IoT Security Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 6.60 Billion |

| Market Size (2029) | USD 28.01 Billion |

| CAGR (2024 - 2029) | 33.53 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

Major Players

*Disclaimer: Major Players sorted in no particular order |

IoT Security Market Analysis

The IoT Security Market size is estimated at USD 6.60 billion in 2024, and is expected to reach USD 28.01 billion by 2029, growing at a CAGR of 33.53% during the forecast period (2024-2029).

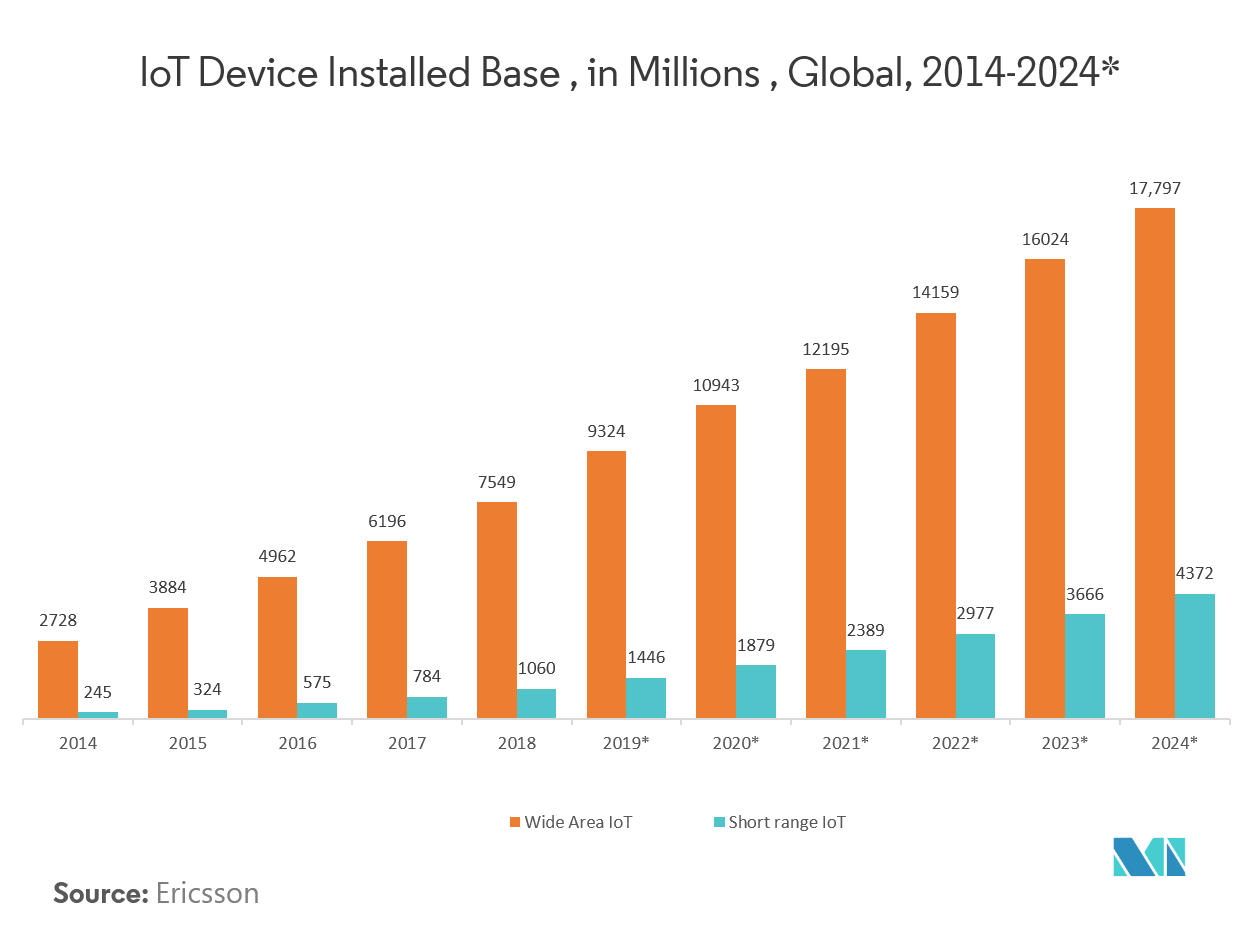

The emerging applications and business models, coupled with the falling device costs, have been driving the adoption rate of IoT, which is, consequently, influencing the number of connected devices, such asconnected cars, machines, meters, wearable, and consumer electronics.

