Mexico Automotive Parts Aluminum Die Casting Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 7.50 % |

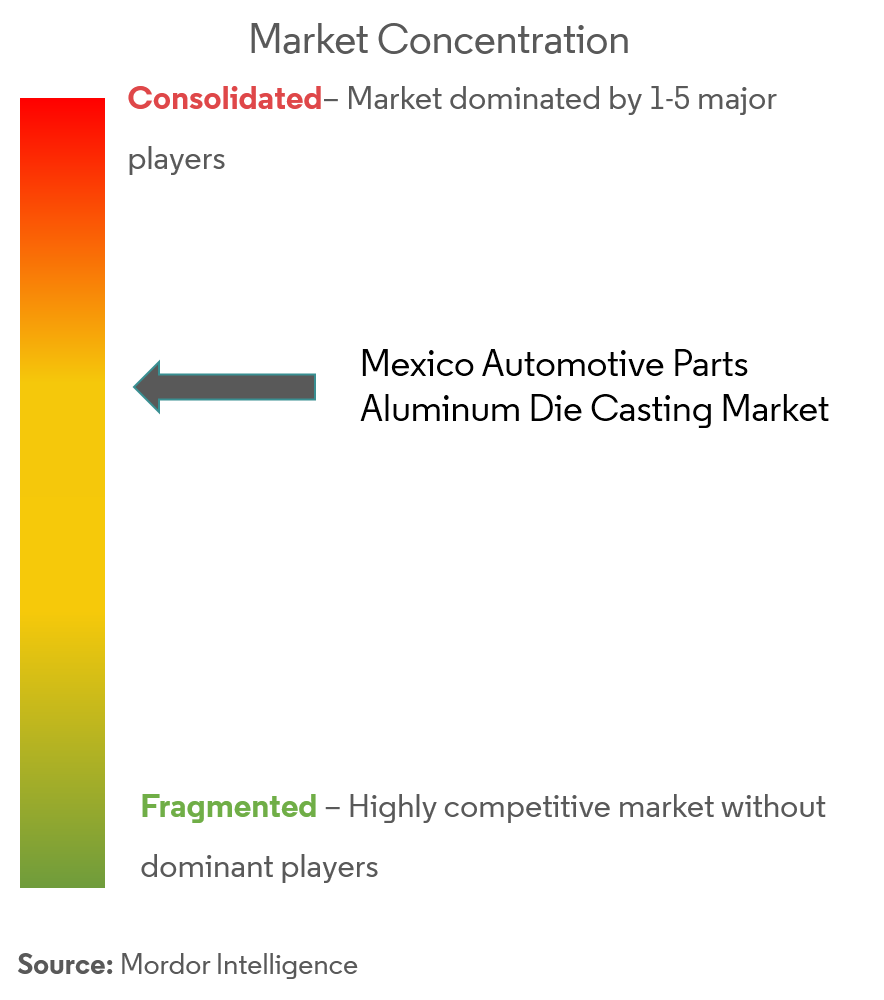

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Mexico Automotive Parts Aluminum Die Casting Market Analysis

The Mexico Automotive Parts Aluminum Die Casting Market is expected to register a CAGR of 7.5%.

Mexico is the seventh-largest producer of aluminum castings in the world. Aluminum die casting accounts for about 80% of the overall automotive parts die castings in the country. Mexico is developing in terms of metalworking industry processes, which is an industry directly linked to car and auto parts manufacturing.

The aluminum die casting industry is growing at a considerate rate in Nuevo Leon, Estado de Mexico, Distrito Federal, Coahuila, and Baja California regions.

The overall Mexican aluminum industry has been growing steadily, at a 13% annual rate, since 2011, and produces around 1.6% of the global production. The aluminum industry is of great importance to the Mexican economy, as the industry contributes to about USD 7 billion to the nation's GDP. The Mexican aluminum industry is likely to welcome technologies that can increase the capacity of recycling scrapped aluminum products, thus strengthening the overall value chain.

