MEMS Gyroscope Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 9.48 % |

| Fastest Growing Market | North America |

| Largest Market | North America |

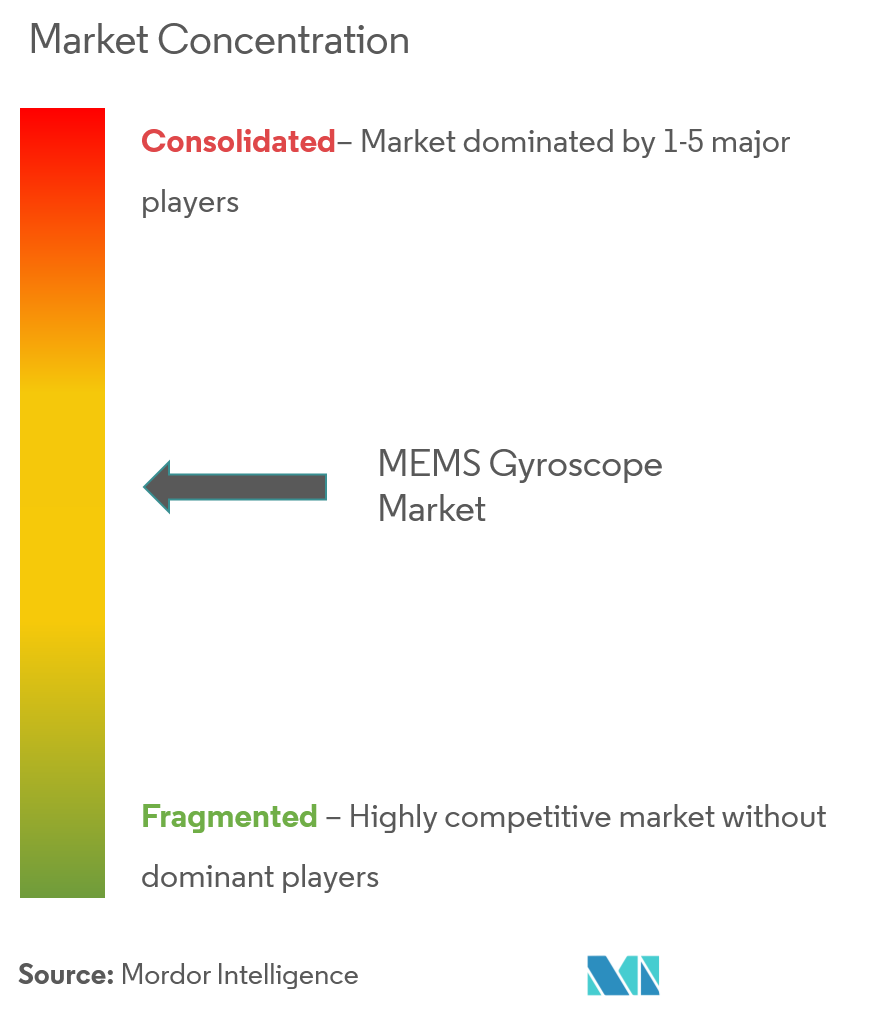

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

MEMS Gyroscope Market Analysis

The MEMS gyroscope market is expected to witness a CAGR of 9.48% during the forecast period (2021- 2026). MEMS gyroscopes are incorporated in several electronic devices, such as digital camcorders, video cameras, digital cameras, personal media players, notebook PCs, and video games.

