Malaysian Retail Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Market Size (2024) | USD 89.66 Billion |

| Market Size (2029) | USD 119.64 Billion |

| CAGR (2024 - 2029) | 5.94 % |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Malaysian Retail Market Analysis

The Malaysia Retail Market size is estimated at USD 89.66 billion in 2024, and is expected to reach USD 119.64 billion by 2029, growing at a CAGR of 5.94% during the forecast period (2024-2029).

The Malaysian retail industry has been one of the largest contributing sectors to the country's gross domestic product (GDP) for the past decades. Several national and international brands have been performing in the country with a broad range of retail outlets across the nation. Despite several new store launches and a broad network of stores, the retail industry has registered a slow rate during the study period, which was drastically dropped during 2020 owing to the COVID-19 pandemic. The movement control order (MCO) restricted the public movement, and the lockdown, which was originally expected to last for two weeks in March 2020 and extended to mid-May 2020, has resulted in a sudden drop in total revenue generated from the retail sector. The sector contracted by around 16% in 2020. Some of the retail segments recorded a great contract, including double-digit contractions during 2020, which includes apparel, footwear, fashion accessories, and others. Similarly, one of the largest distribution channel segments - the hypermarkets, supermarkets, and convenience stores - recorded a drop in the total sales generated.

Malaysian Retail Market Trends

This section covers the major market trends shaping the Malaysia Retail Market according to our research experts:

Food and Beverages Segment has been Contributing a Major Share to the Market Revenue

Malaysia's most significant F&B exports are in the oils and fats category, particularly palm oil-based products, for which the country is one of the largest exporters in the world. The country is also heavily dependent on imports of many staples, including rice, most meat, and seafood, for domestic consumption. The Malaysian food industry is as diverse as the cultures in Malaysia, with a wide range of processed food as per the Asian taste. This industry is predominantly Malaysian-owned, dominated by small and medium-scale companies (SMEs). Besides the SMEs, there are notable foreign companies and MNCs producing processed food products in Malaysia. Despite the challenges due to the ongoing pandemic, the segment recorded growth in transactions due to its contact demand, and the players expanded their online distribution to cope with the demand.

Revenues from Physical Retail Distribution Channels Dropped During 2020 Due to COVID-19

Owing to the lockdown measures and physical distancing norms, the physical retailing in Malaysia contracted largely and recorded a drop in revenue quarter by quarter in 2020. Physical retailing recorded a sudden dip during the late first quarter of 2020. The Malaysian retail sector recorded the largest dip in sales during the second quarter of 2020, with a negative growth rate of 30.9% in retail sales when compared to the same period in 2019. Retail Group Malaysia (RGM) announced several retail outlets have been facing severe revenue drop, which led to the closure of the stores. As of March 2021, the closure of around 15% stores of the total retail stores nationwide. However, the online channel of distribution is strengthening in the country. The dip in various forms of physical retailing, including hypermarkets, supermarkets, convenience stores, specialty stores, franchise, branded, and multi-brand stores, is restricting the market to record growth in revenue transactions.

