Machine Vision Camera Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 9.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Machine Vision Camera Market Analysis

The Machine Vision Camera Market is expected to register a CAGR of approximately 9% over the forecast period (2021 - 2026). The machine vision technology uses an image-recognition algorithm to the object within the image. It facilitates a more detailed and accurate picture of the object without distortion for the applications such as automation, robotics, agriculture drones, and 3D modeling.

- The industries across the domains globally are moving towards automation by adopting advanced technologies for more efficient operations and processes. The manufacturing industries have been using cameras for decades for quality assurance, but with the advancements and AI, the applications range widened for inspection, measurement, and microscopy. The growing implementation of advanced technologies across industries are driving the market of machine vision camera.

- The adoption has gained traction in real-time traffic counting with machine vision, and image recognition enables the automation of control room work and preventive intervention in situations. The companies offering machine vision cameras are experiencing significant growth in recent years due to the increasing demand for such products.

- For instance, Cognex's revenue, has reached USD 806 million and it grew with a CAGR of 21% in the last five years. Also, companies are highly investing in developing their products. In 2018, Cognex spent 14% of its revenue on research and development.

- However, the lack of skilled labour and inconsistency in demand and requirements from the industries limit the growth of the market to an extent.

Machine Vision Camera Market Trends

This section covers the major market trends shaping the Machine Vision Camera Market according to our research experts:

The Demand from Automotive Industry to Grow Significantly

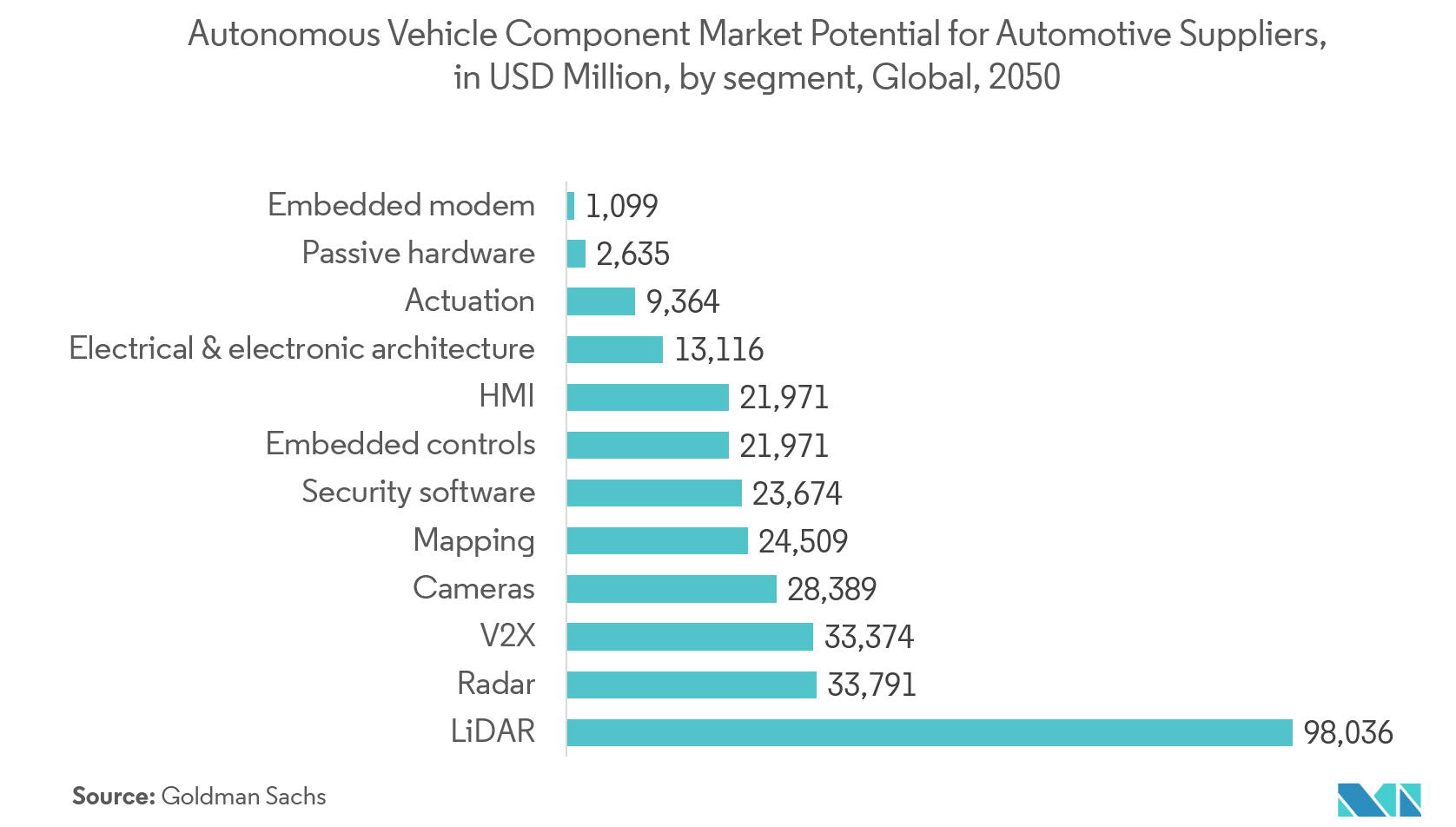

- The automotive industry is transforming rapidly with the autonomous vehicle and automation within the manufacturing plant itself. According to Goldman Sachs, in the ten years, the revenue of ADAS/AV is expected to witness a CAGR of 42% to reach USD 197 billion by 2030.

