Magnetic Sensor Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 3.51 Billion |

| Market Size (2029) | USD 5.14 Billion |

| CAGR (2024 - 2029) | 7.91 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Magnetic Sensor Market Analysis

The Magnetic Sensors Market size is estimated at USD 3.51 billion in 2024, and is expected to reach USD 5.14 billion by 2029, growing at a CAGR of 7.91% during the forecast period (2024-2029).

The high usage of magnetic sensors in new navigation devices, presence detection (building automation-related applications), medical areas, and the automotive sector are leading to a paradigm shift in the magnetic sensors market around the world.

- The increase in demand for IIoT and the production of consumer electronics, electric and hybrid vehicles, and high-quality sensing devices, globally, are influencing the adoption of magnetic sensors across several end-user industries. This is expected to drive the growth of magnetic sensors during the forecast period.

- An increase in the adoption of robotics for factory automation, owing to the Industry 4.0 policies, is driving the need for magnetic sensors for various safety applications in the global market. The development in the services sector in the country and high growth rate of data center and cloud providers are further augmenting the demand for these sensors to be deployed in the power distribution unit (PDU), which forms a crucial part in data centers.

- However, the recent outbreak of COVID-19 is influencing both the demand and production of the semiconductor industry. Asia-Pacific holds the major share in the semiconductor and electronics industry, as countries, such as China, Taiwan, and South Korea, are home to a significant number of pureplay foundries in the world.

Magnetic Sensor Market Trends

This section covers the major market trends shaping the Magnetic Sensors Market according to our research experts:

