Internet of Things in the Energy Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 10.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

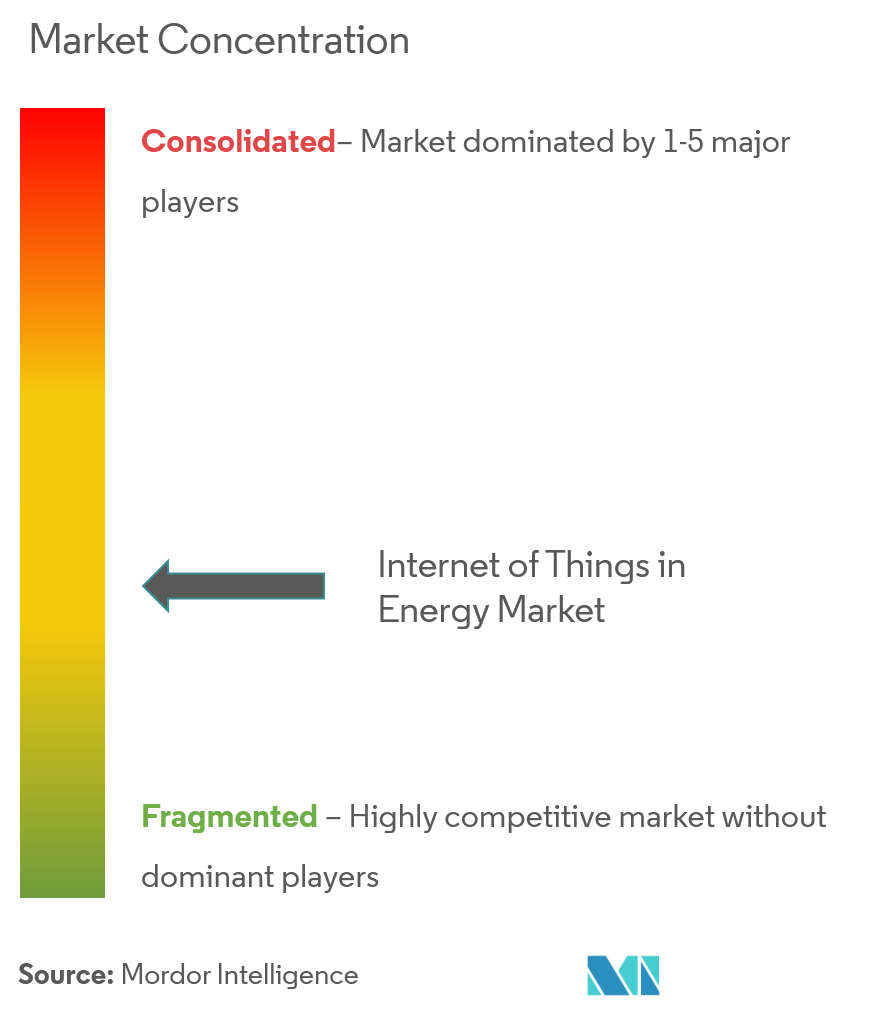

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Internet of Things in the Energy Market Analysis

The Internet of Things in the energy market is expected to witness a CAGR of 10% over the forecast period. According to the International Energy Agency, as a critical enabler of modern life, the energy sector, despite being significantly affected by the COVID-19 pandemic, is also essential for global and national response and recovery efforts.

- The Internet of Things (IoT) is expected to impact the energy sector significantly. From monitoring the temperature of a room using sensors to complex applications that control the energy use of an entire building, IoT helps in cost-cutting.

- Organizations can independently monitor their equipment, including machinery, lighting, heating, and air conditioning systems. IoT device data is analyzed to develop strategies for increasing efficiency. IoT solutions also assist in remotely controlling and regulating systems to establish the highest possible energy production efficiency.

- The decreasing natural resources that produce energy and the increasing wastage of energy have drawn the attention of various nations worldwide to innovate solutions that reduce energy wastage and adopt solutions that offer high efficiency.

- A predictive analytics network monitors the data from sensors embedded in power grids. Thus, machinery can reduce energy transmission and distribution losses, making energy consumption highly efficient and cost-effective worldwide.

