Laminated Label Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.17 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Laminated Label Market Analysis

The laminated labels market was valued at USD 82.81 billion in 2020 and is expected to reach USD 112.05 billion by 2026, at a CAGR of 5.17% over the forecast period 2021 - 2026. Laminated labels are extensively used in outdoor products, products exposed to chemicals and wet or muggy environments. Laminated labels have seen an increased preference in industrial uses as it guarantees that the imprint remains readable and the label is unimpaired for a longer span as compared to non-laminated labels. The fundamental drivers of the global laminated labels market include growing demand for consumer products and growth noted in the logistics business. Also, expanding manufacturing activities are supposed to foster the growth noted in the global laminated labels market. Moreover, factors, such as the expanding demand for manufactured goods and an upsurge in the disposable income of people globally may boost the prospects for market growth until the end of the forecast period.

- Growing preference for a semi-gloss or matte finish in laminates over glossy labels due to easy scanning of barcode on a matte finish label is one of the principal trends driving the laminates segment over the estimated period. Aesthetics and high performance from emerging pressure-sensitive technologies are anticipated to further drive the product demand.

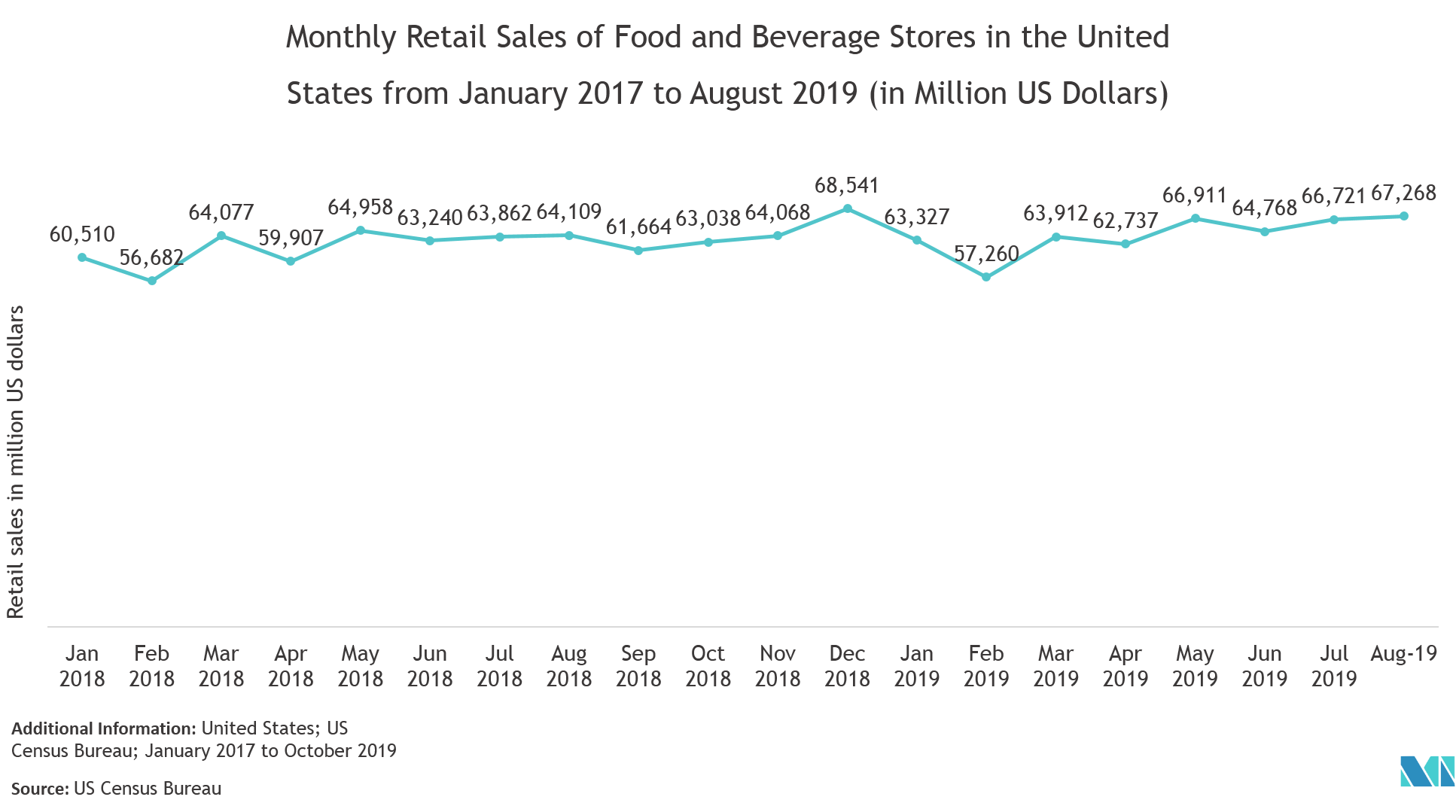

- The segment of food and beverages is inclined to spearhead the global laminated labels market. This can be attributed to the growing awareness of consumers towards authentic products. Apart from that, greater durability and mounting preference towards packaged and branded products are destined to encourage higher growth for the global laminated labels market.

- Competition in the laminated labels market is progressing considerably owing to the advancement in labeling technologies such as 3D printing and thermoforming. Laminated label converters are interested in developing innovative labeling solutions that can endure severe weather conditions such as severe temperature and abrasion.

