Liquid Analytical Instrument Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 6.00 % |

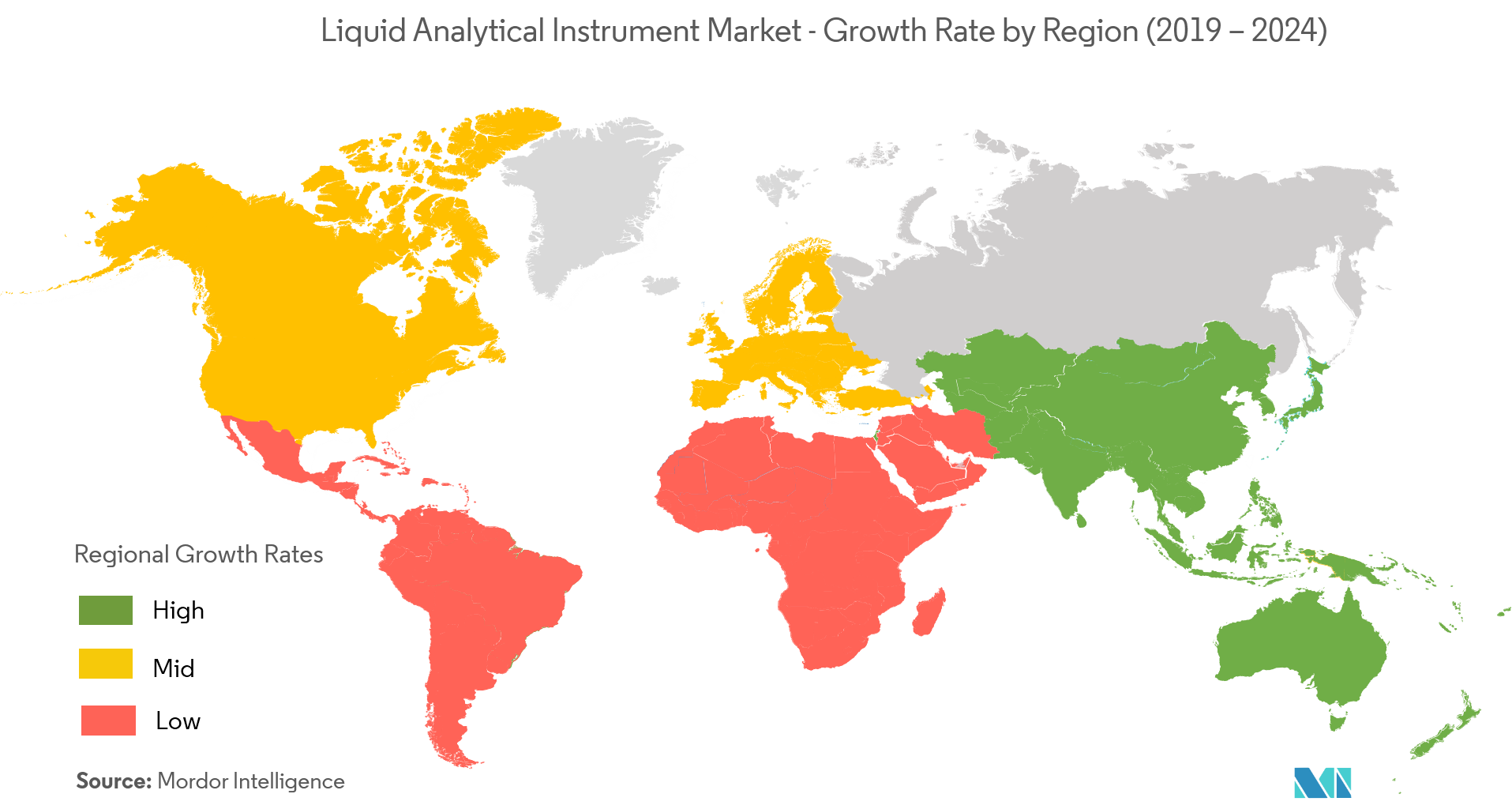

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Liquid Analytical Instrument Market Analysis

The liquid analytical instrument market is expected to grow at a CAGR of 6% during the forecast period (2021 - 2026). Most of the industries that engage in manufacturing and processing of liquids, ranging from water to complex chemicals, use pH, ORP sensors among others for quality monitoring and automation of several industrial processes.