Mexico Automotive Parts Aluminum Die Casting Market Trends

This section covers the major market trends shaping the Mexico Automotive Parts Aluminum Die Casting Market according to our research experts:

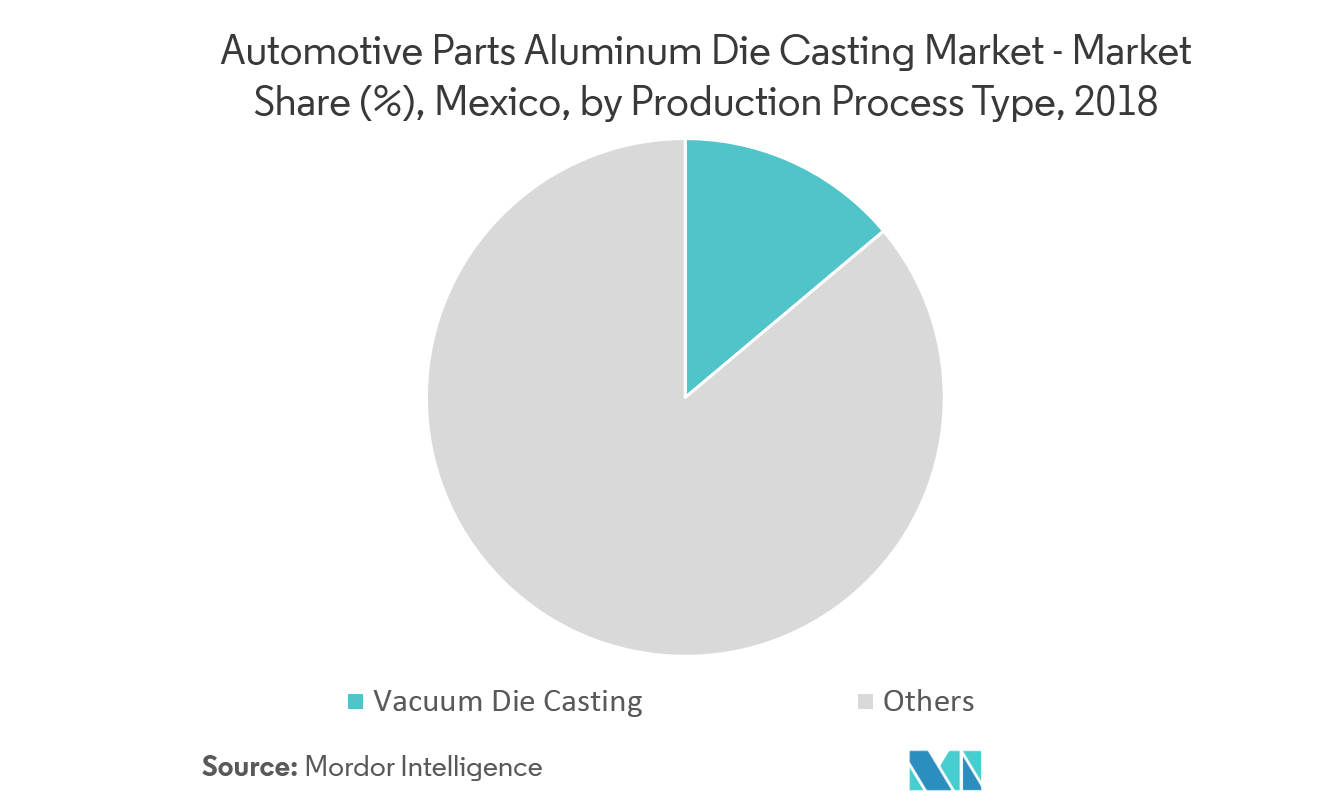

Vacuum Die Casting Process Growing at a Higher CAGR

There have been significant developments and improvements in the conventional die casting process. Currently, the ultra-high-vacuum die casting process is applied for producing large and thin component parts, such as space-frames and pillars, which are usually welded to automobile chassis.

Electrical and hydraulic components in an automobile, work simultaneously. Reliability and quality are given prime importance in transmission parts. The transmission system in an automobile is a complex combination of mechanical functions. It is prone to extreme conditions and environments. This enhances the importance of integrity. Valve bodies, stators, and clutch pistons are some of the commonly die casted transmission parts in the automotive industry.

It has been accepted that, ultra-vacuum die casting produces better weldable automotive products than most of the die casting processes. However, products produced in this process are large and require huge-sized die casting machine, like 2,500-4,000 metric ton of die clamping force. This impacted the popularity of the ultra-high-vacuum die casting process among OEMs and large die casters.