- Companies such as Nexus Solutions offer connected solutions to monitor and reduce energy consumption in buildings. Aquicore is also developing an analytics platform that connects to energy meters that have already been installed, enabling organizations to make decisions that improve staff productivity and reduce energy wastage.

- However, integrating new sustainable distributed energy resources (DER) into the existing grid is designed to distribute centrally generated energy, which is quite challenging.

- IoT was beneficial for the energy sector during the pandemic, from sensors that enable monitoring of room temperatures to managing energy usage from a distance, resulting in sustainable development and cost reduction. Additionally, several IoT systems made it possible to use renewable energy, reducing pollution and exploiting non-renewable resources, enabling enterprises to continue operating despite government lockdowns out of concern for employee safety. For the majority of tasks in businesses in this industry during the pandemic, IoT enabled remote working.

Internet of Things in the Energy Market Trends

This section covers the major market trends shaping the Internet of Things in Energy Market according to our research experts:

Smart Meters Expected to Hold Significant Share

- Smart meters have been among utility companies' most adopted IoT devices in the last few years. These devices interconnect buildings with the smart energy grid, which allows these companies to manage energy flow more effectively. Smart cities are also leveraging smart meters.

- With IoT-ready smart meters, organizations can access rich, real-time data to provide better service while reducing costs and boosting profits. Moreover, this helps effectively balance electric loads, minimize power outages, stream energy distribution through more accurate forecasting, and enable dynamic pricing by raising or lowering costs based on real-time demand.

- By upgrading to smart meters and grids, many governments are also trying to utilize IoT to facilitate localized green energy production growth. For instance, the United States Department of Energy is pursuing a smart grid that can help boost the use of green energy while driving down costs in mass. These factors also force energy companies to invest in IoT technology to keep up with everyone around them.

- With smart meter technology, utilities can also empower their customers to make smarter decisions about their energy usage by providing helpful and detailed feedback on energy consumption using precise, real-time data from their smart meter, improving transparency on monthly energy bills, accurate pricing based on usage, etc. These advantages are boosting the market growth.

North America Region to Witness the Highest Growth

- Due to IoT's growing role in the sector, North America is expected to be a prominent market driven by smart energy projects' deployment. Rapid digitalization across industry verticals and technological advancements has also fueled IoT growth in this region.

- The United States and Canada are the early adopters of technologies such as Big Data, IoT, and mobility, creating significant growth opportunities for the IoT market. These countries have established economies, which strongly empower them to invest in R&D activities. Moreover, the start-up culture in the region is growing more rapidly compared to the other areas.

- Moreover, the region has a strong foothold on IoT vendors, contributing to the market's growth. Some include IBM Corporation, Microsoft Corporation, Intel Corporation, Cisco Systems Inc., and Google Inc.

- Canadian manufacturers depend on innovation and investment in technologies to be competitive. In an environment of increasing input, labor cost, and competition from large global manufacturers, companies here are expected to invest in technologies like IoT to remain competitive and maintain their operating margins. US lawmakers have introduced the "IoT Readiness Act" for massive IoT growth with the 5G networks' arrival.

- In comparison to the United States, Canadian companies have been slower to adopt advanced technologies in the previous year. Advanced Manufacturing survey of SMEs in North America. The Canadian energy sector has been procuring internet-connected sensors to monitor various activities across generating plants, distribution networks, and smart home meters.

Internet of Things in the Energy Industry Overview

The internet of things in the energy market is fragmented. The increasing awareness of energy waste control and cost-effectiveness provides lucrative opportunities in the industrial robot market. Overall, the competitive rivalry among existing competitors is high. Acquisitions and collaboration of large companies with startups are expected, focusing on innovation.

In March 2022, Intel Corporation announced an agreement to acquire Granulate Cloud Solutions Ltd, an Israel-based company. Granulate Cloud Solutions Ltd creates software for continuous real-time optimization. Customers of cloud and data centers will benefit from Granulate's acquisition by increasing compute workload performance and reducing infrastructure and cloud costs.

In March 2022, SAP SE acquired Taulia. The acquisition boosts SAP's offerings for the CFO office and broadens its business network. Taulia's products will continue to be offered separately and fully into SAP software. Within the SAP Group, Taulia will do business as an independent company with its brand.

