Intelligent Lighting Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.40 % |

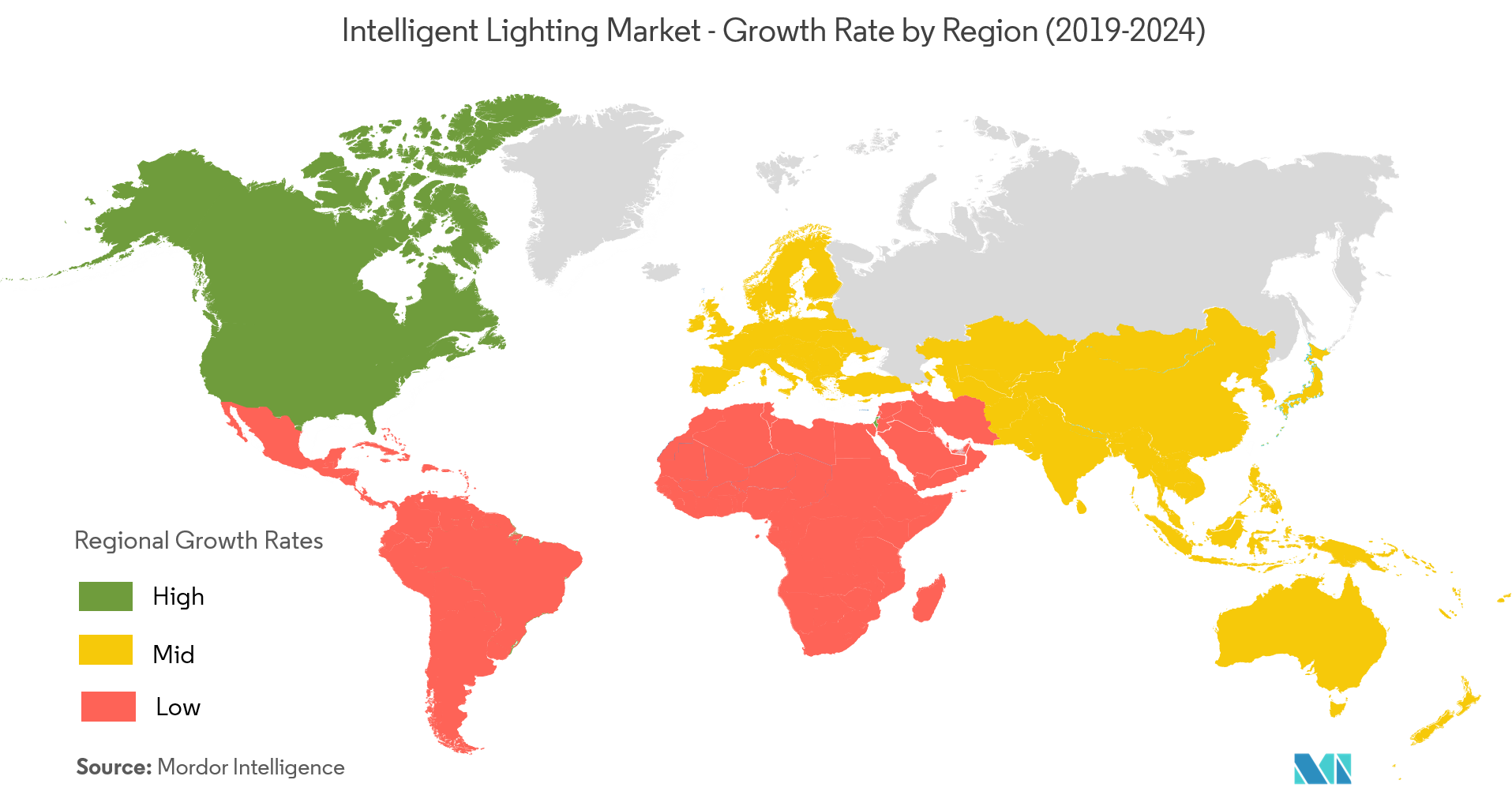

| Fastest Growing Market | North America |

| Largest Market | North America |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Intelligent Lighting Market Analysis

The intelligent lighting market is expected to grow at a CAGR of 5.40% over the forecast period (2021 - 2026). The intelligent lightings are generally referred to automated lightings used in event stages to provide extraordinary complex effects. The products are designed with intelligent programs which reduces the role of lighting operator, hence getting more emphasis on products itself.

- Significant rise in the investments for the entertainment and sporting events including musical concerts, stage shows is one of the significant factor driving the intelligent lighting market. According to the Citi Research, The United States and European countries have witnessed a significant growth in the live events. The Europe region registered over 12% increase in its live concerts and festivals in 2018.

- Additionally, the night clubs are extensively adopting intelligent lightings for offering enhanced lighting effects. Recently, one of the popular night club in Belgium partnered with Martin Harman to install lighting fixtures to support a full schedule of weekly dance parties and DJ sets after rennovation. It installed 24 RUSH MH 10 Beam FX fixtures, which is a compact 60W moving head fixture.

