Laminate Flooring Market Size

| Study Period | 2020 - 2029 |

| Market Size (2024) | USD 2.91 Billion |

| Market Size (2029) | USD 4.13 Billion |

| CAGR (2024 - 2029) | 6.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Laminate Flooring Market Analysis

The Laminate Flooring Market size is estimated at USD 2.91 billion in 2024, and is expected to reach USD 4.13 billion by 2029, growing at a CAGR of 6% during the forecast period (2024-2029).

Laminate flooring is becoming extremely popular in home renovation and improvement due to its ease of use and simplified installation process. The growing emphasis on flooring designs, colors, and aesthetics has further fueled the demand for this product. With a wide range of customization options, laminate flooring allows users to choose contemporary and trendy designs that align with their preferences. The market growth of laminate flooring is driven by consumers' increasing awareness of its numerous advantages, including its exceptional impact resistance, effortless installation, and extended lifespan.

Factors like rapid urbanization, increased consumer spending power, the rise of the DIY trend, and the availability of products on online retail platforms are expected to drive market growth further. The ability of laminate flooring to replicate the look of stone, tiles, and wood has also contributed to its popularity, especially in the booming building sector. The rise in construction projects in developing countries, fueled by urbanization, industrialization, and evolving consumer preferences, has been a critical factor in expanding the laminate flooring market across the world.

The market is divided by type into two segments, i.e., high-density fiberboard laminated flooring and medium-density fiberboard laminated flooring, with the latter being the most prevalent category. Advancements in design and printing technology, along with the introduction of unique product designs by manufacturers, have significantly increased the global demand for laminate flooring. As a result, the market is expected to experience significant growth during the forecast period. Furthermore, laminate flooring offers a cost-effective alternative to engineered wood, natural hardwood, and stone floor coverings.

Laminate Flooring Market Trends

The Significant Growth in the Construction Industry is Expected to Boost the Market's Growth

Laminate flooring is a versatile and popular choice for residential and commercial settings. Its affordability makes it an attractive option for homeowners and business owners alike. With its durable construction, laminate flooring can withstand the wear and tear of everyday life, making it a practical choice for high-traffic areas. Laminate flooring's resistance to scratches and stains are one of the main advantages. This is why households with children or animals and business premises which are subject to heavy foot traffic make it an ideal option. Laminate flooring is easy to maintain, requiring cleaning and occasional mopping to keep it looking its best.

Regarding design, laminate flooring offers many options to suit any style or aesthetic. Users can effortlessly achieve the desired aesthetic of natural materials like wood, stone, or tiles without incurring the expenses and upkeep typically associated with these materials. Users can customize their look by choosing from diverse colors, sizes, and designs to match the style of their home or business. Laminate flooring suits various settings, such as living rooms, bathrooms, hallways, retail stores, offices, restaurants, and hotels. Its versatility and durability make it suitable for almost any room or setting. In recent years, the use of laminate flooring in schools and healthcare facilities has been on the rise. This is due to its ability to withstand heavy foot traffic and maintain a hygienic environment, making it an ideal choice for spaces that require both durability and cleanliness.

Asia-Pacific is Expected to Witness Significant Growth

The market share for laminate flooring in Asia-Pacific is substantial, driven by increased construction projects. Laminate flooring is highly preferred due to its affordability, long-lasting nature, and minimal upkeep needs across various building categories, including residential, commercial, and industrial areas. Moreover, the region's large customer base, fueled by increasing consumer spending power and rapid urbanization, contributes to its growth. Additionally, the governments in the region are investing in infrastructure development projects, such as railway stations, airports, supermarkets, shopping malls, educational institutions, and healthcare facilities, further boosting the market. Asia-Pacific is expected to witness the most significant compound annual growth rate (CAGR) in the market over the forecast period. This growth is primarily due to the rapid economic advancements in countries like China, Malaysia, Indonesia, and India. These countries are witnessing increased residential and commercial construction and consumer spending power.

Furthermore, the changing consumer behavior in China and India, with a preference for a more realistic home appearance, increased competition, fragmented distribution, and a rise in dual-income households, create lucrative opportunities for industry players. Government initiatives to support manufacturing growth in these nations will also contribute to expanding the wood and laminate flooring market. Economic reforms have increased construction activity and higher per capita incomes in Asian countries like India, China, and Japan. The demand for laminate flooring is primarily driven by industrial development, with the region being an early adopter of the industry's benefits. The industry has played a significant role in urbanization, expansion, and construction.

