Industrial Control for Process Automation Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 8.50 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

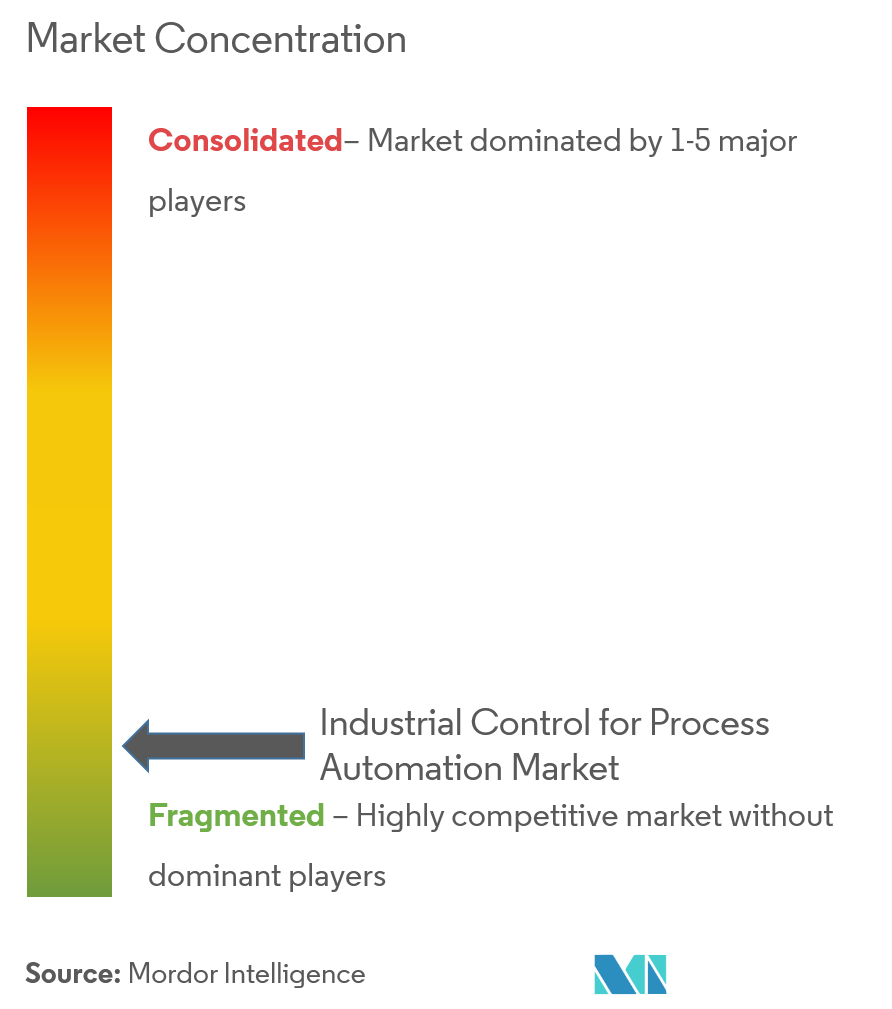

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Industrial Control for Process Automation Market Analysis

The industrial control for process automation market is expected to grow at a CAGR of 8.5% over the forecast period 2021 - 2026. The Internet of Things (IIoT) and Industrial 4.0 are dominating trends in the industrial sector, with machinery and devices being connected via the internet. The number of IoT connected devices rose to 20.35 billion in 2017 from 15.41 billion in 2015 and is expected to reach 51.11 billion by 2023, given the huge push from the investment of the technology providers through continuous research and development. To operate these increasing number of connected devices and machine-to-machine connection in the manufacturing industry, the need for control and supervision is expected to become more prominent; this can be attributed to the increase of network-connected and controlled devices and systems.

- The advent of technology over the past few years has enabled the coupling of mechanical devices with computer-based systems, allowing the latter to operate and control production. This has resulted in the development of automated equipment, capable of generating significantly higher production rates, effortless monitoring, and reduced wastage over traditional machines.