- However, the high cost of the fixtures is somewhere limiting the event organizers to go for rental services rather than adopting them. This is one of the factor restricting the intelligent lighting market growth.

Intelligent Lighting Market Trends

This section covers the major market trends shaping the Intelligent Lighting Market according to our research experts:

Outdoor Application to Grow Significantly

- As the LED is becoming the most preferred light source by every individual for both residential as well as commercial purposes, the adoption on the number of intelligent lighting has increased over the years including wash, beam, and spotlights.

- The emphasis on building iconic architectures has been significant across the world. Also, for making the experience more enhanced, the intelligent lightings are being installed. For instance, in July 2019, the grand mosque was built with an exceptional structure having a 262-foot main dome and four minaret towers rising to a height of 351 feet. It is deployed with 2,556 intelligent lighting fixtures. Further installation of such large iconic infrastructures is expected to drive the demand for outdoor application of intelligent lightings.

- Moreover, there has been a continuous increase in the number of outdoor concerts organized worldwide. According to the Pollstar, in 2018 over 7.7 million tickets got sold considering only leading 20 concert sites in the world.

- The music concert organizers extensively adopting intelligent lighting systems for outdoor applications. Recently, in a music concert by Eric Church at Nissan Stadium in Nashville installed over 420 singe beam moving-head from Elation.

European Market to Account for a Significant Share

- The European region is one of the leading hubs for nightlife across the world with major destinations like Amsterdam, Monte Carlo, and Berlin. The recent study by the Club Commission in Berlin has witnessed that visitors spent over EUR 200 per day, which cumulatively managed these clubs in the city to make EUR 168 million in 2018.

- The fashion industry in Italy is also one of the leading economy driven industry and is known for the fashion shows held in the country. Companies are strategically targeting these events to provide an enhanced experience to the visitors. For instance, Calzedonia fashion show in Verona deployed a number of moving heads from Coemar Light Emotion.

- The companies offering intelligent lightings in the region are focusing on partnering with event organizers for music festivals. Recently the International Music Summit (IMS) organized in the Mediterranean island of Ibiza in August 2019, deployed a lighting systems including intelligent lightings from Martin Harman. The increase in such large events in the region is expected to drive the demand intelligent lightings in the market.

Intelligent Lighting Industry Overview

The market for intelligent lighting is moderately consolidated because of the dominance by a few key companies in the market. These companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments by the companies are listed below.

- March 2019- PR Lighting announced to release its latest beam intelligent light XR 580 Beam. The company has claimed that it features with PHILIPS MSD Platinum 25R 550W with 100V~240VAC. The head of the light is can cover pan 540º and tilt 270º with auto position correction.

Intelligent Lighting Market Leaders

-

Samsung Electronics Co. Ltd (Harman Professional France SAS)

-

Coemar Lighting Srl

-

High End Systems Inc

-

Guangzhou guanghong Stage Lighting Equipment Co., Ltd.

-

Clay Paky SpA

*Disclaimer: Major Players sorted in no particular order

Intelligent Lighting Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Growth in Entertainment and Sports Events

-

4.3 Market Restraints

- 4.3.1 High Unit Cost is Leading Businesses to Go for Rental Services of these Equipments