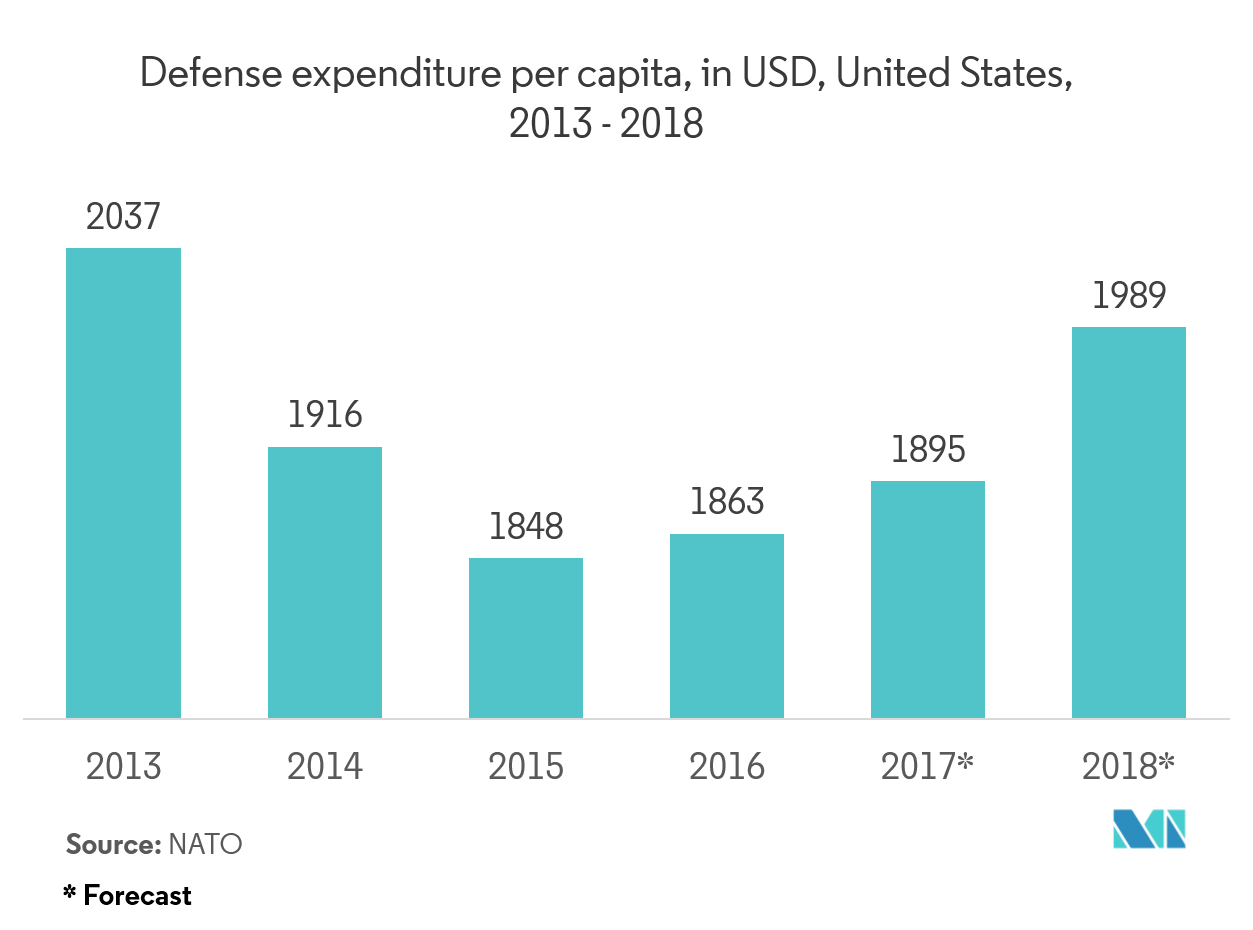

- The gyroscope market is primarily driven by increased defense expenditure, across the world. According to SIPRI, global military spending remains very high at USD 1.7 trillion. With increased expenditure, the various military organizations are poised to adopt the latest technology in order to enhance efficiency.

- There has been an increased proliferation of mobile devices. MEMS gyroscope facilitates a high level of motion sensing accuracy required in smartphones. Thus, the increased demand for smartphone is positively impacting the adoption rate of MEMS gyroscope sensors.

MEMS Gyroscope Market Trends

This section covers the major market trends shaping the MEMS Gyroscope Market according to our research experts:

Automotive and Aerospace Sector is Expected to Hold the Major Market Share

- Vehicle dynamic control (VDC) system consists of a gyroscope, a low-g accelerometer, and wheel-speed sensors at each wheel (the ABS can also use the wheel-speed sensors). Wheel speed is measured, and the predicted turn rate of the car is compared with that measured by the gyroscope.

- Rollover detection systems use a gyroscope to detect the roll rate. An accelerometer reading vertical acceleration (Z-axis) is also required because large roll angles can be encountered in banked curves with no possibility of a rollover.

