Integrated Marine Automation System Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 2.50 % |

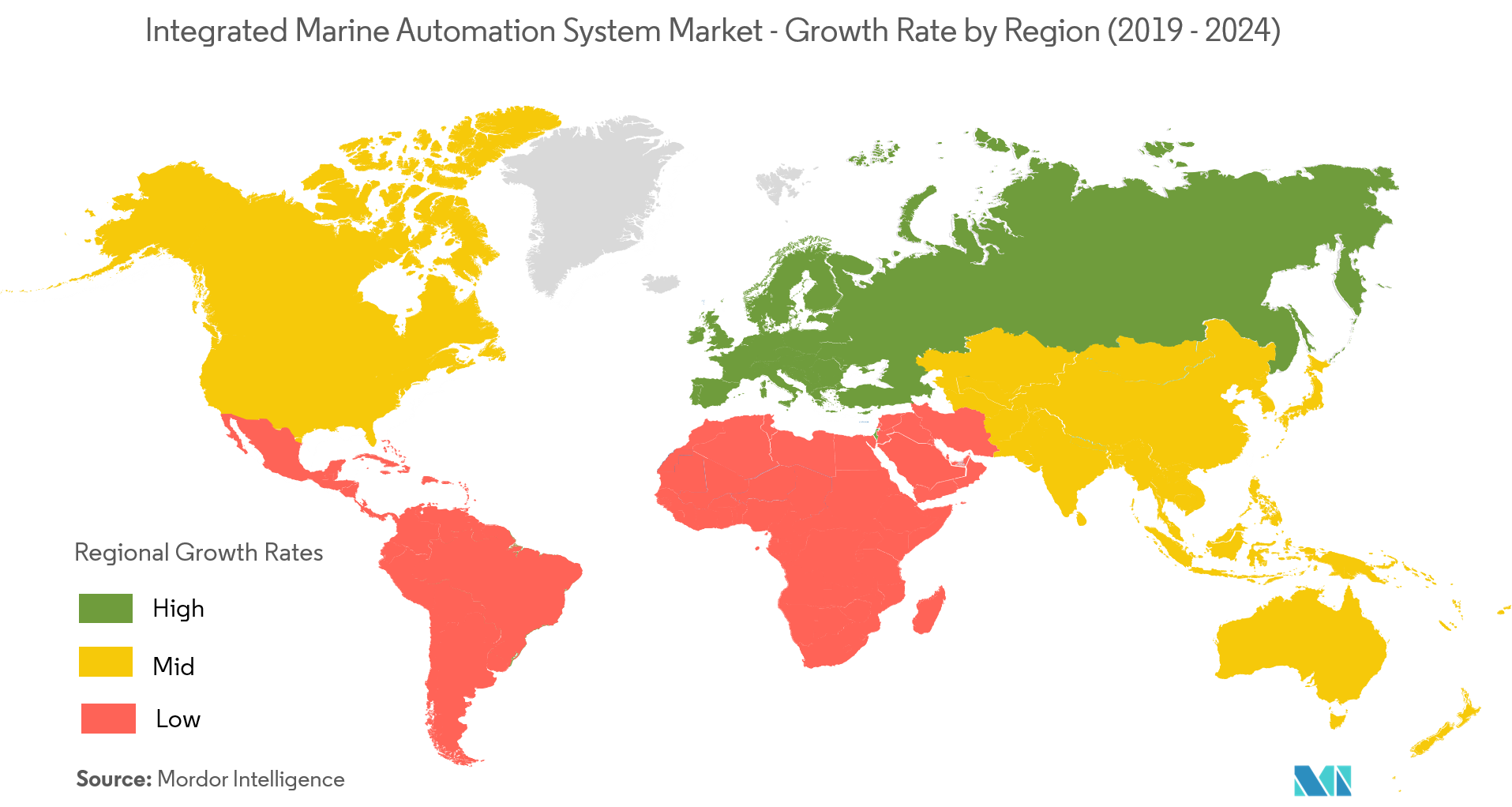

| Fastest Growing Market | Europe |

| Largest Market | Europe |

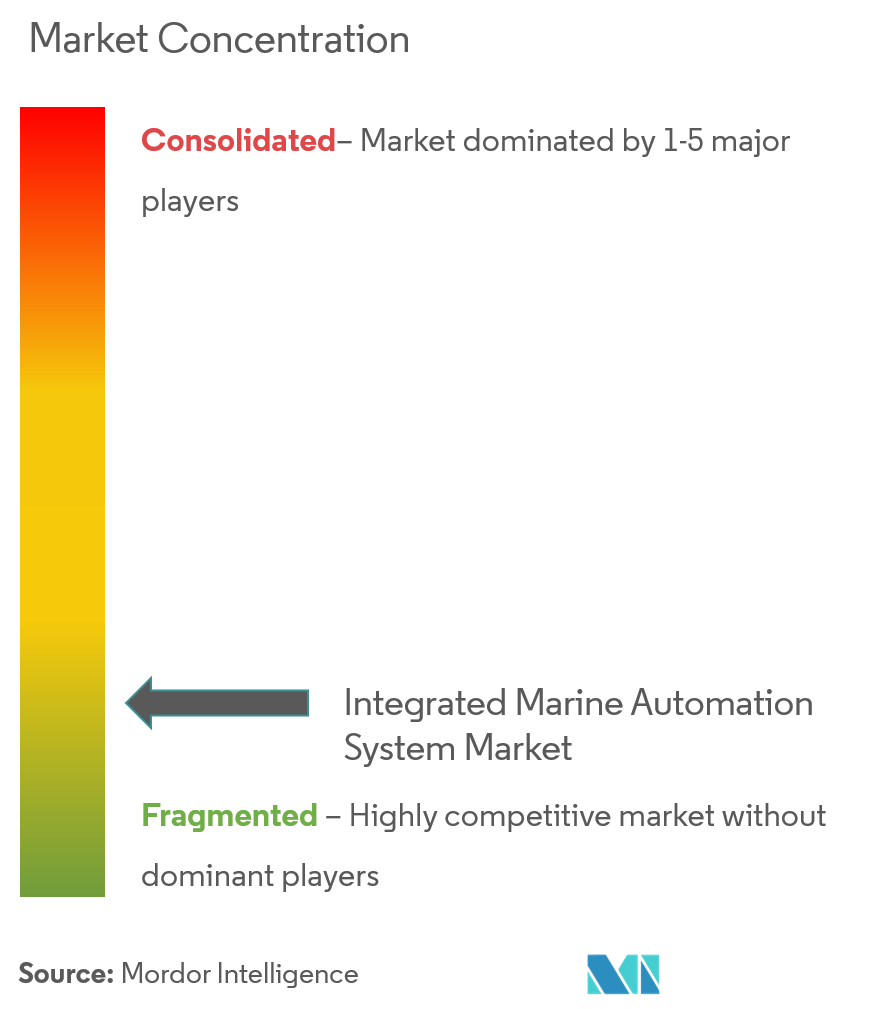

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Integrated Marine Automation System Market Analysis

The integrated marine automation system market is projected to grow at a CAGR of 2.5% during the forecast period (2021 - 2026). The adoption of new technological capabilities such as AI and machine learning augmented with different software use, to support the solutions offered in this market has been a new trend. For instance, Marine image annotation software (MIAS) is used to assist the annotation of underwater imagery. Integration into accessible MIAS is currently limited to semi-automated processes of pixel recognition through computer vision modules. The development in this field will be a new trend towards the integration of AI in automation in information management under the vessel management segment.

