Infection Surveillance Solutions Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 0.63 Billion |

| Market Size (2029) | USD 1.20 Billion |

| CAGR (2024 - 2029) | 13.87 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Infection Surveillance Solutions Market Analysis

The Infection Surveillance Solutions Market size is estimated at USD 0.63 billion in 2024, and is expected to reach USD 1.20 billion by 2029, growing at a CAGR of 13.87% during the forecast period (2024-2029).

- Stringent government policies for preventing hospital-associated infections are aiding in developing analytical and infection surveillance solutions for application in the healthcare industry. Hospital-acquired infections are a major cause of mortality and morbidity and provide a challenge to clinicians.

- The US Department of Health and Human Services released the 'National Action Plan to Prevent Health Care-Associated Infections: Road Map to Elimination (HAI Action Plan),' outlining specific five-year goals for the prevention of healthcare-associated infections. Additionally, the World Health Organization (WHO) developed a protocol for implementing the Surgical Unit-based Safety Programme in African hospitals.

- Moreover, the rise in the number of surgeries is also one of the drivers of the market, as with surgery, surgical site infections (SSIs) represent a substantial clinical and economic burden on patients and the healthcare system. The prevention of SSIs entails surveillance activities. According to the Lancet Commission for Global Surgery (LCoGS), 11% of the global burden of the disease requires surgical care, anesthesia management, or both. Some studies have estimated this burden to be as high as 30%. The LCoGS estimated that 5,000 surgeries are required to meet the surgical burden of disease for 100,000 people in LMICs (low-to-middle-income countries).

- Surgical site infections are not just a problem for poor countries; in the United States, they contribute to patients spending more than 400,000 extra days in hospital at the cost of an additional USD 10 billion per year (source: WHO).

- However, Healthcare providers are often reluctant to engage with technology, partly due to the scale and pace of changes and partly through lack of education and training and concerns over liability and funding.

- Moreover, many healthcare facilities are required by regulatory bodies to have infection surveillance solutions in place. For instance, the International Health Regulations (2005) (IHR 2005) require countries to designate a National IHR Focal Point for communications with WHO to establish and maintain core capacities for surveillance and response, including at designated points of entry.

Infection Surveillance Solutions Market Trends

Infection Surveillance by Services is expected to Drive the Market Growth

- Maintenance and support services are very important as these are involved in the prevention of infection and mitigation of persistent infections after the treatment. These are usually required post-surgery and other treatments where the human body is vulnerable. Termed a surgical site infection surveillance service (SSISS), this service allows hospitals to record incidents of infection after surgery, track patient results, and review or change practice to avoid further infections.

- Nations such as Brazil and Argentina chose to use World Bank loans to develop surveillance capacity, and the US Agency for International Development (USAID) redesigned its surveillance strategy to focus on the use of data to improve public health interventions.

- Moreover, more than providing surgical teams with the current surveillance data is required. Surgical teams need to be provided with historical data in order to establish how they have been performing in the past and data from other teams to enable comparison of performance (for example, benchmarking against other surgical teams doing similar procedures). Surveillance training should be conducted by individuals who have expertise in HAI surveillance, epidemiology, and infection prevention and control. Therefore, consultation and training play a vital role.

- Companies are also in the foray as most recently, in February 2023, the National Health Service (NHS) signed a USD 23.60 million deal to enable health-service organizations to deploy the technology by awarding a contract to US-based healthcare giant Baxter for buying a comprehensive infection-control platform for replacing various specialist software programs used by NHS trusts to collect and process data, alongside spreadsheets and paper documents.

- As stay-at-home orders expired and businesses began to reopen, companies like ICCS saw a significant uptick in requests from companies seeking epidemiologists trained in infection prevention to guide how to safely and properly resume operations and stay open. Therefore, the above factors are providing the impetus to the vendors in the market to extend their reach in the new market.

North America Holding Substantial Share of the Market

- North America is one of the largest markets for medical technology research industries globally. The huge market in the region is mainly due to growing R&D activities in the medical sciences. Particularly in the United States of America, Health and Human Services (HHS), which is governed by the cabinet-level department of the US federal government, is very liberal in funding and maintaining technological research in medical sciences.

- The vital government initiatives and increasing incidence of HAIs in the United States are likely to drive the market for infection surveillance. For instance, the National Action Plan (2020-2025) was introduced to combat antibiotic-resistant bacteria, such as Carbapenem-resistant Enterobacteriaceae, methicillin-resistant Staphylococcus aureus, etc.

- Studies also stated that in the United States, 1 out of every 25 hospitalized patients suffers from HAI. As many of these infections occur in the intensive care unit (ICU), hospitals are facing struggles in reducing the infection rate. Due to these issues, the US Department of Health and Human Services made it a priority. It made it a national reduction of HAIs with the objective of building a safer, more inexpensive healthcare system for all Americans.

