Lithium Ion Energy Accumulator Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 12.25 % |

| Fastest Growing Market | Middle East and Africa |

| Largest Market | North America |

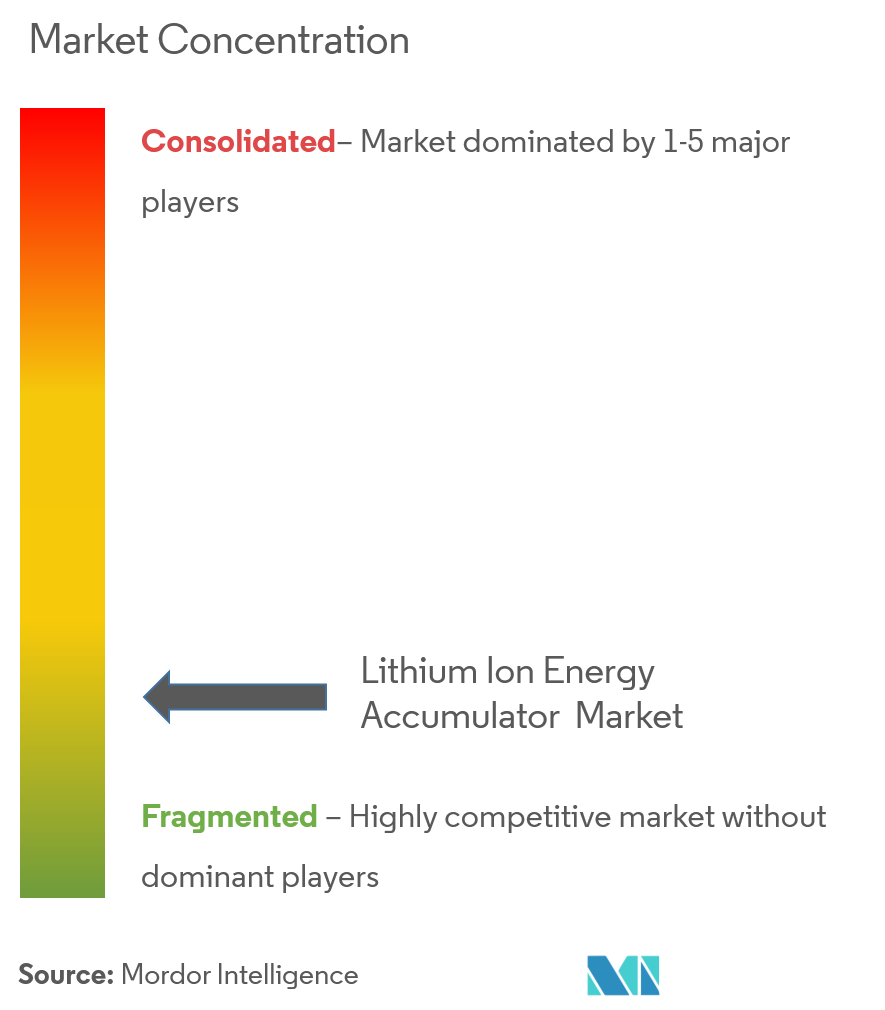

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Lithium Ion Energy Accumulator Market Analysis

The Lithium Ion Energy Accumulator Market is expected toregistger a CAGR of 12.25% over the forecast period 2021 - 2026. Over the last few decades, several forms of rechargeable batteries have found takers in consumer and utility scale applications. The general trend toward the development of batteries with longer run times and higher energy density can be clearly witnessed in this market.

- New forms of lithium ion batteries have been threatening to disrupt the energy accumulators market, by offering best-in-class energy density and a greater number of charge/discharge cycles. Plunging unit costs and higher adoption rates in utility-scale applications will aid the growth of lithium ion batteries, while lead-acid batteries are expected to reign over the SLI segment.

- The emergence of new forms of energy storage applications, such as solid electrolyte, magnesium ion, and metal-air batteries, may transform the market dynamics.

- Moreover, with the increasing urbanization, the demand for consumer electronics goods is also increasing at an exponential rate, thus, driving the market for Li-ion energy accumulators (batteries). Acquisition costs and realization of several power/energy projects may open up new opportunities for the growth in this market.

- However, Li-ion battery manufacturers have to be mindful of its limitations, such as relatively low-temperature threshold, highly reactive nature of lithium, and deployment costs. Lack of charging infrastructure and greater utilization of non-renewable sources of energy (impeding adoption for energy storage applications) are expected to impede the growth in this market.

