Market Trends of Industrial Direct Radiography Industry

This section covers the major market trends shaping the Industrial Direct Radiography Market according to our research experts:

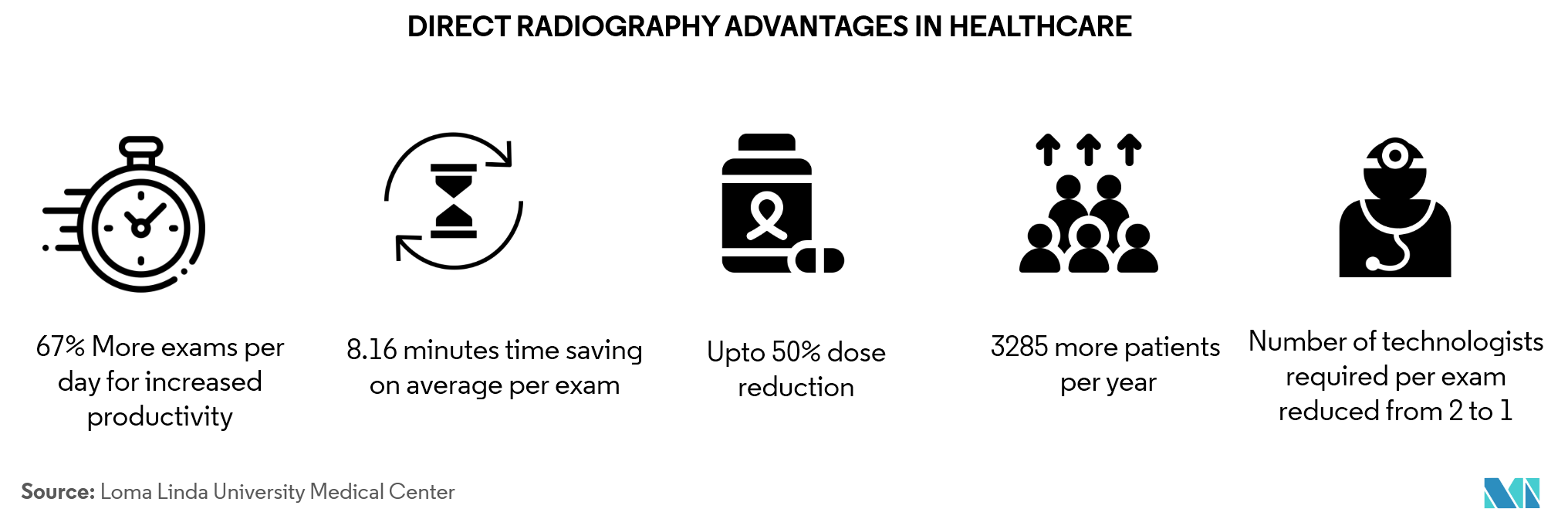

Healthcare to Witness the Highest Growth

- There are many benefits of direct radiography to the healthcare industry. The physician can view the image on his mobile device and the same can be seen simultaneously by physicians who are kilometers apart.

- The American Dental Association has developed recommendations for dental radiographic examinations in partnership with FDA for strengthening the dentist's judgment. ADA has also collaborated with more than 80 health care organizations to promote Image Gently, an initiative to “child-size” radiographic examination of children in medicine and dentistry.

- Three healthcare systems across the United States selected Fujifilm's Digital Radiography Solutions for enhancing imaging capabilities and patient outcomes in April 2018. This signifies an increasing trend of healthcare facilities towards adoption of digital radiography.

- To remain competitive, players are coming out with offerings and innovations which are changing the market landscape. In April 2019, Samsung's new image post-processing engine (IPE), S-Vue 3.02, received FDA clearance. The software is a part of the company's digital radiography (DR) machines – GC85A and GM85 which lowers the dose of digital radiography while producing the same image quality.

