Infrared Detector Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 9.40 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

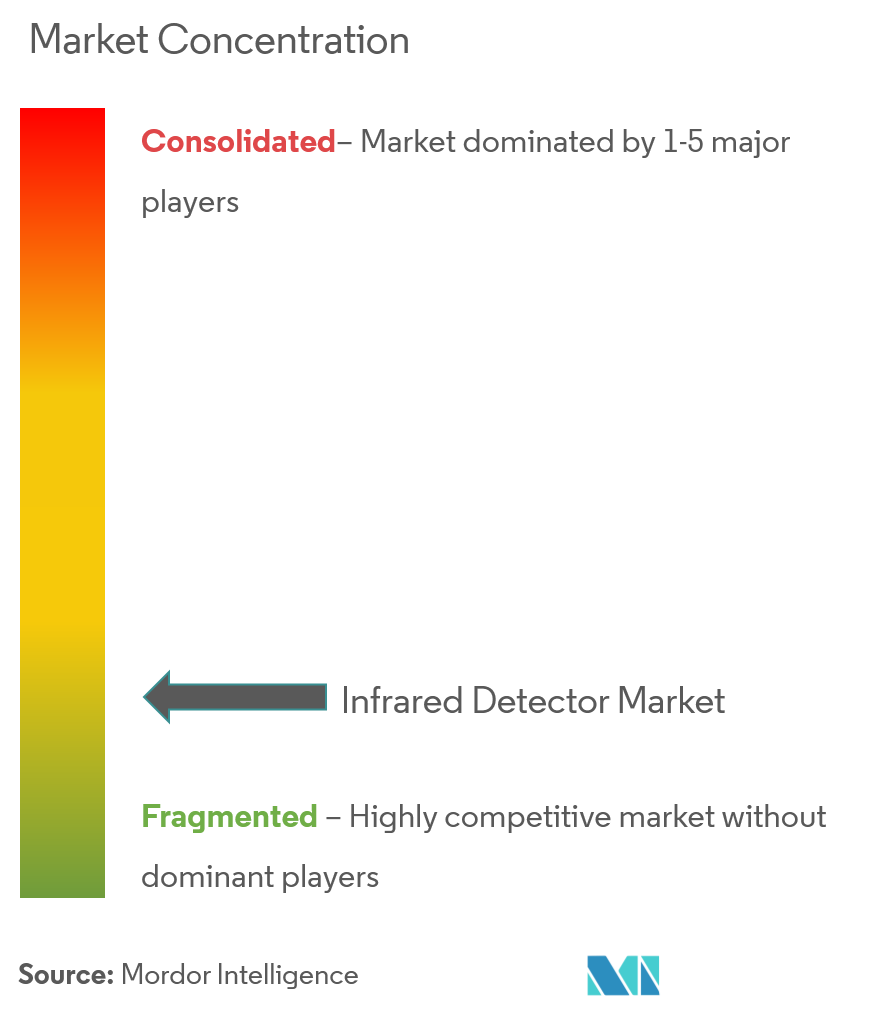

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Infrared Detector Market Analysis

The infrared detector market is expected to register a cagr of 9.4% over the forecast period of (2021 - 2026). The rising use of infrared detectors in industrial and manufacturing applications and an increase in the demand for consumer electronics, such as smartphones and tablets, are expected to aid the growth of the infrared detectors market.

- Infrared detectors are gaining momentum as a highly significant security apparatus in various applications, due to the quickly advancing technologies. They are used in industrial plants to monitor the efficient functioning of motors, boilers, electrical peripherals, and bearings.

- Emerging trends that are impacting the infrared detector market include an increase in the use of infrared detectors for smart homes, night vision, and surveillance.

- However, the high cost of technology and low reliability and usability in harsh environmental conditions are hampering the growth of the infrared detectors market.

Infrared Detector Market Trends

This section covers the major market trends shaping the Infrared Detector Market according to our research experts:

People and Motion Sensing Application is Anticipated to Lead the Market

- The infrared detector is mainly used in the people and motion sensing applications and is anticipated to the lead the overall market during the forecast period. The increasing use of infrared detectors in places, such as retail shops, airports, homes, museums, and libraries for counting people and motion detection had contributed to its dominance in the market.

