDT Sensors Market?

In 2024, the North America accounts for the largest market share in Inductive and LVDT Sensors Market.

What years does this Inductive and LVDT Sensors Market cover?

The report covers the Inductive and LVDT Sensors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Inductive and LVDT Sensors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Patient Centric Healthcare App Industry Report

Statistics for the 2024 Patient Centric Healthcare App market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Patient Centric Healthcare App analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.