Mass Transit Security Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| CAGR | 8.70 % |

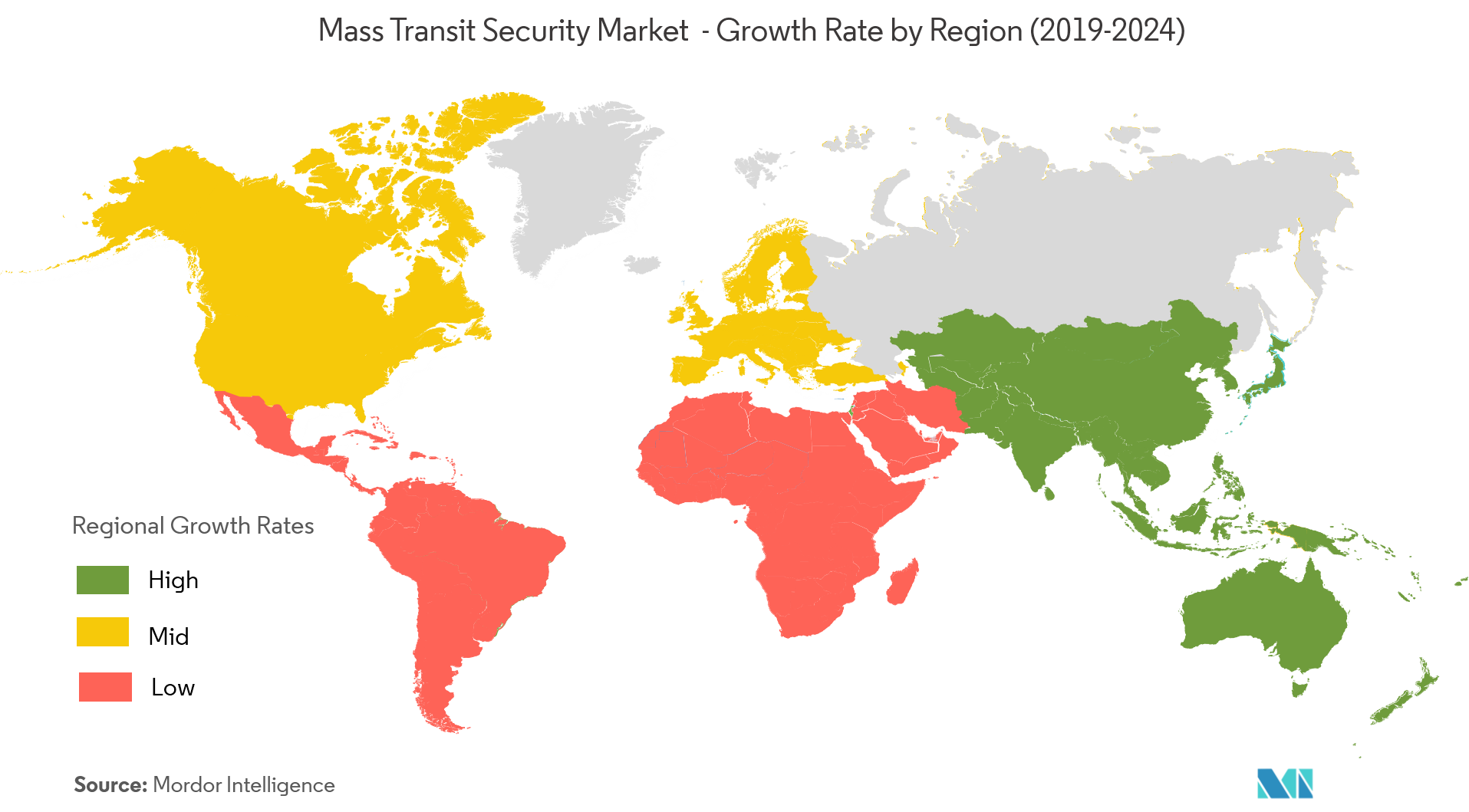

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Mass Transit Security Market Analysis

The mass transit security market is anticipated to register a CAGR of over 8.7% over the forecast period (2021 - 2026). Transportation is critical infrastructure, disruption or destruction of its systems or assets can have a negative and disastrous effect on the public health and safety and the economic status of a country.

- The growing concerns regarding terror attacks and crimes have increased the requirement for infrastructural development in the mass transit security market. Technologies, such as video surveillance and voice recognition, are being used across a number of transportation hubs for the purpose of surveillance and identification.

- Over the years, there has also been the introduction of various scanners, which detect specific compounds and solutions, for instance, the Department of Homeland Security (DHS) has been exploring the expansion of passenger and luggage screening at various railway networks globally.