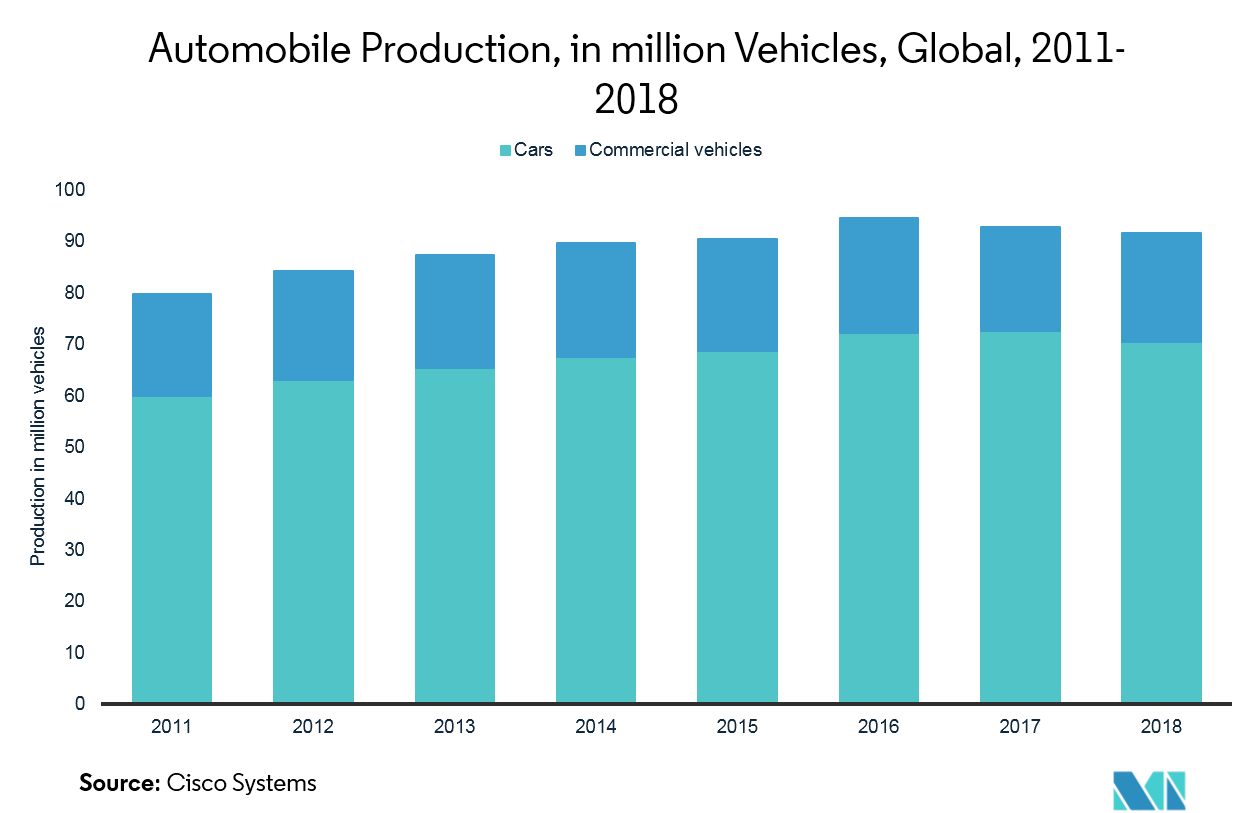

Automotive Industry to Hold Largest Share of the Market

- In the case of automotive applications, GMR and TMR sensors have demonstrated less power consumption than mW and µW during continuous operation. They are also easily accommodated in package sizes less than their counterparts. Thus, they are finding increasing deployment in auto parts.

- The demand for magnetic sensors is anticipated to increase in the automotive industry. Sensing devices are increasingly being used in this industry to improve vehicle convenience and fuel efficiency. Also, mandatory regulations by government bodies, such as the installation of safety equipment and sensing elements in automobiles, are estimated to create significant opportunities for the growth of the market studied.

- Magnetic sensor vendors are focusing on providing efficient devices, which can serve an extensive range of automotive applications. The increase in demand and penetration of electric vehicles and hybrid electric vehicles and the use of GPS in automobiles may also fuel the demand for magnetic sensors from the automotive industry.

- Moreover, hall and GMR-based magnetic sensors are increasingly being used for motorcycles, three-wheel, and all-terrain vehicle applications. These sensors are being developed for switching applications in these vehicles, as well as the position and speed measurement for lightweight construction and reduced battery operation space, weight, and power consumption in electric vehicles.

Asia-Pacific to Hold the Largest Share of the Market Studied

- China is one of the most promising automotive and consumer electronics manufacturing nation, globally. Due to increased use of applications, such as anti-braking system (ABS) and anti-locking system, where magnetic sensors are widely utilized, the automobile industry holds an important position in the market in this region.

- Moreover, Japan is a supplier of industrial robots and their components, such as reducers, servo motors, and various sensors, to the world. The developments in industrial robots, of late, involves precision in positioning accuracy. It further requires accurate detection of joint angles, where magnetic sensors play a key role.

- The magnetic sensor market in India is mainly growing due to the proliferation of smartphones, as smartphones use hall-effect sensors to support compass applications. However, one of the factors restraining the market currently is the spread of coronavirus, as several states of India have issued lockdown orders to curb the spread of coronavirus.

Magnetic Sensor Industry Overview

The magnetic sensors market is highly competitive. The improved manufacturing practices and adoption of TMR technology are poised to offer substantial growth opportunities to sensor fabricators and associated industry participants. The market is identified to be highly technology intensive. Thus, the players in the market are integrating advanced technological products, like xMR, into their product portfolios. These companies include AKM, Infineon Technologies, Allegro Microsystems, Melexis, TDK, Diodes, and Honeywell.

- November 2019 - Allegro MicroSystems launched the ATS17051, one of the first gear tooth sensor ICs designed to provide incremental position for electric vehicle traction motors operating up to 30k RPM. The device addresses the engineers' traction motor challenges, which include vibration at startup and running mode, high rotational speed, mechanical space constraints, high operating temperatures, and ISO 26262 safety requirements.

- June 2019 - Infineon Technologies AG expanded its sensor portfolio by a new AMR-based angle sensor, which is aimed at providing high accuracy in low magnetic fields. The XENSIV TLE109A16 product line is designed to address the need for very precise, fast, and cost-efficient angle measurement at one of the high functional safety levels in automotive and industrial applications.

