Industrial Wireless Sensors Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 12.40 % |

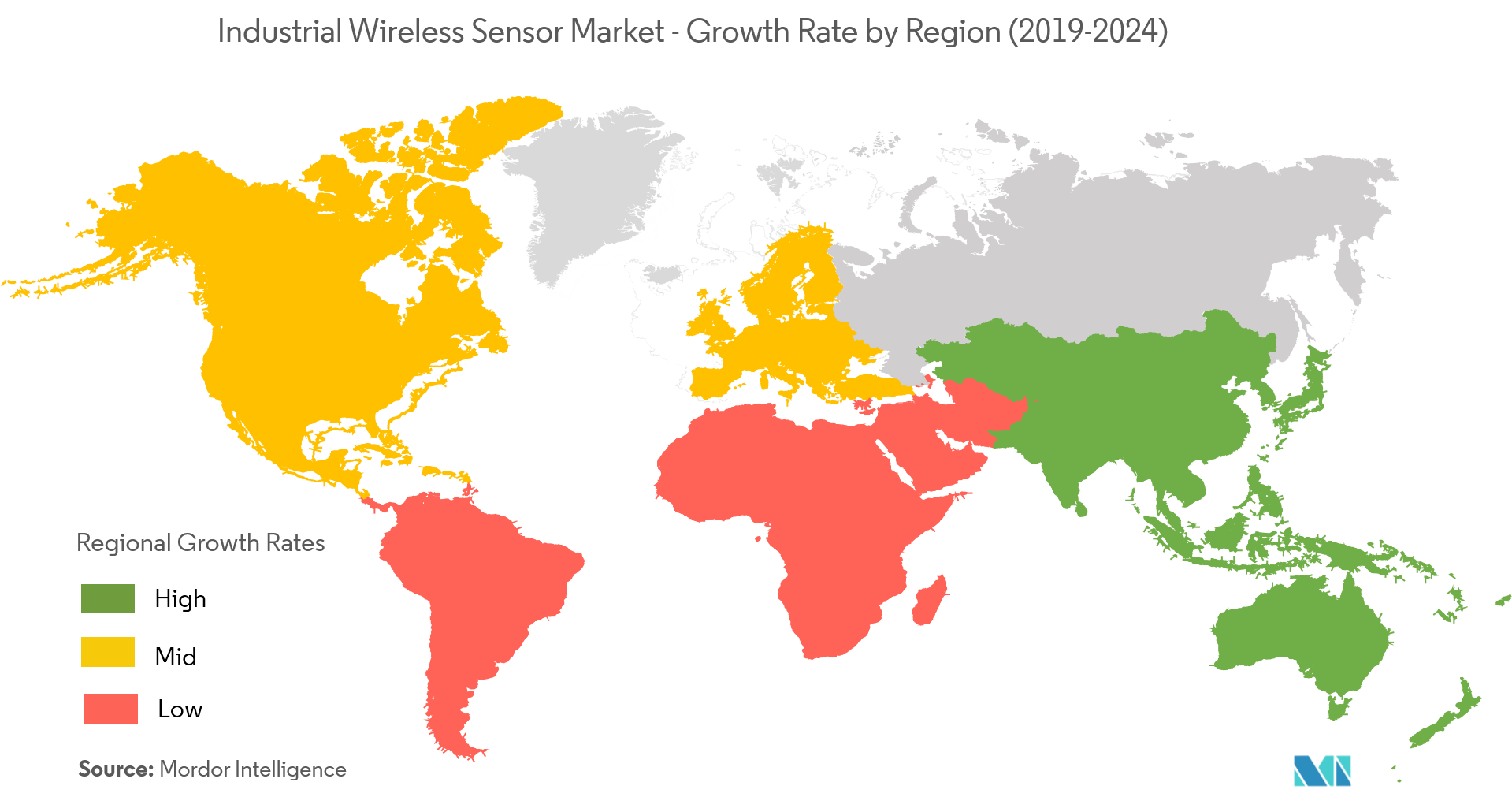

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

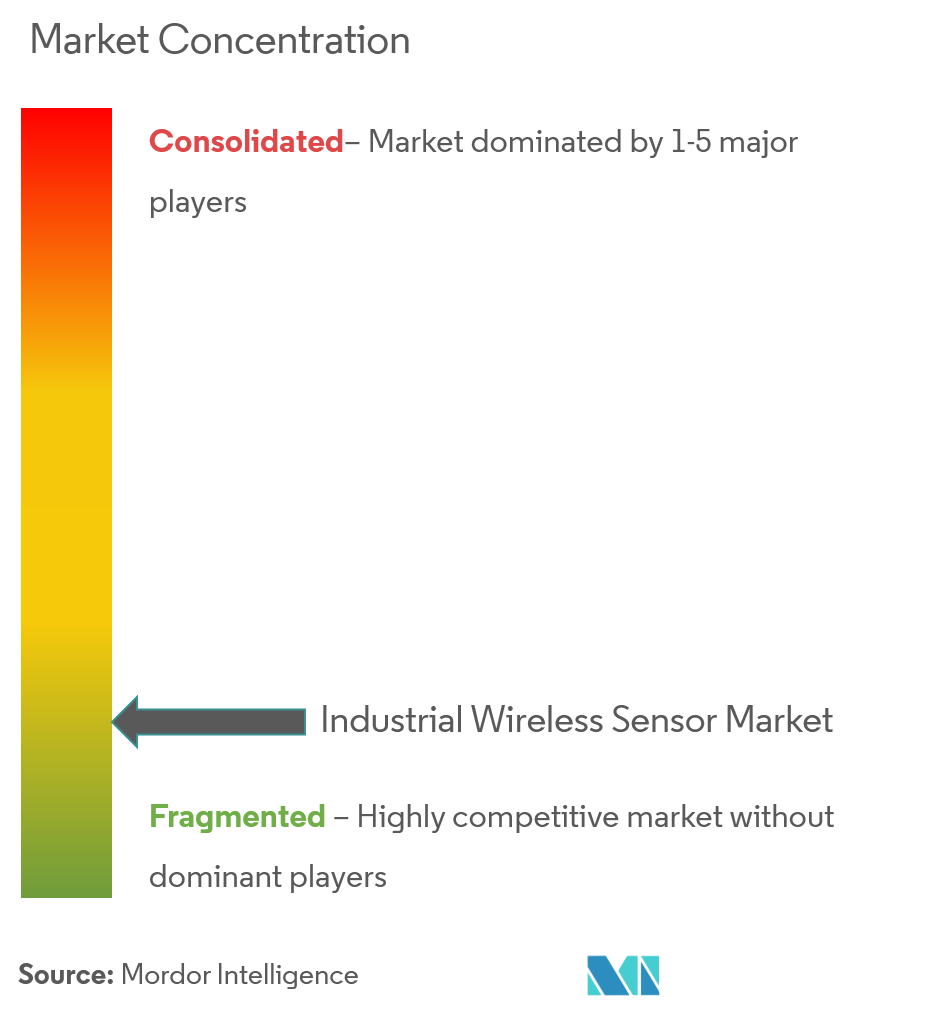

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Industrial Wireless Sensors Market Analysis

The industrial wireless sensor market is expected to register a CAGR of 12.4% during the forecast period (2021 - 2026). There are rapid technological advances for the wireless sensors thereby strengthening its products and applications. Industrial wireless sensors are classified into different types such as flow, temperature, pressure, gas sensors and others. These industrial sensors have various features such as a high degree of precision, reliability, range, variety, and sensitivity and enable advanced control and automation of different industrial processing units. The development of cost-effective, present sensor networks primarily depends upon the speed and quality of technological advancement, the advancement of technical regulations and standards and the alternate methods of power supply. Wireless sensors are standard measurement tools that are equipped with transmitters that can convert signals from process control instruments into a radio transmission.

- One of the major factor leading to the increasing use of wireless sensors is the need for monitoring and analyzing real-time data.

