Manufacturing Analytics Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 24.00 % |

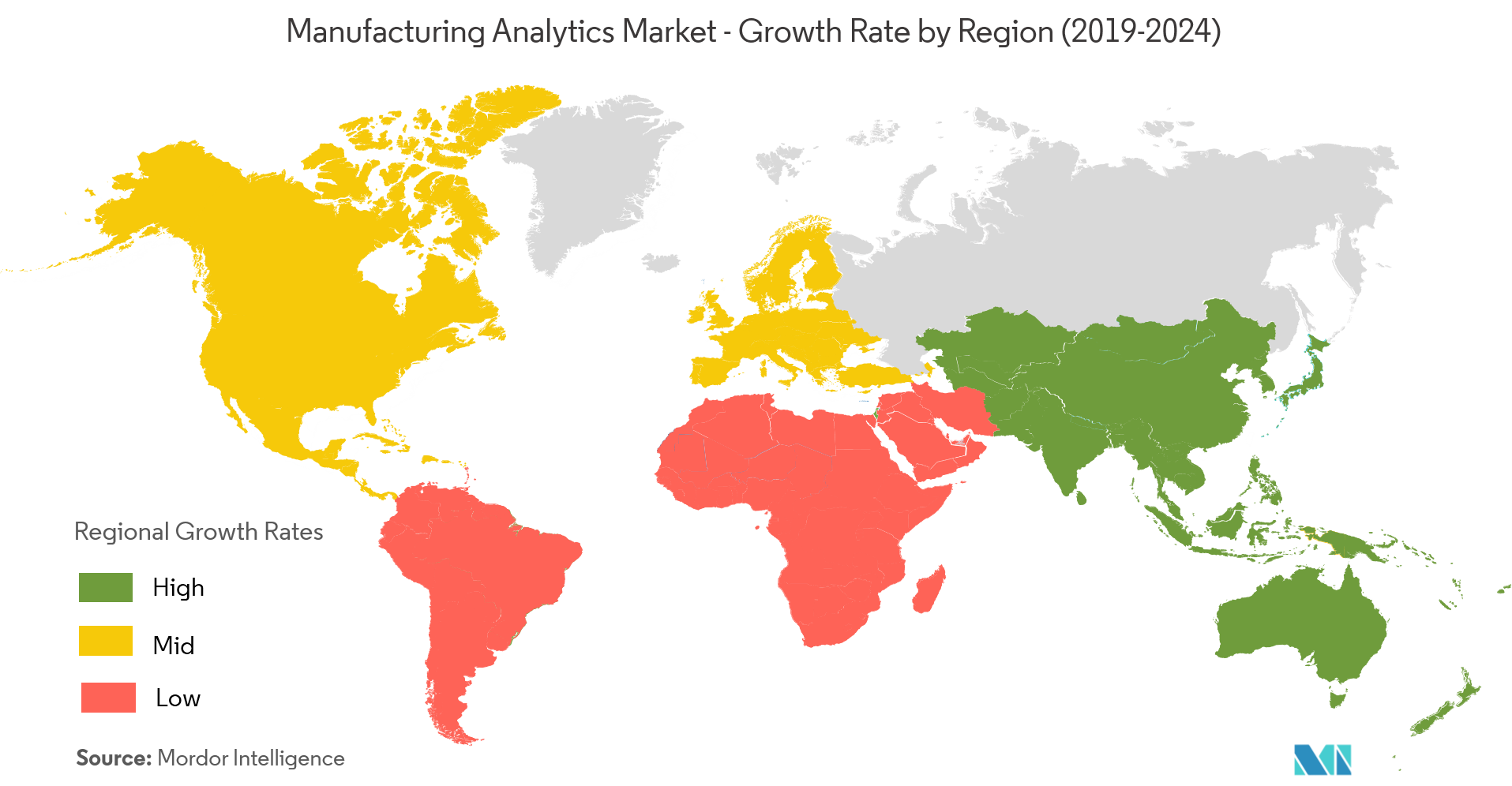

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Manufacturing Analytics Market Analysis

The manufacturing analytics market is projected to register a CAGR of 24% during the forecast period (2021 - 2026). The application of analytics in various segments of the manufacturing process is increasing the demand for the manufacturing analytics market thereby minimize operational cost and streamlining the overall supply-chain logistics.

- The emergence of industrial internet of things (IIoT) along with increasing business agility and scalability has helped in the adoption of advanced data management strategies having surging demand for process optimization.

- Increasing multiple industry data sources across in-factory databases have increased the demand for big data analytics in the manufacturing sector, whereas complex operation and low return on investment from manufacturing analytics tools is hindering its market growth.

- Moreover, with the introduction of Industry 4.0, the production establishments took a step forward and implemented many IoT and IIoT solutions to get live feedback from factories and working environments.

