Diode Laser Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 11.20 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

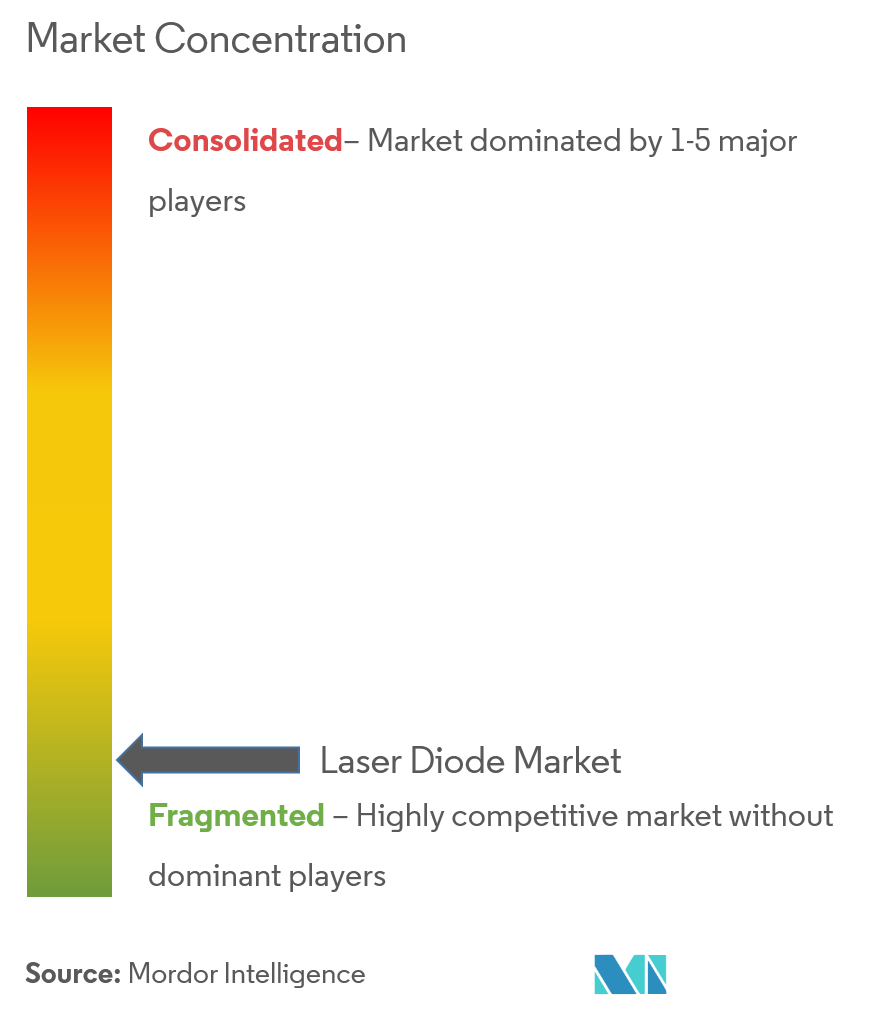

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Diode Laser Market Analysis

The global laser diode market was valued at USD 8.84 billion in 2020, and it is expected to reach USD 16.25 billion by 2026, registering a CAGR of 11.2%, between 2021 - 2026. According to the laser-focus world, the market for laser materials-processing systems grew by an incredible 50% from 2016 to 2018. In 2019, one of the key trends is the rise of VCSEL technology for applications like facial recognition in smartphones. VCSELs are a type of laser diode that offers superior beam properties, thermal stability, and device scalability compared to products like Fabry Perot laser diodes.

- The increasing adoption of high-power laser diodes in autonomous vehicle technologies drives the market. The optical technologies are in demand for autonomous vehicles, such as high laser beam, which is converted into white light and directed onto the road via tiny reflectors by the high light density of the laser that helps the drivers to see 600 meters ahead of them (about double the distance possible with the previous LED high beams). LiDAR systems are the key to the development of autonomous vehicles. Research institutes, photonics companies, and traditional suppliers of automotive parts are currently positioning themselves with new LiDAR technology to play a part in this market in the future.

- Fraunhofer Institute for Microelectronic Circuits and Systems IMS presented a Flash LiDAR Instead of directing the laser beam onto a rotating mirror for a 360 degrees view, the system emits laser flashes that expose a rectangular measuring field up to 100 meters wide. Highly sensitive single-photon avalanche diodes (SPADs) detect reflected light.

- Growing directed energy application of laser diode is driving the market. The use of lasers for directed energy (DE) applications is increasing, while diversity in requirements and technology is continuously evolving. Directed energy applications, such as to eliminate airborne drones and intercontinental ballistic missiles, among other missions are increasing significantly, are witnessing the application of DE.

- High-power laser weapons are becoming an increasingly important component within the United States' defense arsenal. The use of lasers for DE is a broad and diverse space. DE applications range from comparatively lower-powered, man-portable lasers offering powers on the order of 10 kW of optical output power with the mission of eliminating airborne drones, to extremely high-powered lasers with megawatt-class (MW) power levels mounted on high-altitude platforms for the destruction of boost-phase intercontinental ballistic missiles.

