Machine Tools Market Size

| Study Period | 2020 - 2029 |

| Market Size (2024) | USD 103.57 Billion |

| Market Size (2029) | USD 119.58 Billion |

| CAGR (2024 - 2029) | 2.92 % |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Asia |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Machine Tools Market Analysis

The Machine Tools Market size is estimated at USD 103.57 billion in 2024, and is expected to reach USD 119.58 billion by 2029, growing at a CAGR of 2.92% during the forecast period (2024-2029).

- The growth of the global motion control market has triggered a substantial demand for motion control products, particularly in the robotics, electronics assembly, semiconductor, machine tool, and renewable energy industries. Advancements are being made in control components and have aided the simplification of machine design.

- To be more exact, in the machine tool industry, production climbed from USD 73 billion to USD 85 billion on the path to recovering from dips in 2020, while overall machine tool consumption increased from USD 70 billion in 2020 to USD 80 billion in 2021. Production worldwide outstripped consumption by USD 5 billion. This discrepancy might be caused, at least in part, by machine tool manufacturers seeking to anticipate supply chain problems. Machine tool prices may be under pressure due to the consequent surplus of tools, but they are more likely to be under pressure due to interruptions in the global supply chain, affecting machine tool manufacturers.

- With some jockeying for position, the top six producers: China, Germany, Italy, Japan, South Korea, and the United States; remain the same as in 2020. Due to a USD 2 billion rise from 2020, US production reached USD 7.5 billion in 2021. Due to increased production in Japan and a modest decline in output in Germany, Japan overtook Germany as the world's second-largest economy. Italy's output increased, but the U.S.'s increase was more significant, allowing it to overtake Italy and move to the number four spot.

- Despite being overshadowed by the recent impact of the pandemic, the movement toward e-mobility remains a significant point of focus for the machine tool industry, particularly for machine tool manufacturers and other traditional automotive part suppliers, as automotive firms are increasingly focusing on developing and producing electric vehicles (EVs).

Machine Tools Market Trends

Growth of the Automotive industry is driving the Machine Tool Industry

By 2030, India might be a global leader in shared transportation, opening doors for electric and driverless vehicles. To cut pollutants, electric vehicles are becoming more popular. By 2030, the electric car industry is anticipated to generate five crore employment. Between April 2000 and March 2022, the automobile industry attracted cumulative equity FDI inflows of around 32.84 billion USD. By 2023, the Indian government anticipates that the vehicle industry, key to the machine tool industry will draw 8-10 billion USD in domestic and foreign investments. Around the world, 79.1 million automobiles were produced in 2021, a 1.3% rise from 2020. The number of motor vehicles produced globally in 2020 and 2021 may be found in this infographic.

The European Automobile Manufacturers' Association (ACEA) urges policymakers to create an environment that will allow the market to recover and transition to zero-emission vehicles, as the EU car market is anticipated to contract by more than a quarter in 2019 compared to pre-pandemic 2019 levels. ZEV new registrations reached a significant milestone in 2021, accounting for 5.2% of all newly registered motor vehicles. In Canada, 1.6 million new cars were reported in 2021, a 6.5% increase from the previous year. Together, the three largest provinces in Canada accounted for 93.4% of new zero-emission vehicle registrations in 2021; 42.8% were in Quebec, 27.7% in British Columbia, and 22.9% in Ontario, regions where machine tool companies are likely to see increased demand.

CNC Machine Tools Expected to Dominate the Machine Tools Industry

Computer numerical control (CNC) machines streamline operational processes by reducing production time and minimizing human error. The growing demand for automated manufacturing in the industrial sector has resulted in the increasing usage of CNC machines within the machine tools industry. Also, the establishment of manufacturing facilities in Asia-Pacific has spurred the use of computer numerical controls in the sector.

Many machine tool manufacturers focus on efficient manufacturing techniques to try and gain a competitive advantage in the global machine tools market. They re-design their facilities, which contain CNC machines. Also, the integration of 3D printing with CNC machines is becoming a common addition to some new production units, which is expected to offer better multi-material capability and little resource wastage.