Manufacturing Analytics Market Trends

This section covers the major market trends shaping the Manufacturing Analytics Market according to our research experts:

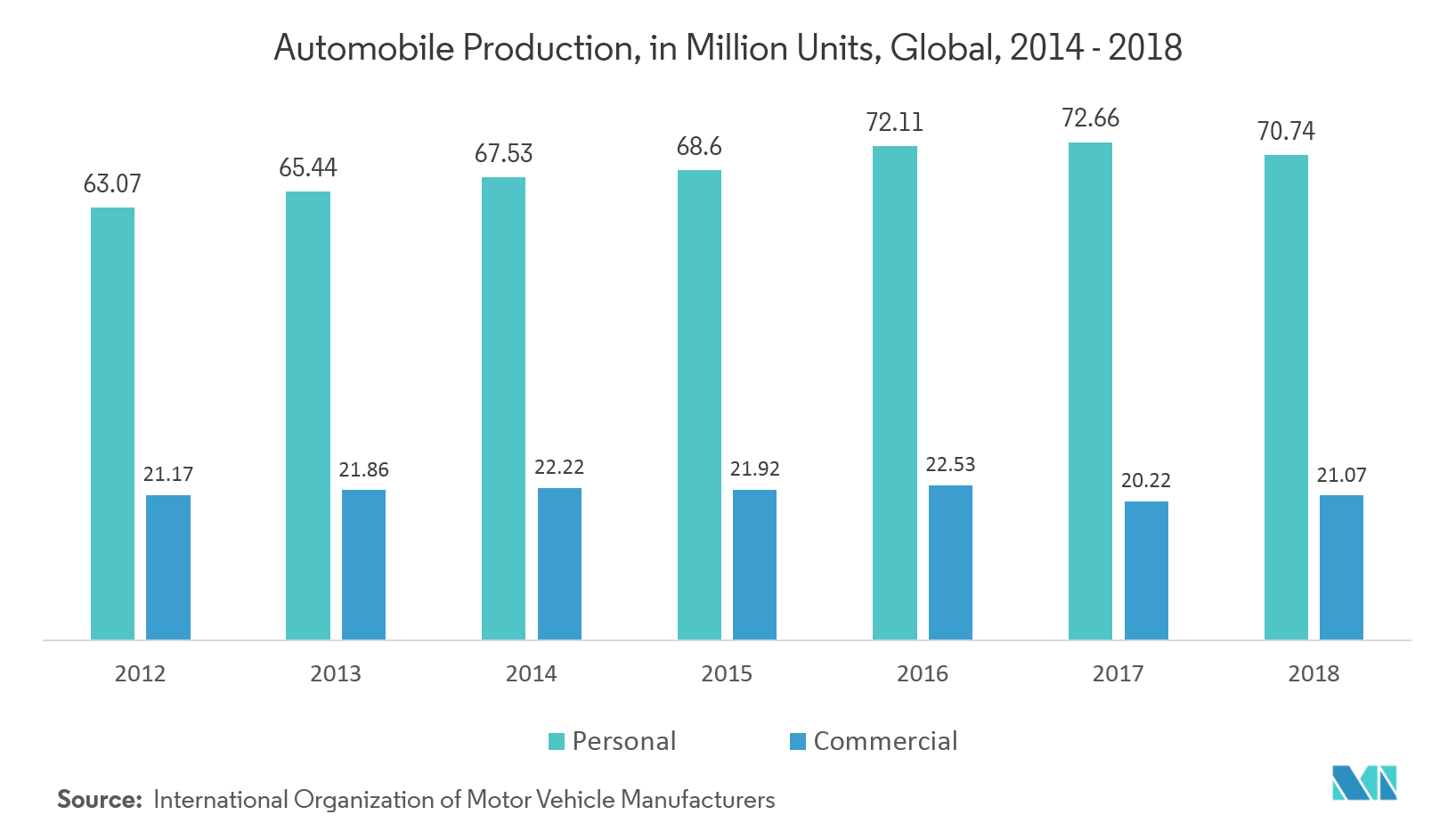

Automotive Sector is Expected to Grow at a Significant Rate

- The automotive industry is currently transitioning towards a more data-driven industry to avoid the costs associated with faulty assembly, over inventory stocking, and can plan for the maintenance of the assembly lines more accurately. It has all been possible due to the adoption of predictive analytics in the industry.

- With the emergence of industry IoT, a networked system, M2M communication the automotive industry is positioning itself towards industry 4.0 ready. Sensors, RFIDs, barcode readers, and robots are now standard in the industry’s manufacturing floor. These devices have increased the data generation points exponentially.

- Big data analytics, especially with the advancement of predictive analytics, is a growing at a tremendous rate and helps in centralizing the data across multiple sites so that the consistency of data is achieved during the manufacturing workflow across the automotive sector.

North America is Expected to be the Largest Market

- North America is the leading market due to increasing focus on innovations, as well as ongoing research, and development in manufacturing analytics technology for stable economic growth in the US and Canada.

- The early adoption of these tools among the manufacturing sector is an important factor behind the growth of the market in North America. With the significant presence of manufacturing sector especially heavy industries across the region is expected to be the front-runners in the growth of manufacturing analytics market.

- Moreover, the presence of some the prominent players of the manufacturing analytics market such as SAP SE, IBM Corporation, General Electric Company, TIBCO Software, among others across the North America region is driving the growth of the market during the forecast period.