- With continuous technological advancement, the adoption of a machine vision camera has increased for the application of autonomous vehicles, including parking cameras, CMS cameras for side view, SVS cameras for a 360-degree view around the car. The increasing penetration of ADAS and autonomous vehicles across the world is expected to drive the market the machine vision cameras.

- Further, the machine vision cameras are used in the automotive manufacturing process, including inspection, and for measurement in research and development of new parts. These applications use a barcode scanner, 3D imaging cameras, line scan cameras, etc.

- Goldman Sachs has also stated that the camera segment has the potential to reach the market size of over USD 28 billion for automotive vehicle component suppliers.

- Many automotive companies are also expanding their production capacity and presence internationally, which will create more demand for machine vision cameras. For instance, in 2018, BMW inaugurated its new manufacturing plant for autonomous electric vehicles in Dingolfin, Lower Bavaria.

Asia-Pacific Region to Witness the Fastest Growth

- The demand for machine vision cameras is expected to see a steady growth rate in the region owing to the growing end-user industries. In the automotive sector specifically, the increasing investments in the region coupled with the growth in investments related to e-vehicles are further expected to propel the machine vision camera market. For instance, General Motors has invested USD 2.8 billion as new investment in South Korea in 2018 over the next ten years as part of its plan to restructure its embattled unit in the country.

- Further, international key electronics and automation companies are investing in Asian machine vision companies seeing growth in the region. For instance, in 2018, Samsung in partnership with ABB, Chinese venture firm Tsing Capital and Hong Kong’s Waterwood, has invested USD 20 million in Vion Technologies, a Chinese company specializing in machine vision systems including cameras and artificial intelligence (AI).

- Moreover, the region is investing in connected infrastructure projects, which represent 10% of the total global projects are currently running towards energy, transportation, water, and rail. These developments in the region are driving the demand for machine vision camera market growth.

Machine Vision Camera Industry Overview

The market for Machine Vision Camera is moderately consolidated with a few numbers of dominating players in the market. The companies are adopting strategic partnerships and new product development strategies to gain more market share and presence across the world. The companies are also focusing on increasing their product portfolio for machine vision camera accessories.

- June 2020 - FLIR Systems, Inc. introduced the new FLIR Blackfly S visible spectrum camera module, the first to integrate the Sony Pregius S IMX540 sensor with 24.5 MP at 12 FPS in a USB3 camera. The combination of the Blackfly S feature set with IMX540's high megapixel (MP) count and fast imaging enables engineers and researchers from biomedical to semiconductor industries to inspect more in less time and with fewer cameras required.

- October 2019 - FLIR Systems launched the FLIR Firefly DL, the industry's first deep learning, inference-enabled machine vision camera with FLIR Neuro technology. With its small size, low weight, minimal power consumption, and deep learning capabilities, the FLIR Firefly DL camera is ideal for embedding into mobile, desktop, and handheld systems.

Machine Vision Camera Market Leaders

-

Keyence Corporation

-

Adimec Advanced Image Systems BV

-

Allied Vision Technologies GmbH

-

Basler AG

-

Cognex Corporation

*Disclaimer: Major Players sorted in no particular order

Machine Vision Camera Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increasing Implementation of Advanced Technologies in Industries

-

4.3 Market Restraints

- 4.3.1 Lack of Skilled Labour and Inconsistency in the End-user Requirements/Demands

-

4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

-

4.5 Technology Snapshot

- 4.5.1 Key Interface Methods For Machine Vision Cameras

- 4.5.1.1 USB 2.0/USD 3.0

- 4.5.1.2 GigE

- 4.5.1.3 Camera Link

- 4.5.1.4 Others

- 4.5.2 Key Technological Advancements - Shutter Technology, Hyperspectral Imaging, etc.

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Inline

- 5.1.2 Area Scan

-

5.2 By End-user Industries

- 5.2.1 Electronics & Semiconductor

- 5.2.2 Automotive

- 5.2.3 Heathcare

- 5.2.4 Food Processing

- 5.2.5 Aerospace

- 5.2.6 Other End-user Industries

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Allied Vision Technologies GmbH

- 6.1.2 Keyence Corporation

- 6.1.3 Adimec Advanced Image Systems bv.

- 6.1.4 Basler AG

- 6.1.5 Cognex Corporation

- 6.1.6 LMI Technologies, Inc.

- 6.1.7 Omron Microscan Systems, Inc.

- 6.1.8 SICK AG

- 6.1.9 Teledyne DALSA Inc.

- 6.1.10 Tordivel AS

- 6.1.11 National Instruments Corporation

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityMachine Vision Camera Industry Segmentation

The scope of the study for the machine vision camera market is limited to both types, Inline, and area scan. The study has considered the offerings of the product as well as machine vision camera accessories by vendors and their applications in a wide range of industries globally.

| By Type | Inline |

| Area Scan | |

| By End-user Industries | Electronics & Semiconductor |

| Automotive | |

| Heathcare | |

| Food Processing | |

| Aerospace | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Machine Vision Camera Market Research FAQs

What is the current Machine Vision Camera Market size?

The Machine Vision Camera Market is projected to register a CAGR of 9% during the forecast period (2024-2029)

Who are the key players in Machine Vision Camera Market?

Keyence Corporation, Adimec Advanced Image Systems BV, Allied Vision Technologies GmbH, Basler AG and Cognex Corporation are the major companies operating in the Machine Vision Camera Market.

Which is the fastest growing region in Machine Vision Camera Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Machine Vision Camera Market?

In 2024, the North America accounts for the largest market share in Machine Vision Camera Market.

What years does this Machine Vision Camera Market cover?

The report covers the Machine Vision Camera Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Machine Vision Camera Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Machine Vision Camera Industry Report

Statistics for the 2024 Machine Vision Camera market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Machine Vision Camera analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.