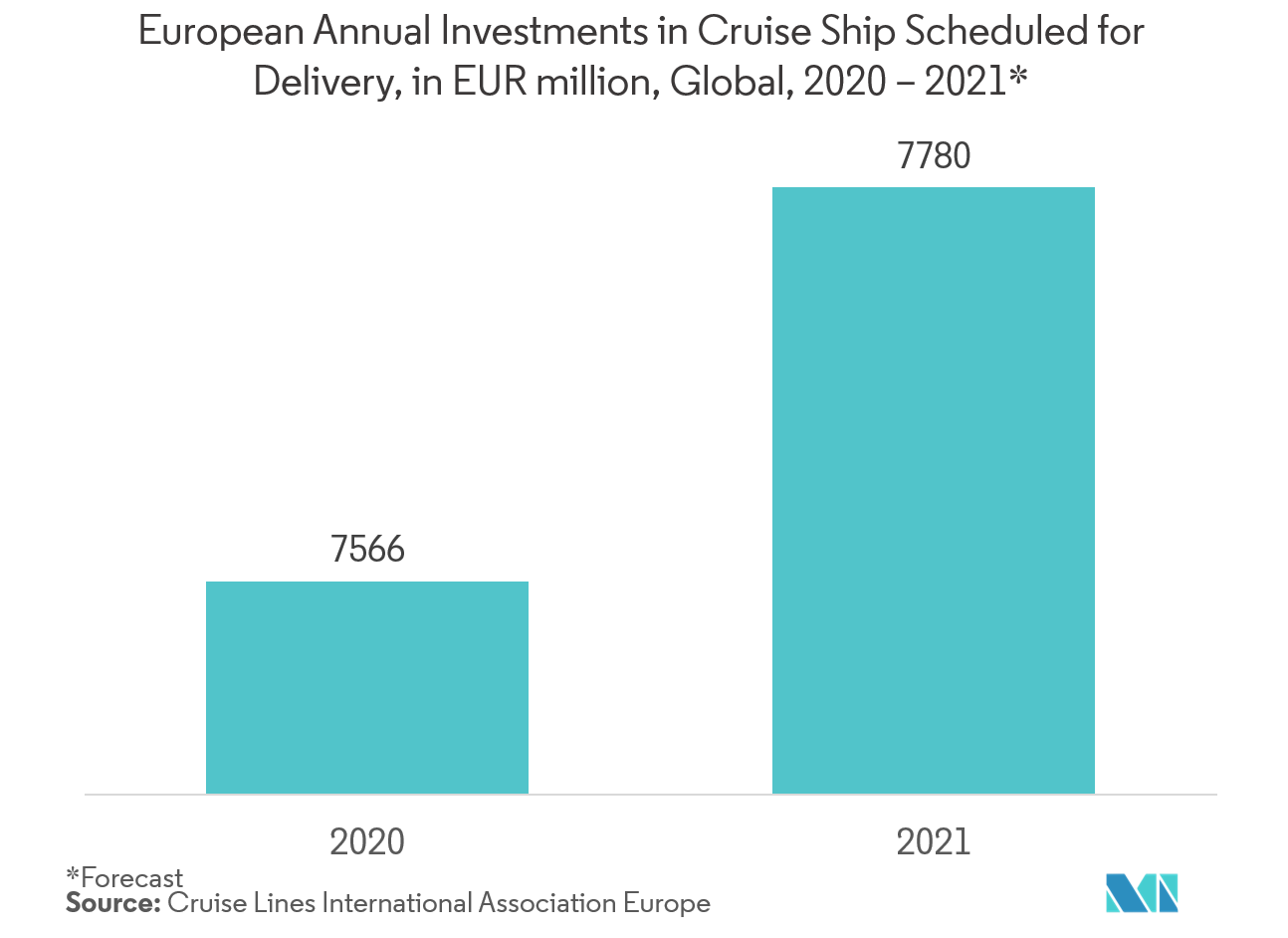

- High growth in the maritime tourism industry is driving the market as cruising is considered a well-established vacation zone in the North American and European region and a developing sector in several other emerging regions. This demands the development of more cruise ships by which the market growth is rising.