- Increasing dependency on the connected devices is creating the need to keep the connected device secure. According to Ericsson, it is estimated that nearly 400 million IoT devices, with cellular connections in 2016, are projected to reach 1.5 billion by 2022. This robust growth is expected to be driven by the increased industry focus on deploying a connected ecosystem and the standardization of 3GPP cellular IoT technologies.

- In 2019, for instance, Symantec Corp. announced a new service that enables its Cloud Workload Protection (CWP) solution and AMZN GuardDuty from Amazon, to provide automated remediation and enhanced threat intelligence for Amazon Web Services (AWS) workloads and storage. This new service is anticipated to help enterprises to navigate the complex security landscape, allowing AWS customers to automate and streamline critical components of cloud security.

- Increasing number data breaches, emergence of smart cities, are some of the factors driving the market.

- .However, factors, such as the dearth of skilled workforce and less awareness about the importance of the IoT security solutions hinder the market growth.

IoT Security Market Trends

This section covers the major market trends shaping the IoT Security Market according to our research experts:

Network Security Is Expected to Witness the Fastest Growth Rate

- IoT networks are the prominent targets and the primary concern for enterprises across the world. The network security segment covers various subsegments, such as firewalls, servers, VPN, IDS, IPS, WIDPS, gateway, and network hardware. The growing trend of adopting BYOD and IoTs in enterprises is increasing the security concerns of attacks on enterprise networks. For instance, according to IT Candor, the size of the global network hardware market during fiscal 2018 was valued at USD 181 billion. Enterprise network hardware alone was valued at USD 52 billion.

- According to the IBM X-Force threat intelligence report, in 2018 it was recorded an increase of 5,400% in the number of IoT vulnerabilities over the number reported just five years earlier. Mirai attack, back in 2016, is a prominent example of using IoT to attack servers. The malware used botnet, which enlisted over 150,000 devices to send 1TB of data per second at the vendor's servers.

- To date, the majority of the IoT based attacks have occurred in DDoS form. According to Symantec's report, three kinds of DDoS associated malware, such as LightAidra, Kaiten, and Mirai, collectively accounted for nearly 80% of the 2018 year's IoT attacks.

- Many vendors in the market are emphasizing on providing solutions specific to tackle issues related to network security. For instance, Palo Alto Networks is delivering IoT security as an integrated service through the firewall; the capability was due to the recent acquisition of Zingbox by Palo Alto Networks.Such initiatives by various vendors are expected to mitigate the network threats over the forecast period and drive the market demand for the network security segment.