- Airports account for a significant share of demand for mass transit solutions and are expected to continue its dominance over the forecast period, owing to the robust rise in the number of airports and consequent air passenger traffic. Increased air passenger traffic might lead to a rise in threats to passengers because of the higher chances of unacceptable practices and passenger threats.

Mass Transit Security Market Trends

This section covers the major market trends shaping the Mass Transit Security Market according to our research experts:

Increase in Air Traffic is Anticipated to Generate Demand in Airways Segment

- The transit security in airways includes perimeter security, command, control and integration, cybersecurity, communications, surveillance, access control, and screening. Of these, the majority of developments are expected to take place in the screening, big data markets and these sectors are particularly witnessing upgrades and new investments as part of the airport security market.

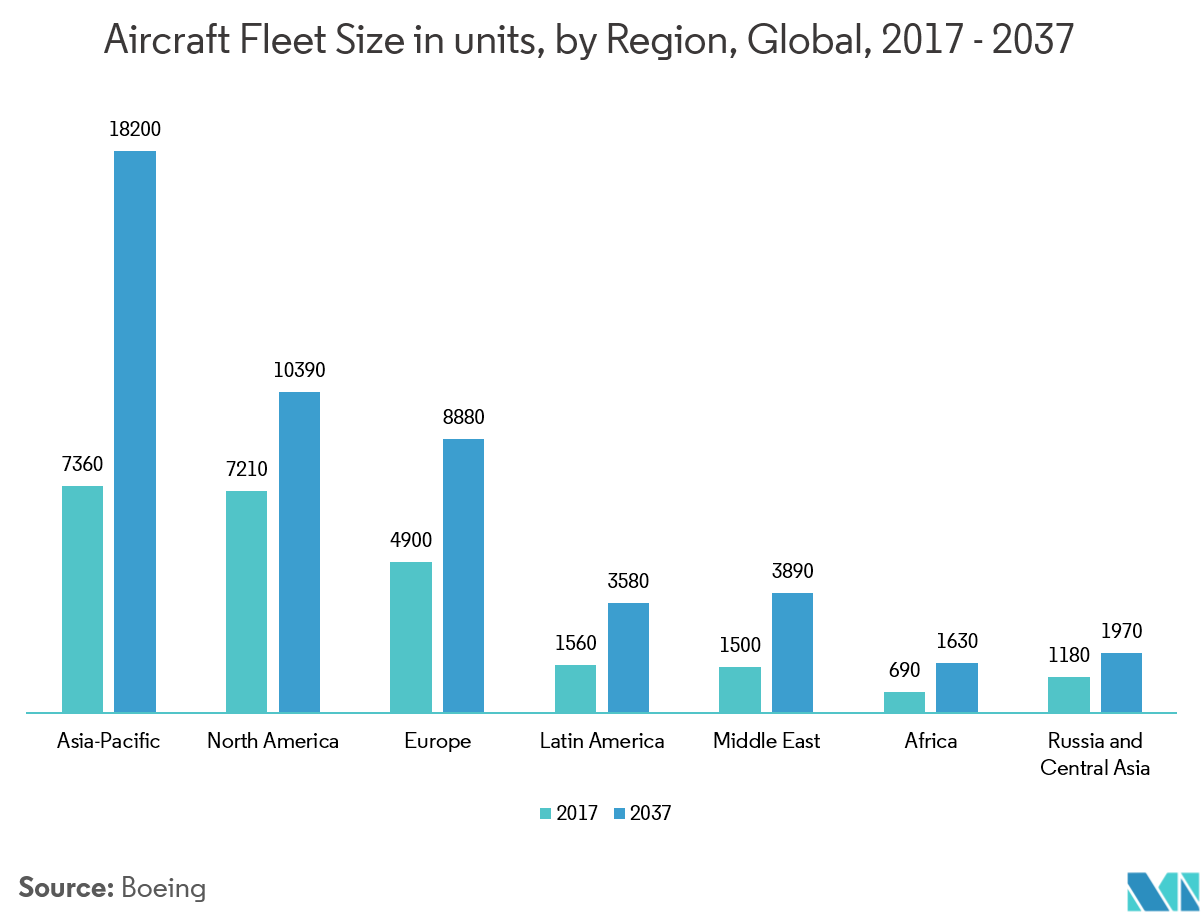

- Aircraft fleet is expected to increase over the years. All regions including Asia-Pacific, North America, Europe, Latin America, Middle East, Africa, and Russia and Central Asia are expected to witness this rise.

- While air fleet size and passenger traffic are expected to rise significantly over the forecast period, it makes airports more prone to security threats such as bombs, loots, and robberies, etc. Therefore, with increasing passenger traffic in aircraft, airports are intensely focusing on security in the airport premises.