Laminate Flooring Industry Overview

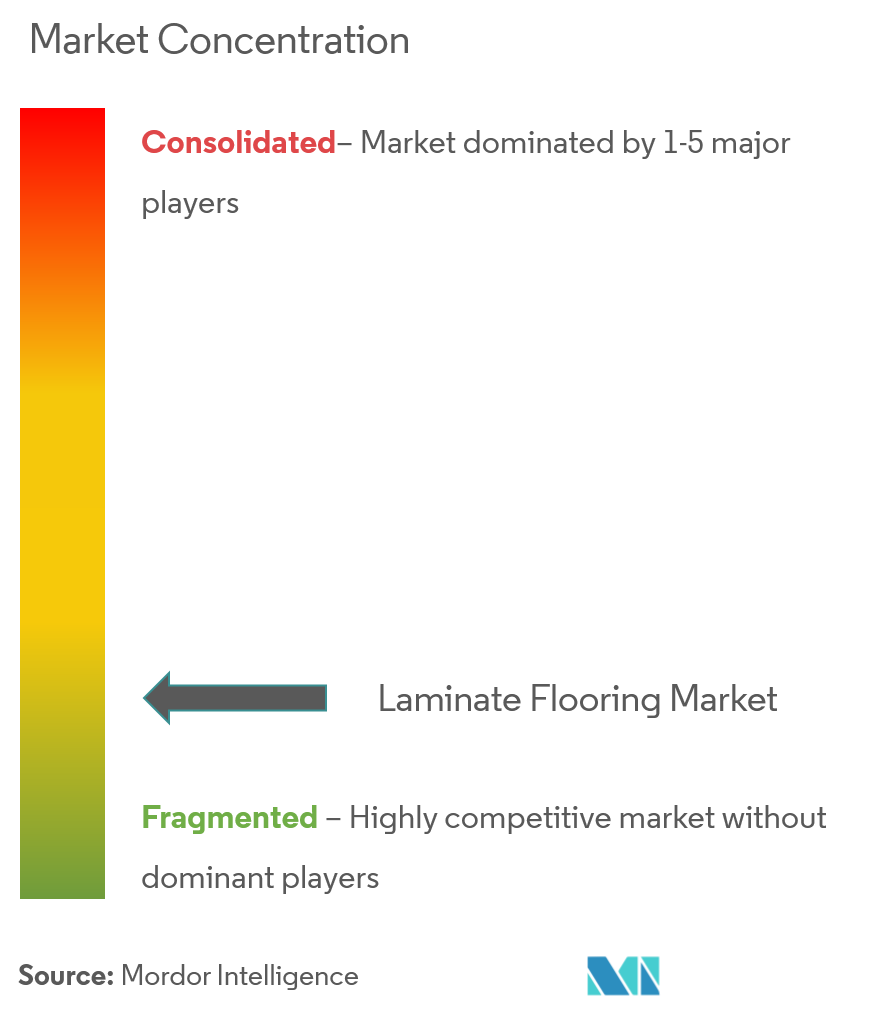

The market for laminate flooring is highly fragmented. Major multinational companies in the laminate flooring market are covered in the report. Players like Tarkett SA, Mohawk Industries Inc., Shaw Industries Group Inc., and Beaulieu International Group dominate the market. Through product innovation and technology developments, mid-sized and smaller businesses are growing their market share by winning new businesses and entering untapped sectors.

Laminate Flooring Market Leaders

-

Tarkett SA

-

Mohawk Industries Inc.

-

Shaw Industries Group Inc.

-

Armstrong Flooring Inc.

-

Beaulieu International Group

*Disclaimer: Major Players sorted in no particular order

Laminate Flooring Market News

- September 2023: Shaw Industries Group Inc. formed a strategic partnership with the Classen Group. Through this partnership, Shaw became the sole distributor of the company’s new commercial flooring products in North America.

- June 2023: Unilin Technologies and Mohawk Industries signed the digital printing licensing contract with Swiss Krono, a leading global manufacturer of innovative flooring solutions.

Laminate Flooring Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Growing Construction Industry is Driving the Market

-

4.3 Market Restraints

- 4.3.1 Increasing Competition from Alternative Flooring Options such as Vinyl and Hardwood are Restraints

-

4.4 Market Opportunities

- 4.4.1 Expansion into Emerging Markets is an Opportunity

- 4.5 Industry Value Chain Analysis

-

4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 High-density Fiberboard Laminated Flooring

- 5.1.2 Medium-density Fiberboard Laminated Flooring

-

5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

-

5.3 By Distribution Channel

- 5.3.1 Multi-branded stores

- 5.3.2 Specialty Stores

- 5.3.3 Online Stores

- 5.3.4 Other Distribution Channels

-

5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Peru

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

-

6.2 Company Profiles

- 6.2.1 Tarkett SA

- 6.2.2 Mohawk Industries Inc.

