Malted Wheat Flour Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.20 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Europe |

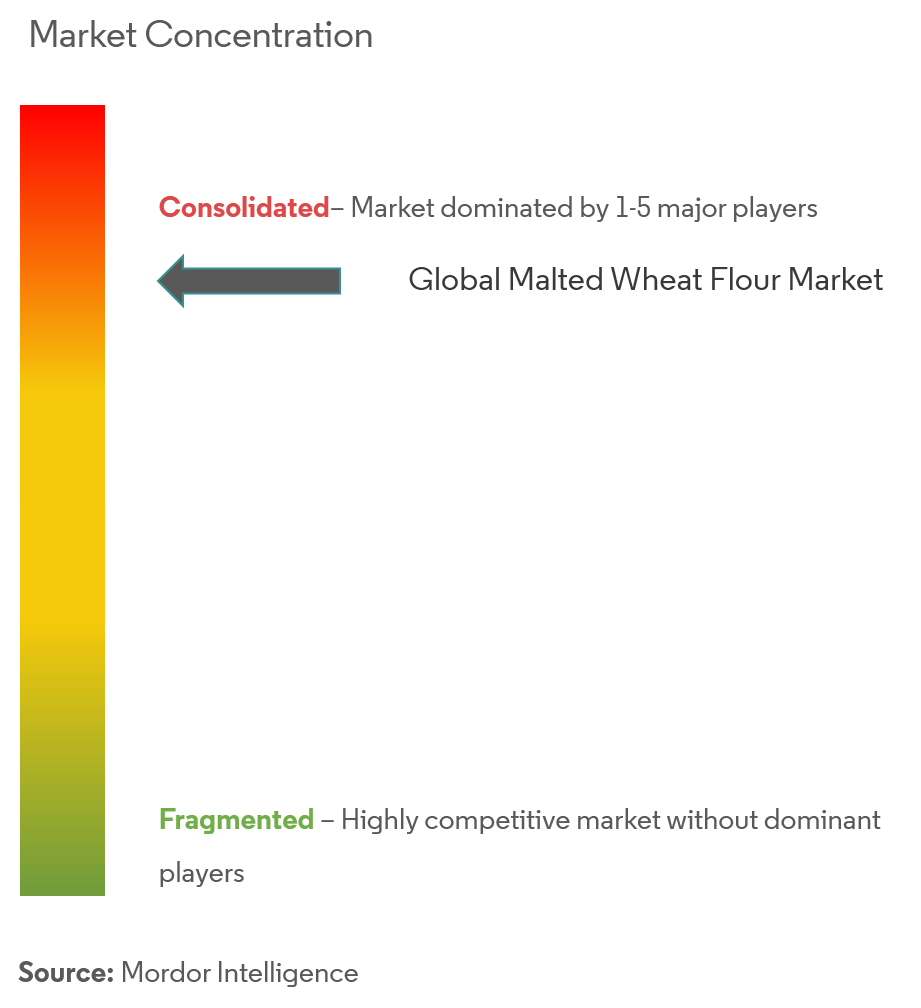

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Malted Wheat Flour Market Analysis

The global malted wheat flour market is growing at a CAGR of 5.2% during the forecast period (2019-2024).

- The market is driven by the increasing demand for beer and bakery-confectionery products where it is used extensively as a key ingredient. Also, product development with new formulations such as organic beers, gluten-free beers has fueled market growth.