Furthermore, with the rising concerns over global warming and the depletion of energy reserves, CNC machines are actively being used in power generation, as this process requires wide-scale automation.

Machine Tools Industry Overview

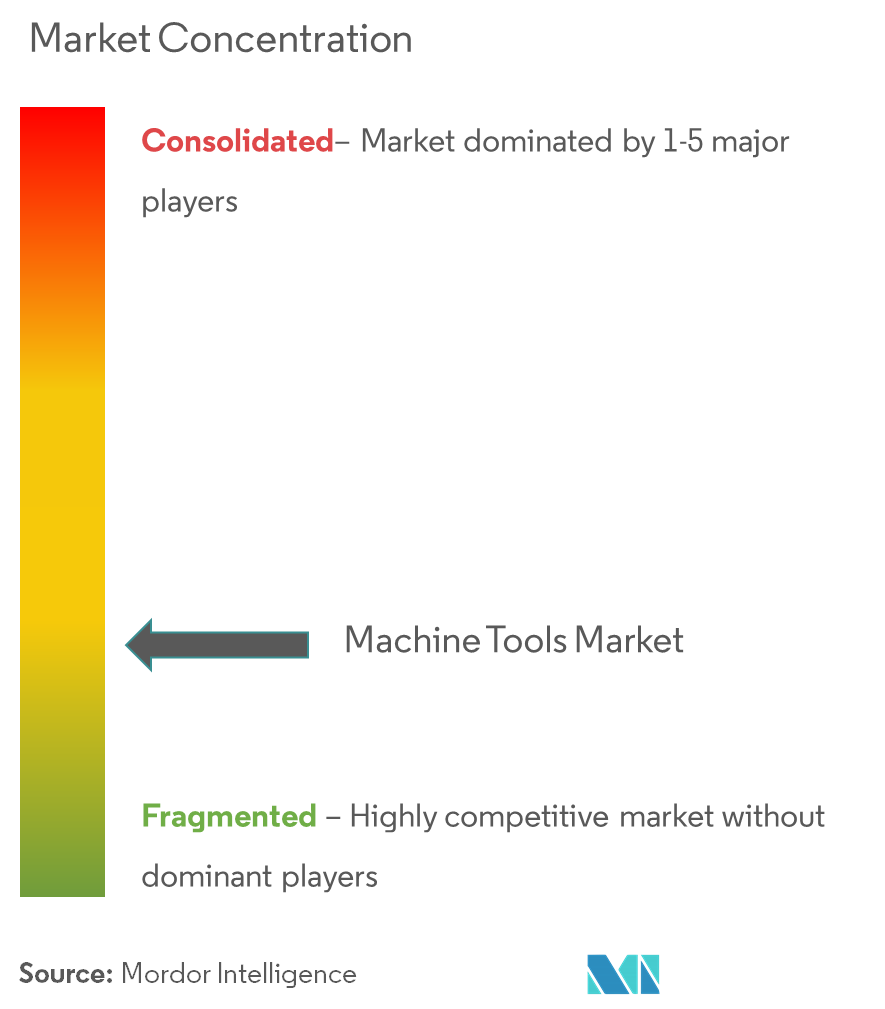

The Machine Tools Market is relatively fragmented, with significant global and small and medium-sized local players. Some considerable machine tools companies include TRUMPF Group, Shenyang Machine Tool Group, Amada Co. Ltd, DMG Mori Seiki Co., Ltd, Falcon Machine Tools Co. Ltd, and many others. The regional hubs in the global machine tools market include China, Germany, Japan, and Italy. The machine tool companies are also focusing on developing more automated solutions with an increasing preference for automation. Furthermore, the industry is witnessing a trend of consolidation through mergers and acquisitions, highlighted by machine tool industry statistics. These strategies help companies enter new market areas and gain new customers.