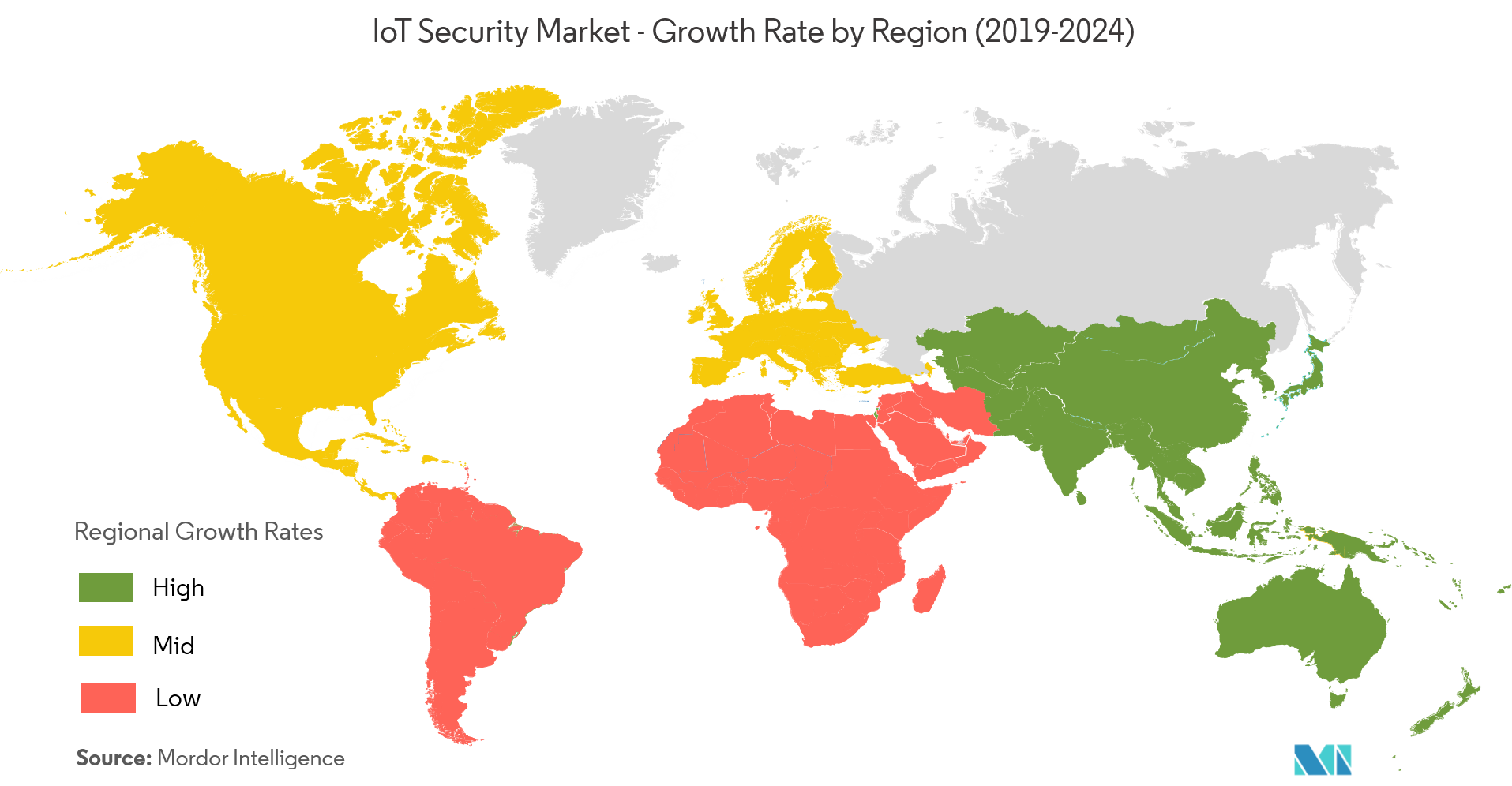

Asia-Pacific Occupies The Largest Market Share

- Asia-Pacific is the most prominent region for the adoption of IoT, owing to smart city projects being built in the region. The massive industrialization and the rising number of mobile device users in Asia-Pacific also indicate that the region is expected to witness significant growth.

- According to the Cisco VNI report, by 2022, the region may have 2.6 billion internet users (62% of the population), up from 1.7 billion (41% of the population) in 2017. The region is also estimated to have 13.1 billion networked devices/connections by 2022, up from 8.6 billion in 2017. Asia-Pacific, however, is 35% more likely to be targeted by advanced cyber attacks when compared to the world, according to a report by FireEye.

- According to the National Institute of Information and Communication Technology (NIICT), there has been a significant increase in the number of cyberattacks to IoT Devices. NICT predicts that the number of cyberattacks may reach 30 billion devices by 2020, when compared to 15 billion devices in 2015. Such instances are propelling the government and the related organizations to deploy IoT security solutions to mitigate the damages.

- With a rising trend toward IoT, China’s technological innovation has led to increasing demand in the smart home market from Chinese consumers. The country’s central smart home systems consist of lighting control systems, security systems, entertainment systems (audio and video), home appliances, and others.

IoT Security Industry Overview

The IoT Securitymarket is moderately competitive and consists of a few significant market players operating across the globalmarket. In terms of market share, some of theplayers currently dominate the market. However, with the advancement in the security accessacross the industrialservices, new players are increasing their market presence thereby expanding their business footprint across the emerging economies. Some of the key players in the market areSymantec Corporation, IBM Corporation, Check Point Software Technologies Ltd.,Intel Corporation,Hewlett Packard Enterprise Company,Cisco Systems Inc.,Fortinet Inc.,Trustwave Holdings,Thales Group (Gemalto NV), among others.