- With the outbreak of COVID-19, the demand for laser diodes decreased, due to nationwide lockdowns imposed in countries. Additionally, the shortages in the supply of raw material, along with a significant decrease in the demand are expected to continue until the end of 2020, due to the disruption in the supply chain across worldwide. According to IPC's survey of electronics businesses, around 69% of the respondents are informed by their suppliers that there will be delays in shipments due to COVID-19.

- Moreover, the major manufacturers in North America and Europe extended the shutdowns in plants, and some are working with minimal workforce. For instance, Osram, Coherent, IPG, and Sharp Corporation decided to continue the production process with a limited workforce. This is suggestive of a decreased demand for laser diodes in various industrial applications.

Diode Laser Market Trends

This section covers the major market trends shaping the Laser Diode Market according to our research experts:

Adoption of Laser in Medical and Healthcare to Drive the Market Growth

- The past few years have witnessed increased demand for laser diodes in the healthcare sector owing to their assistance to physicians to focus the beam with better precision on directed areas, preventing unwanted damage to the surrounding area.

- However, these lasers are used to process plastics for medical devices (polymer processing). There is an increased demand for cosmetic surgery procedures, which include surgical and non-surgical procedures that improve the appearance by reshaping and enhancing the body structure. For instance, according to American Society of Plastic Surgeons (ASPS), almost 18 million people underwent surgical and minimally invasive cosmetic procedures in the United States in 2018 for contouring, skin resurfacing, wrinkle and pigmentation reduction, and tattoo removal, providing the growth to the energy-based aesthetic treatment system.

- Of all the wavelengths in which the laser diode operates, the green laser diodes have operational advantages over other wavelengths. As these green laser diodes are capable of operating in a wide range of temperatures, have a long lifetime, and are highly reliable at continuous operation, the growth potential of this type of laser diodes is high.

- The applications of green laser diodes include projection applications, biotechnology, spectroscopy, medical applications, etc. Due to the increased demand in the healthcare sector, green laser diodes are expected to occupy the largest share of the laser diode market during the forecast period.

- Besides, lasers available in the femtosecond and picosecond variants, are slowly gaining traction in the medical equipment. Femtosecond variant lasers are widely used for marking the glass, allowing the traceability of syringes and other glass devices. Also, laws mandating the marking of medical devices across various regions are further driving the increasing demand for ultrafast lasers, whose applications included stents and catheters.

- Further, these lasers are being used for processing plastics for medical devices, also known as polymer processing. There is an increased demand for cosmetic surgery procedures, which include surgical and non-surgical procedures that improve the appearance by reshaping and enhancing the body structure. For instance, according to the American Society of Plastic Surgeons (ASPS), the total number of minimally-invasive cosmetic treatments has gone up a whopping 228% since 2000.

- However, these lasers are used for processing plastics for medical devices (polymer processing). There is an increased demand for cosmetic surgery procedures, which include surgical and non-surgical procedures that improve the appearance by reshaping and enhancing the body structure. For instance, according to the American Society of Plastic Surgeons (ASPS), almost 18 million people underwent surgical and minimally invasive cosmetic procedures in the United States in 2018.

Asia-Pacific to Witness a Significant Growth

- The laser diode market in the Asia-Pacific region is witnessing robust growth, primarily owing to the widespread presence of electronics and automobile manufacturing organizations and an increase in the purchasing power of consumers. The region is also witnessing a growth in the adoption of smartphones and digitization of business processes, fuelling the adoption of laser diodes to cater to the booming consumer electronics and automotive sector.

- The growing demand for smartphones and other major consumer electronics products from countries, such as China, the Republic of Korea, India, and Singapore, are encouraging many companies to set up production establishments in the Asia-Pacific region. The abundant availability of raw materials and the low establishment and labor costs are also helping the companies launch their production centers in the region.

- For instance, in October 2019, an Australian semiconductor developer, BluGlass Ltd, announced its direct-to-market business unit, which will offer higher brightness and higher efficiency GaN laser diodes. The laser diodes can be used in various commercial applications, such as industrial lasers, automotive and general lighting, displays, and life sciences.

- The Asia-Pacific semiconductors market was boosted by the strong domestic demand, causing the market to become the largest in the world. According to WSTS, in 2019, the semiconductor industry in the Asia-Pacific region (except Japan) was expected to reach revenues of around USD 297 billion.

- Further, in May 2019, researchers from Japan demonstrated that a long-elusive kind of laser diode based on organic semiconductors is possible, making way for the further expansion of lasers in applications, such as displays, biosensing, healthcare, and optical communications. The organic laser diodes use carbon-based organic materials, primarily to emit light instead of the inorganic semiconductors, such as gallium arsenide and gallium nitride, which were used in traditional devices.

