IoT Middleware Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 15.16 Billion |

| Market Size (2029) | USD 35.92 Billion |

| CAGR (2024 - 2029) | 18.82 % |

| Fastest Growing Market | North America |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

IoT Middleware Market Analysis

The IoT Middleware Market size is estimated at USD 15.16 billion in 2024, and is expected to reach USD 35.92 billion by 2029, growing at a CAGR of 18.82% during the forecast period (2024-2029).

- The growing adoption of IoT technology across end-user industries, such as manufacturing, automotive, and healthcare, is positively driving the market’s growth. With the traditional manufacturing sector amid a digital transformation, IoT is fueling the next industrial revolution of intelligent connectivity. This is changing how industries approach increasingly complex processes of systems and machines to improve efficiency and reduce downtime. With the growth in the number of devices connected to the internet, there is a greater need for seamless collaboration and connectivity between those devices, thus making IoT middleware a significant focus area for businesses.

- Additionally, the IoT Middleware market is witnessing substantial demand in various This is driven by the need to manage the growing number of connected devices and the vast amount of data they generate. The integration of IoT middleware in end-user sectors is expected to streamline operations, enhance service delivery, and create new business opportunities.

- Adopting an industry-agnostic application middleware plays a vital role in reducing the complexity of future changes to their IoT solutions. Further, with the growing integration of IoT into mobile devices, machinery, equipment, and tablets, among other devices, the need for a platform to support and integrate such demands has become necessary.

- Government initiatives, such as smart city projects, are expected to create demand for IoT middleware. Trends, such as connected buildings, smart factories, and smart homes, are expected to create opportunities for the market. Moreover, the smart cities' concept has marked a great prospect with the IoT in the energy, waste, and infrastructure sectors.

IoT Middleware Market Trends

Manufacturing Expected to Have the High Potential Growth

- Industry 4.0 and IoT are at the center of new technological approaches for developing, producing, and managing the entire logistics chain, otherwise known as smart factory automation. Massive shifts in manufacturing due to Industry 4.0 and the acceptance of IoT require enterprises to adopt agile, smarter, and innovative ways to advance production with technologies that complement and augment human labor with robotics and reduce industrial accidents caused by process failure.

- With the high rate of adoption of connected devices and sensors and the enabling of M2M communication, there has been a surge in data points that are generated in the manufacturing industry. These data points can be of various kinds, ranging from a metric describing the time taken for the material to pass through one process cycle to a more advanced one, such as calculating the material stress capability in the automotive industry.

- IoT Middleware can implement IoT-based virtual manufacturing applications as well as IoT-based factory automation, which encourages manufacturers to deploy IoT devices in key manufacturing establishments. Another factor driving the market growth is the advantage of IoT in attaining “informed” manufacturing. IoT middleware enables four essential elements of manufacturing, such as Products, People, Processes, and Infrastructure, to work seamlessly.

- Also, a significant consideration while aiming for the manufacturing industry is the promotion of flexibility through open architectures that support customization and streamlined software upgrades across multiple devices. Therefore, this segment is expected to benefit from the rapid emergence of Open-source IoT middleware developments.

- Additionally, manufacturing organizations in many countries worldwide are increasingly investing in emerging technologies, thus creating significant growth opportunities for adopting IoT middleware in the manufacturing sector. For instance, according to a survey conducted by CommBank in January 2022, 42% of Australian manufacturers intend to invest in the emerging technology area relating to intelligent automation and robotic process automation over the next two to three years. Investment in mobile, connectivity, and the Internet of Things (IoT) was among the second intended investment areas, with 40% of manufacturers intending to invest.

North America Region is Anticipated to Holds Major Market Share

- North America is expected to be a prominent market due to the growing role of IoT among the significant revenue-generating end-user industries of the region, driven by the deployment of connected cars, smart energy projects, home automation, and a focus on smart manufacturing. The US and Canada are the early adopters of technologies, such as Big Data, IoT, and mobility, and it creates significant growth opportunities for the IoT middleware market.

- The United States is on the verge of the fourth industrial revolution. Data is being used on a large scale for production while integrating it with a wide variety of manufacturing systems throughout the supply chain. Therefore, the emergence of information technology and the increased usage of IoT across a wide range of manufacturing, industrial, and automotive applications have added a new dimension to conducting business operations.

- Manufacturers in the region rely on IIoT platforms for general process optimization, dashboards and visualization, and condition monitoring. SMEs are becoming increasingly flexible in incorporating new technologies with their existing systems, whereas large manufacturers have massive budgets for digitization.

- Another significant driver is the prevalence of an environment of increasing input, labor cost, and competition from large global manufacturers, which is expected to attract investment in technologies such as IoT to remain competitive and maintain operating margins.

