Maritime Security Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 0.00 % |

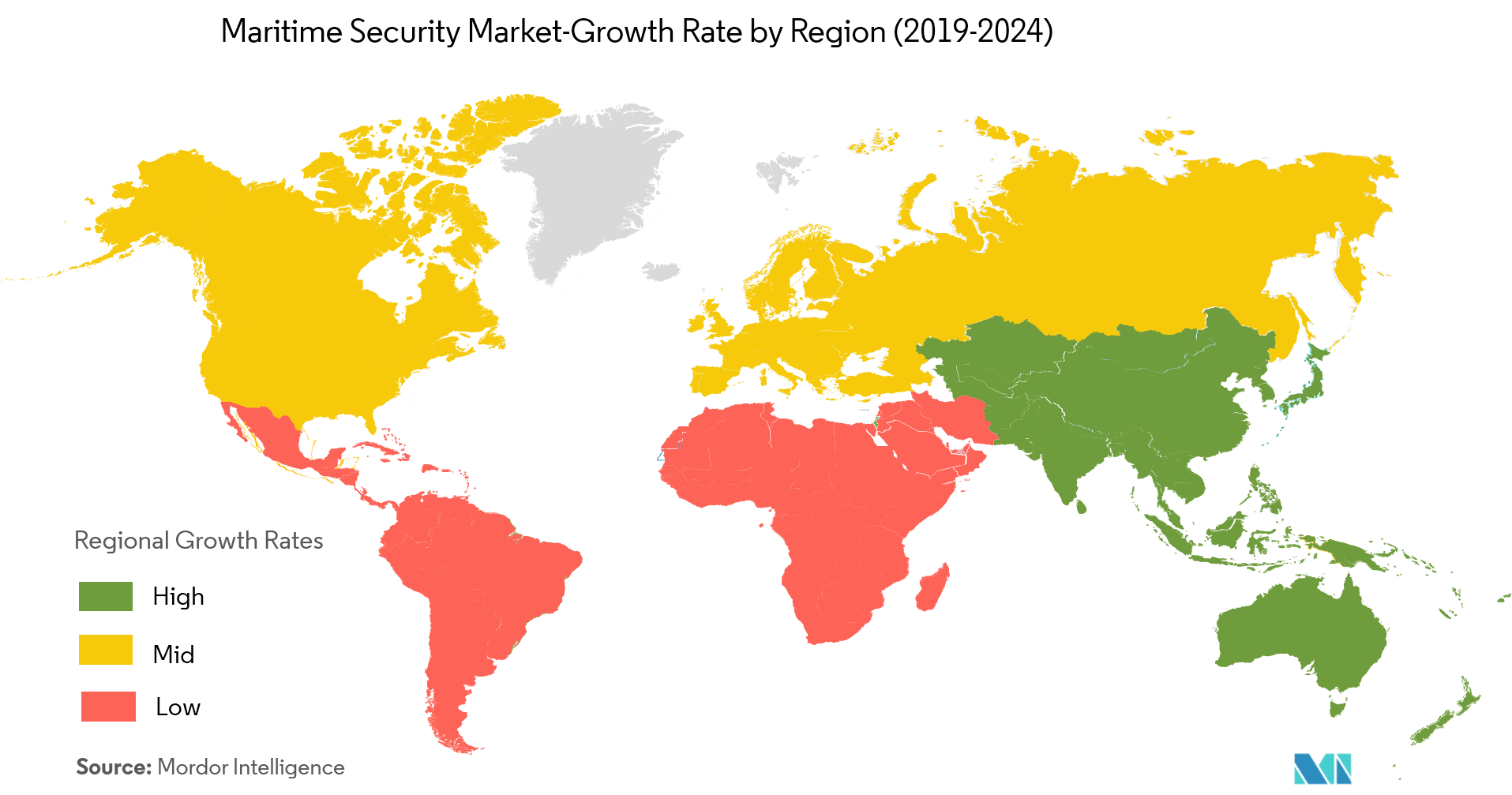

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Maritime Security Market Analysis

- In response to criminality and violence in the maritime sector, the shipping industry has increasingly relied on several models of maritime security to protect vessels and seafarers. This trend has resulted in a proliferation of weapons at sea, and various types of security measures, operating aboard seafaring ships.

- Maritime terrorism, drug trafficking, gun-running, piracy, and other non-traditional seaborne attacks, increased exponentially in the past decade and threatens many nations today. This state has given rise to a shift towards asymmetric forces, from the use of conventional force-structured defense forces. Maritime security is critical to national, as well as human, safety, and it is also linked to economic development, since it affects sea trade.