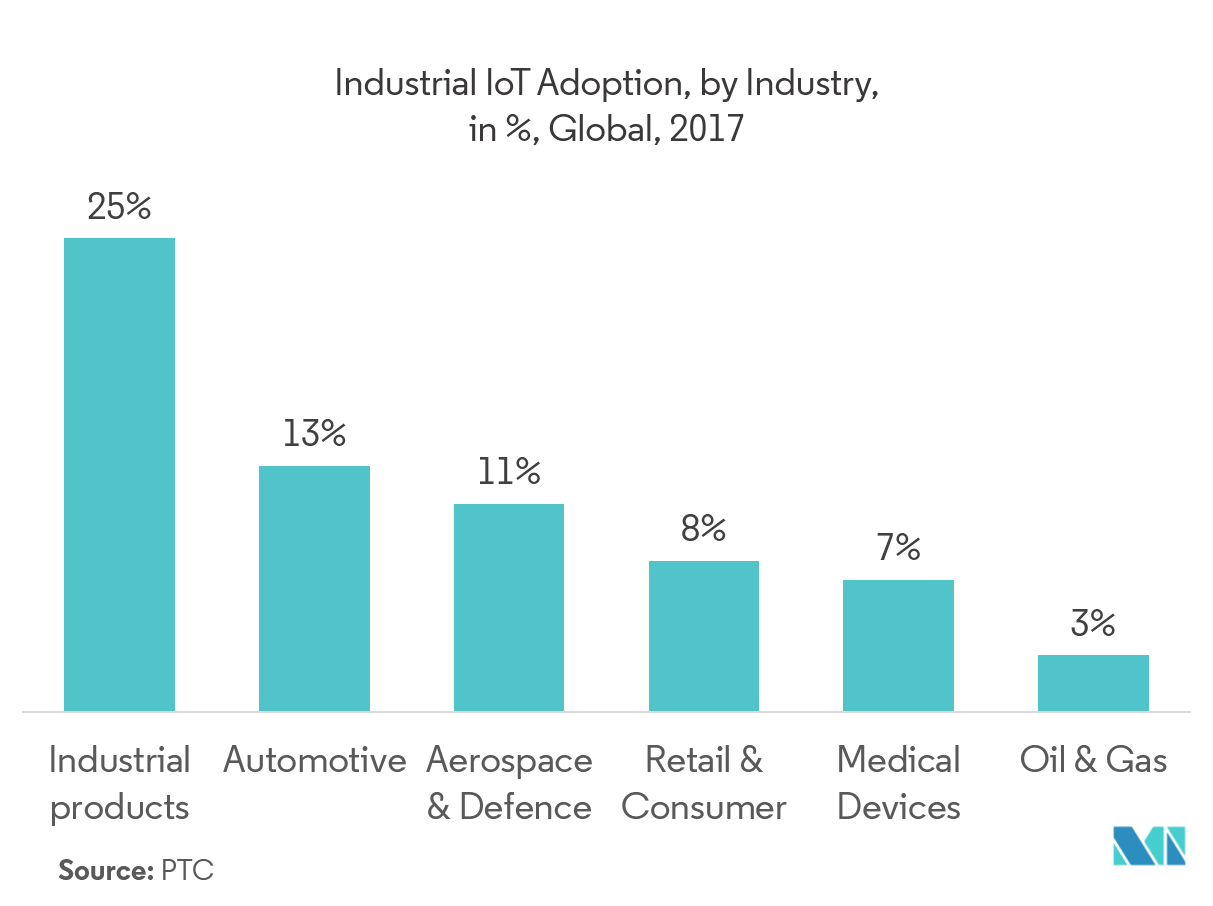

- Growing Industrial 4.0 and IIoT is also a major driver for the wireless sensors. The ever-increasing demands of manufacturers and the drive towards the realization of IIoT and Industry 4.0 is further propelling the growth of the industrial wireless sensors market.

- There is a rapid rise in demand for wireless sensors in the oil and gas industry owing to the growth of the market. Due to the continuously increasing demand for energy and power, there is a rise in demand for oil and gas globally.

- The major factor responsible for hindering the growth of this market is data security and the high cost of the sensors.

- Originally conceptualized for military use, these networks now have wide-ranging applications in civilian, industrial, and consumer markets. These extend from preventing trespassing in monitoring building strength and evaluating water quality to measuring individual heart rate.

Industrial Wireless Sensors Market Trends

This section covers the major market trends shaping the Industrial Wireless Sensors Market according to our research experts:

Oil & Gas Segment Expected to Witness Significant Growth

- The introduction of high-tech sensors has entirely changed the way oilfields are operated. Wireless sensors are used in the oil and gas industry to give managers and decision makers the ability to track and control the entire plant belonging to the sector. IIoT sensing units are mounted at numerous locations to make it possible to consume and analyze data from multiple resources.

- Due to the rise in the demand for oil and gas across the world, the global oil and gas industry is focusing on the efficient supply of crude oil. To cater to this growing demand, the oil and gas companies need to expand their exploration opportunities and upgrade their existing processes. In order to increase productivity and to achieve energy efficiency, oil and gas companies are focusing on the effective deployment of wireless sensors in their plants, refineries, and production sites.

- Oil and gas companies need to control, monitor, maintain and secure the processes and industrial assets in an efficient manner. Industrial and environmental applications require real-time information related to physical events like pressure, temperature or humidity. In the past, the only way to transfer the sensed data to the control center was through cumbersome and costly wires.

- Various regulatory authorities of the oil and gas industry have defined the need for more accurate, much better and real-time monitoring by the sector. With the help of sensor networks, the ability to record multiple data factors from multiple devices simultaneously and use the consolidated information will assist in identifying the health of tools as well as forecast any prospective failures. The best use of IIoT in this industry can bring about increased performance, avoid downtimes, and anticipate performance.

North America Expected to Hold Significant Market Share

- The industrial wireless sensors in the North America region is majorly driven by the investments in the industrial internet of things (IIoT) to increase productivity, deliver high-quality products, and track the performance of products after they leave the factory floor. Moreover, the US is a hub for industrial wireless sensors, and most of the end-user industries in the region have deployed these sensors.

- The manufacturers belonging to the US region focus on investing in R&D activities to improve accuracy and reliability. Various industry players are focusing on product differentiation to avoid price competition. The growth of wireless sensors in the region is hindered by the maturity of the end-user segment and environmental impact on sensors.