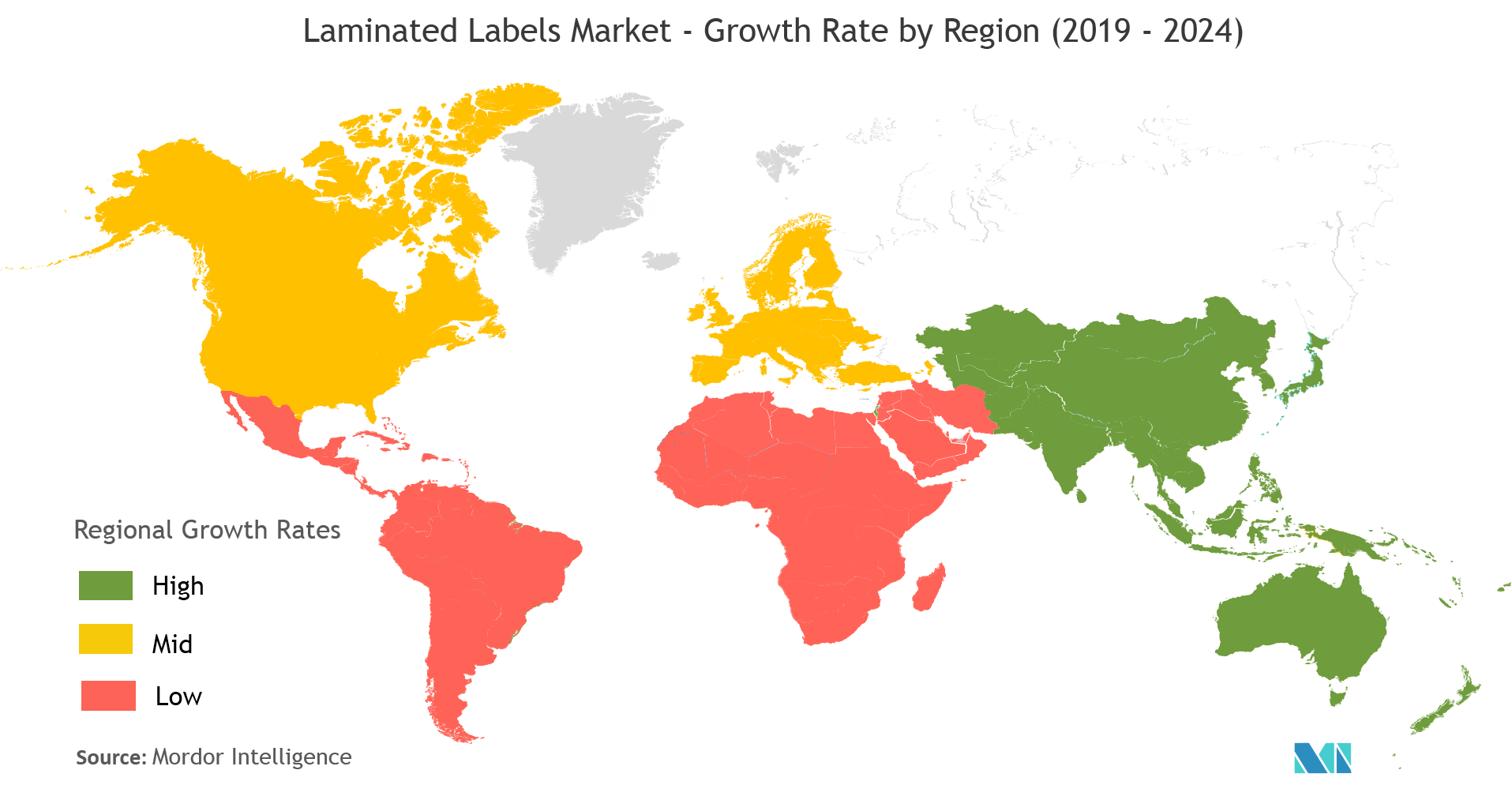

- In terms of volume, the Asia Pacific market influenced the global laminated labels industry. The growth in this area is driven by expanding consumer durables, food & beverage, and pharmaceutical industry. China and India are forecasted to experience healthy growth accompanied by other Southeast Asian countries.

Laminated Label Market Trends

This section covers the major market trends shaping the Laminated Labels Market according to our research experts:

Laminated Labels are being Widely Adopted by the FMCG Industry

- With the latest technologies making their way into the FMCG sector, the industry is supposed to continue its progress in sales. Thus, owing to increasing sales and growing technological developments, smart technologies, including laminated labels, are being extensively embraced by the FMCG vertical. Laminated Labels provide complete information about individual items on store shelves without any mechanical stress, weathering, and chemical influences, ensuring authenticity and supply-chain integrity while creating distinct opportunities for brands to involve with customers.

- Labeling is an essential part of marketing, which influences and deeply influences customer buying behavior. With the expanding pool of brand choices in the FMCG vertical, brand managers and designers are exploring ways to attract customers. The beverage industry is observing an increasing trend of laminated labeling, owing to personalization.

- Manufacturers are continually looking for distinct ways to present their products and formulate new identities for their brand. This demand imposes new labeling technologies to develop and grow continuously. Increasing demand for waterproof labels and labels used on refrigerated and frozen products is predicted to drive the product requirement of laminated labels for food & beverage applications.