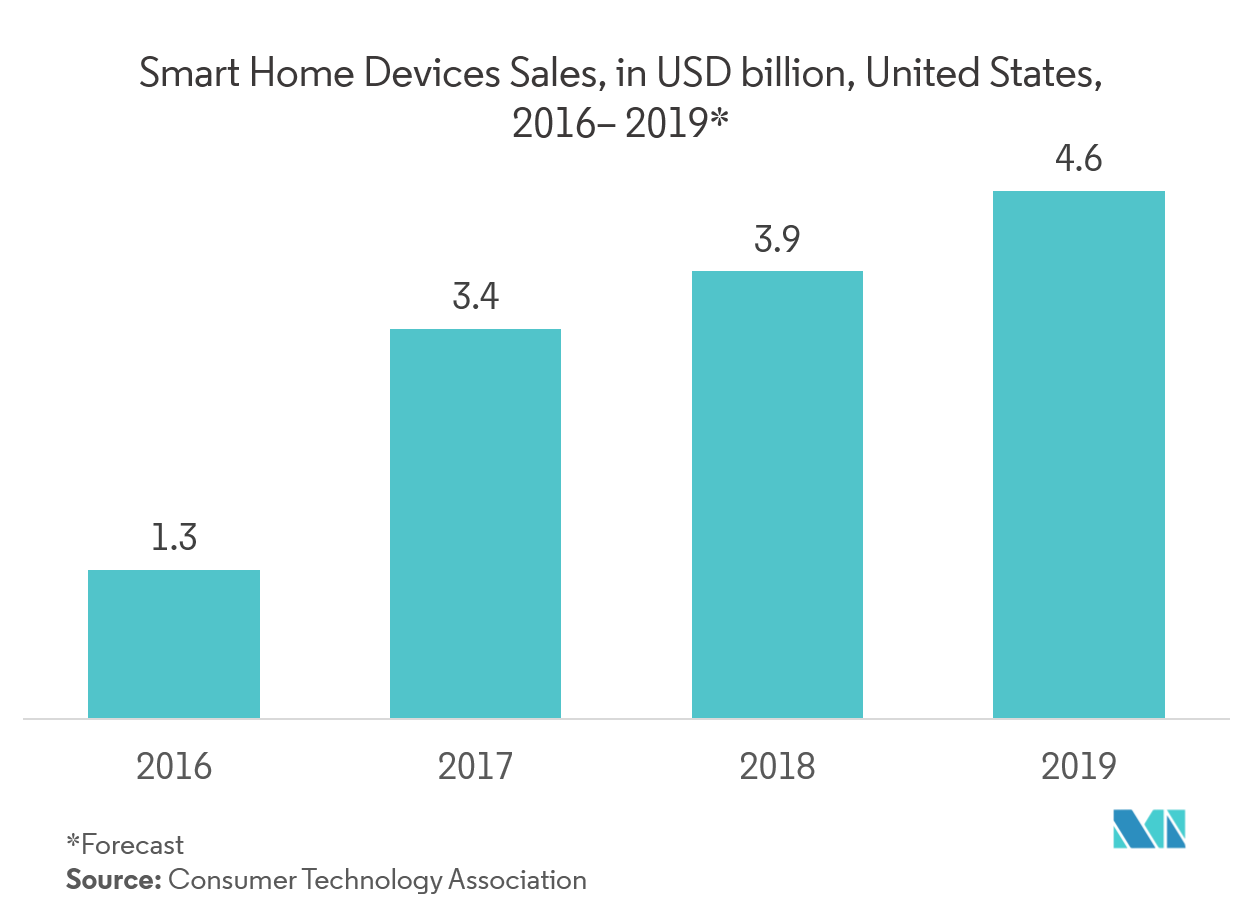

- An increase in the deployment of smart homes devices may augment the need for infrared detectors. In homes, infrared detectors serve two primary purposes: intrusion detection and occupancy detection.

- Occupancy-related infrared detectors identify a person’s presence by detecting the minor human body motions entering and leaving any of small fields of view. Intrusion-related sensors help to ignore the minor action, like pet movements and non-moving objects of changing temperature. Intrusion detectors can distinguish pets from people by size, not only by relative IR signal strength.

- Thus, the positive impact of infrared detectors may be enormous. Smart home systems provide an ideal use case because they cannot function without smart sensors. Thus, the aforementioned factors are expected to aid the growth of the infrared detectors market.