- Growing seaborne trades is driving the market. According to the United Nations, International seaborne trade stored momentum in 2017, with volumes expanding by 4%, which was the fastest growth in the last five years and is still expanding at present. Developing economies continue to make a major contribution, such as the Asia region. This demands more cargo ships by which the market growth rises as it decreases operational costs for ships by equipping them with automation systems.

- Digitalization in ships is vulnerable to cyber threats, which are restraining the market to grow. As ships are increasingly utilizing systems that rely on digitization which call for cyber risk management on board. As technology continues to develop, information technology (IT) and operational technology (OT) onboard ships are being networked together and more frequently connected to the internet. This brings the greater risk of unauthorized access or malicious attacks to ship's systems and networks.

Integrated Marine Automation System Market Trends

This section covers the major market trends shaping the Integrated Marine Automation System Market according to our research experts:

Commercial Marine Vessels to Witness Significant Growth to Market

- Cruise ships are the type of passenger ships that come under commercial segments and with an increasing number of tourism activities and increase in disposable income for people, firms are highly investing in cruise ships and various automation firms provide their products for navigation support, equipment monitoring and safety improvements to shipbuilding companies.

- For instance, in 2017, ABB supplied the complete power, propulsion, and automation package for a series of new cruise vessels being built by MV WERFTEN for Genting Hong Kong brands Crystal Cruises and Star Cruises.

- Various cruise ship lines business that operates a fleet of small luxury cruise ships are opening to automation. For instance, in Sep 2019, Windstar Cruises announced to re-engine its Star-class vessels which will involve new automation and control systems, tank monitoring systems, upgraded boilers, and ballast water treatment systems. This will be sourced by Fincantieri who provides ship automation and navigation systems for Naval vessels, Cruise ships, Ferries and Yachts.

- Moreover, in July 2019, UK cruise business known as Saga Cruises of Europe developed new Spirit-class passenger ships, which integrates navigation, automation, propulsion management and safety systems costing USD 400m. The ships will have a safety monitoring and control system (SMCS) integrated into the ship automation and navigation systems supplying by Kongsberg Maritime. Various other European firms are investing in cruise ships for delivering it globally, by which the market for integrated marine automation will grow high in the future.

Europe Accounts for Highest Market Share

- Europe accounts for remarkable market share in terms of revenue generation with an increasing number of cruise ships and autonomous ships, which are the key factors in propelling growth in this region.

- Hub ports, for instance, Rotterdam, Antwerp, Le Havre, and Hamburg in Europe have little option but to invest in boosting infrastructure and deploying the largest available cranes to handle the giant vessels that can exchange 10,000 TEU in one port call. Developments in technology have empowered terminals in these ports to automate many functions that create faster and more efficient handling solutions. Also, automation will become critical in handling mega-ships and the more digitally connected supply chains of the future.

- In addition, increasing demand for maritime services is another factor expected to drive growth of the target market in Europe region. Kongsberg recently launched two fully automated ferries for crossing the one-mile stretch between Anda and Lote in Norway. These vessels (the GLOPPEFJORD and the EIDESFJORD) have been in operation since 2018, and are fully autonomous with the exception of a human captain’s handling of docking procedures. This enhances the growth of integrated automation in this region.

- Moreover, in Dec 2018, Rolls-Royce successfully demonstrated the world’s first fully autonomous ferry in the archipelago south of the city of Turku, Finland that successfully navigate autonomously during its voyage between Parainen and Nauvo with the return journey conducted under remote control through automation.

Integrated Marine Automation System Industry Overview

The integrated marine automation system marketis highly fragmented and the vast majority of the players functioning in the global are in continuous innovation to improve theperformance in scalability andautomatedtracking.These major players with the prominent share in the market are focusing on expanding their customer base across foreign countries.Key players in the market areEmerson IN,Kongsberg Gruppen, etc. Recent developments in the market are -

- Sep 2019 - Kraken Robotics Inc.subsidiary, Kraken Robotic Systems Inc., received a purchase order from ThayerMahan Inc., for a KATFISH 180 system for USD 2.9 million. Kraken’s KATFISH 180, an actively stabilized towfish with Synthetic Aperture Sonar (SAS) provides wide-area seafloor survey, with high area coverage rates; superior pixel resolution for detection and classification; real-time, full-swath, full-resolution SAS processing; 200m+ operating depth; altitude- or depth-keeping navigation; automatic target detection; and in-stride classification.