- In order to check the solubility and biological availability of the chemical constituents of water, the organizations and the related bodies have started the adoption of pH sensors and analyzers. This is expected to boost market growth over the forecast period.

- The increasing adoption of the liquid analytical instruments in the treatment of the wastewater led out by various industries such as Pulp and paper, water and wastewater plants among others, that consume large volumes of water. The wastewater treatment from these plants is a serious environmental concern.

- Infrastructural development across these industries is expected to boost market growth throughout the forecast period. for instance, the Delhi Jal Board (DJB), India, approved setting up of a new sewage treatment plant (STP) at Okhla that would be able to treat 124 million gallons of wastewater per day and will come up at a cost of Rs 1,161 crores.

- Stringent environmental and government regulations are propelling the various end-user industries to deploy the liquid analytical instruments to avoid the wastage and to promote the re-use of water. Therefore the usage of liquid analytical instruments is likely to grow.

- For instance, the Drinking-Water Contaminants-Standards and Regulations laid down by the U.S. Environmental Protection Agency (EPA) regarding public drinking water and quality of water in end-use industries is one such case.

Liquid Analytical Instrument Market Trends

This section covers the major market trends shaping the Liquid Analytical Instrument Market according to our research experts:

pH & ORP Analyzer to hold the largest market Share

- With ORP being a measure of the electrical potential of a reaction and pH being a measure of acidity or alkalinity, these pH & ORP analyzers enable the user to improve predictive maintenance and reduce the time and costs associated with sensor maintenance and replacement, optimizing your OPEX for industries.

- The pH & ORP sensors are increasingly being used in the power, chemicals, water & wastewater, food & beverage, pharmaceuticals industries. In the power industry, the pH sensors are used to measure the pH of the ultrapure water that is used to drive the turbines. This increased adoption is expected to boost market growth over the forecast period.