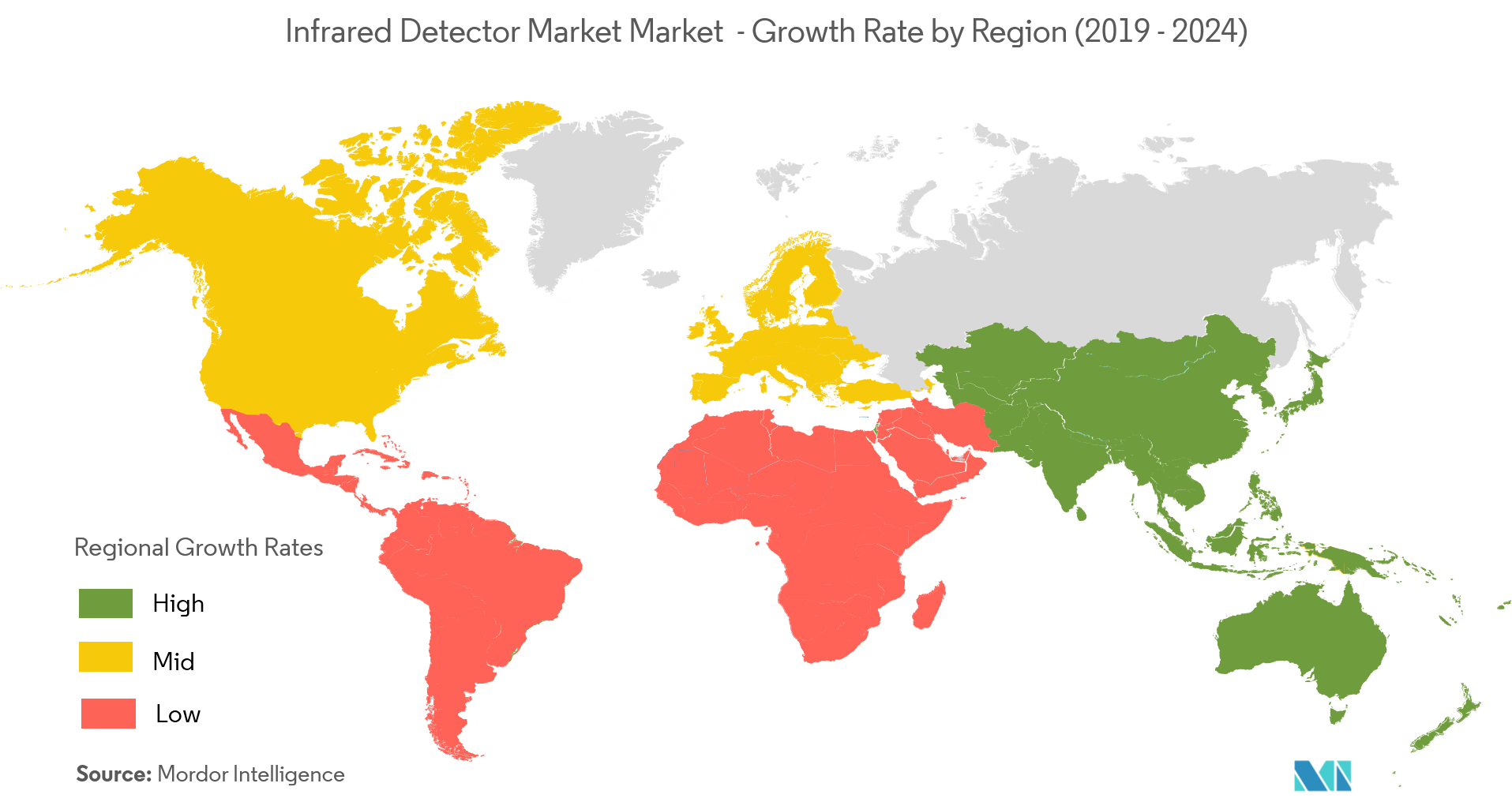

Asia-Pacific is Expected to Witness the Highest Growth Rate

- The Asia-Pacific region is anticipated to witness the highest CAGR, of all the regions considered in the market studied, over the forecast period 2019-2024. The region is witnessing an increase in the demand for infrared detectors from the military and defense sectors and temperature measurement and industrial applications.