Manufacturing Analytics Industry Overview

The manufacturing analyticsmarket is moderatelycompetitive and consists of severalplayers. In terms of market share, few of the major players currently dominate the market. Moreover, due to innovation across the cloud segment, most of the companies are increasing their market presence, thereby tapping customersacross the subsequent markets.

- April 2019 -TIBCO Software Inc.announced that it has enhanced its collaboration with Singapore Polytechnic (SP) to expand data analytics and Internet of Things (IoT) knowledge in the region, supporting Singapore’s mission to nurture local entrepreneurs. As part of the collaboration, SP and TIBCO will expand the network of universities in Singapore, TIBCO’s regional hub, offering initiatives that both drive innovation and position these institutions to add economic value.

- April 2019 -Alteryx Inc. announced its new office opening in Tokyo. The new office will support the success of hundreds of current customers in the country, including Honda and Toyo Engineering, and growing demand for its end-to-end analytics and data science platform in the broader APAC market. This office opening is indicative of the company’s 96% Y-o-Ygrowth in international markets for the full year, which accounted for 29%of overall revenue in2018.

Manufacturing Analytics Market Leaders

-

SAP SE

-

Oracle Corp.

-

SAS Institute Inc.

-

salesforce.com Inc. (Tableau Software Inc.)

-

TIBCO Software Inc.

*Disclaimer: Major Players sorted in no particular order

Manufacturing Analytics Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Adoption of BI and Advanced Data Management Strategies in Manufacturing Applications

- 4.3.2 Increasing Application of Industry 4.0 Across Various Segments of Manufacturing Industries

-

4.4 Market Restraints

- 4.4.1 High Initial Investment in the Transation of IIoT Across Industrial Region

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

-

4.6 Technology Snapshot

- 4.6.1 Machine Learning Algorithm (Contextual Analysis)

- 4.6.2 AI-Driven Recommendation (Smart Analytics)

- 4.6.3 Operational Dashboards (Data Visualization)

- 4.6.4 IoT & Streaming Analytics (Advanced Analytics)

- 4.6.5 Built-in Predictive Maintenance (Predictive Analytics)

- 4.6.6 Big Data Analytics (Deep Insights)

5. MARKET SEGMENTATION

-

5.1 By Deployment

- 5.1.1 Cloud-based

- 5.1.2 On-premise

-

5.2 By Appllication

- 5.2.1 Inventory Management

- 5.2.2 Supply Chain Optimization

- 5.2.3 Predictive Maintenance

- 5.2.4 Other Applications

-

5.3 By End-user Industry

- 5.3.1 Electronics

- 5.3.2 Oil & Gas

- 5.3.3 Automotive

- 5.3.4 Pharmaceutical

- 5.3.5 Food & Beverage

- 5.3.6 Other End-user Industries

-

5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Alteryx Inc.

- 6.1.2 TIBCO Software Inc.

- 6.1.3 SAS Institute Inc.

- 6.1.4 SAP SE

- 6.1.5 Salesforce.com Inc. (Tableau Software Inc.)

- 6.1.6 Oracle Corp.

- 6.1.7 Sisense Inc.

- 6.1.8 IBM Corp.

- 6.1.9 General Electric Company

- 6.1.10 Northwest Analytics Inc.

- 6.1.11 DXC Technology Company

- 6.1.12 QlikTech Inc.

- 6.1.13 Wipro Limited

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityManufacturing Analytics Industry Segmentation

Manufacturing analytics is used for gathering data from local or geographically distributed sources in the form of different data streams, that can be organized and structured to enable meaningful analysis. It helps in utilizing the existing production data by integrating and visualizing the data to further analyze it by using suitable data mining methods. Standalone manufacturing analytics solutions such as root-cause analysis, process debottleneck analysis, defect reduction initiatives among others, are considered under the scope of the market.

| By Deployment | Cloud-based |

| On-premise | |

| By Appllication | Inventory Management |

| Supply Chain Optimization | |

| Predictive Maintenance | |

| Other Applications | |

| By End-user Industry | Electronics |

| Oil & Gas | |

| Automotive | |

| Pharmaceutical | |

| Food & Beverage | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Manufacturing Analytics Market Research FAQs

What is the current Manufacturing Analytics Market size?

The Manufacturing Analytics Market is projected to register a CAGR of 24% during the forecast period (2024-2029)

Who are the key players in Manufacturing Analytics Market?

SAP SE, Oracle Corp., SAS Institute Inc., salesforce.com Inc. (Tableau Software Inc.) and TIBCO Software Inc. are the major companies operating in the Manufacturing Analytics Market.

Which is the fastest growing region in Manufacturing Analytics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Manufacturing Analytics Market?

In 2024, the North America accounts for the largest market share in Manufacturing Analytics Market.

What years does this Manufacturing Analytics Market cover?

The report covers the Manufacturing Analytics Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Manufacturing Analytics Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Manufacturing Analytics Industry Report

Statistics for the 2023 Manufacturing Analytics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Manufacturing Analytics analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.