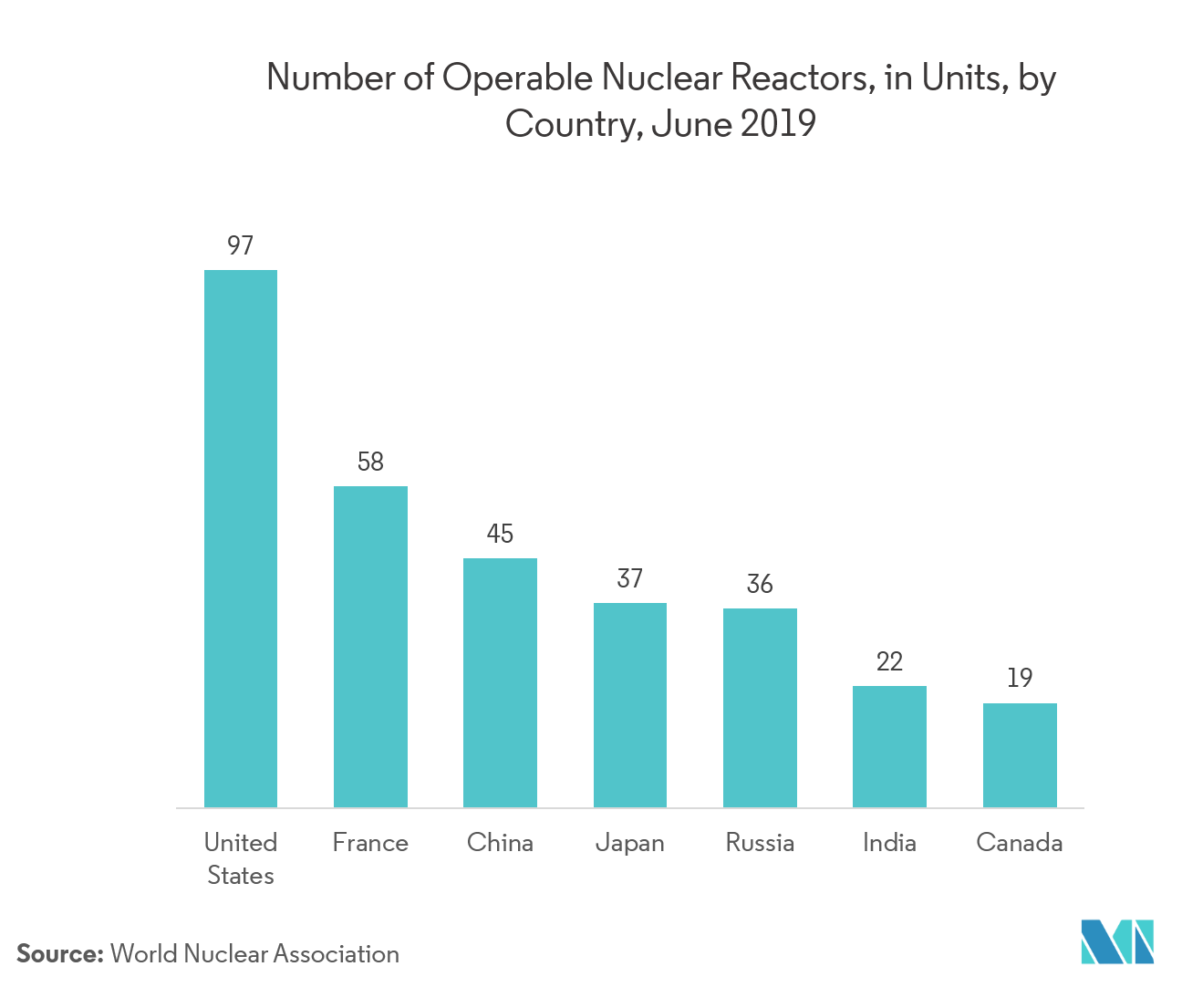

- The anticipated increase in the number of nuclear power plants (due to the increasing demand for electricity and the ability to support the environmental concerns) is expected to boost the adoption of the pH & ORP analyzers over the forecast period. For instance, in September 2018, South Field Energy LLC chose global engineering and construction company, Bechtel, to build a USD 1.3 billion 1,182-megawatt combined-cycle energy plant in the Columbiana County, Ohio.

North America is Expected to Hold the Largest Share

- The increasing pollutants being released into the rivers of the region has propelled the governments of the region to invest in the cleaning and the treatment of the water to make it habitable for the population to consume.

- For instance, in June 2019, Lake George a town in New York awarded bids for the new wastewater treatment plant, that would see Lake George replacing its old plant with a new USD 24 million-plus wastewater treatment plant as the old plant releases an excessive amount of nitrates, which can cause algal blooms that degrade the water quality of the lake.

- Some of the prominent players in the industry through strategic partnerships, research and development, and mergers & acquisitions have been able to further the technology which is expected to boost the adoption of the liquid analytical instruments over the forecast period.

- For instance, in April 2019, Emerson introduced two new sensors viz. Rosemount 550pH sensor and Rosemount 550DW dissolved oxygen sensor adaptor. The Rosemount 550pH sensor for immediate verification and standardization, eliminating the initial stabilization process, which can generally slow start-up by 30 minutes to two hours offers the unique capability of being stored wet.

Liquid Analytical Instrument Industry Overview

The competitive rivalry between the players in the liquid analytical instrument is high owing to the presence of some key players such as Emerson, ABB, among others which have over a decade experience in the market. Their ability to continually innovate their products has enabled them to gain a competitive advantage over other players. These players have been able to gain a strong footprint in the market due to the strategic partnerships and mergers & acquisitions these players enter into.

- June 2019 - Endress+Hauser releaseda new generation of ISFET sensors such asMemosens CPS47D, CPS77D, and CPS97D made with unbreakable PEEK for glass-free pH measurement and liquid analysis.