- Navigation system relies on compass and GPS information when the system is first started. The direction of travel is then matched up with map data to give the system more certainty regarding direction. With the adoption of GPS navigation systems, customers are most likely to shift to Gyroscope-powered GPS in order to get accurate readings.

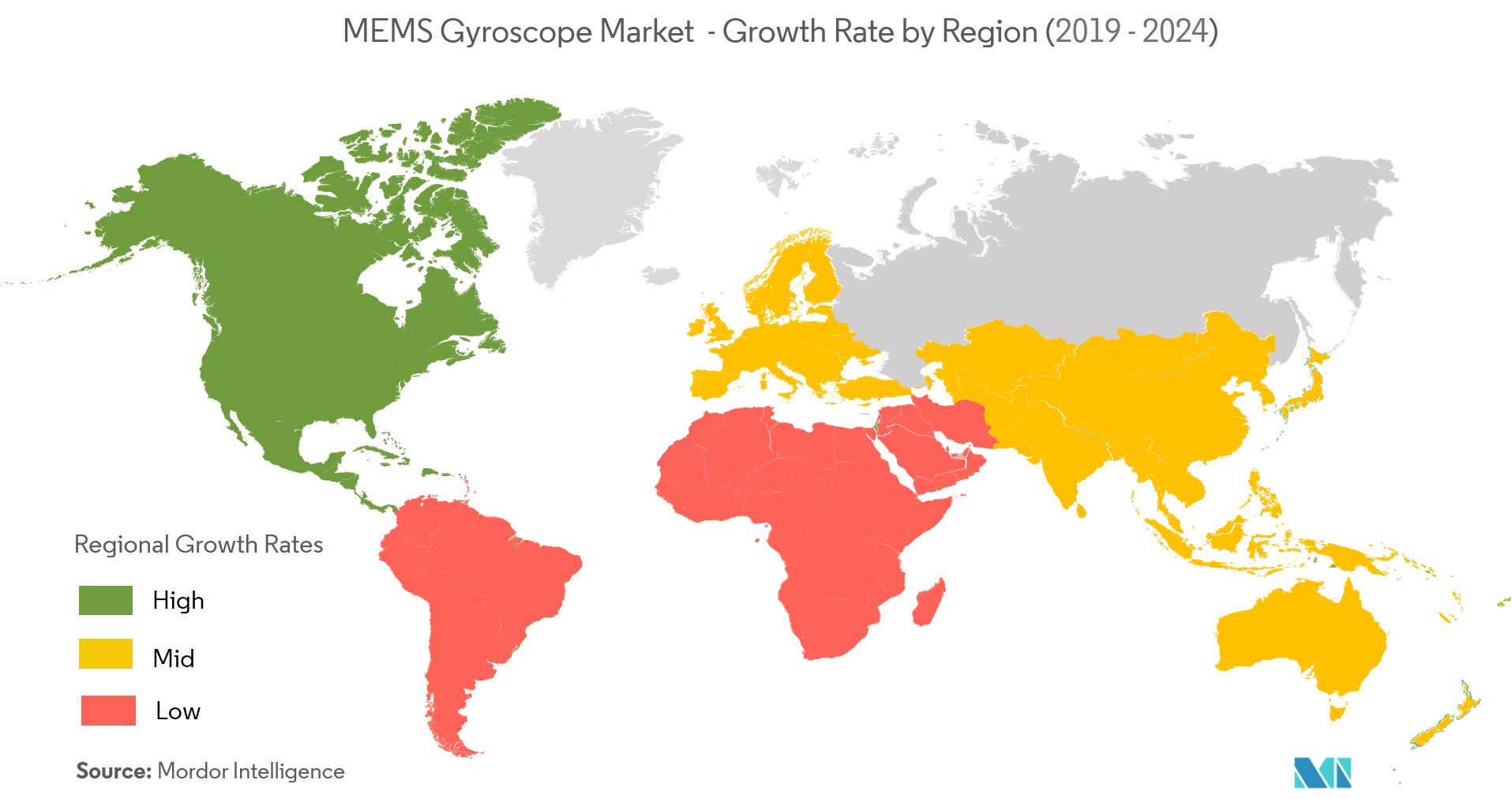

North America is Expected to Hold the Major Market Share

- Gyroscope technologies are primarily being developed in the North American region. Driven by government regulations for safety and emissions, the introduction of high-end options in modern vehicles by major automobile manufacturers and consumer demand for safety, comfort, infotainment applications, and fuel efficiency, automotive electronics content per vehicle is on the rise. As the electronics content is increasing in automobiles, the number of automotive sensors used in vehicles is also increasing.