- The major factor driving the growth of the market is increasing the use of enabling technologies in manufacturing, rising adoption of industrial robots in the manufacturing sector driven by collaborative robots, connected enterprise along with mass production to cater to rising population, and government initiatives toward the adoption of industrial automation in various industries.

- The rising cost of labor, coupled with the immense pressure on manufacturers to meet deadlines, has resulted in increased adoption of automation in factories. Additionally, the factors like improved efficiency and reduction in production costs, compared to the conventional manufacturing process, are boosting the adoption of automation, which is acting as a driver for industrial control systems.

- Moreover, the operations of DCS, PLC, SCADA, and MES are complex and require a highly-skilled workforce. Furthermore, initial investment associated with a traverse from an assembly line through automated production line is expected to be high. Along with it, the cost involved in training the employees with the usage of the new sophisticated equipment is also added, which could be unaffordable for certain small- and medium-sized end users. These factors are hindering the market growth

Industrial Control for Process Automation Market Trends

This section covers the major market trends shaping the Industrial Control for Process Automation Market according to our research experts:

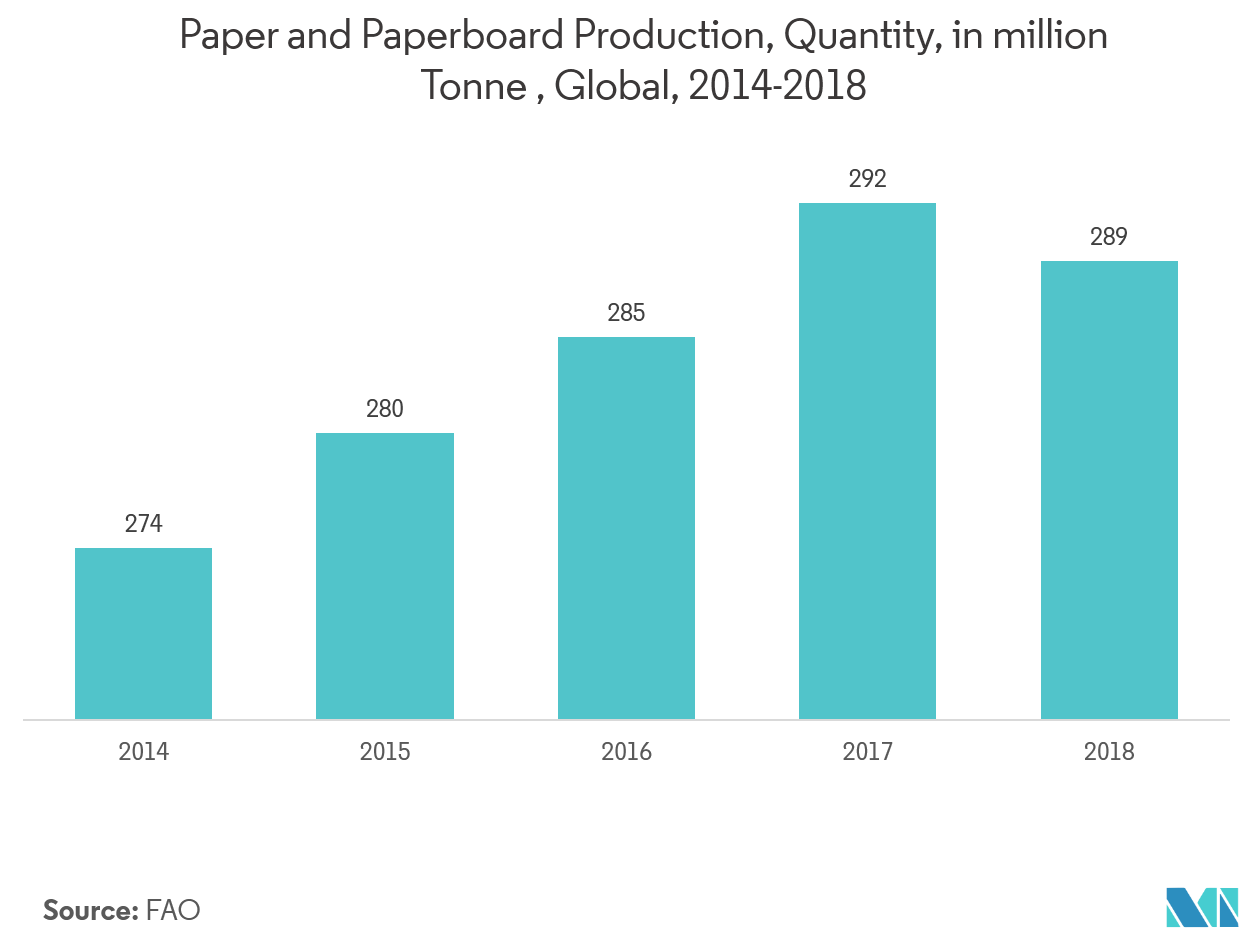

Paper and Pulp Segment is Expected to Register a Significant Growth

- The numerous processes in the paper and pulp industry require the raw materials pass through a lot of process with close monitoring of temperature and chemical content and the process automation allows to achieve the same from one location through the process automation. The paper and related products have seen an increase in the past five years and the demand is expected to show similar trends with the increase in demand from Asian, North American, and European regions over the forecast period. All these regions are expected to further drive the demand in the paper and pulp industry for increased process adoption.

- Process automation is also considered as the primary level of automation, which allows the collection of data continuously and real-time basis, this enables the industry to further use these systems for data visualization and predictive plant maintenance. The paper and pulp industry involves a number of steps for the conversion of wood into paper. Activities, such as wood preparation, bleaching, chemical recovery required high utilization of raw material, which can be better controlled, as automation helps in the efficient conversion of raw materials.

- The production in the industry is also facing a shortage, due to the presence of bottlenecks in production. A typical manual operator is the main bottleneck, which allows only about 60 rolls per hour of production, which can be improved by process automation and drive the growth over the forecast period.