- Growing foreign direct investments and affirmative governmental policies were undertaken in China and India are predicted to encourage market growth in the Asia Pacific. Implementations of regulations governing labeling and packaging obligations as per CLP Regulation on the classification, labeling, and packaging of substances and mixtures are projected to encourage the laminated labels market growth in the region.

Asia-Pacific is Poised to Witness Highest Growth Rate

- The Asia-Pacific region accounts for the most substantial share of the global market during the projected period. Moreover, the presence of emerging economies, such as China and India, is driving the regional laminated labels market. The major applications of laminated labels in China include the cosmetics, food, and pharmaceutical sectors, which have substantial demand, owing to the huge population in the region.

- According to the National Bureau of Statistics, China’s industrial production increased by 6.1% in 2018. The increase is expected to maintain as a result of the expansion in retail sales of industrial products by about 10.4%. These determinants are also serving as a meaningful driver for automation in the country.

- Indian manufacturing and production sector is one of the largest growth sectors, recording a 7.9% y-o-y growth. The Make in India initiative proposes to make India evenly attractive for domestic and foreign actors and give global acknowledgment to the Indian economy. By the end of 2020, the Indian manufacturing division is expected to touch USD 1 trillion.

Laminated Label Industry Overview

The Laminated Labels Marketis moderately competitive, owing to the presence of established as well as emerging vendors that are leveraging the presence of a number of suppliers of laminated labels.The global laminated labels market is anticipated to generate higher revenues from a growing number of merger and acquisition strategies by the market players. These strategies are undertaken by these market players to gain a vital share of the market.