However, vacuum die casting production process eliminates the air from the mold and allows the front of molten metal to merge freely without forming any shuts or pores, which is major issue in pressure die casting process.

A sudden shift from pressure die casting to vacuum may not be possible due to the higher productivity and ease of manufacture of the automotive die casting parts, which employ pressure die casting method. However, this change is gradual and expected to continue to increase, during the forecast period.

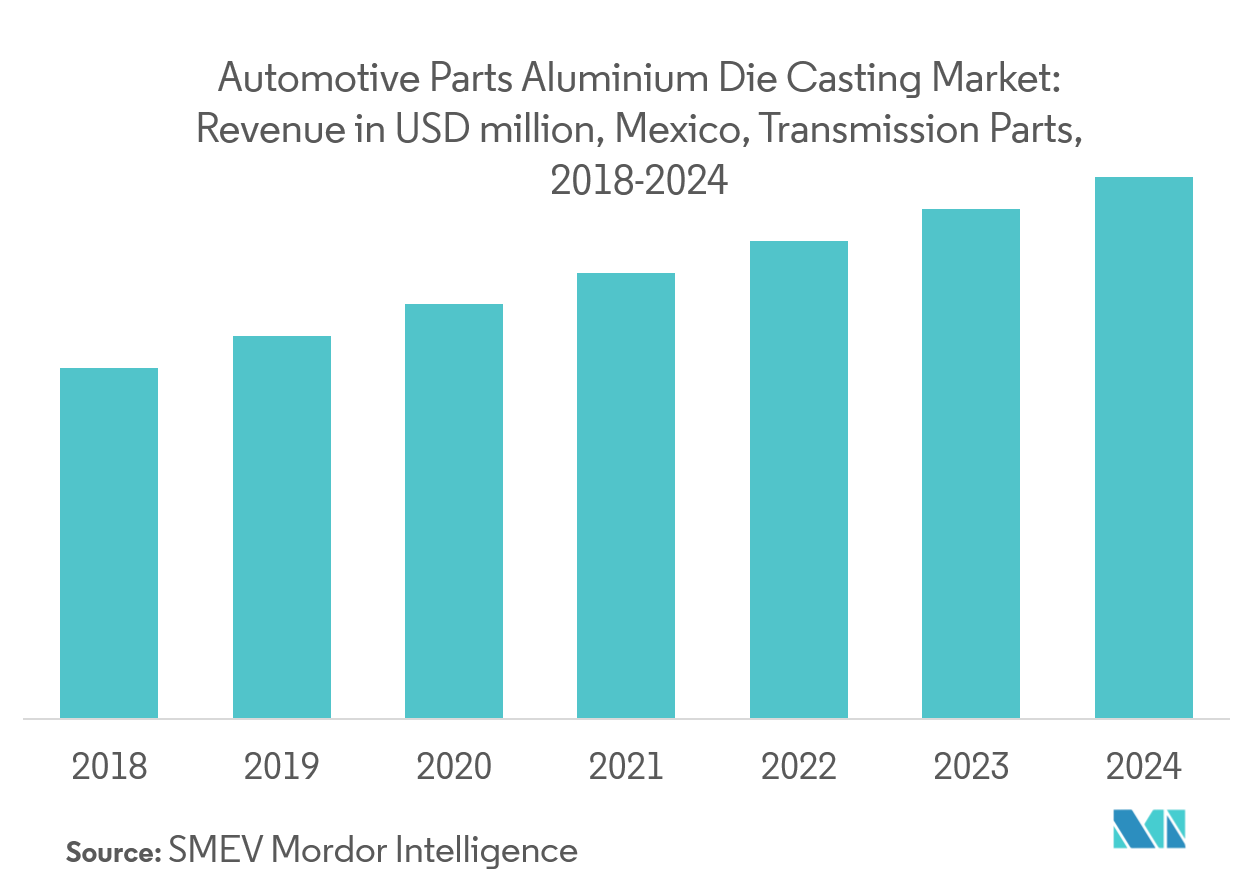

Increase Adoption of Aluminum in Transmission Parts

Electrical and hydraulic components in an automobile work simultaneously. Reliability and quality are of utmost importance in transmission parts. The transmission system in an automobile is a complex combination of mechanical functions. It is prone to extreme conditions and environments, making the integrity a very high priority. Valve bodies, stators, and clutch pistons are some of the commonly die casted transmission parts in the automotive industry.