- Sept 2019-Trustwave announced a cloud-based cybersecurity platform that serves as the foundation for the company’s managed security services, products and other cybersecurity offerings. The Trustwave Fusion platform is purpose-built to meet the enterprise, where it is involved in operations as it embraces digital transformation and contend with a continuously evolving security landscape.

- June 2019 -Symantec Corp.announced a new service for Symantec’s Cloud Workload Protection (CWP) solution and Amazon Guard Duty to provide automated remediation and enhanced threat intelligence for AWS workloads and storage. This new service will help enterprises to navigate the complex security landscape, allowing AWS customers to automate and streamline key components of cloud security.

IoT Security Market Leaders

-

Broadcom Inc. (Symantec Corporation)

-

IBM Corporation

-

Intel Corporation

-

HP Enterprise Company

-

AT&T Inc.

*Disclaimer: Major Players sorted in no particular order

IoT Security Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Number of Data Breaches

- 4.3.2 Emergence of Smart Cities

-

4.4 Market Restraints

- 4.4.1 Growing Complexity among Devices, Coupled with the Lack of Ubiquitous Legislation

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type of Security

- 5.1.1 Network Security

- 5.1.2 End-point Security

-

5.2 By Solution

- 5.2.1 Software

- 5.2.2 Services

-

5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Healthcare

- 5.3.3 Government

- 5.3.4 Manufacturing

- 5.3.5 Energy & power

- 5.3.6 Retail

- 5.3.7 BFSI

- 5.3.8 Others End-user Industries

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Broadcom Inc. (Symantec Corporation)

- 6.1.2 IBM Corporation

- 6.1.3 Check Point Software Technologies Ltd.

- 6.1.4 Intel Corporation

- 6.1.5 Hewlett Packard Enterprise Co.

- 6.1.6 Cisco Systems Inc.

- 6.1.7 Fortinet Inc.

- 6.1.8 Trustwave Holdings

- 6.1.9 Thales Group (Gemalto NV)

- 6.1.10 AT&T Inc.

- 6.1.11 Palo Alto Networks Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityIoT Security Industry Segmentation

IoT security is the technological area concerned with mitigating cyber threats regarding connected devices and networks in the internet of things. IoT involves adding internet connectivity to a system of interrelated computing devices, mechanical and digital machines, objects, and/or people. This interconnectivity of devices through the internet opens them up to a number of serious vulnerabilities if they are not properly protected. This market is characterized by growing levels of product penetration, moderate/high product differentiation, and high levels of competition.

| By Type of Security | Network Security | |

| End-point Security | ||

| By Solution | Software | |

| Services | ||

| By End-user Industry | Automotive | |

| Healthcare | ||

| Government | ||

| Manufacturing | ||

| Energy & power | ||

| Retail | ||

| BFSI | ||

| Others End-user Industries | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Mexico |

| Brazil | ||

| Rest of Latin America | ||

| Geography | Middle East & Africa | United Arab Emirates |

| Saudi Arabia | ||

| Rest of Middle-East & Africa |

IoT Security Market Research FAQs

How big is the IoT Security Market?

The IoT Security Market size is expected to reach USD 6.60 billion in 2024 and grow at a CAGR of 33.53% to reach USD 28.01 billion by 2029.

What is the current IoT Security Market size?

In 2024, the IoT Security Market size is expected to reach USD 6.60 billion.

Who are the key players in IoT Security Market?

Broadcom Inc. (Symantec Corporation), IBM Corporation, Intel Corporation, HP Enterprise Company and AT&T Inc. are the major companies operating in the IoT Security Market.

Which is the fastest growing region in IoT Security Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in IoT Security Market?

In 2024, the Asia Pacific accounts for the largest market share in IoT Security Market.

What years does this IoT Security Market cover, and what was the market size in 2023?

In 2023, the IoT Security Market size was estimated at USD 4.94 billion. The report covers the IoT Security Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the IoT Security Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

IoT Security Industry Report

Statistics for the 2024 IoT Security market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. IoT Security analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.