- Aiding this trend is the formation of the “Advanced Manufacturing Partnership (AMP) 2.0,” an initiative undertaken to make the industry universities. The federal government is investing in emerging technologies and smart manufacturing initiatives, such as the Smart Manufacturing Leadership Coalition (SMLC), to drive and facilitate the broad adoption of manufacturing intelligence. Such trends in the market are also expected to emphasize the need for IoT middleware solutions in the market.

IoT Middleware Industry Overview

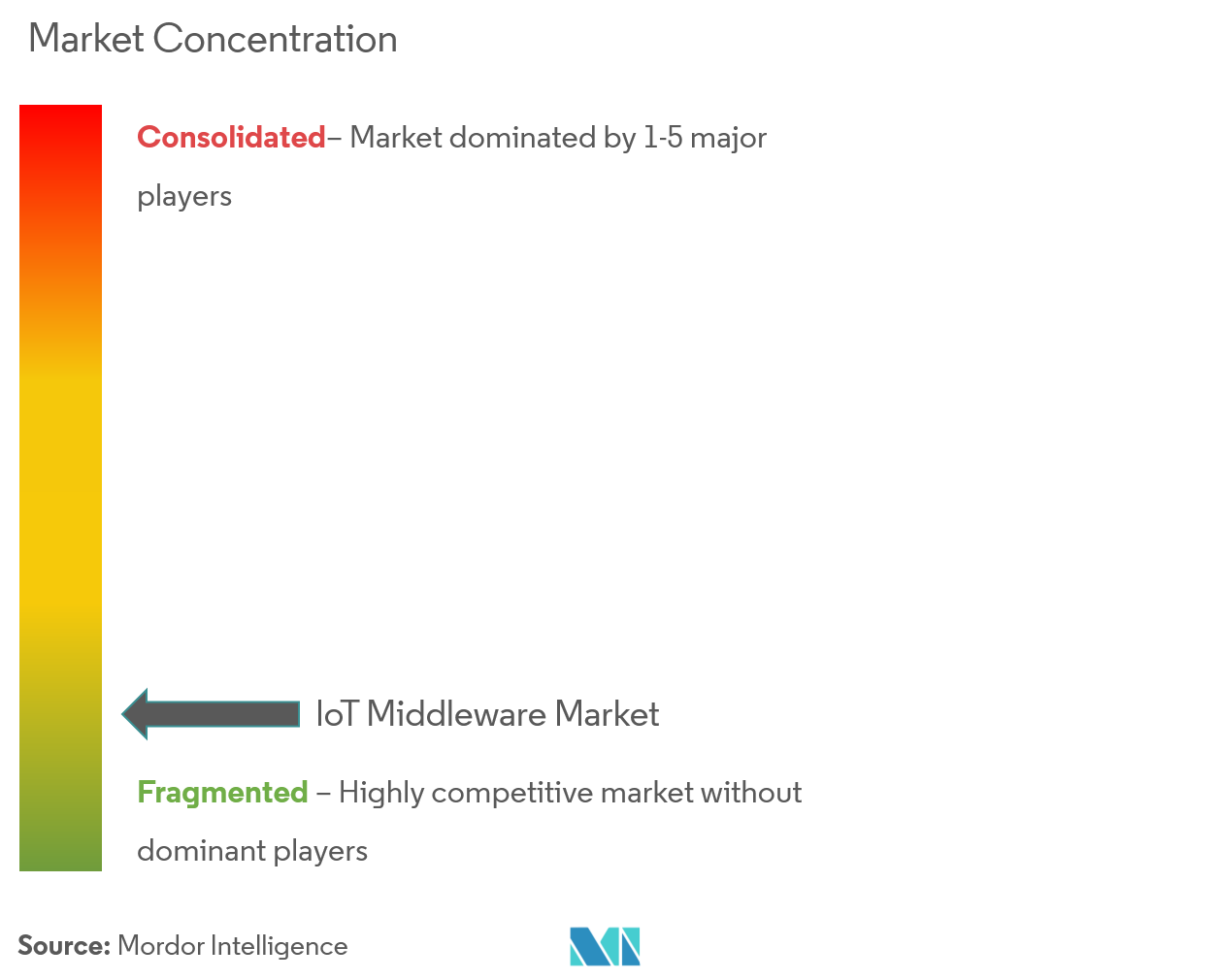

The IoT middleware market is highly competitive, poised to disrupt the traditional IT industry by introducing innovative solutions for enterprises. Market players are embracing key strategies such as product innovation, mergers, and acquisitions to enhance their product functionality and maintain their competitive edge. Notable companies operating in this market landscape include Cisco Systems Inc., IBM Corp., Oracle Corporation, ClearBlade Inc., and PTC Inc., among others.

In March 2023, Alliot Technologies, a specialized provider of IoT solutions, introduced its groundbreaking IoT Middleware platform called Symbius. This innovative platform is designed to eliminate the barriers associated with cellular IoT. Symbius is set to become one of the pioneering platforms of its kind, offering the unique capability to decode recorded data into a standardized format.