- In American hospitals, as per the Centers for Disease Control estimations, HAIs account for around 1.7 million infections and 99,000 associated deaths each year. These statistics are driving healthcare centers to adopt infection surveillance solutions in order to provide better care to patients. Many hospitals, such as Allegheny General Hospital, Pittsburgh, Thomas Jefferson University Hospital, Philadelphia, etc., are adopting infection surveillance solutions to minimize HAI incidents.

- Canada is also progressing toward mitigating HAIs, which creates demand for Infection Surveillance solutions in the country. For instance, the Coalition of Healthcare-Acquired Infection Reduction (CHAIR) Canada, a not-for-profit group of industry and healthcare professionals working together to reduce healthcare-acquired infections (HAIs), has set a target to achieve an 80% reduction in healthcare-acquired infections (HAIs) by 2024.

- These dynamics are influencing the growth of technological advances in the hospital, which, in turn, boost the infection surveillance solutions market.

Infection Surveillance Solutions Industry Overview

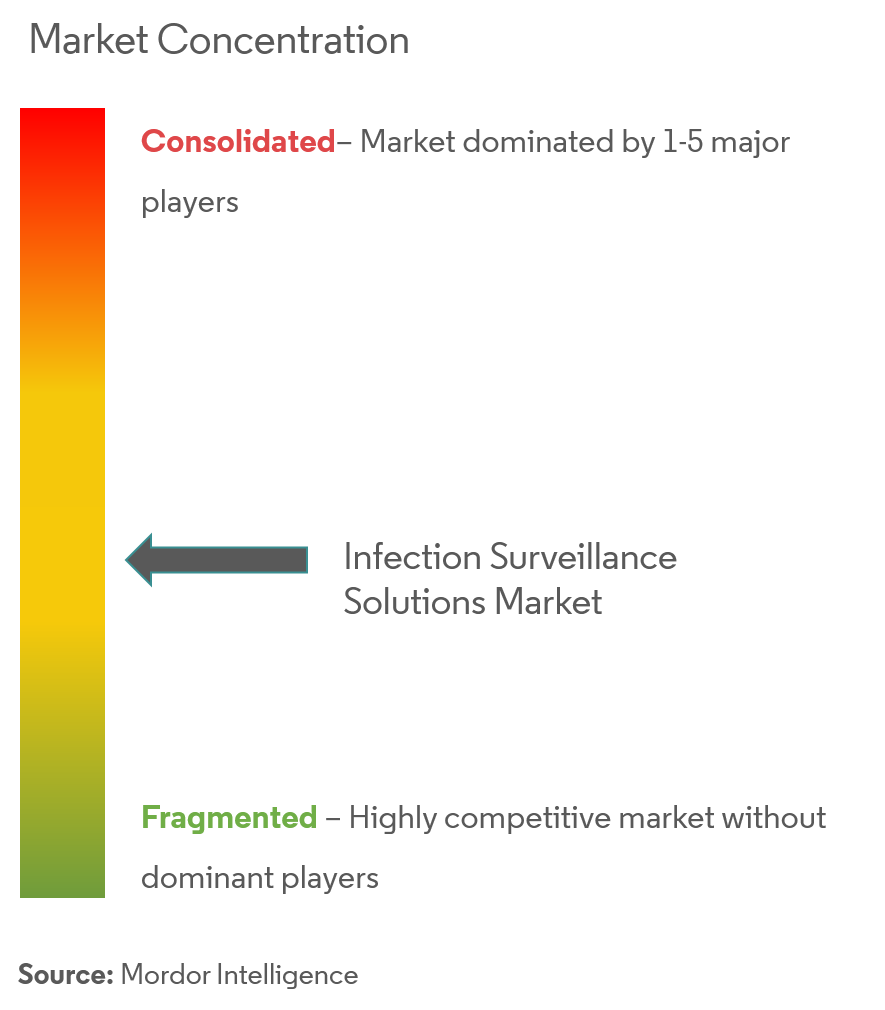

The market under examination features several prominent global contenders competing in a highly competitive landscape. Notably, brand identity plays a significant role in this market, given the security concerns it addresses. These market players are persistently involved in endeavors aimed at maintaining a competitive edge. These efforts include continuous product innovations and advancements, strategic partnerships, and strategic acquisitions.

In January 2023, GAMA Healthcare, based in Hertfordshire, unveiled its latest infection prevention and control solutions for the worldwide healthcare market at Arab Health 2023. The company took the initiative to lead a series of live demonstrations, affording visitors the opportunity to witness their pioneering solutions in Environmental Decontamination, Patient Skincare, and Capital Equipment in action.

In November 2022, Wolters Kluwer expanded its clinical surveillance portfolio with the introduction of the Sentri Sepsis Monitor. This innovative system employs clinical natural language processing (NLP) and advanced algorithms to monitor hospital patients around the clock, enabling the early identification of sepsis indicators.