- Additionally, in January 2020, USHIO announced the launch of a new 660nm red laser diode, which produces an output power of 200mW CW/400mW pulsed. The series is available with three different types of connectors—CC, AC, or FN—designated as HL65221DG, HL65222DG, and HL65223DG, respectively. These high-power laser diodes offer a built-in monitoring photo-diode at the lasing wavelength.

Diode Laser Industry Overview

The laser diode market is fragmented and highly competitive, owing to the presence of many small and large players. The players are expanding their portfolio, which caters to the intense rivalry among the players. Key players are

- March 2020 - IPG Photonics Corporation announced that it is extending its portfolio of coherent modules with support for single fiber, and bi-directional transmission. IPG photonics also announced support for extended temperature operations across its Menara-branded Hytham line of coherent transceiver modules.

- February 2020 - OSRAM Opto Semiconductor GmbH launched 65-Watt laser to its LiDAR photonics portfolio. It will be used in autonomous driving for capturing the immediate vehicle surroundings, ensuring high-resolution images for subsequent systems.

Diode Laser Market Leaders

-

Coherent Inc.

-

IPG Photonics Corporation

-

OSRAM Opto Semicobductor GmbH (OSRAM GmbH)

-

Trumpf Inc.

-

Cutting Edge Optronics Inc. (Northrop Grumman Corp.)

*Disclaimer: Major Players sorted in no particular order

Diode Laser Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

-

4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

-

4.4 Market Drivers

- 4.4.1 Increasing Adoption of High-power Laser Diodes in Autonomous Vehicle Technologies

- 4.4.2 Growing Directed Energy Application of Laser Diode

-

4.5 Market Restraints

- 4.5.1 High Initial Investments

- 4.6 Assessment of Impact of Covid-19 on the Industry

5. TECHNOLOGY SNAPSHOT

-

5.1 Construction

- 5.1.1 Fabry Perot

- 5.1.2 DFB and DDR

- 5.1.3 VCSEL

- 5.1.4 External Cavity and Quantum Cascade

6. MARKET SEGMENTATION

-

6.1 End-user Application

- 6.1.1 Healthcare/Medical

- 6.1.2 Telecommunication

- 6.1.3 Industrial

- 6.1.4 Automotive

- 6.1.5 Other End-user Applications

-

6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

- 7.1.1 Coherent Inc.

- 7.1.2 Cutting Edge Optronics Inc. (Northrop Grumman Corp.)

- 7.1.3 IPG Photonics Corporation

- 7.1.4 OSRAM Opto Semiconductors Inc.

- 7.1.5 TRUMPF Inc.

- 7.1.6 Sharp Corporation

- 7.1.7 Sumitomo Corporation

- 7.1.8 ROHM Semiconductor USA LLC

- 7.1.9 Frankfurt Laser Company

- 7.1.10 OSI Laser Diode Inc.

- 7.1.11 Hamamatsu Photonics K.K.

- 7.1.12 Jenoptik AG

- 7.1.13 Nichia Corporation

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityDiode Laser Industry Segmentation

A laser diode produces coherent radiation when current passes through it, which is very similar to the concept of light-emitting diodes (LEDs). Unlike bulky, high intensity, and high powered lasers that are used for advanced industrial applications and market study comprises of end-users such as Healthcare/Medical, Telecommunication, Industrial, etc.

| End-user Application | Healthcare/Medical |

| Telecommunication | |

| Industrial | |

| Automotive | |

| Other End-user Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East and Africa |

Diode Laser Market Research FAQs

What is the current Laser Diode Market size?

The Laser Diode Market is projected to register a CAGR of 11.20% during the forecast period (2024-2029)

Who are the key players in Laser Diode Market?

Coherent Inc., IPG Photonics Corporation, OSRAM Opto Semicobductor GmbH (OSRAM GmbH), Trumpf Inc. and Cutting Edge Optronics Inc. (Northrop Grumman Corp.) are the major companies operating in the Laser Diode Market.

Which is the fastest growing region in Laser Diode Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Laser Diode Market?

In 2024, the Asia Pacific accounts for the largest market share in Laser Diode Market.

What years does this Laser Diode Market cover?

The report covers the Laser Diode Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Laser Diode Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Laser Diode Industry Report

The report on the laser diode market provides an in-depth industry analysis and market forecast, offering a comprehensive overview of the market trends and growth rate. The industry reports cover various end-user applications, including healthcare, telecommunication, industrial, and automotive sectors. The market segmentation is detailed, providing insights into market leaders and market size. This industry research includes a market review and market outlook, highlighting the market value and industry statistics.

The report also includes industry information and industry sales, giving a clear picture of the market data and market predictions. The market growth and industry outlook are discussed, presenting a thorough market analysis and industry overview. The industry trends and market forecast are crucial for understanding the market dynamics and future prospects.

A sample of this industry analysis is available as a free report PDF download, offering a glimpse into the detailed market research and report example. This report is essential for research companies looking to understand the market size and market share. The industry statistics and market segmentation provide valuable insights for strategic planning and decision-making.

Overall, the market report is a comprehensive guide for stakeholders, offering detailed industry analysis and market forecast to help navigate the evolving market landscape.