Machine Tools Market Leaders

-

TRUMPF Group

-

Shenyang Machine Tool Group

-

Amada Co. Ltd

-

DMG Mori Seiki Co., Ltd

-

Falcon Machine Tools Co. Ltd

*Disclaimer: Major Players sorted in no particular order

Machine Tools Market News

- March 2023: Phillips Machine Tools announced a strategic partnership with JFY International to broaden its solution portfolio for metal processing customers. JFY International, a member of the TRUMPF Group, is a full-service provider of sheet metal processing solutions, offering CNC bending, punching, shearing, 2D laser cutting machines, and even automation, from a single machine to a fully automated line. Through its partners, JFY International guarantees professional consulting, quick responses, and excellent on-time services.

- December 2022: EIT Manufacturing, the largest innovation community in the industry in Europe, and AMT - Advanced Machine Tools, the new biennial event with the latest innovations in machine tools, machinery deformation, cutting and forming, instruments, components, and accessories, and its auxiliary industry, join forces to foster innovation and digital transformation in the metal industry. By signing this collaboration agreement, EIT Manufacturing, and AMT give industrial manufacturing specialists in Europe access to a world of opportunities.

- September 2022: HELLER Machine Tools announced a strategic partnership with TITANS of CNC, Inc. The key points of the agreement include cooperation in machining technology, process, and practical application. TITANS of CNC agreed to install two 5-axis machining centers into their Texas facility: the HF 5500 with the fifth axis in the workpiece and the CP 6000 with the fifth axis in the tool - and a Round Pallet Storage System.

Machine Tools Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Defination

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

- 2.5 Project Process and Structure

- 2.6 Engagement Framework

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

-

4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.2 Market Restraints

- 4.2.3 Market Opportunities

-

4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers/Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Key Government Regulations and Initiatives for the Manufacturing Sector

- 4.6 Metalworking Industry Snapshot

-

4.7 Technology Snapshot

- 4.7.1 Connected and Automated Machines

- 4.7.2 Advanced Controls/Motion Control Systems

- 4.7.3 Digitalization and Industry 4.0

- 4.7.4 Artificial Intelligence (AI) for Accurate Metal Cutting

- 4.8 Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Milling Machines

- 5.1.2 Drilling Machines

- 5.1.3 Turning Machines

- 5.1.4 Grinding Machines

- 5.1.5 Electrical Discharge Machines

- 5.1.6 Others

-

5.2 By End User

- 5.2.1 Automotive

- 5.2.2 Fabrication and Industrial Machinery Manufacturing

- 5.2.3 Marine and Aerospace & Defense

- 5.2.4 Precision Engineering

- 5.2.5 Other End Users

-

5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 Middle East and Africa

- 5.3.5 Latin America

6. COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

-

6.2 Company Profiles

- 6.2.1 Trumpf Group

- 6.2.2 Shenyang Machine Tool Group

- 6.2.3 Amada Co. Ltd

- 6.2.4 Dalian Machine Tool Group

- 6.2.5 Komatsu Ltd

- 6.2.6 Dmg Mori Seiki Co. Ltd

- 6.2.7 Schuler AG

- 6.2.8 Jtekt Corporation

- 6.2.9 Okuma Corporation

- 6.2.10 Mag

- 6.2.11 Makino Milling Machine Co. Ltd*

- *List Not Exhaustive

7. FUTURE OF THE MARKET

8. APPENDIX

- 8.1 GDP Distribution by Activity - Key Countries

- 8.2 Insights into Capital Flows Key Countries

- 8.3 Economic Statistics for the Manufacturing Sector

- 8.4 Global Manufacturing Industry Statistics

Machine Tools Industry Segmentation

A machine tool is a machine for handling or machining metal or other rigid materials, usually by cutting, boring, grinding, shearing, or other forms of deformations. The machine tools industry can be classified into metal-cutting machines and metal-forming machines. A complete background analysis of the Global Machine Tools Market, including the assessment of the economy and contribution of sectors in the economy, market overview, machine tools market size, machine tool market share estimation for key segments, and emerging trends in the market segments, market dynamics, and geographical trends, and COVID-19 impact is included in the report.