- July2019 - Coveris acquired100% of the shares of Amberley Adhesive Labels Ltd a company based in Dorset, UK. The acquisition of Amberley underpins theendeavor of looking forward to a successful expansion of labels capabilities and further develop the potential ofnew facility.

- July2018 -L’Oréal and Avery Dennison Collaborated to Eliminate Label Waste. This liner recycling program will help brands divert glassine paper liner (waste from the label application process) from landfills into recycled products. Through this program, L’Oréal Australia will divert over six tonnes of glassine paper liner in Australia into recycled paper for use in the recycled paper industry.

Laminated Label Market Leaders

-

Avery Dennison Corporation

-

Coveris Holdings S.A.

-

CCL Industries Inc.

-

Constantia Flexibles Group GmbH

-

3M Company

*Disclaimer: Major Players sorted in no particular order

Laminated Label Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Augmented Demand for Packaged Foods & Beverages

- 4.3.2 Increasing Consumer Awareness About Information of the Product

-

4.4 Market Restraints

- 4.4.1 Rising Use of Metallized Foils

- 4.4.2 Increase in Prices of Raw Material and Diminished Profit

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Material Type

- 5.1.1 Polyester

- 5.1.2 Polypropylene

- 5.1.3 Vinyl

- 5.1.4 Other Material Types

-

5.2 By Form

- 5.2.1 Rolls

- 5.2.2 Sheets

-

5.3 By Composition

- 5.3.1 Adhesive

- 5.3.2 Facestock

- 5.3.3 Release Liner

-

5.4 By Application

- 5.4.1 FMCG

- 5.4.2 Manufacturing

- 5.4.3 Fashion and Apparel

- 5.4.4 Electronics and Appliance

- 5.4.5 Pharmaceuticals

- 5.4.6 Retail Labels

- 5.4.7 Other Applications

-

5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of Latin America

- 5.5.5 Middle-East & Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Rest of Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Avery Dennison Corporation

- 6.1.2 CCL Industries Inc.

- 6.1.3 3M Company

- 6.1.4 Coveris Holdings S.A.

- 6.1.5 Torraspapel Adestor

- 6.1.6 Constantia Flexibles Group GmbH

- 6.1.7 R.R. Donnelley & Sons Company

- 6.1.8 Flexcon Company, Inc.

- 6.1.9 Stickythings Limited

- 6.1.10 Gipako Ltd.

- 6.1.11 Hub Labels Inc.

- 6.1.12 Cenveo Corporation

- 6.1.13 Ravenwood Packaging Ltd.

- 6.1.14 Reflex Labels Ltd.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityLaminated Label Industry Segmentation

Laminated Labels are utilized to seal the base label optimally to give protection against mechanical stress, weathering, and chemical influences. The principal purpose is to give strong protection through multiple layers of composite elements in a laminate. Various films are available that can enhance the appearance as aspired with optical design effects.

| By Material Type | Polyester | |

| Polypropylene | ||

| Vinyl | ||

| Other Material Types | ||

| By Form | Rolls | |

| Sheets | ||

| By Composition | Adhesive | |

| Facestock | ||

| Release Liner | ||

| By Application | FMCG | |

| Manufacturing | ||

| Fashion and Apparel | ||

| Electronics and Appliance | ||

| Pharmaceuticals | ||

| Retail Labels | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| France | ||

| United Kingdom | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Rest of Latin America | ||

| Geography | Middle-East & Africa | South Africa |

| Rest of Middle-East & Africa |

Laminated Label Market Research FAQs

What is the current Laminated Labels Market size?

The Laminated Labels Market is projected to register a CAGR of 5.17% during the forecast period (2024-2029)

Who are the key players in Laminated Labels Market?

Avery Dennison Corporation, Coveris Holdings S.A., CCL Industries Inc., Constantia Flexibles Group GmbH and 3M Company are the major companies operating in the Laminated Labels Market.

Which is the fastest growing region in Laminated Labels Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Laminated Labels Market?

In 2024, the Asia Pacific accounts for the largest market share in Laminated Labels Market.

What years does this Laminated Labels Market cover?

The report covers the Laminated Labels Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Laminated Labels Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Laminated Labels Industry Report

Statistics for the 2023 Laminated Labels market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Laminated Labels analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.