Malaysian Retail Industry Overview

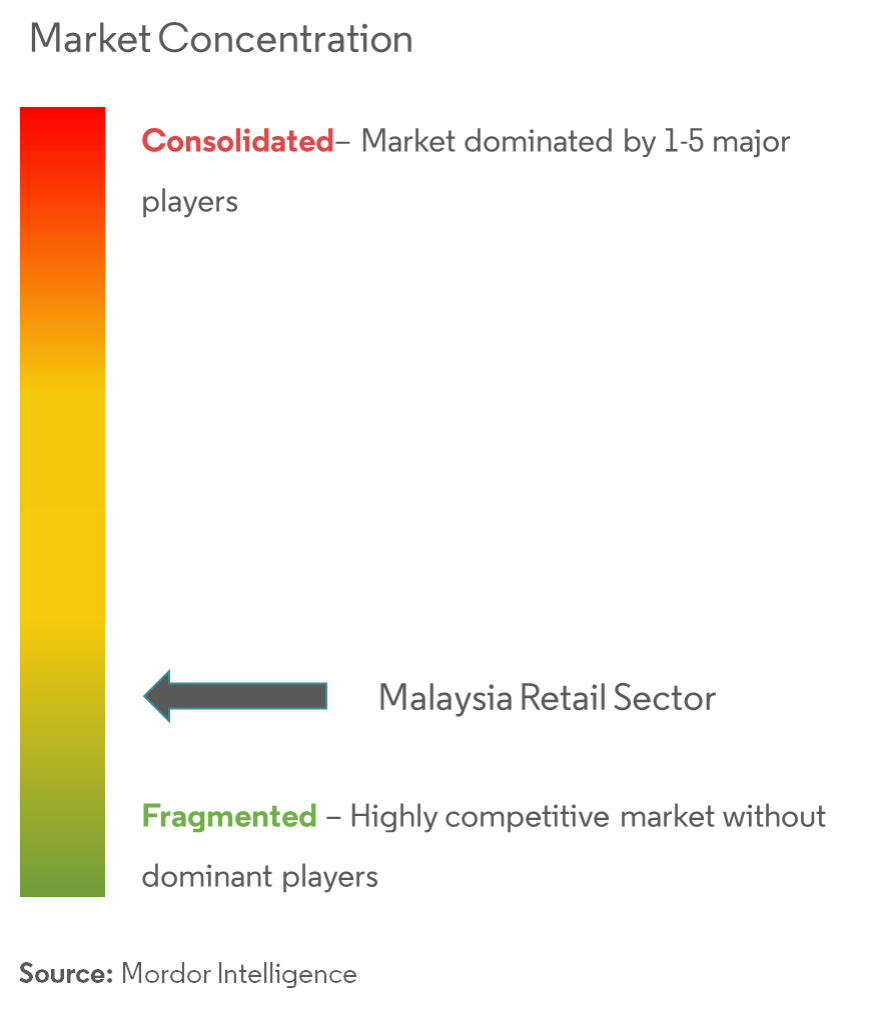

The report covers major international players operating in the Malaysian retail market. In terms of market share, few of the major players currently dominate the market. The organized retail market has been growing significantly with companies expanding stores and considering the business potential in new areas. Most of the unorganized retail outlets are increasingly being replaced with big retail hypermarkets, supermarkets, and other retail chains. This is expected to continue on a large scale during the forecast period, which may significantly lead to market growth.

Malaysian Retail Market Leaders

-

B.I.G. Store Sdn Bhd

-

7-Eleven

-

MJ Department Stores Sdn Bhd

-

Tesco

-

AEON CO (M) Bhd

*Disclaimer: Major Players sorted in no particular order

Malaysian Retail Market News

- In December 2020, Robinson & Co., one of the leading global department store operators, exited the Malaysian market following its inability to continue operations due to weak demand due to the COVID-19 pandemic.

Malaysian Retail Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints/Challenges

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.6 Consumer Behavior Analysis

- 4.7 Insights into Technological Innovations in the Retail Industry

- 4.8 Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

-

5.1 By Product

- 5.1.1 Food and Beverages

- 5.1.2 Personal and Household Care

- 5.1.3 Apparel, Footwear, and Accessories

- 5.1.4 Furniture, Toys, and Hobby

- 5.1.5 Electronic and Household Appliances

- 5.1.6 Other Products

-

5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets, Convenience Stores, and Department Stores

- 5.2.2 Specialty Stores

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

6. COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

-

6.2 Company Profiles

- 6.2.1 Parkson Holdings Bhd

- 6.2.2 Suiwah Corp. Bhd

- 6.2.3 B.I.G. Store Sdn Bhd

- 6.2.4 AEON Group

- 6.2.5 7-Eleven

- 6.2.6 The Store Corp. Bhd

- 6.2.7 Padini Holdings Bhd

- 6.2.8 Isetan

- 6.2.9 MJ Department Stores Sdn Bhd

- 6.2.10 Tesco*

- *List Not Exhaustive

7. FUTURE OF THE MALAYSIA RETAIL SECTOR

8. DISCLAIMER

9. ABOUT US

** Subject To AvailablityMalaysian Retail Industry Segmentation

The report on the Malaysian retail sector provides a comprehensive evaluation of the market, with an analysis of the segments in the market. Moreover, the report also provides the competitive profile of the key manufacturers, along with regional analysis. The Malaysia retail sector is segmented by products (food and beverages, personal and household care, apparel, footwear, and accessories, furniture, toys, and hobby, electronic and household appliances, and other products), and distribution channel (supermarkets/hypermarkets, convenience stores, and department stores, specialty stores, online, and other distribution channels). The report offers market size and forecasts for the Malaysian retail industry in value (USD million) for all the above segments.

| By Product | Food and Beverages |

| Personal and Household Care | |

| Apparel, Footwear, and Accessories | |

| Furniture, Toys, and Hobby | |

| Electronic and Household Appliances | |

| Other Products | |

| By Distribution Channel | Supermarkets/Hypermarkets, Convenience Stores, and Department Stores |

| Specialty Stores | |

| Online | |

| Other Distribution Channels |

Malaysian Retail Market Research FAQs

How big is the Malaysia Retail Market?

The Malaysia Retail Market size is expected to reach USD 89.66 billion in 2024 and grow at a CAGR of 5.94% to reach USD 119.64 billion by 2029.

What is the current Malaysia Retail Market size?

In 2024, the Malaysia Retail Market size is expected to reach USD 89.66 billion.

Who are the key players in Malaysia Retail Market?

B.I.G. Store Sdn Bhd, 7-Eleven, MJ Department Stores Sdn Bhd, Tesco and AEON CO (M) Bhd are the major companies operating in the Malaysia Retail Market.

What years does this Malaysia Retail Market cover, and what was the market size in 2023?

In 2023, the Malaysia Retail Market size was estimated at USD 84.63 billion. The report covers the Malaysia Retail Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Malaysia Retail Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Retail in Malaysia Industry Report

Statistics for the 2024 Retail in Malaysia market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Retail in Malaysia analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.