The Machine Tools Market is Segmented by Type (Milling Machines, Drilling Machines, Turning Machines, Grinding Machines, Electrical Discharge Machines among others), End User (Automotive, Fabrication, and Industrial Machinery Manufacturing, Marine and Aerospace & Defense, Precision Engineering, and Other End Users), and Geography (Asia-Pacific, North America, Europe, Latin America, and Middle East & Africa). The report offers the machine tools market size, machine tool market share, and forecasts in values (USD billion) for all the above-mentioned segments.

| By Type | Milling Machines |

| Drilling Machines | |

| Turning Machines | |

| Grinding Machines | |

| Electrical Discharge Machines | |

| Others | |

| By End User | Automotive |

| Fabrication and Industrial Machinery Manufacturing | |

| Marine and Aerospace & Defense | |

| Precision Engineering | |

| Other End Users | |

| By Geography | Asia-Pacific |

| North America | |

| Europe | |

| Middle East and Africa | |

| Latin America |

Machine Tools Market Research FAQs

How big is the Machine Tools Market?

The Machine Tools Market size is expected to reach USD 103.57 billion in 2024 and grow at a CAGR of 2.92% to reach USD 119.58 billion by 2029.

What is the current Machine Tools Market size?

In 2024, the Machine Tools Market size is expected to reach USD 103.57 billion.

Who are the key players in Machine Tools Market?

TRUMPF Group, Shenyang Machine Tool Group, Amada Co. Ltd, DMG Mori Seiki Co., Ltd and Falcon Machine Tools Co. Ltd are the major companies operating in the Machine Tools Market.

Which is the fastest growing region in Machine Tools Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Machine Tools Market?

In 2024, the Asia accounts for the largest market share in Machine Tools Market.

What years does this Machine Tools Market cover, and what was the market size in 2023?

In 2023, the Machine Tools Market size was estimated at USD 100.55 billion. The report covers the Machine Tools Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Machine Tools Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

What are the primary end-user segments driving the demand for the Machine Tools Market?

The primary end-user segments driving the demand for the Machine Tools Market include a) Automotive and Aerospace b) Electronics and Healthcare c) Precision Engineering and Fabrication d) Marine and Defense

What are the key trends driving the growth of the Machine Tools Market?

The key trends driving the growth of the Machine Tools Market are a) Increasing demand for precision components across diverse sectors b) Advancements in automation and robotics c) Increasing adoption of CNC (Computer Numerical Control) technology, and advancements in machine design and control components

Machine Tools Industry Report

The report on Plastic Decking Companies provides an extensive market overview segmented by type, application, end user, and geography. The industry analysis covers various types, including pressure-treated wood, redwood, tropical hardwood, cedar, wood-plastic composites, and other types. The market segmentation also includes applications such as railing, floor, wall, and other applications, with a focus on both residential and non-residential end users.

Industry reports indicate that the market trends and market share are crucial aspects of the analysis, with detailed insights into market size and market growth. The industry research highlights the market forecast, offering a comprehensive industry outlook and market predictions. The report pdf download provides market data and industry statistics, ensuring a thorough understanding of the market value and industry sales.

The industry information includes a historical overview and a market review, emphasizing the market leaders and their role in the market growth. The market segmentation by geography covers Asia-Pacific, North America, Europe, and the rest of the world, providing a detailed market analysis for each region.

The report example demonstrates the market trends and market share, with a focus on industry trends and market outlook. The industry research includes a market forecast, predicting future market growth and industry size. The market review and market predictions are supported by industry statistics and market data, ensuring a comprehensive understanding of the market value and industry sales.

In conclusion, the industry reports provide an in-depth market overview, focusing on market trends, market share, and market growth. The industry outlook and market forecast offer valuable insights into the future of the plastic decking market, supported by detailed industry research and market data. The report pdf download serves as a useful tool for understanding the market segmentation, industry size, and market value, providing a complete picture of the industry's current state and future prospects.