In February 2022, Intel Acquired Linutronix, the PREEMPT RT (Real Time) architect and a technology provider for industrial Linux. With the growth of Intel's software ecosystem, this acquisition reflects Intel's commitment to supporting the Linux kernel and the Linux community.

Internet of Things in the Energy Market Leaders

-

AGT International

-

Cisco Systems Inc.

-

IBM Corporation

-

Intel Corporation

-

SAP SE

*Disclaimer: Major Players sorted in no particular order

Internet of Things in the Energy Market News

- Nov 2022: With the subsequent development in indoor cellular networks, Huawei Technologies Co. Ltd started offering 5G distributed massive MIMO. To replicate Massive MIMO indoors, Huawei offers to coordinate distributed indoor radio networks like the enhanced antenna arrays of Massive MIMO.

- Jul 2022: A post-quantum cryptography (QPC) edition of Crypto Quantique's QuarkLink chip-to-cloud IoT security platform was released. Crypto Quantique specializes in quantum-driven cybersecurity for the IoT. The updated platform, particularly the selected vital encapsulation mechanism (KEM), CRYSTALS-Kyber, is said to be the first to incorporate post-quantum algorithms announced for standardization by the National Institute of Standards and Technology (NIST).

- Feb 2022: Nokia and AT&T collaborated to enhance 5G uplink with distributed massive MIMO. Through the distributed tremendous MIMO technique, this collaboration aims to improve uplink performance while maintaining downlink efficiency. At AT&T Labs, a gigantic distributed MIMO lab system prototype was installed and tested. Based on simulations, the 5G uplink capacity will grow by 60-90%.

Internet of Things in the Energy Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Industry

-

4.5 Market Drivers

- 4.5.1 Increasing Awareness of Energy Consumption Control

-

4.6 Market Restraints

- 4.6.1 High Risk Associated with Data

5. MARKET SEGMENTATION

-

5.1 Type

- 5.1.1 Hardware

- 5.1.1.1 Smart Thermostats

- 5.1.1.2 Smart Meters

- 5.1.1.3 EV Charging Stations

- 5.1.1.4 Other Types of Hardware

- 5.1.2 IoT Software

- 5.1.3 IoT Platform

- 5.1.4 IoT Security

- 5.1.5 IoT Services

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles*

- 6.1.1 AGT International

- 6.1.2 Carriots SL

- 6.1.3 Cisco Systems Inc.

- 6.1.4 Davra Networks

- 6.1.5 Flutura Business Solutions LLC

- 6.1.6 IBM Corporation

- 6.1.7 Intel Corporation

- 6.1.8 Maven Systems Private Limited

- 6.1.9 SAP SE

- 6.1.10 Wind River Systems Inc.

7. INVESTMENT ANALYSIS

8. FUTURE OF THE MARKET

** Subject To AvailablityInternet of Things in the Energy Industry Segmentation

IoT technology in the energy sector cuts costs and creates more productive connected buildings. The Internet of Things in the energy market provides different hardware, software, services, connectivity, and integrated solutions.

The Internet of Things in the Energy Market is segmented by Type (Hardware, IoT Software, IoT Platform, IoT Security, and IoT Services) and Geography. The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| Type | Hardware | Smart Thermostats |

| Smart Meters | ||

| EV Charging Stations | ||

| Other Types of Hardware | ||

| Type | IoT Software | |

| IoT Platform | ||

| IoT Security | ||

| IoT Services | ||

| Geography | North America | |

| Europe | ||

| Asia Pacific | ||

| Latin America | ||

| Middle East and Africa |

Internet of Things in the Energy Market Research FAQs

What is the current Internet of Things in Energy Market size?

The Internet of Things in Energy Market is projected to register a CAGR of 10% during the forecast period (2024-2029)

Who are the key players in Internet of Things in Energy Market?

AGT International, Cisco Systems Inc., IBM Corporation, Intel Corporation and SAP SE are the major companies operating in the Internet of Things in Energy Market.

Which is the fastest growing region in Internet of Things in Energy Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Internet of Things in Energy Market?

In 2024, the North America accounts for the largest market share in Internet of Things in Energy Market.

What years does this Internet of Things in Energy Market cover?

The report covers the Internet of Things in Energy Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Internet of Things in Energy Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Internet of Things in the Energy Industry Report

Statistics for the 2023 Internet of Things in the Energy market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Internet of Things in the Energy analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.