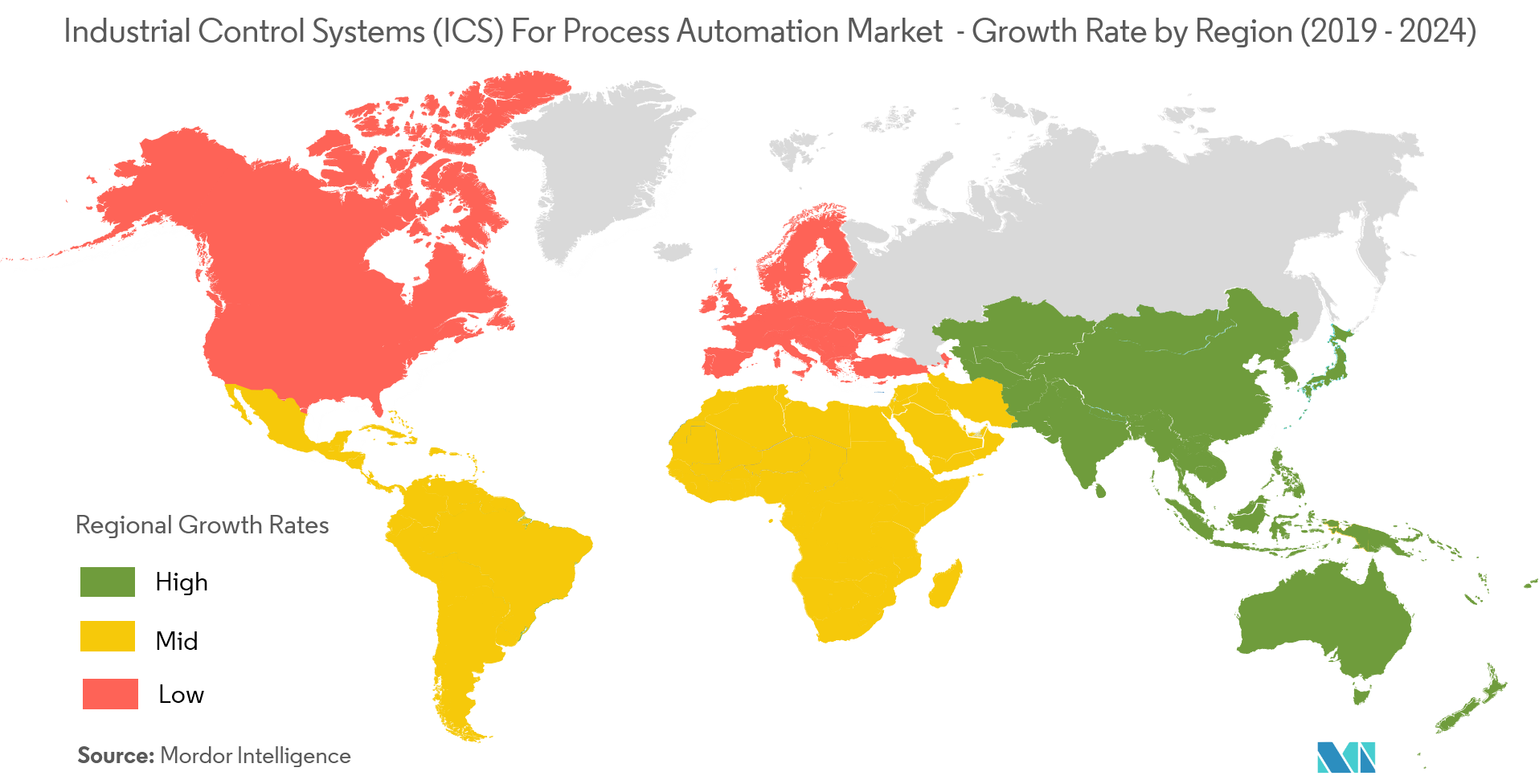

Asia-Pacific to be the Fastest Growing Market

- Due to the increasing adoption of the automation technologies and technological innovation in various industries, APAC is expected to hold the highest market share in the industrial control for the process automation market.

- Industrial control systems in developed regions like Europe and North America have reached the saturation point, owing to the early adoption of technological innovations. Hence, the most robust growth opportunity lies in emerging economies, such as the Asian countries.

- In emerging economies, several government initiatives promote techniques for efficient industrial production through automation. Application of Industrial control systems in countries, like South Korea, Indonesia, and China are on the rise, along with other emerging economies across the world.

- Moreover, China is working on innovative industrial practice by implementing automation technologies in manufacturing. Besides, research institutes and corporates are collaboratively working to improve China's manufacturing processes. Companies such as Honda (Japan), Toyota (Japan), and Suzuki (Japan) are developing smart factories for manufacturing robots, sensors, wireless technologies, and machine vision systems, thus propelling the growth of the industrial control for process automation market in Japan.

Industrial Control for Process Automation Industry Overview

The industrial control for process automation market isfragmented. The market is highly competitive due to the presence of many small and large players. Some of the key players includeABB Ltd.,Schneider Electric,Honeywell International Inc.,Siemens AG,Rockwell Automation,Omron Co.,General Electric Co., among others.

- June 2019 -Honeywell unveiled ExperionPKS Highly Integrated Virtual Environment (HIVE), a fundamentally new approach to engineering and maintaining industrial control systems. This is an evolution of the company’s flagship Experion Process Knowledge System (PKS). Experion PKS HIVE uses Honeywell's LEAPproject execution principles, software and networking to unchain control applications from physical equipment and controllers from physical IO. This enables control systems to be engineered and implemented in less time, at lower cost and risk, and with simpler, modular builds.