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

-

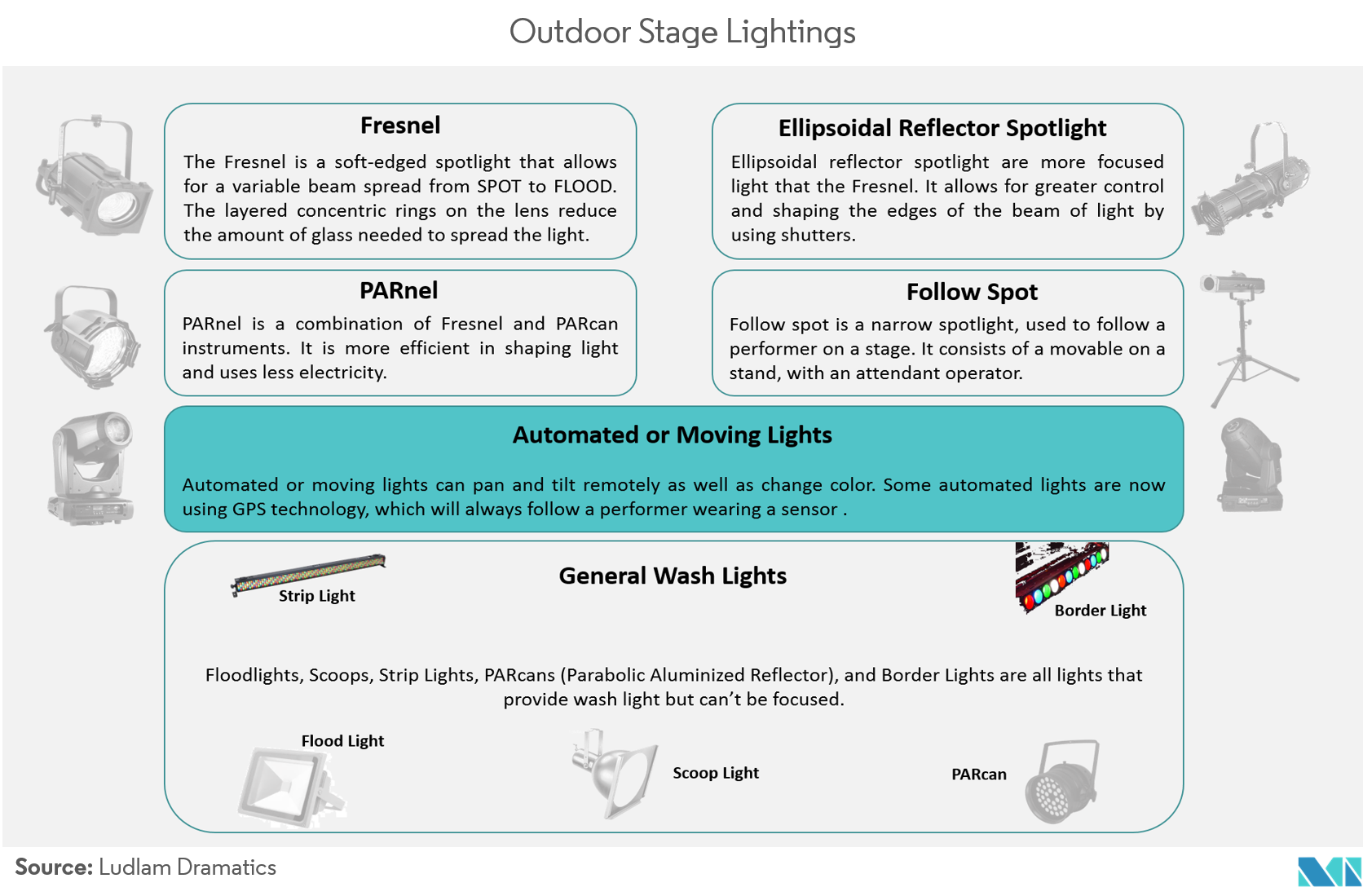

4.6 Technology Snapshot

- 4.6.1 Profile Lights

- 4.6.2 Spot Lights

- 4.6.3 Wash Lights

- 4.6.4 beam and hybrid Lights

5. MARKET SEGMENTATION

-

5.1 By Light Source

- 5.1.1 LED

- 5.1.2 HID

- 5.1.3 Laser

-

5.2 By Application

- 5.2.1 Indoor

- 5.2.2 Outdoor

-

5.3 By End User

- 5.3.1 Theaters and Concerts

- 5.3.2 TV Studios

- 5.3.3 Commercial Places

- 5.3.4 Other End Users

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Latin America

- 5.4.4.2 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Samsung Electronics Co. Ltd (Harman Professional France SAS)

- 6.1.2 Coemar Lighting Srl

- 6.1.3 High End Systems Inc

- 6.1.4 Guangzhou guanghong Stage Lighting Equipment Co., Ltd.

- 6.1.5 Clay Paky SpA

- 6.1.6 PR Lighting Ltd.

- 6.1.7 Chauvet & Sons Inc.

- 6.1.8 ADJ Products, LLC.

- 6.1.9 ROBE LIGHTING S. R. O

- 6.1.10 GTD America Technology Inc.

- 6.1.11 Elation Professional Lighting Inc

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityIntelligent Lighting Industry Segmentation

The scope of the study for the intelligent lighting market has considered the companies offering these type of lighting solutions for a wide range of applications across the geographical regions.

| By Light Source | LED | |

| HID | ||

| Laser | ||

| By Application | Indoor | |

| Outdoor | ||

| By End User | Theaters and Concerts | |

| TV Studios | ||

| Commercial Places | ||

| Other End Users | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle-East & Africa |

Intelligent Lighting Market Research FAQs

What is the current Intelligent Lighting Market size?

The Intelligent Lighting Market is projected to register a CAGR of 5.40% during the forecast period (2024-2029)

Who are the key players in Intelligent Lighting Market?

Samsung Electronics Co. Ltd (Harman Professional France SAS), Coemar Lighting Srl, High End Systems Inc, Guangzhou guanghong Stage Lighting Equipment Co., Ltd. and Clay Paky SpA are the major companies operating in the Intelligent Lighting Market.

Which is the fastest growing region in Intelligent Lighting Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Intelligent Lighting Market?

In 2024, the North America accounts for the largest market share in Intelligent Lighting Market.

What years does this Intelligent Lighting Market cover?

The report covers the Intelligent Lighting Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Intelligent Lighting Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Intelligent Lighting Industry Report

Statistics for the 2024 Intelligent Lighting market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Intelligent Lighting analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.