Inductors Cores & Beads Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 10.11 Billion |

| Market Size (2029) | USD 12.25 Billion |

| CAGR (2024 - 2029) | 3.91 % |

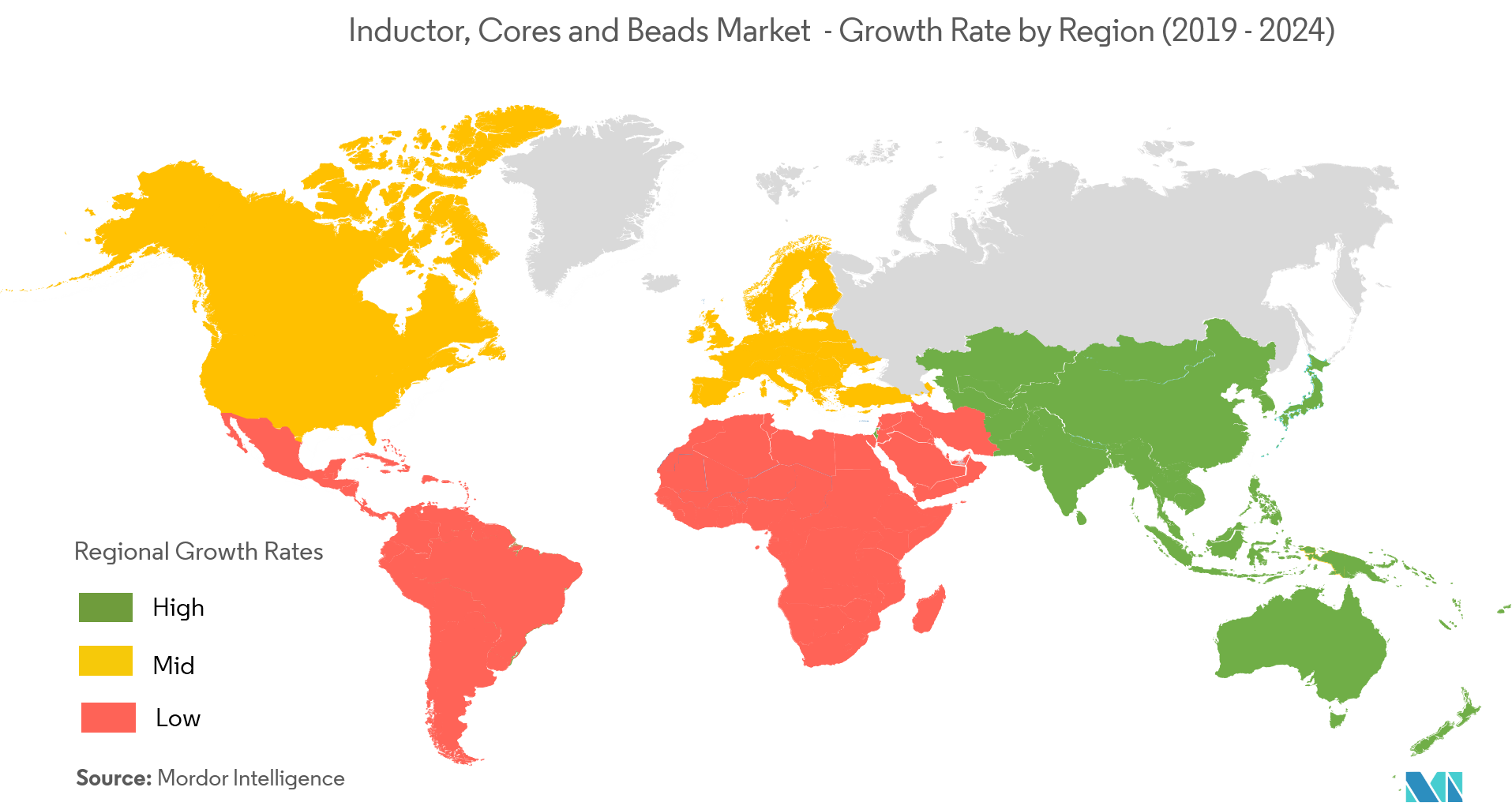

| Fastest Growing Market | North America |

| Largest Market | Asia Pacific |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Inductors Cores & Beads Market Analysis

The Inductors, Cores and Beads Market size is estimated at USD 10.11 billion in 2024, and is expected to reach USD 12.25 billion by 2029, growing at a CAGR of 3.91% during the forecast period (2024-2029).

New product development of SMDs are gaining momentum, centering on small chips for smartphones, modules, and IoT terminals, and high-reliability chips for automotive application.

- The increasing power supply density and efficiency is a challenge for most of the inductor designers. There is a continuous need for reduced size and high-performance power solutions to meet increasingly stringent application requirements.