- Wireless sensors have various uses and are used in factory settings for the flow of production, data monitoring and other functions as well as in defense, building automation and various other industries like food and beverage. The increasing demand for renewable energy development, new energy sources, government regulations, and rapid technological advancements are the key drivers that are making the wireless sensors to grow lucratively in this region.

Industrial Wireless Sensors Industry Overview

The industrial wireless sensor market is fragmented. It is a highly competitive market without dominant players present in the market. There are various mergers and acquisitions taking place, and different new technologies are in the pipeline which are expected to further propel more competition among the players.

- March 2018:Lord Corporation announced the launch of a new network ready wireless gateway. The new WSDA 2000 Wireless Sensor Data Aggregator connects high-speed sensor data directly to the cloud. By using this, users can capture up to 256,000 samples per second across the wireless sensor network, with up to 4,000 samples per second per node.

- November 2017:Honeywell launched new connected gas sensors to support safe industrial operations. The new Sensepoint XRL is a fixed gas detector that monitors industrial operations for specific hazardous gases, such as carbon monoxide or methane.

Industrial Wireless Sensors Market Leaders

-

ABB Ltd.

-

Rockwell Automation Inc.

-

Honeywell International Inc.

-

Siemens AG

-

Schneider Electric SE

*Disclaimer: Major Players sorted in no particular order

Industrial Wireless Sensors Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

5. MARKET DYNAMICS

-

5.1 Market Drivers

- 5.1.1 Growing Industry 4.0 and IIoT

- 5.1.2 Need For Monitoring And Analyzing Real-Time Data

-

5.2 Market Restraints

- 5.2.1 High Cost Of Sensors And Data Security

6. MARKET SEGMENTATION

-

6.1 By Product Type

- 6.1.1 Temperature Sensor

- 6.1.2 Gas Sensor

- 6.1.3 Pressure Sensor

- 6.1.4 Humidity Sensor

- 6.1.5 Flow Sensor

- 6.1.6 Biosensor

- 6.1.7 Other Product Types

-

6.2 By End-user Industry

- 6.2.1 Manufacturing

- 6.2.2 Oil & Gas

- 6.2.3 Medical

- 6.2.4 Energy & Power

- 6.2.5 Mining

- 6.2.6 Other End-user Industries

-

6.3 Geography

- 6.3.1 North America

- 6.3.1.1 US

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 UK

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the world

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Siemens AG

- 7.1.5 Schneider Electric SE

- 7.1.6 STMicroelectronics Inc.

- 7.1.7 Emerson Electric Co.

- 7.1.8 General Electric Co.

- 7.1.9 Texas Instruments Inc.

- 7.1.10 NXP Semiconductors N.V.

- 7.1.11 BAE Systems Inc.

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityIndustrial Wireless Sensors Industry Segmentation

An industrial wireless sensor is a device that detects and responds to the input from the physical environment. The input could be position, level, gas, pressure, temperature, image humidity, flow, motion, and force. Industrial sensors are important across various industries such as oil & gas, pharmaceuticals, chemicals, manufacturing, mining, and energy & power. The industrial wireless sensors are like transducers that alter the physical quantity into electrical signals. The indications given through the signals are processed through an electronic automation system and portray natural variations in the device or instrument.

| By Product Type | Temperature Sensor | |

| Gas Sensor | ||

| Pressure Sensor | ||

| Humidity Sensor | ||

| Flow Sensor | ||

| Biosensor | ||

| Other Product Types | ||

| By End-user Industry | Manufacturing | |

| Oil & Gas | ||

| Medical | ||

| Energy & Power | ||

| Mining | ||

| Other End-user Industries | ||

| Geography | North America | US |

| Canada | ||

| Geography | Europe | Germany |

| UK | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the world |

Industrial Wireless Sensors Market Research FAQs

What is the current Industrial Wireless Sensor Market size?

The Industrial Wireless Sensor Market is projected to register a CAGR of 12.40% during the forecast period (2024-2029)

Who are the key players in Industrial Wireless Sensor Market?

ABB Ltd., Rockwell Automation Inc., Honeywell International Inc., Siemens AG and Schneider Electric SE are the major companies operating in the Industrial Wireless Sensor Market.

Which is the fastest growing region in Industrial Wireless Sensor Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Industrial Wireless Sensor Market?

In 2024, the North America accounts for the largest market share in Industrial Wireless Sensor Market.

What years does this Industrial Wireless Sensor Market cover?

The report covers the Industrial Wireless Sensor Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Industrial Wireless Sensor Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Industrial Wireless Sensor Industry Report

Statistics for the 2024 Industrial Wireless Sensor market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Industrial Wireless Sensor analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.