- Emerging economies in East Asia are acquiring more purchasing power and a need to secure increasing energy needs. As geopolitical control changed from the Atlantic to the Pacific, policy-makers in the EU sought to pay closer attention to the vast maritime region that lies in between the Indian Ocean. All significant sea-powers rely on the so-called Great Connector, that stretches from the Cape of Good Hope to the Strait of Malacca.

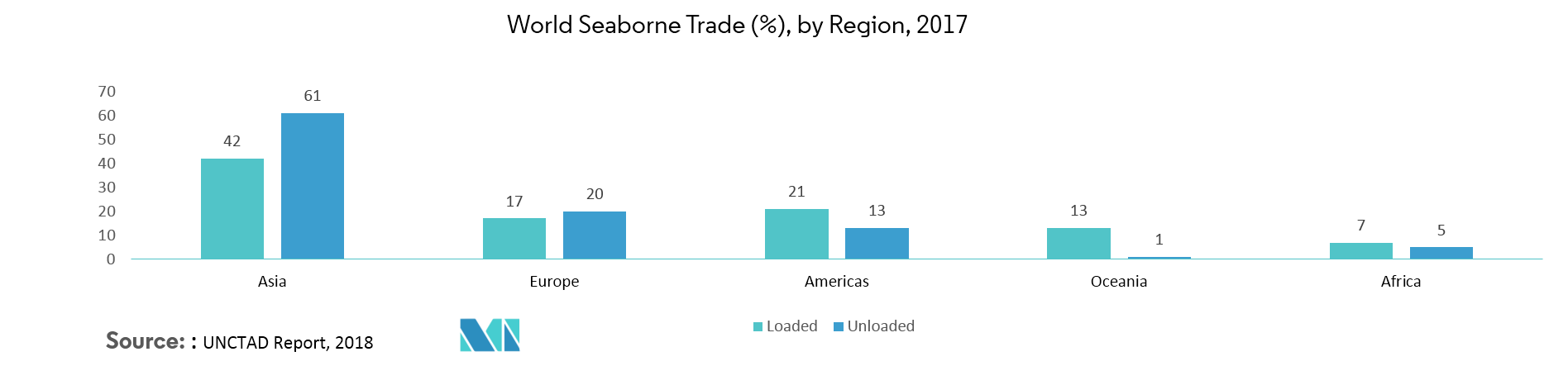

- According to the UNCTAD forecasts, in the Review of Maritime Transport, published in 2018, world seaborne trade increased in 2017, reaching 10.7 billion tons, reflecting an additional 110 million tons. This is expected to grow further in the current fiscal year.

- Further, there have been reports of links between cyberattacks and physical piracy, in which pirates have reportedly identified ships that carry valuable cargo and minimal onboard security, by infiltrating the systems of shipping companies. This has led to the emergence of developing a sound security system, with services such as a private communication channels, etc.

- The use of drones as surveillance support system is expected to gain a foothold in maritime security, and it can enhance the security with the exposure of threats during nighttime and testing weather conditions.

Maritime Security Market Trends

This section covers the major market trends shaping the Maritime Security Market according to our research experts:

Increased Seaborne Threats And Ambiguous Maritime Security Policies

- There have been reports of links between cyber attacks and physical piracy, in which pirates have reportedly identified ships that carry valuable cargo and minimal onboard security, by infiltrating the systems of shipping companies. This has led to the emergence of developing a sound security system, with services such as a private communication channel, etc.

- Maritime terrorism, drug trafficking, gun-running, piracy, and other non-traditional seaborne attacks, increased exponentially in the past decade and threatens many nations today. This state has given rise to a shift towards asymmetric forces, from the use of conventional force-structured defense forces. Maritime security is critical to national, as well as human, safety, and it is also linked to economic development since it affects sea trade.

- Post-Cold War, the maritime security ecosystem in the Indian Ocean transformed, and this has given rise to non-conventional security challenges in the Indian Ocean, such as piracy, human and drug trafficking, as well as maritime terrorism. Piracy operations on shipping and energy industries have impacted almost all ships navigating in the waters of the Indian Ocean, the Gulf of Guinea, and Southeast Asia.

- The security situation in the Horn of Africa is particularly bad. Violent insurgencies are frequent, in some sea routes, and they threaten the political and economic stability of neighboring nations. Lack of multi-nation maritime security strategy across oceans is making this naval force projection vulnerable.

- For instance, in September 2018, in the West Africa sea region, near Conakry Port, violent crime is reported periodically, and one such attack happened days after a robbery and kidnapping attempt, targeting a vessel at Conakry anchorage, in the early second week of September.

North America Has The Largest Share In The Market.

- The United States maritime domain is distinctive in its scope and diversity, with more than 95,000 miles of coastline, and 350 ports. Border operation teams with high integration of security solutions, in Canadian and US agencies, work together sharing information and expertise, to support operations along the United States and Canadian border. NORAD’s maritime warning mission provides a value-added contribution to the maritime defense and security of Canada and the United States in North America.