IoT Middleware Market Leaders

-

Cisco Systems Inc.

-

IBM Corp. (Red Hat Inc.)

-

Oracle Corporation

-

ClearBlade Inc.

-

PTC Inc.

*Disclaimer: Major Players sorted in no particular order

IoT Middleware Market News

- March 2023: UnaBiz, an IoT Service Provider and Integrator company, and LORIOT, a global Swiss-based IoT company specializing in long-range connectivity and network management, partnered to empower clients to deploy extensive IoT solutions, offering them the flexibility to choose from multiple protocols tailored to their specific use cases. This collaboration involves the integration of LORIOT's hybrid Network Management System, Hummingbird, with UnaBiz's middleware IoT data management platform, UnaConnect, to develop a comprehensive catalog of various products and services.

- May 2022: STMicroelectronics, a prominent global semiconductor company catering to a wide range of electronics applications, joined forces with Microsoft to enhance the security of emerging Internet-of-things (IoT) applications. As part of this collaboration, STMicroelectronics will incorporate its ultra-low-power STM32U5 microcontrollers (MCUs) with Microsoft Azure RTOS and IoT Middleware, along with a certified secure implementation of Arm Trusted Firmware-M (TF-M) for embedded systems.

IoT Middleware Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the IoT Middleware Ecosystem

5. MARKET DYNAMICS

-

5.1 Market Drivers

- 5.1.1 Developments Across Open-source Platforms

- 5.1.2 Increasing M2M Communications

-

5.2 Market Restraints

- 5.2.1 Complex Technologies Pertaining to the Development of IoT Middleware

-

5.3 Analysis of IoT Middleware Applications

- 5.3.1 Application Management

- 5.3.2 Data Management

- 5.3.3 Other Applications

6. MARKET SEGMENTATION

-

6.1 By Platform

- 6.1.1 Application Enablement

- 6.1.2 Device Management

- 6.1.3 Connectivity Management

-

6.2 By End-user Industry

- 6.2.1 Manufacturing

- 6.2.2 Healthcare

- 6.2.3 Energy and Utilities

- 6.2.4 Transportation and Logistics

- 6.2.5 Agriculture

- 6.2.6 Other End-user Industries

-

6.3 Geography***

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 IBM Corp. (Red Hat Inc.)

- 7.1.3 Oracle Corporation

- 7.1.4 ClearBlade Inc.

- 7.1.5 PTC Inc.

- 7.1.6 Arrayent Inc.

- 7.1.7 Axiros GmbH

- 7.1.8 Davra Networks

- 7.1.9 Amazon Web Services Inc.

- 7.1.10 Bosch.IO GmbH

- 7.1.11 MuleSoft LLC (Salesforce Company)

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. MARKET OPPORTUNITIES AND FUTURE OF THE MARKET

** Subject To AvailablityIoT Middleware Industry Segmentation

IoT middleware is software that interfaces components and sensors, making communication possible among several IoT elements. Middleware is part of the architecture enabling connectivity for massive numbers of diverse things by offering a connectivity layer for sensors and for the application layer that delivers services that ensure effective communications among the software.

The IoT middleware market is segmented by platform (application enablement, device management, connectivity management), end-user industry (manufacturing, healthcare, energy and utilities, transportation and logistics, agriculture, and Other End-User Industries), and geography (North America, Latin America, Europe, Asia-Pacific, and Middle East and Africa).

The market sizes and forecasts are provided in terms of value in USD for all the above segments.

| By Platform | Application Enablement |

| Device Management | |

| Connectivity Management | |

| By End-user Industry | Manufacturing |

| Healthcare | |

| Energy and Utilities | |

| Transportation and Logistics | |

| Agriculture | |

| Other End-user Industries | |

| Geography*** | North America |

| Europe | |

| Asia | |

| Australia and New Zealand | |

| Latin America | |

| Middle East and Africa |

IoT Middleware Market Research FAQs

How big is the IoT Middleware Market?

The IoT Middleware Market size is expected to reach USD 15.16 billion in 2024 and grow at a CAGR of 18.82% to reach USD 35.92 billion by 2029.

What is the current IoT Middleware Market size?

In 2024, the IoT Middleware Market size is expected to reach USD 15.16 billion.

Who are the key players in IoT Middleware Market?

Cisco Systems Inc., IBM Corp. (Red Hat Inc.), Oracle Corporation, ClearBlade Inc. and PTC Inc. are the major companies operating in the IoT Middleware Market.

Which is the fastest growing region in IoT Middleware Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in IoT Middleware Market?

In 2024, the North America accounts for the largest market share in IoT Middleware Market.

What years does this IoT Middleware Market cover, and what was the market size in 2023?

In 2023, the IoT Middleware Market size was estimated at USD 12.31 billion. The report covers the IoT Middleware Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the IoT Middleware Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

IoT Middleware Industry Report

Statistics for the 2024 IoT Middleware market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. IoT Middleware analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.