- June 2019 -Schneider Electric, opened its first smart factory in Mexico, a showcase for customers and partners to witness how digital transformation can help them make informed, data-driven decisions that bring about improved profitability, asset management performance, operational efficiency and a smarter productive workforce while keeping the operations secure, agile and environmentally sustainable.

Industrial Control for Process Automation Market Leaders

-

ABB Ltd.

-

Schneider Electric

-

Honeywell International Inc.

-

Siemens AG

-

General Electric Co.

*Disclaimer: Major Players sorted in no particular order

Industrial Control for Process Automation Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Dynamics

-

4.3 Market Drivers

- 4.3.1 Increasing Industrial Automation

- 4.3.2 Rise in Infrastructure Investments

- 4.3.3 Growth in Demand for Process Automation Among Different Industry Verticals

- 4.3.4 Need for Process and Energy Efficiency

-

4.4 Market Restraints

- 4.4.1 Lack of Skilled Workforce

- 4.4.2 High Capital Investment

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By System

- 5.1.1 Supervisory Control and Data Acquisition System (SCADA)

- 5.1.2 Distributed Control System (DCS)

- 5.1.3 Programmable Logic Controller (PLC)

- 5.1.4 Machine Execution System (MES)

- 5.1.5 Product Lifecycle Management (PLM)

- 5.1.6 Enterprise Resource Planning (ERP)

- 5.1.7 Human Machine Interface (HMI)

- 5.1.8 Other Systems

-

5.2 By End-user Vertical

- 5.2.1 Oil and Gas

- 5.2.2 Chemical and Petrochemical

- 5.2.3 Power

- 5.2.4 Life Sciences

- 5.2.5 Food and Beverage

- 5.2.6 Metals and Mining

- 5.2.7 Other End-user Verticals (Water and Wastewater, Pulp and Paper, Cement, Glass, and Textile, among others)

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Schneider Electric SE

- 6.1.2 Siemens AG

- 6.1.3 ABB Limited

- 6.1.4 Emerson Electric Co.

- 6.1.5 Omron Corporation

- 6.1.6 Rockwell Automation Inc.

- 6.1.7 Honeywell International Inc.

- 6.1.8 Yokogawa Electric Corporation

- 6.1.9 GLC Controls Inc.

- 6.1.10 Mitsubishi Electric Corporation

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityIndustrial Control for Process Automation Industry Segmentation

| By System | Supervisory Control and Data Acquisition System (SCADA) |

| Distributed Control System (DCS) | |

| Programmable Logic Controller (PLC) | |

| Machine Execution System (MES) | |

| Product Lifecycle Management (PLM) | |

| Enterprise Resource Planning (ERP) | |

| Human Machine Interface (HMI) | |

| Other Systems | |

| By End-user Vertical | Oil and Gas |

| Chemical and Petrochemical | |

| Power | |

| Life Sciences | |

| Food and Beverage | |

| Metals and Mining | |

| Other End-user Verticals (Water and Wastewater, Pulp and Paper, Cement, Glass, and Textile, among others) | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Industrial Control for Process Automation Market Research FAQs

What is the current ICS for Process Automation Market size?

The ICS for Process Automation Market is projected to register a CAGR of 8.5% during the forecast period (2024-2029)

Who are the key players in ICS for Process Automation Market?

ABB Ltd., Schneider Electric, Honeywell International Inc., Siemens AG and General Electric Co. are the major companies operating in the ICS for Process Automation Market.

Which is the fastest growing region in ICS for Process Automation Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in ICS for Process Automation Market?

In 2024, the Asia Pacific accounts for the largest market share in ICS for Process Automation Market.

What years does this ICS for Process Automation Market cover?

The report covers the ICS for Process Automation Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the ICS for Process Automation Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

ICS for Process Automation Industry Report

Statistics for the 2024 ICS for Process Automation market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. ICS for Process Automation analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.