- Sep 2019 -Konsberghas been contracted to provide a “full picture” upgrade for the Tidewater Marine Offshore Supply Vessel (OSV). As a solitary supplier under the terms of the contract, Konsberg will deliver and install a state-of-the-art hybrid power solution including K-Pos DP (Dynamic Positioning), K-Chief 700 IAS (Integrated Automation System) and AGS (Advanced Generator Supervisor) upgrades designed to significantly improve energy efficiency, optimize power management and enhance vessel positioning maneuvers.

Integrated Marine Automation System Market Leaders

-

Emerson Electric Co

-

Kongsberg Gruppen

-

ABB Group

-

Rockwell Automation Inc.

-

Jason Marine Group

*Disclaimer: Major Players sorted in no particular order

Integrated Marine Automation System Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 High Growth in the Maritime Tourism Industry

- 4.2.2 Volumetric Growth in Seaborne Trades

-

4.3 Market Restraints

- 4.3.1 Vulnerability to Cyberthreats Through Digitalization

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. TECHNOLOGY SNAPSHOT

6. MARKET SEGMENTATION

-

6.1 By Product

- 6.1.1 Hardware

- 6.1.2 Software

-

6.2 By Solution

- 6.2.1 Vessel Management

- 6.2.2 Power Management

- 6.2.3 Safety System

- 6.2.4 Other Solutions (Process Control System)

-

6.3 End-User

- 6.3.1 Commercial

- 6.3.2 Defense

-

6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 South Korea

- 6.4.3.3 Japan

- 6.4.3.4 India

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.4.1 Latin America

- 6.4.4.2 Middle-East & Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Kongsberg Gruppen

- 7.1.3 ABB Group

- 7.1.4 Rockwell Automation inc.

- 7.1.5 Jason Marine Group

- 7.1.6 Ulstein Group

- 7.1.7 SMEC Automation

- 7.1.8 Logimatic

- 7.1.9 Sedni Marine Systems

- 7.1.10 Siemens AG

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityIntegrated Marine Automation System Industry Segmentation

The integrated marine automation system is a distributed monitoring and control system. New enhanced human-machine interfaces (HMI) and open system architecture are providing the highest standard in quality and functionality in vessel management, safety system, etc, with increasing compliance with maritime safety norms for end-users such as in commercial and defense sector.

| By Product | Hardware | |

| Software | ||

| By Solution | Vessel Management | |

| Power Management | ||

| Safety System | ||

| Other Solutions (Process Control System) | ||

| End-User | Commercial | |

| Defense | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| South Korea | ||

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle-East & Africa |

Integrated Marine Automation System Market Research FAQs

What is the current Integrated Marine Automation System Market size?

The Integrated Marine Automation System Market is projected to register a CAGR of 2.5% during the forecast period (2024-2029)

Who are the key players in Integrated Marine Automation System Market?

Emerson Electric Co, Kongsberg Gruppen, ABB Group, Rockwell Automation Inc. and Jason Marine Group are the major companies operating in the Integrated Marine Automation System Market.

Which is the fastest growing region in Integrated Marine Automation System Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Integrated Marine Automation System Market?

In 2024, the Europe accounts for the largest market share in Integrated Marine Automation System Market.

What years does this Integrated Marine Automation System Market cover?

The report covers the Integrated Marine Automation System Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Integrated Marine Automation System Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Integrated Marine Automation System Industry Report

Statistics for the 2024 Integrated Marine Automation System market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Integrated Marine Automation System analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.