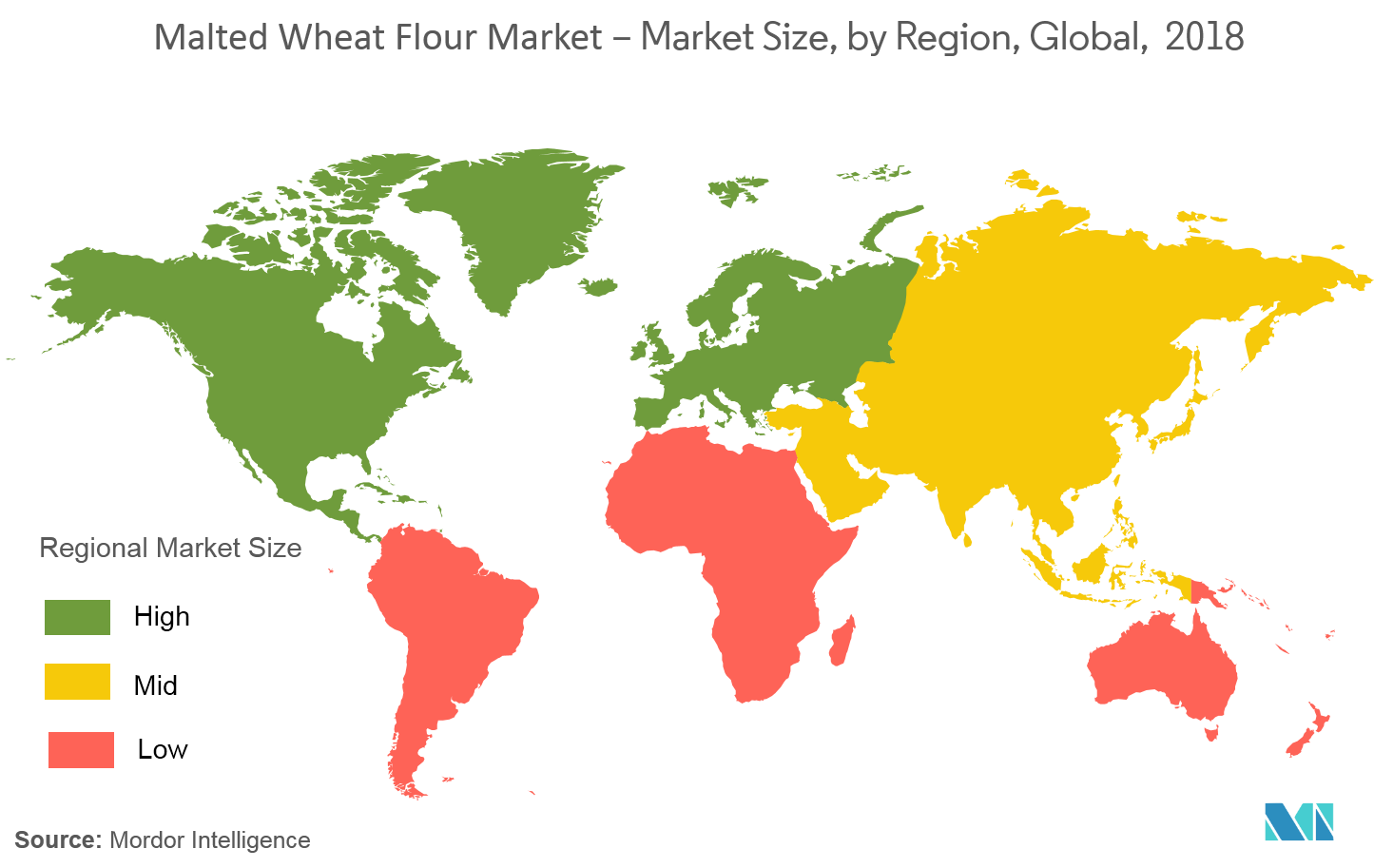

- Geographically, Europe & North America dominatethe market owing to the increasing demand for alcoholic beverages in these regions. Asia-Pacific, followed by Middle East and Africa and South America regions are also witnessing a steady market growth due to the increasing preference for malted wheat flour as an additional ingredient in baked products.

Malted Wheat Flour Market Trends

This section covers the major market trends shaping the Malted Wheat Flour Market according to our research experts:

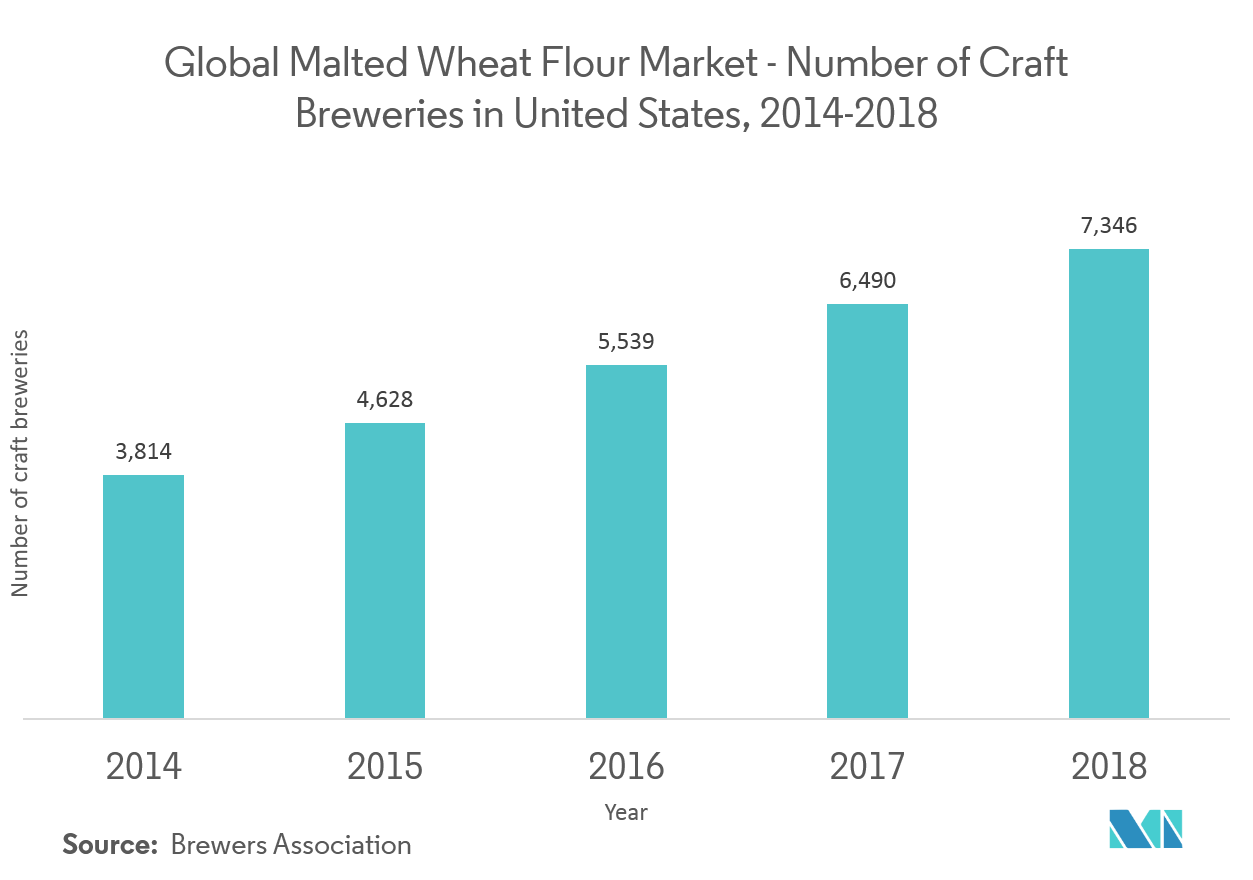

Growing demand for brewing industries

The popularity for the brewing industries have experienced a significant growth during the past few years, thus boosting the malted wheat flour market. Consumers across the world are seeking distinctive and flavorful beers, which is pushing the market for hopped malt extrct in the beer market space. Moreover, the increasing development of microbreweries and the growing production of craft beer has led to growing demand for specialty malts. The National Brewers Association revealed that as of January 2018, the consumption of malt by the US craft brewers was approximately 40% of the total malt consumed by all the brewers in the United States.

Europe & North America to drive the market

Countries like United Kingdom, Germany, and United States from the European and North American region are mostly dominating the market owing to the increasing demand for alcoholic beverages in these regions. Also, the government initiatives to incorporate new breweries has been boosting the market growth, resulting into a double-digit growth till 2017 in the United States, and the number of small, independent breweries, microbreweries, and brewpubs increased to 7,346 in 2018 as per the data revealed by the Brewers Association.

Malted Wheat Flour Industry Overview

The malted wheat flour market is consolidated in nature having few numbers of domestic and multinational player competing for market share. Companies focusing on new product launch with healthier ingredients/organic claim along with acquisition, merger, partnership and expansions as their key marketing strategy.

Malted Wheat Flour Market Leaders

-

Imperial Malts Ltd.

-

IREKS GmbH

-

Muntons plc

-

Crisp Malt GmbH

-

Simpsons Malt Ltd

*Disclaimer: Major Players sorted in no particular order

Malted Wheat Flour Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Application

- 5.1.1 Beverage

- 5.1.2 Food

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Spain

- 5.2.2.2 United Kingdom

- 5.2.2.3 Germany

- 5.2.2.4 France

- 5.2.2.5 Italy

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Imperial Malts Ltd.

- 6.4.2 IREKS GmbH

- 6.4.3 Muntons plc

- 6.4.4 Crisp Malt GmbH

- 6.4.5 Simpsons Malt Ltd

- 6.4.6 Great Western Malting Co.

- 6.4.7 Malteurop

- 6.4.8 GrainCorp Malt group

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityMalted Wheat Flour Industry Segmentation

The global malted wheat flour market is segmented by application and geography. By application, the market is segmented into beverages and food; and by geography into North America, Europe, Asia-Pacific, South America and Middle East and Africa.

| Application | Beverage | |

| Food | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | South Africa |

| Saudi Arabia | ||

| Rest of Middle East and Africa |

Malted Wheat Flour Market Research FAQs

What is the current Malted Wheat Flour Market size?

The Malted Wheat Flour Market is projected to register a CAGR of 5.20% during the forecast period (2024-2029)

Who are the key players in Malted Wheat Flour Market?

Imperial Malts Ltd., IREKS GmbH, Muntons plc, Crisp Malt GmbH and Simpsons Malt Ltd are the major companies operating in the Malted Wheat Flour Market.

Which is the fastest growing region in Malted Wheat Flour Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Malted Wheat Flour Market?

In 2024, the Europe accounts for the largest market share in Malted Wheat Flour Market.

What years does this Malted Wheat Flour Market cover?

The report covers the Malted Wheat Flour Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Malted Wheat Flour Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Malted Wheat Flour Industry Report

Statistics for the 2024 Malted Wheat Flour market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Malted Wheat Flour analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.