Lithium Ion Energy Accumulator Market Trends

This section covers the major market trends shaping the Lithium Ion Energy Accumulator Market according to our research experts:

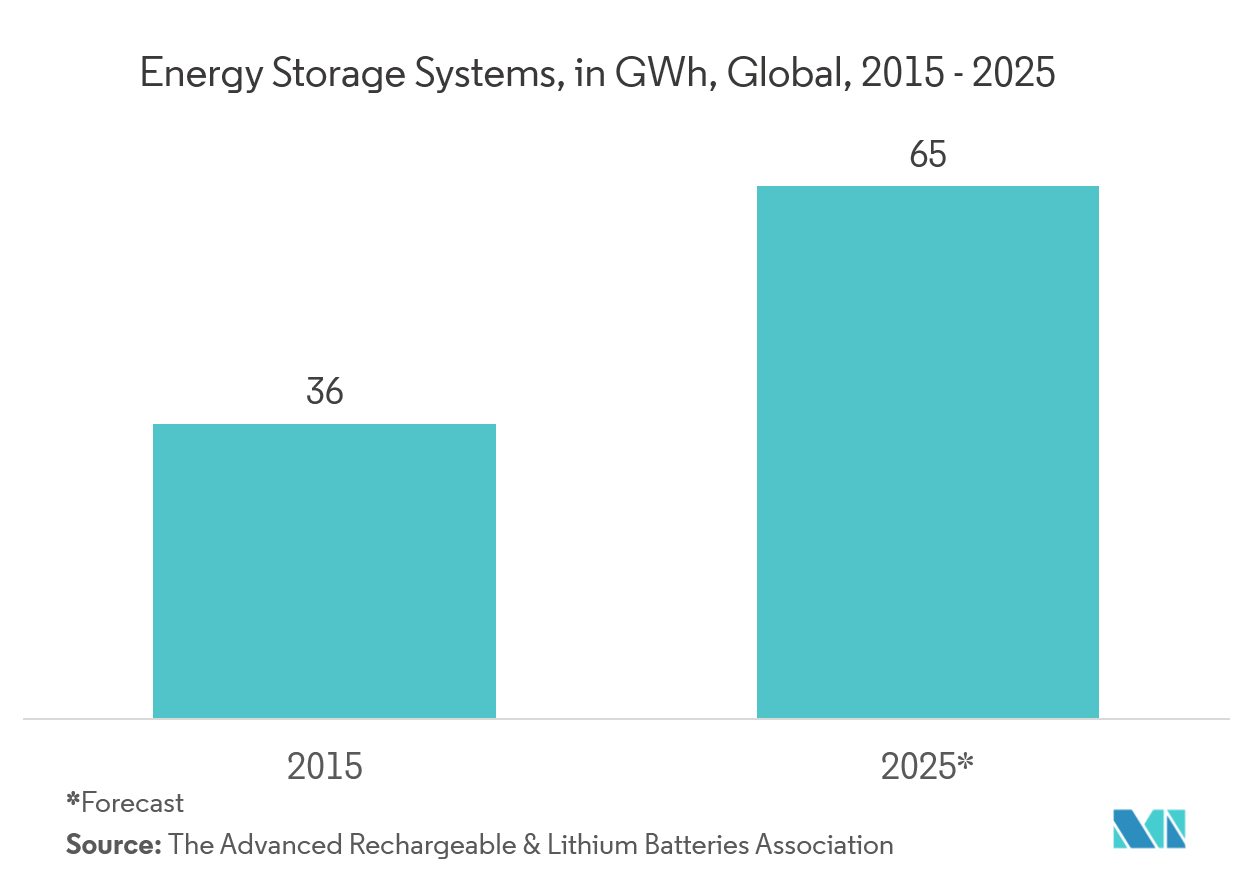

Technological Advancements in Energy Storage Devices are Driving the Market Growth

- Electrical energy storage devices (EES) have undergone rapid transformation ever since their inception, owing to continual innovations and emergence of new technologies, which have greatly improved their capacity and retention. These devices are widely used in several applications, such as portable devices, stationary energy resources, and automotive vehicles.

- Technological advancements in EES systems hold great potential for the future. The development of cost-effective solutions may greatly improve the deployment of renewable energy mechanisms across the world. Incremental innovations in EES systems may drive the growth in the energy accumulators market.