- The architecture of Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (C4ISR), has been enhanced with intelligence information sharing among the nations, in the wake of 9/11. North America, over the past few years, has taken giant leaps regarding technological advancement, with companies’ making approaches to add value to the market growth.

- In this region, the market is gaining more prospect by the risk analysis services, offered by the companies, i.e., data-driven risk analysis is the emerging application in risk identification, for high-risk and low-risk routes. This profoundly impacts the shipping costs and insurance premium, for shipping companies.

Maritime Security Industry Overview

The Maritime Security Market is highly concentrated as the Maritime Security deals with nations security the role played by small or many companies is reduced due to which the market is concentrated. Some of the key players in the Market include Northrop Grumman Corporation, BAE Systems Inc., Honeywell International Inc., Thales Group. Some key developments in the market are Saab signed a contract with ASC, to provide an upgraded Integrated Ship Control Management and Monitoring System (ISCMMS) to four Royal Australian Navy Collins class submarines. In this, it will deliver updated hardware, and spares, that address obsolescence issues, and maintain regional superiority edge, for Australian submarines in March 2018. Saab announced the establishment of development and production, in Abu Dhabi. Through this capability center, the company grows its presence in the United Arab Emirates (UAE). The center is aimed at the production of a variety of defense and security products, with an initial focus on sensor systems in December 2017.

Maritime Security Market Leaders

-

Saab AB

-

Northrop Grumman Corporation

-

BAE Systems Inc.

-

Honeywell International Inc.

-

Kongsberg Gruppen

*Disclaimer: Major Players sorted in no particular order

Maritime Security Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increased Seaborne Threats And Ambiguous Maritime Security Policies

- 4.3.2 Increasing Adoption Of Security Technologies In Bric Countries

-

4.4 Market Restraints

- 4.4.1 High Risk Rate In Ungoverned Zones

- 4.4.2 Unstructured Security Standards And Technologies

- 4.5 Value Chain / Supply Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Screening and Scanning

- 5.1.2 Communications

- 5.1.3 Surveillance and Tracking

- 5.1.3.1 Underwater Surveillance

- 5.1.3.2 Video Surveillance

- 5.1.3.3 Radar

- 5.1.3.4 Other Surveillance and Tracking Types

- 5.1.4 Detectors

- 5.1.4.1 RFID

- 5.1.4.2 Laser Finders

- 5.1.5 Other Detectors Type

-

5.2 By End User

- 5.2.1 Coast Guard

- 5.2.2 Military

- 5.2.3 Other End Users

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 SAAB Group

- 6.1.2 Thales Group

- 6.1.3 ESC Global Security

- 6.1.4 Honeywell International Inc.

- 6.1.5 Harris Corporation

- 6.1.6 Selex ES

- 6.1.7 Northrop Grumman Corporation

- 6.1.8 Elbit Systems Ltd

- 6.1.9 Signalis GmbH

- 6.1.10 BAE Systems Inc.

- 6.1.11 Terma AS

- 6.1.12 Sonardyne International Ltd

- 6.1.13 Kongsberg Gruppen

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityMaritime Security Industry Segmentation

Maritime security is frequently defined as the protection from threats to the freedom or good order at sea. Issues clustered under the notion of maritime security include crimes such as piracy, armed robbery at sea, trafficking of people and illicit goods, illegal fishing or pollution.

| By Type | Screening and Scanning | |

| Communications | ||

| Surveillance and Tracking | Underwater Surveillance | |

| Video Surveillance | ||

| Radar | ||

| Other Surveillance and Tracking Types | ||

| Detectors | RFID | |

| Laser Finders | ||

| Other Detectors Type | ||

| By End User | Coast Guard | |

| Military | ||

| Other End Users | ||

| Geography | North America | |

| Europe | ||

| Asia Pacific | ||

| Latin America | ||

| Middle East and Africa |

Maritime Security Market Research FAQs

What is the current Maritime Security Market size?

The Maritime Security Market is projected to register a CAGR of 0% during the forecast period (2024-2029)

Who are the key players in Maritime Security Market?

Saab AB, Northrop Grumman Corporation, BAE Systems Inc., Honeywell International Inc. and Kongsberg Gruppen are the major companies operating in the Maritime Security Market.

Which is the fastest growing region in Maritime Security Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Maritime Security Market?

In 2024, the North America accounts for the largest market share in Maritime Security Market.

What years does this Maritime Security Market cover?

The report covers the Maritime Security Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Maritime Security Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Maritime Security Industry Report

Statistics for the 2024 Maritime Security market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Maritime Security analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.