Infection Surveillance Solutions Market Leaders

-

IBM Corporation (Truven Health Analytics)

-

Gojo Industries Inc

-

VigiLanz Corporation

-

Cerner Corporation

-

RL Datix Ltd

*Disclaimer: Major Players sorted in no particular order

Infection Surveillance Solutions Market News

- June 2024: The Asian Development Bank (ADB) approved a USD 170 million policy-based loan to bolster India's health sector preparedness for future pandemics. The initiative focuses on strengthening disease surveillance systems to swiftly tackle public health threats. Additionally, it will set up laboratory networks to monitor infectious diseases across states, union territories, and metropolitan regions.

- February 2024: Inovalon, a provider of cloud-based software solutions that empower data-driven healthcare, has announced its collaboration with VigiLanz. VigiLanz, an Inovalon solution, is recognized as a provider of SaaS-based clinical surveillance and patient safety technology.

Infection Surveillance Solutions Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Stringent Government Policies for Preventing Hospital Associated Infections

- 4.2.2 Rise in the Number of Surgeries

-

4.3 Market Restraints

- 4.3.1 Reluctance Among Medical Professionals to Adopt Advanced Healthcare Tools

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. TECHNOLOGY SNAPSHOT AND INDUSTRY POLICY

6. MARKET SEGMENTATION

-

6.1 By Offering

- 6.1.1 Software

- 6.1.1.1 On-Premise

- 6.1.1.2 Cloud

- 6.1.2 Services

- 6.1.2.1 Maintenance and Support

- 6.1.2.2 Consultation and Training

- 6.1.2.3 Implementation Service

-

6.2 By End-User

- 6.2.1 Hospitals

- 6.2.2 Long-term Care Facilities

- 6.2.3 Other End Users

-

6.3 By Geography***

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles*

- 7.1.1 IBM Corporation (Truven Health Analytics)

- 7.1.2 Gojo Industries Inc.

- 7.1.3 VigiLanz Corporation

- 7.1.4 Cerner Corporation

- 7.1.5 RL Datix Ltd

- 7.1.6 DEB Group Ltd (SC Johnson & Son)

- 7.1.7 Epic Systems Corporation

- 7.1.8 Baxter International Inc. (ICNet International)

- 7.1.9 Becton, Dickinson and Company

- 7.1.10 Theradoc (Premier Inc)

8. INVESTMENT ANALYSIS

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityInfection Surveillance Solutions Industry Segmentation

The demand for infection surveillance has been on the rise as the need to curb hospital-acquired infections and other epidemics is intensifying. Infection surveillance solutions are designed to continuously monitor and interpret health data to ensure accurate implementation of preventive measures. The major factors contributing to the growth of this market include an increase in the incidence of HAIs and a growth in the number of surgeries coupled with government protocols for the prevention of HAIs.

The infection surveillance solutions market is segmented by offering (software and services), end-user (hospitals, long-term care facilities, and other end-users), and geography (Europe, Asia-Pacific, and the Rest of the World). The report offers market forecasts and size in value (USD) for all the above segments.

| By Offering | Software | On-Premise |

| Cloud | ||

| By Offering | Services | Maintenance and Support |

| Consultation and Training | ||

| Implementation Service | ||

| By End-User | Hospitals | |

| Long-term Care Facilities | ||

| Other End Users | ||

| By Geography*** | North America | United States |

| Canada | ||

| By Geography*** | Europe | United Kingdom |

| Germany | ||

| France | ||

| Italy | ||

| Spain | ||

| By Geography*** | Asia | China |

| India | ||

| Japan | ||

| By Geography*** | Australia and New Zealand | |

| Latin America | ||

| Middle East and Africa |

Infection Surveillance Solutions Market Research FAQs

How big is the Infection Surveillance Solutions Market?

The Infection Surveillance Solutions Market size is expected to reach USD 0.63 billion in 2024 and grow at a CAGR of 13.87% to reach USD 1.20 billion by 2029.

What is the current Infection Surveillance Solutions Market size?

In 2024, the Infection Surveillance Solutions Market size is expected to reach USD 0.63 billion.

Who are the key players in Infection Surveillance Solutions Market?

IBM Corporation (Truven Health Analytics), Gojo Industries Inc, VigiLanz Corporation, Cerner Corporation and RL Datix Ltd are the major companies operating in the Infection Surveillance Solutions Market.

Which is the fastest growing region in Infection Surveillance Solutions Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Infection Surveillance Solutions Market?

In 2024, the North America accounts for the largest market share in Infection Surveillance Solutions Market.

What years does this Infection Surveillance Solutions Market cover, and what was the market size in 2023?

In 2023, the Infection Surveillance Solutions Market size was estimated at USD 0.54 billion. The report covers the Infection Surveillance Solutions Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Infection Surveillance Solutions Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Infection Surveillance Solutions Industry Report

Statistics for the 2024 Infection Surveillance Solutions market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Infection Surveillance Solutions analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.