- According to the International Air Traffic Association (IATA), over 4,378 million number of passengers have traveled through airways in 2018, and 63.3 million tonnes of freight was transported through airways in the same period.

- Acknowledging the UN’s Security Council Resolution 2309, IATA passed a resolution on aviation security during the 73rd annual general meeting (AGM), held in May 2017, which requires all aviation stakeholders to develop a revolutionary framework to secure the air travel for passengers and crew.

- Further, International authorities such as ICAO, IATA, and ACI believe that the current airport security model is not efficient enough to tackle the threats raised by terrorism across the globe and needs to be addressed effectively, as enhancing the security of civil aviation is the first priority.

North America to Hold a Significant Share

- The increasing number of passengers and freight from across the globe to the North American region has demanded the need for transit security at airports, ports, railway stations, and bus stations. According to US Customs and Border Protection, more than 11 million maritime containers arrive at its seaports. At land borders, another 11 million arrive by truck and 2.7 million by rail. To ensure public safety at these places the countries in the region are deploying video surveillance systems, security screening systems, narcotic detectors, etc.

- Increasing air freight traffic in the region is also providing significant opportunities for the market studied over the forecast period. According to the StatCan, in 2017, approximately 1.31 million metric ton of air freight was loaded and unloaded at Canadian airports. In order to deal with such cases, the Canadian Air Transport Security Authority uses Itemiser DX desktop explosives trace detection systems from Morpho Detection.

- Also, the increasing concerns of drug trafficking are rising demand for enhanced security in the region. Recently, there are various cases of drug trafficking at airports in places such as Dallas and various others, where smugglers were found to be exporting banned drugs out of the airport by dubious means.

- According to the World Drug Report, 2017 by the International Narcotics Control Board (INCB) and UNODC, illegal fentanyl and heroin exports from Mexico to the United States are on the rise. US Customs and Border Protection officers seized USD 180,000 worth of narcotics in 2018. Alarmed at the increasing attempts to smuggle out banned drugs, the adoption of narcotics scanner is likely to increase in such places. This, in turn, is expected to influence the demand for the mass transit security market over the forecast period.