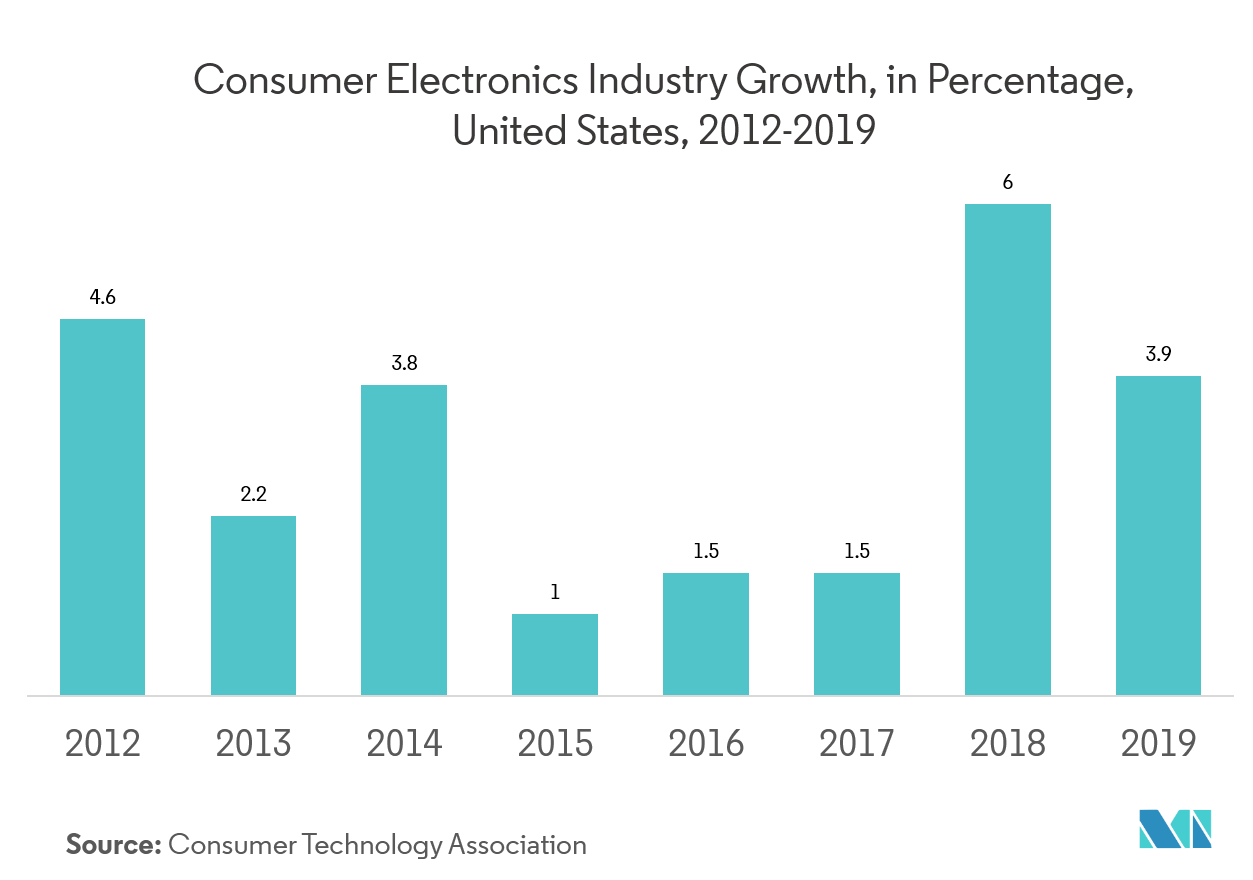

- Globally, the growing demand for consumer electronics, such as smartphones, tablets, portable gaming consoles, laptops, set-top boxes, among others, is the major factor driving the demand for various inductors, core and beads.

- The market is also witnessing a boost in demand from applications, which require high reliability, in the industrial, aerospace and defense, and medical sectors.

Inductors Cores & Beads Market Trends

This section covers the major market trends shaping the Inductors Cores & Beads Market according to our research experts:

Consumer Electronic to Witness a Significant Market Share

- Around 15 percent of a smartphone is made from ceramics and glass that is from electronic applications with circuit boards for thermal management employs cores of passive components like inductors, fuses or resistors.

- The Internet of Things and 5G network is expected to boost the overall speed and efficiency of communicating information between devices and networks, IoT, autonomous driving and M2M performances.

- Most of consumer electronic products are high-power devices, and the power ranges from hundred to several kilowatts.The amount of magnetic components employed depends on the power of the charging pile. On an average, 20 magnetic components are required in a charging pile, of which the inductor is used in a larger amount.

- The challenge remains the large chip area utilisation. For instance, Intel stated that the on-chip inductors used in their DC-DC converters for power management in multi-core processors occupy approximately a quarter of the total available chip area, which made them costly.

North America to Hold a Significant Market Share

- The United States witnesses a growing use of inductors in automotive electronics and increasing adoption of smart grid technologies. Due to their various applications, inductors are one of the primary components of many electronic systems. Because of the extensive usage, more inductors are being applied in several industries across North America.

- U.S. utilities invested approximately USD 144 billion in electricity generation, transmission, and distribution infrastructure in 2016. According to IEA, U.S. investments in smart grids infrastructure stood at USD 12.6 billion in 2018.