- EES enables energy infrastructure companies to provide stored energy at very low prices, when the demand for energy is high and there are no other means of meeting the spike in demand. Some of the most innovative and efficient EES technologies are Flow batter, Flywheel, Thermal Energy Storage System, and Fuel cells.

- EES technologies can be broadly classified into electrical, mechanical, chemical, and thermal storage technologies. Lead acid batteries, which are widely used for storing electricity, fall under the category of electrical energy storage batteries, while lithium ion batteries fall under chemical energy storage units.

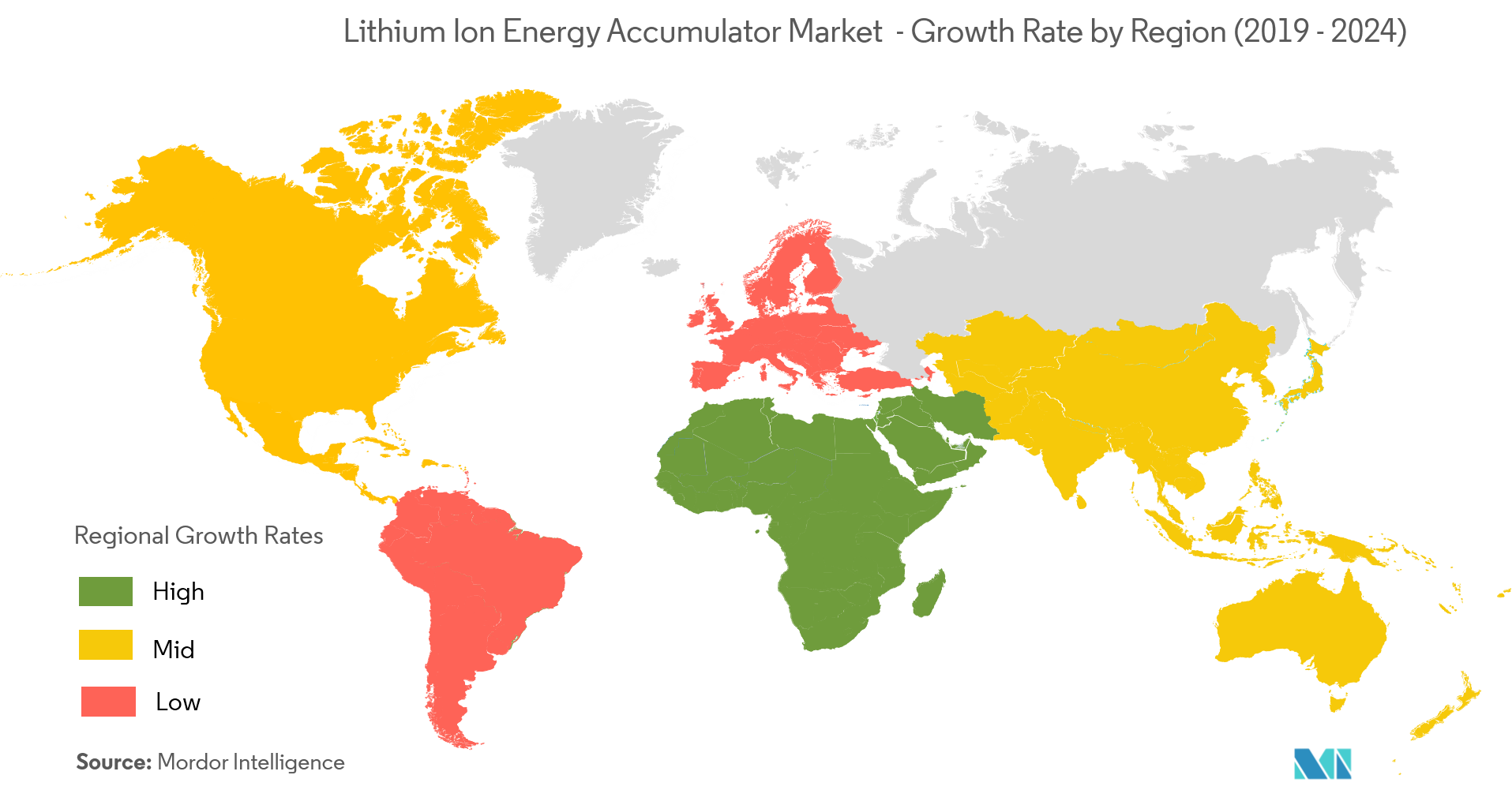

Middle East & Africa to Have the Highest Growth

- The Middle East & African region is the late adopter of renewable energy resources. This region is richly endowed with abundant renewable resource potential. This region is one of the largest benefactors of abundant sunshine and wind energy potential.