Mass Transit Security Industry Overview

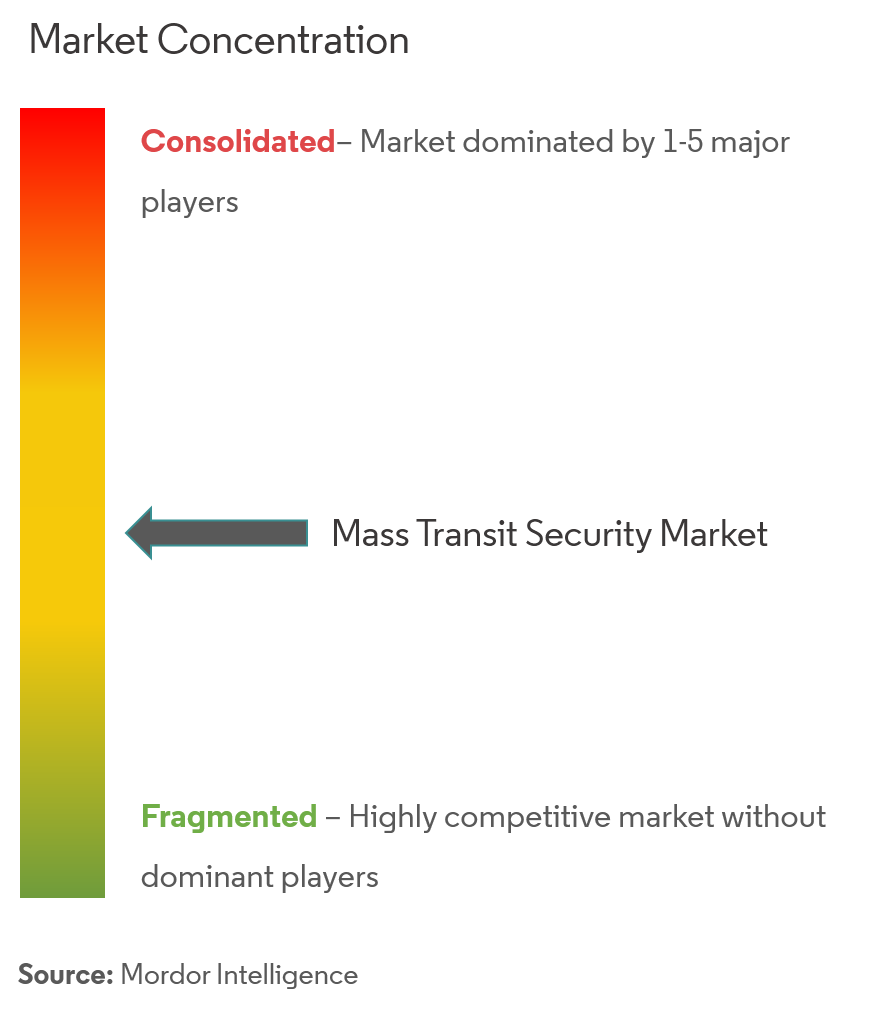

The mass transit security systems market is moderately fragmented due to the presence of many small and large vendors. The major vendors have the benefit of the experience and scale of project undertaken over relatively new vendors. Collaboration with the infrastructure and technological ecosystem provider is critical in the amrket. The market is gaining traction and is expected to grow over the forecast period. To survive this intensely competitive environment, vendors are strategically innovating to distinguish their products and services offered, through clear and unique value propositions. The market is expected to see the intensified competition with an increase in product/service extensions, technological innovations, and mergers and acquisitions.

- November 2018 -Smiths Detection and its local distributor, Eastronics, have been selected by the Israel Airport Authority (IAA) to supply 32 advanced checkpoint lanes for Ben Gurion Airport and the new Ramon International Airport, which is due to open in 2019.

- February 2018 -Astrophysics Inc. announced a partnership withSynapse Technology Corporation. Through this partnership, the company announced to offer their XIS-6040 with integrated AI software Syntech SOLUTION, capable of detecting handguns and knives.

Mass Transit Security Market Leaders

-

Smiths Detection Inc.

-

L-3 Communications Holdings, Inc.

-

Bosch Security Systems Inc.

-

Panasonic Security Systems Inc.

-

Nice Systems, Inc.

*Disclaimer: Major Players sorted in no particular order

Mass Transit Security Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Constant Need for Public Safety Solutions

- 4.3.2 Massive Transportation Infrastructural Development

- 4.3.3 Ongoing Adoption of Smart Transportation

-

4.4 Market Restraints

- 4.4.1 High Intial Investment and Infrastructure Cost

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Transportation

- 5.1.1 Airways

- 5.1.2 Waterways

- 5.1.3 Railways

- 5.1.4 Roadways

-

5.2 By Application

- 5.2.1 Video Surveillance

- 5.2.2 Passenger & Baggage Screening system

- 5.2.3 Cargo Inspection System

- 5.2.4 Perimeter Intrusion Detection

- 5.2.5 Fire Safety & Detection System

- 5.2.6 Tracking and Navigation

- 5.2.7 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Smiths Detection, Inc.

- 6.1.2 Security Electronic Equipment Co. Ltd.

- 6.1.3 L-3 Communications Holdings, Inc.

- 6.1.4 Rapiscan Systems

- 6.1.5 OSI Systems Inc.

- 6.1.6 Analogic Corporation

- 6.1.7 Nuctech Company Limited

- 6.1.8 Axis Communications AB

- 6.1.9 Bosch Security Systems Inc.

- 6.1.10 Panasonic Security Systems, Inc.

- 6.1.11 Tyco International PLC

- 6.1.12 IndigoVision Group PLC

- 6.1.13 Nice Systems, Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityMass Transit Security Industry Segmentation

The mass transit security ensures the safety of goods, products, and people in addition to the associated infrastructure while traveling and else. Applications such as video surveillance, passenger and baggage screening, cargo inspection system, perimeter intrusion detection, and fire safety and detection are considered in the scope of the study. While, applications such as access control, nuclear and radiological are considered under other applications.

| By Transportation | Airways | |

| Waterways | ||

| Railways | ||

| Roadways | ||

| By Application | Video Surveillance | |

| Passenger & Baggage Screening system | ||

| Cargo Inspection System | ||

| Perimeter Intrusion Detection | ||

| Fire Safety & Detection System | ||

| Tracking and Navigation | ||

| Other Applications | ||

| Geography | North America | US |

| Canada | ||

| Geography | Europe | Germany |

| UK | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | |

| Middle East & Africa |

Mass Transit Security Market Research FAQs

What is the current Mass Transit Security Market size?

The Mass Transit Security Market is projected to register a CAGR of 8.70% during the forecast period (2024-2029)

Who are the key players in Mass Transit Security Market?

Smiths Detection Inc., L-3 Communications Holdings, Inc., Bosch Security Systems Inc., Panasonic Security Systems Inc. and Nice Systems, Inc. are the major companies operating in the Mass Transit Security Market.

Which is the fastest growing region in Mass Transit Security Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Mass Transit Security Market?

In 2024, the North America accounts for the largest market share in Mass Transit Security Market.

What years does this Mass Transit Security Market cover?

The report covers the Mass Transit Security Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Mass Transit Security Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Mass Transit Security Industry Report

Statistics for the 2024 Mass Transit Security market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Mass Transit Security analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.