- Primarily, the government regulations in North America drive the demand for automobile safety features that range from passive to integrated active and passive safety systems. These developments are driving increased demand for applications, such as tire pressure monitoring, electronic stability control, occupant detection, and advanced driver assistant systems.

- MEMS Gyroscope has enabled exciting applications in portable devices, including optical image stabilization for camera performance improvement, the user interface for additional features and ease of use, and gaming for more exciting entertainment. As North America is the biggest market for consumer electronics, the adoption rate of MEMS gyroscope is expected to follow the same trend.

MEMS Gyroscope Industry Overview

The MEMS gyroscope market is moderatelycompetitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. Manufacturers are introducing innovative features to gain a competitive advantage. They are marketing their products with specific features to attract customers.

- February 2019: Bosch Sensortec launched ideation community to foster and accelerate innovative IOT applications.Bosch Sensortec further invited anyone interested in learning about the new community to visit the Bosch Boothat embedded world in Nuremberg.

- January 2019:At CESin Las Vegas, Nevada, Bosch Sensortec announced the BMI270, an ultra-low power smart Inertial Measurement Unit (IMU) specifically targeted at wearable applications. It offers a strongly improved accelerometer offset and sensitivity performance, enabled by the newest Bosch MEMS process technology.

MEMS Gyroscope Market Leaders

-

Analog Devices Inc.

-

Bosch Sensortec GmbH

-

InvenSense Inc. (TDK)

-

STMicroelectronics N.V.

-

Murata Manufacturing Co., Ltd.

*Disclaimer: Major Players sorted in no particular order

MEMS Gyroscope Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increased Proliferation of Smartphones

- 4.3.2 Increased Defense Expenditure

-

4.4 Market Restraints

- 4.4.1 High Up-front Costs Involved

-

4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Application

- 5.1.1 Consumer Electronics (Mobile Devices, Handheld Gaming Consoles, Cameras)

- 5.1.2 Automotive and Aerospace

- 5.1.3 Other Applications (Industrial, Healthcare)

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Analog Devices Inc.

- 6.1.2 Bosch Sensortec GmbH

- 6.1.3 InvenSense Inc. (TDK)

- 6.1.4 STMicroelectronics N.V.

- 6.1.5 Murata Manufacturing Co., Ltd.

- 6.1.6 KIONIX Inc. (ROHM)

- 6.1.7 ASC GmbH

- 6.1.8 Rion Technology Co. Ltd.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityMEMS Gyroscope Industry Segmentation

Traditional spinning gyroscopes work on the basis that a spinning object that is tilted perpendicularly to the direction of the spin will have a precession. The precession keeps the device oriented in a vertical direction so the angle relative to the reference surface can be measured.

| By Application | Consumer Electronics (Mobile Devices, Handheld Gaming Consoles, Cameras) |

| Automotive and Aerospace | |

| Other Applications (Industrial, Healthcare) | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

MEMS Gyroscope Market Research FAQs

What is the current MEMS Gyroscope Market size?

The MEMS Gyroscope Market is projected to register a CAGR of 9.48% during the forecast period (2024-2029)

Who are the key players in MEMS Gyroscope Market?

Analog Devices Inc., Bosch Sensortec GmbH, InvenSense Inc. (TDK), STMicroelectronics N.V. and Murata Manufacturing Co., Ltd. are the major companies operating in the MEMS Gyroscope Market.

Which is the fastest growing region in MEMS Gyroscope Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in MEMS Gyroscope Market?

In 2024, the North America accounts for the largest market share in MEMS Gyroscope Market.

What years does this MEMS Gyroscope Market cover?

The report covers the MEMS Gyroscope Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the MEMS Gyroscope Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

MEMS Gyroscope Industry Report

Statistics for the 2024 MEMS Gyroscope market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. MEMS Gyroscope analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.