- 6.2.3 Shaw Industries Group Inc.

- 6.2.4 Armstrong Flooring Inc.

- 6.2.5 Beaulieu International Group

- 6.2.6 Mannington Mills Inc.

- 6.2.7 Classen Group

- 6.2.8 Formica Group

- 6.2.9 Kaindl Flooring

- 6.2.10 De Flooring International*

- *List Not Exhaustive

7. MARKET FUTURE TRENDS

8. DISCLAIMER AND ABOUT US

** Subject To AvailablityLaminate Flooring Industry Overview

Laminate flooring comprises several synthetic layers, such as wear, design, core, and back layers, fused using lamination. The top layer, usually composed of melamine and aluminum oxide, protects against scratches and moisture, ensuring durability. Compared to engineered wood, solid hardwood, and stone floor coverings, laminate flooring is more affordable and accessible to install and maintain.

The global laminate flooring market is segmented by type, application, and geography. By type, the market is segmented into high-density fiberboard laminated flooring and medium-density fiberboard laminated flooring. By application, the market is segmented into residential, commercial, and industrial. By distribution channel, the market is segmented into offline stores and online stores. By geography, the market is segmented into North America, Europe, Asia-Pacific, South America, and Middle East and Africa. The report offers market size and forecasts for the laminate flooring market in terms of value (USD) for all the above segments.

| By Type | High-density Fiberboard Laminated Flooring | |

| Medium-density Fiberboard Laminated Flooring | ||

| By Application | Residential | |

| Commercial | ||

| By Distribution Channel | Multi-branded stores | |

| Specialty Stores | ||

| Online Stores | ||

| Other Distribution Channels | ||

| By Geography | North America | United States |

| Canada | ||

| Mexico | ||

| By Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| By Geography | Asia-Pacific | India |

| China | ||

| Japan | ||

| Rest of Asia-Pacific | ||

| By Geography | South America | Brazil |

| Argentina | ||

| Peru | ||

| Rest of South America | ||

| By Geography | Middle East and Africa | Saudi Arabia |

| United Arab Emirates | ||

| Qatar | ||

| Rest of Middle East and Africa |

Laminate Flooring Market Research Faqs

How big is the Laminate Flooring Market?

The Laminate Flooring Market size is expected to reach USD 2.91 billion in 2024 and grow at a CAGR of 6% to reach USD 4.13 billion by 2029.

What is the current Laminate Flooring Market size?

In 2024, the Laminate Flooring Market size is expected to reach USD 2.91 billion.

Who are the key players in Laminate Flooring Market?

Tarkett SA, Mohawk Industries Inc., Shaw Industries Group Inc., Armstrong Flooring Inc. and Beaulieu International Group are the major companies operating in the Laminate Flooring Market.

Which is the fastest growing region in Laminate Flooring Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Laminate Flooring Market?

In 2024, the North America accounts for the largest market share in Laminate Flooring Market.

What years does this Laminate Flooring Market cover, and what was the market size in 2023?

In 2023, the Laminate Flooring Market size was estimated at USD 2.74 billion. The report covers the Laminate Flooring Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Laminate Flooring Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Laminate Flooring Industry Report

The Laminate Flooring Market Report provides a comprehensive market analysis, including market size, market share, and market growth. This industry report offers valuable insights into market trends and market forecast, ensuring a thorough understanding of the industry's outlook. The report covers various segments, such as type, application, distribution channel, and geography, offering a detailed market overview.

The market research highlights the performance of market leaders and provides an industry overview, including industry analysis and industry trends. The report also includes market segmentation, market value, and market data, which are crucial for understanding the market dynamics.

The industry information and industry statistics presented in the report are based on extensive industry research and industry reports. The report example and report PDF provide a clear and concise summary of the findings. The market review and market predictions offer insights into future market developments, while the market outlook and market forecast provide a long-term perspective on the market growth.

Overall, the Laminate Flooring Market Report is an essential resource for research companies and industry professionals seeking to understand the market's growth rate, industry sales, industry size, and market segmentation. The report's detailed analysis and comprehensive data make it a valuable tool for strategic planning and decision-making.