- Moreover, the MEA region has a vast amount of space conducive for the development of large-scale solar power plants. The renewable energy share of the overall energy consumption in the Middle East region has been pegged at less than 5% in several Middle Eastern countries.

- Even with abundant resources, efficient energy storage plays an important role in the proper utilization of these resources. Energy consumption in the MEA region has grown rapidly over the last few decades, partly due to high economic growth and increase in urbanization. Regional consumption of electricity is estimated to grow at a rapid rate over the reporting period.

Lithium Ion Energy Accumulator Industry Overview

The market studied is highly fragmented, with the presence of a large number ofplayers that occupy around half of the marketshare of the overall figure. Some of the key players in the market includeAsahi Kasei Corp.,Panasonic Corporation, Samsung SDI Co.,Panasonic Corporation,Toshiba Corporation,HitachiLtd,and Sony Corporation.

- May 2019 -Samsung SDI introducednew ESS products at ‘EESEurope 2019’. It unveiledE3, an ESS model with energy density enhanced by 20%. Designed for utility and commercial, the model can be widely used to supplement uneven energy production of some renewable energies, such as solar and wind power, or to store cheap, off-peak electricity during peak hours at commercial ESS facilities.

- March 2018 - Panasonic Corporationbegan the mass production of prismatic-type automotive lithium-ion batteries at its Dalian’s factory, based in China.

Lithium Ion Energy Accumulator Market Leaders

-

Asahi Kasei Corp.

-

Panasonic Corporation

-

Samsung SDI Co.

-

Toshiba Corporation

-

Hitachi Ltd

*Disclaimer: Major Players sorted in no particular order

Lithium Ion Energy Accumulator Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Rising Emphasis on Energy Management

-

4.4 Market Restraints

- 4.4.1 Difficulties in Customization According to Business Needs

-

4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Value Chain Analysis

- 4.7 Technology Snapshot

5. MARKET SEGMENTATION

-

5.1 By Application

- 5.1.1 Consumer Electronics

- 5.1.2 Transportation

- 5.1.3 Industrial

- 5.1.4 Other Applications

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Asahi Kasei Corp.

- 6.1.2 Panasonic Corporation

- 6.1.3 Samsung SDI Co.

- 6.1.4 Toshiba Corporation

- 6.1.5 Hitachi Ltd

- 6.1.6 TDK Corporation

- 6.1.7 LG Chem Ltd

- 6.1.8 Sony Corporation

- 6.1.9 Amperex Technology Limited

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityLithium Ion Energy Accumulator Industry Segmentation

Lithium ion energy accumulator is an electrical device, which is capable of charging and discharging. It consists of a positive and negative electrode, divided by separator and an electrolytic solution. The accumulator charges/discharges by having a chemical reaction between the positive and negative electrode material. Most of the lithium ion batteries are used in laptops, PCs, and mobile phones.

| By Application | Consumer Electronics |

| Transportation | |

| Industrial | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Lithium Ion Energy Accumulator Market Research FAQs

What is the current Lithium Ion Energy Accumulator Market size?

The Lithium Ion Energy Accumulator Market is projected to register a CAGR of 12.25% during the forecast period (2024-2029)

Who are the key players in Lithium Ion Energy Accumulator Market?

Asahi Kasei Corp., Panasonic Corporation, Samsung SDI Co., Toshiba Corporation and Hitachi Ltd are the major companies operating in the Lithium Ion Energy Accumulator Market.

Which is the fastest growing region in Lithium Ion Energy Accumulator Market?

Middle East and Africa is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Lithium Ion Energy Accumulator Market?

In 2024, the North America accounts for the largest market share in Lithium Ion Energy Accumulator Market.

What years does this Lithium Ion Energy Accumulator Market cover?

The report covers the Lithium Ion Energy Accumulator Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Lithium Ion Energy Accumulator Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Lithium Ion Energy Accumulator Industry Report

Statistics for the 2024 Lithium Ion Energy Accumulator market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Lithium Ion Energy Accumulator analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.