-

July 2019 - Electro-Chemical Devices (ECD) launched a new highly intelligent PPB Sodium Trace Analyzer for high-purity and ultra-pure water requirements across industries such asPower Generation, Electronics, Pharmaceuticals among others. Theadvanced trace analyzer,NA6 Sodium Analyzer includes a color touchscreen user interface and comes with a low-reagent consumption design that reduces plant measurement operating costs.

Liquid Analytical Instrument Market Leaders

-

Endress + Hauser

-

Emerson Electric Co.

-

Yokogawa Electric Corporation TOP

-

ABB Inc

-

Schneider Electric SE

*Disclaimer: Major Players sorted in no particular order

Liquid Analytical Instrument Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 The Rising Demand for Real-Time Liquid Monitoring

- 4.3.2 Stringent Environmental Standards Regarding the Waste Water and Water Quality Management

-

4.4 Market Restraints

- 4.4.1 High Maintenance Cost

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

-

4.7 Technology Snapshot

- 4.7.1 By Type

- 4.7.1.1 pH & ORP Analyzer

- 4.7.1.2 Oxygen Analyzer

- 4.7.1.3 Conductivity Analyzer

- 4.7.1.4 Turbidity & Density Analyzer

- 4.7.1.5 Other Types

5. MARKET SEGMENTATION

-

5.1 By End-user Industry

- 5.1.1 Water Treatment

- 5.1.2 Food & Beverages

- 5.1.3 Medical

- 5.1.4 Energy & Power

- 5.1.5 Oil & Gas

- 5.1.6 Other End-user Industries

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Rest of Latin America

- 5.2.5 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Schneider Electric GmbH

- 6.1.2 Endress+Hauser Management AG

- 6.1.3 Emerson Electric Co.

- 6.1.4 Yokogawa Electric Corporation

- 6.1.5 ABB Inc

- 6.1.6 Honeywell Inc

- 6.1.7 Teledyne Technologies Incorporated

- 6.1.8 Analytical Systems Keco

- 6.1.9 Mettler-Toledo International Inc.

- 6.1.10 Electro-Chemical Devices, Inc.

- 6.1.11 Hach Company(Danaher)

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityLiquid Analytical Instrument Industry Segmentation

The Liquid Analytical Instrumentsused to measure liquid properties such as pH, ORP, conductivity, dissolved oxygen, chlorine and turbidity among others are considered in this study. Liquids such as water, beverages, dairy products, chemicals among others that are used across industries such aschemical process,food & beverage, pharmaceutical,water & wastewater, power (upstream), refining (midstream and stream) among others., can be analyzed through these instruments in order to maintain consistent product quality, for process optimization and safety and ultimately comply with stringent regulations to reduce environmental concern. Vendors in the market offer transmitters, sensors and also liquid analyzer systems to cater to theon-line measurement of the liquids.

| By End-user Industry | Water Treatment | |

| Food & Beverages | ||

| Medical | ||

| Energy & Power | ||

| Oil & Gas | ||

| Other End-user Industries | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Rest of Latin America | ||

| Geography | Middle-East & Africa |

Liquid Analytical Instrument Market Research FAQs

What is the current Liquid Analytical Instrument Market size?

The Liquid Analytical Instrument Market is projected to register a CAGR of 6% during the forecast period (2024-2029)

Who are the key players in Liquid Analytical Instrument Market?

Endress + Hauser, Emerson Electric Co., Yokogawa Electric Corporation TOP, ABB Inc and Schneider Electric SE are the major companies operating in the Liquid Analytical Instrument Market.

Which is the fastest growing region in Liquid Analytical Instrument Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Liquid Analytical Instrument Market?

In 2024, the North America accounts for the largest market share in Liquid Analytical Instrument Market.

What years does this Liquid Analytical Instrument Market cover?

The report covers the Liquid Analytical Instrument Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Liquid Analytical Instrument Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Liquid Analytical Instrument Industry Report

Statistics for the 2024 Liquid Analytical Instrument market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Liquid Analytical Instrument analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.