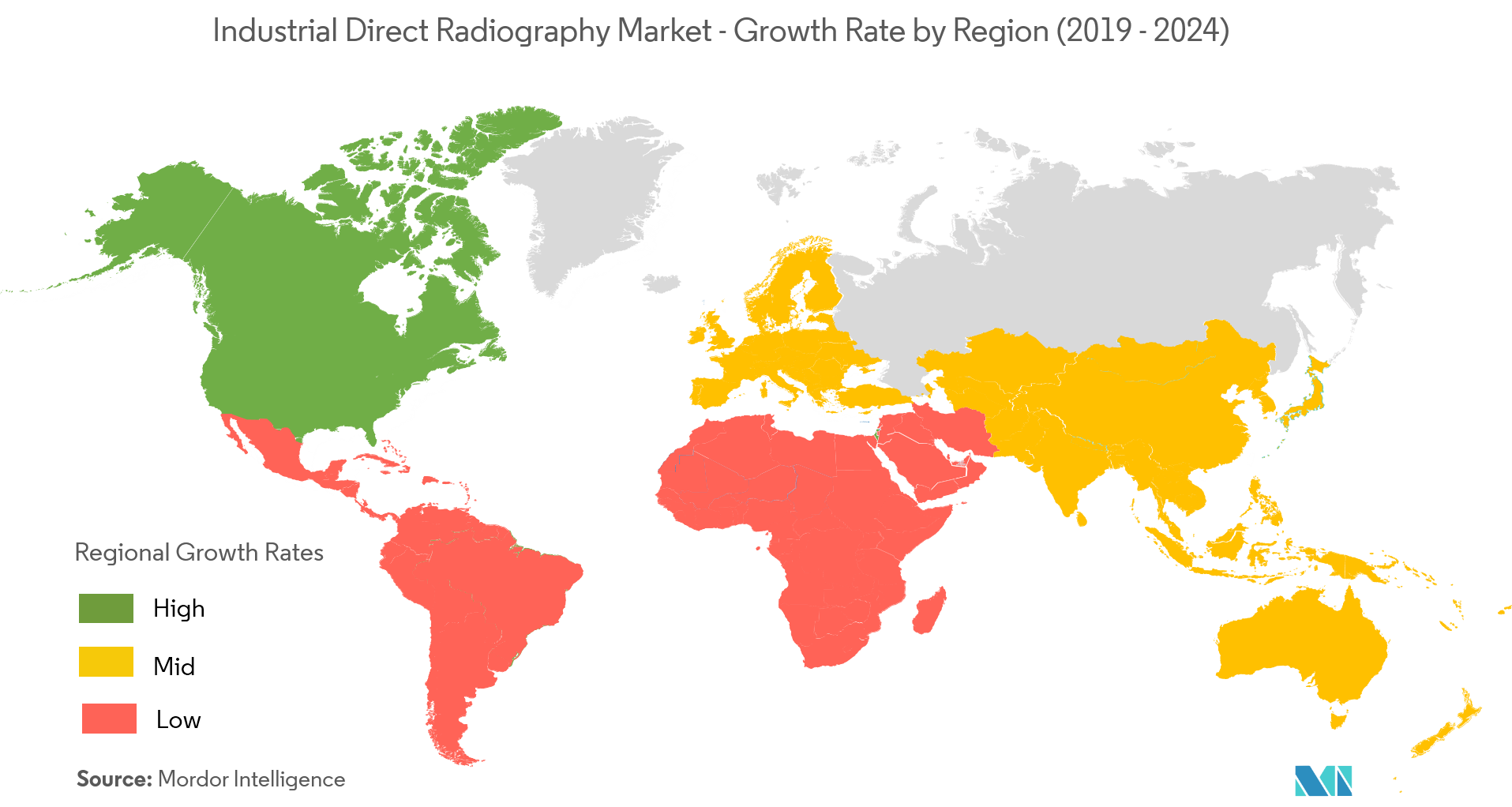

North America to Dominate the Market

- North America market has the largest market share due to increasing demand from healthcare industry and supporting government regulations.

- Healthcare facilities are increasingly adopting mobile radiographic equipment. For instance, UCHealth Greeley Hospital became the first facility in the US in August 2019 to adopt the Mobilett Elara Max mobile X-ray system from Siemens Healthineers. An year before, at the Opelousas General Health System (OGHS) at Louisiana, Visaris Americas installed fully robotic, Vision C ceiling-suspended digital X-ray suite.

- In 2019 Shimadzu Medical Systems USA received U.S. Food and Drug Administration(FDA) clearance for the FluoroSpeed X1 patient side conventional radiographic fluoroscopy (RF) table system. This indicates growing FDA's interest towards radiography equipment.

- Innovations are also being witnessed in the region related to healthcare. Towards the end of 2018, Konica Minolta Healthcare launched Dynamic Digital Radiography or X-Ray in Motion which is enabling to bring digital radiography to life by visualizing movement using conventional X-ray.