- The application of inductors, core and beads find their applications in modern adaptive LED headlights because of their low power consumption and multifunctional adaptability, these are replacing conventional halogen and HID headlights, ADAS, automotive ignition systems, among others.

- The Unites States automotive production in 2018 stands at 11.31 billion cars and commercial vehicles and Canada's automotive production at 2.02 miliion cars and commericial vehicles, as per OICA.

- The region expects a gradual ease in China-US trade spats after May of 2019, when the United States raised import tariffs on USD 200 billion of Chinese goods, which further affected the electronic component industry.

Inductors Cores & Beads Industry Overview

The inductor, cores and beadsmarket's opportunities have resulted in intense competition. There are a significant number of manufacturers vying for the increasing market share. The market witnesses increased innovation in the form of reduced size and varying the form of cores to achieve higher inductance.

- September 2019 - TDK introduced metal-core power inductors tomeet the tough conditions forharsh automotive environments, these conductors have a wide operating temperature range from -55 °C up to +155 °C.

- June 2019 -TDK launched a Thin-Film Power Inductor specifically for Mobile Device Design tohandle 4% higher currents and 12% lower resistance than conventional products.

- June 2019 - Kemet Corporation launched new range of SMD metal composite power inductors to suit modern power applications inDC-DC converters that are utilized in a variety of commercial and consumer applications including notebook computers, tablets, servers and HDTVs.

Inductors Cores & Beads Market Leaders

-

TDK corporation

-

Vishay International Inc.

-

Panasonic Corporation

-

Murata Manufacturing Co. Ltd.

-

Taiyo Yuden Co. Ltd.

*Disclaimer: Major Players sorted in no particular order

Inductors Cores & Beads Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Introduction to Market Drivers and Restraints

- 4.4 Market Drivers

- 4.5 Market Restraints

5. MARKET SEGMENTATION

-

5.1 By Inductor Type

- 5.1.1 Power Inductors

- 5.1.2 MultiLayer Chip Inductors

- 5.1.3 RF Inductors

- 5.1.4 Other Inductor Types

-

5.2 By Core Material

- 5.2.1 Air Core

- 5.2.2 Ferrite Core

- 5.2.3 Ceramic Core

- 5.2.4 Other Core Types

-

5.3 By Chip Beads

- 5.3.1 MultiLayered Beads

- 5.3.2 Ferrite Beads

- 5.3.3 EMI Beads

-

5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Computing

- 5.4.3 Communications

- 5.4.4 Consumer Electronics

- 5.4.5 Other End-User Industries

-

5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 TDK Corporation

- 6.1.2 Vishay International Inc.

- 6.1.3 Panasonic Corporation

- 6.1.4 Murata Manufacturing Co. Ltd.

- 6.1.5 Taiyo Yuden Co. Ltd.

- 6.1.6 Kemet Corporation

- 6.1.7 AVX Corporation

- 6.1.8 Texas Instruments

- 6.1.9 TT Electronics Plc

- 6.1.10 Hefei MyCoil Technology Co., Ltd.

- *List Not Exhaustive

7. INVESTMENT OPPORTUNITIES

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityInductors Cores & Beads Industry Segmentation

The different types of inductors with core materials and chip beads type are covered in the scope of the study. The market is further segmented by different end-user verticals (automotive, computing, , communication, consumer electronics).

| By Inductor Type | Power Inductors |

| MultiLayer Chip Inductors | |

| RF Inductors | |

| Other Inductor Types | |

| By Core Material | Air Core |

| Ferrite Core | |

| Ceramic Core | |

| Other Core Types | |

| By Chip Beads | MultiLayered Beads |

| Ferrite Beads | |

| EMI Beads | |

| By End-User Industry | Automotive |

| Computing | |

| Communications | |

| Consumer Electronics | |

| Other End-User Industries | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Latin America | |

| Middle East and Africa |

Inductors Cores & Beads Market Research FAQs

How big is the Inductors, Cores and Beads Market?

The Inductors, Cores and Beads Market size is expected to reach USD 10.11 billion in 2024 and grow at a CAGR of 3.91% to reach USD 12.25 billion by 2029.

What is the current Inductors, Cores and Beads Market size?

In 2024, the Inductors, Cores and Beads Market size is expected to reach USD 10.11 billion.

Who are the key players in Inductors, Cores and Beads Market?

TDK corporation, Vishay International Inc., Panasonic Corporation, Murata Manufacturing Co. Ltd. and Taiyo Yuden Co. Ltd. are the major companies operating in the Inductors, Cores and Beads Market.

Which is the fastest growing region in Inductors, Cores and Beads Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Inductors, Cores and Beads Market?

In 2024, the Asia Pacific accounts for the largest market share in Inductors, Cores and Beads Market.

What years does this Inductors, Cores and Beads Market cover, and what was the market size in 2023?

In 2023, the Inductors, Cores and Beads Market size was estimated at USD 9.73 billion. The report covers the Inductors, Cores and Beads Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Inductors, Cores and Beads Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Inductors, Cores and Beads Industry Report

Statistics for the 2024 Inductors, Cores and Beads market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Inductors, Cores and Beads analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.