Employing vacuum has become the latest trend in the manufacture of transmission valve bodies, in order to restrict the porosity to the minimum. Blue Ridge has come up with a complex turbine with vanes, optimized for efficient fluid flow. This construction structure provides a seal, capable of both die expansion and controlling pressure of molten metal between moving members of the die, for a better end product.

Die casters are found to employ advanced die design, along with utilizing simulation techniques and power venting systems. These, coupled with thermal analysis of the die casting, are expected to produce clutch pistons catering to the specific concerns of piston use and assembly.

Mexico Automotive Parts Aluminum Die Casting Industry Overview

Some of the major aluminium die casted parts manufacturers in Mexico include Nemak, Bocar, and Dynacast. These companies are focusing on expanding their production capacity, in order to not only cater to the domestic needs, but also to export them to Europe and East Asia markets.

In 2017, Nemak opened a new high-pressure die casting plant in Monterrey, Mexico. The company produces aluminum automotive components, like engine blocks, transmission cases, and structural components. It invested nearly USD 200 million in the establishment of the new plant.

Owing to the growing Mexican automotive industry, the presence of tier 1, tier 2, and tier 3 suppliers have been increasing significantly. The number reached more than 400 suppliers in the country, as of 2017. With the rising trend of lightweight and robust automotive parts, the above suppliers are likely to adopt aluminum parts manufactured through HPDC, during the forecast period.

Mexico Automotive Parts Aluminum Die Casting Market Leaders

-

Dynacast

-

Nemak

-

Bocar, S.A. de C.V.,

-

Ryobi Die Casting

-

Sandhar Technologies Limited

*Disclaimer: Major Players sorted in no particular order

Mexico Automotive Parts Aluminum Die Casting Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Technology Trends

-

4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.5 Market Restraints

5. MARKET SEGMENTATION

-

5.1 By Production Process Type

- 5.1.1 Pressure Die Casting

- 5.1.2 Vacuum Die Casting

- 5.1.3 Squeeze Die Casting

- 5.1.4 Semi-solid Die Casting

-

5.2 By Application Type

- 5.2.1 Body Assemblies

- 5.2.2 Engine Parts

- 5.2.3 Transmission Parts

6. COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

-

6.2 Company Profiles

- 6.2.1 Power Cast

- 6.2.2 Form Technologies (Dynacast)

- 6.2.3 Bocar Group

- 6.2.4 Mino Industry USA, Inc.

- 6.2.5 Ryobi Die Casting Inc.

- 6.2.6 Sandhar Technologies Limited

- 6.2.7 Spark Minda, Ashok Minda Group

- 6.2.8 Anderton Castings

- 6.2.9 MES Inc.

- 6.2.10 Global-Tek Manufacturing

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityMexico Automotive Parts Aluminum Die Casting Industry Segmentation

The Mexico Automotive Parts Aluminum Die Casting Market report covers the growing demand and adoption of aluminum die castings in the country’s Automotive Sector, Technological developments, Latest Product Developments, and market shares of players operating in the market. The scope of the report includes:

| By Production Process Type | Pressure Die Casting |

| Vacuum Die Casting | |

| Squeeze Die Casting | |

| Semi-solid Die Casting | |

| By Application Type | Body Assemblies |

| Engine Parts | |

| Transmission Parts |

Mexico Automotive Parts Aluminum Die Casting Market Research FAQs

What is the current Mexico Automotive Parts Aluminum Die Casting Market size?

The Mexico Automotive Parts Aluminum Die Casting Market is projected to register a CAGR of 7.5% during the forecast period (2024-2029)

Who are the key players in Mexico Automotive Parts Aluminum Die Casting Market?

Dynacast, Nemak, Bocar, S.A. de C.V.,, Ryobi Die Casting and Sandhar Technologies Limited are the major companies operating in the Mexico Automotive Parts Aluminum Die Casting Market.

What years does this Mexico Automotive Parts Aluminum Die Casting Market cover?

The report covers the Mexico Automotive Parts Aluminum Die Casting Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Mexico Automotive Parts Aluminum Die Casting Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Mexico Automotive Parts Aluminum Die Casting Industry Report

Statistics for the 2024 Mexico Automotive Parts Aluminum Die Casting market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Mexico Automotive Parts Aluminum Die Casting analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.