- Major countries contributing to the growth of infrared detector market in the region are Japan, China, India, and Taiwan. Additionally, Japan has a large manufacturing base of infrared detectors, which are exported worldwide.

- For instance, some of the major companies operating in the production of infrared detectors are Nicera (Japan) and Murata Manufacturing (Japan). The other driver fueling the growth of the market in the region is rising security concerns in the region.

- This reduction in the cost of the infrared detector is anticipated to expand the usage of IR detectors in many applications, such as biomedical imaging, spectroscopy, and automotive applications, in the region.

Infrared Detector Industry Overview

The major players include Honeywell International Inc., Texas Instruments Inc., FLIR Systems Inc., Omron Corporation, Hamamatsu Photonics KK, Murata Manufacturing Co. Ltd, Raytheon Company, Sofradir SAS, among others. The market is fragmented due to the major competition in the market. Therefore, the market concentration will be low.

- May 2018 -Honeywell International Inc. launched a new connected portable infrared detector designed to keep the workers safe in dangerous confined spaces while featuring a simple and easy to use design.

Infrared Detector Market Leaders

-

Honeywell International Inc.

-

Texas Instruments Inc.

-

FLIR Systems Inc.

-

Omron Corporation

-

Raytheon Company

*Disclaimer: Major Players sorted in no particular order

Infrared Detector Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Use of Infrared Detectors in Industrial and Manufacturing Applications

- 4.3.2 Increasing Security Concerns

-

4.4 Market Restraints

- 4.4.1 Low Reliability and Usability in Harsh Environmental Conditions

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Thermal Detector

- 5.1.2 Photo (Quantum) Detector

-

5.2 By Spectral range

- 5.2.1 Short-wave Infrared

- 5.2.2 Medium-wave Infrared

- 5.2.3 Long-wave Infrared

-

5.3 By Application

- 5.3.1 People and Motion Sensing

- 5.3.2 Temperature Measurement

- 5.3.3 Industrial

- 5.3.4 HVAC

- 5.3.5 Smart Homes

- 5.3.6 Military and Defense

- 5.3.7 Spectroscopy and Biomedical Imaging

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Honeywell International Inc.

- 6.1.2 Excelitas Technologies Corp

- 6.1.3 Texas Instruments Inc.

- 6.1.4 FLIR Systems Inc.

- 6.1.5 Omron Corporation

- 6.1.6 Hamamatsu Photonics KK

- 6.1.7 Murata Manufacturing Co. Ltd

- 6.1.8 Raytheon Company

- 6.1.9 Sofradir SAS

- 6.1.10 Nippon Ceramic Co. Ltd

- 6.1.11 Infratec Gmbh

- 6.1.12 ULIS SAS

- *List Not Exhaustive

7. INVESTMENT ANAYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityInfrared Detector Industry Segmentation

Infrared detectors are used to sense the specific characteristics of its surroundings by either detecting or emitting infrared radiation. These electronic detectors can also sense motion and measure heat emitted by objects. With the advancements in technology, infrared sensors have become light in weight and have also become more affordable. Also, the power consumption in such sensors is too low.

| By Type | Thermal Detector | |

| Photo (Quantum) Detector | ||

| By Spectral range | Short-wave Infrared | |

| Medium-wave Infrared | ||

| Long-wave Infrared | ||

| By Application | People and Motion Sensing | |

| Temperature Measurement | ||

| Industrial | ||

| HVAC | ||

| Smart Homes | ||

| Military and Defense | ||

| Spectroscopy and Biomedical Imaging | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| France | ||

| United Kingdom | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | |

| Middle East & Africa |

Infrared Detector Market Research FAQs

What is the current Infrared Detector Market size?

The Infrared Detector Market is projected to register a CAGR of 9.40% during the forecast period (2024-2029)

Who are the key players in Infrared Detector Market?

Honeywell International Inc., Texas Instruments Inc., FLIR Systems Inc., Omron Corporation and Raytheon Company are the major companies operating in the Infrared Detector Market.

Which is the fastest growing region in Infrared Detector Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Infrared Detector Market?

In 2024, the North America accounts for the largest market share in Infrared Detector Market.

What years does this Infrared Detector Market cover?

The report covers the Infrared Detector Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Infrared Detector Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Infrared Detector Industry Report

Statistics for the 2024 Infrared Detector market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Infrared Detector analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.