Magnetic Sensor Market Leaders

-

Infineon Technologies AG

-

Honeywell International Inc.

-

NXP Semiconductors

-

ST Microelectronics

-

Texas Instruments

*Disclaimer: Major Players sorted in no particular order

Magnetic Sensor Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

-

4.3 Market Drivers

- 4.3.1 Increasing Regulations Around Energy-efficient Systems and Automobiles

- 4.3.2 Emerging Applications in Consumer Electronics and Data Centers

-

4.4 Market Restraints

- 4.4.1 Falling Average Selling Prices (ASPS) of Semiconductors and Sensors

- 4.4.2 Coronavirus Outbreak Influencing the Electronics Industry

- 4.4.2.1 Assessment of COVID-19 Impact on the Industry

5. MARKET SEGMENTATION

-

5.1 Technology

- 5.1.1 Hall Effect

- 5.1.2 Anisotropic Magneto Resistance (AMR)

- 5.1.3 Giant Magneto Resistance (GMR)

- 5.1.4 Tunneling Magneto Resistance (TMR)

- 5.1.5 Other Technologies

-

5.2 Application

- 5.2.1 Automotive

- 5.2.2 Consumer Electronics

- 5.2.3 Industrial (Excluding Automotive)

- 5.2.4 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Infineon Technologies AG

- 6.1.2 Analog Devices

- 6.1.3 Crocus Technology

- 6.1.4 Honeywell International Inc.

- 6.1.5 Allegro Microsystems (Sanken Electric Company)

- 6.1.6 Murata Manufacturing Co. Ltd

- 6.1.7 NVE Corporation

- 6.1.8 NXP Semiconductors NV

- 6.1.9 Omron Corporation

- 6.1.10 ST Microelectronics NV

- 6.1.11 TDK Corporation

- 6.1.12 TE Connectivity

- 6.1.13 Texas Instruments Inc.

- *List Not Exhaustive

- 6.2 Investment Analysis

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityMagnetic Sensor Industry Segmentation

Magnetic sensors are classified in terms of measuring a complete magnetic field or vector-components of the magnetic field. Permanent magnets, such as neodymium magnets, are used to trigger the magnetic sensors in several applications. The magnetic sensor is used to identify the magnitude and direction of the magnetic field. It includes a rotating sensor tip, which measures both transverse and longitudinal magnetic fields around the objects.

| Technology | Hall Effect | |

| Anisotropic Magneto Resistance (AMR) | ||

| Giant Magneto Resistance (GMR) | ||

| Tunneling Magneto Resistance (TMR) | ||

| Other Technologies | ||

| Application | Automotive | |

| Consumer Electronics | ||

| Industrial (Excluding Automotive) | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle East & Africa |

Magnetic Sensor Market Research FAQs

How big is the Magnetic Sensors Market?

The Magnetic Sensors Market size is expected to reach USD 3.51 billion in 2024 and grow at a CAGR of 7.91% to reach USD 5.14 billion by 2029.

What is the current Magnetic Sensors Market size?

In 2024, the Magnetic Sensors Market size is expected to reach USD 3.51 billion.

Who are the key players in Magnetic Sensors Market?

Infineon Technologies AG, Honeywell International Inc., NXP Semiconductors, ST Microelectronics and Texas Instruments are the major companies operating in the Magnetic Sensors Market.

Which is the fastest growing region in Magnetic Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Magnetic Sensors Market?

In 2024, the Asia Pacific accounts for the largest market share in Magnetic Sensors Market.

What years does this Magnetic Sensors Market cover, and what was the market size in 2023?

In 2023, the Magnetic Sensors Market size was estimated at USD 3.25 billion. The report covers the Magnetic Sensors Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Magnetic Sensors Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Magnetic Sensor Industry Report

Statistics for the 2024 Magnetic Sensor market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Magnetic Sensor analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.