Microbial Culture Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 2.07 Billion |

| Market Size (2029) | USD 2.62 Billion |

| CAGR (2024 - 2029) | 4.73 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Europe |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Microbial Culture Market Analysis

The Microbial Culture Market size is estimated at USD 2.07 billion in 2024, and is expected to reach USD 2.62 billion by 2029, growing at a CAGR of 4.73% during the forecast period (2024-2029).

- Fermented foods have grown tremendously in recent years giving way to a profitable market of food culture. Probiotics and functional foods are the new trends in the market capturing the world across, from the US to developing regions. Functional dairy products have created a huge competition among microbial culture companies.

- Microbial culture is also gaining attraction from the manufacturers due to the growing acceptance of the bio-preservation concept. Bio-preservation is an attractive alternative to chemical and physical preservation. Food fermentations offer excellent models for studying the basic principles and mechanisms of bio-preservation, and traditional fermentations may be valuable resources of new strains for bio-preservation.

Microbial Culture Market Trends

This section covers the major market trends shaping the Microbial Culture Market according to our research experts:

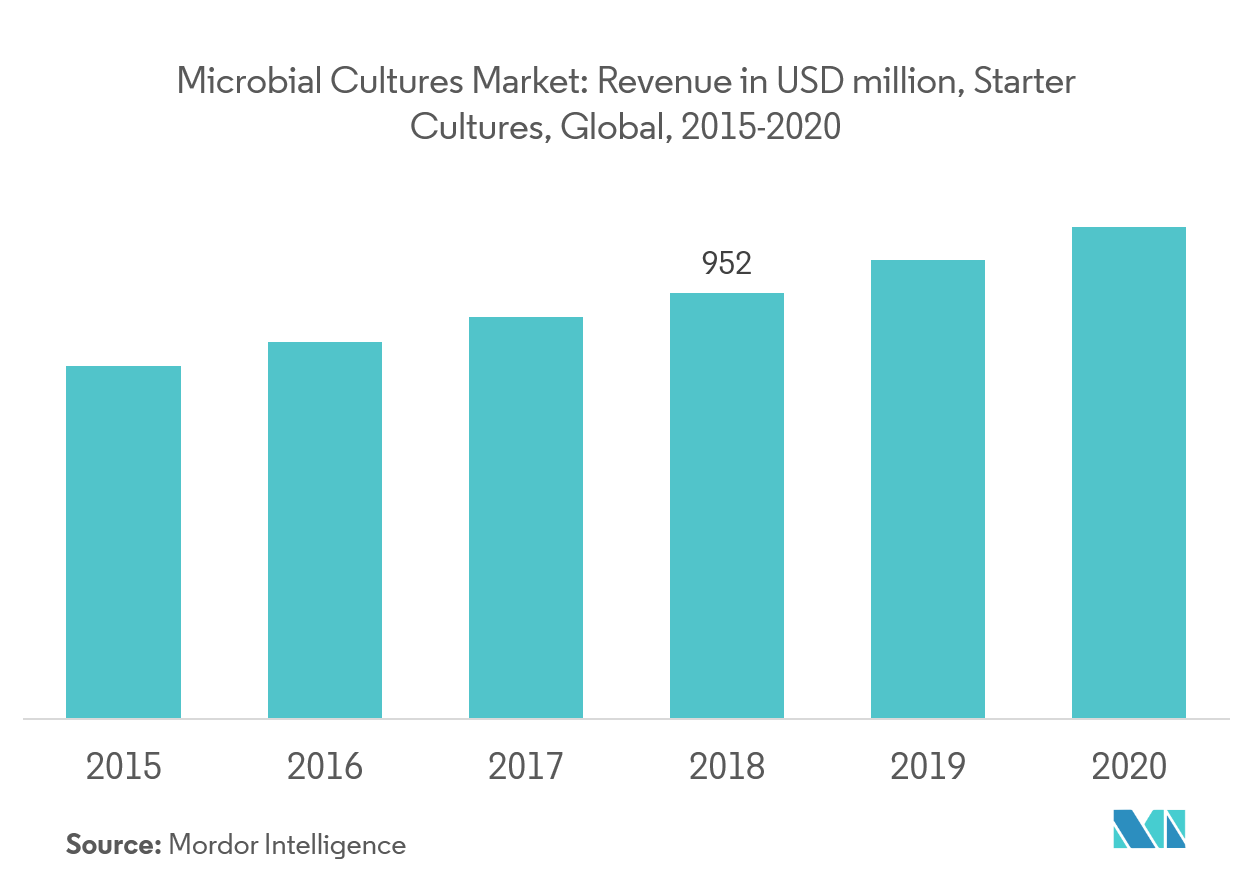

Starter Cultures Remains the Major Driver of the Market

Consumption of fermented food has substantially increased in recent years, due to their valuable traits that extend well beyond shelf life, preservation, and sensory qualities. Fermented food production is mainly carried out using starter cultures for a precise and expectable fermentation. Lactic acid bacteria (LAB) and yeast are the highly studied starters applied in several fermented food production industries, such as dairy, meat, sourdough, vegetables, etc. Dairy cultures are the most prominent category of starter cultures. In China, India, and the rest of Asia, as well as the Middle East, the dairy culture markets are experiencing a boom in growth and innovation.

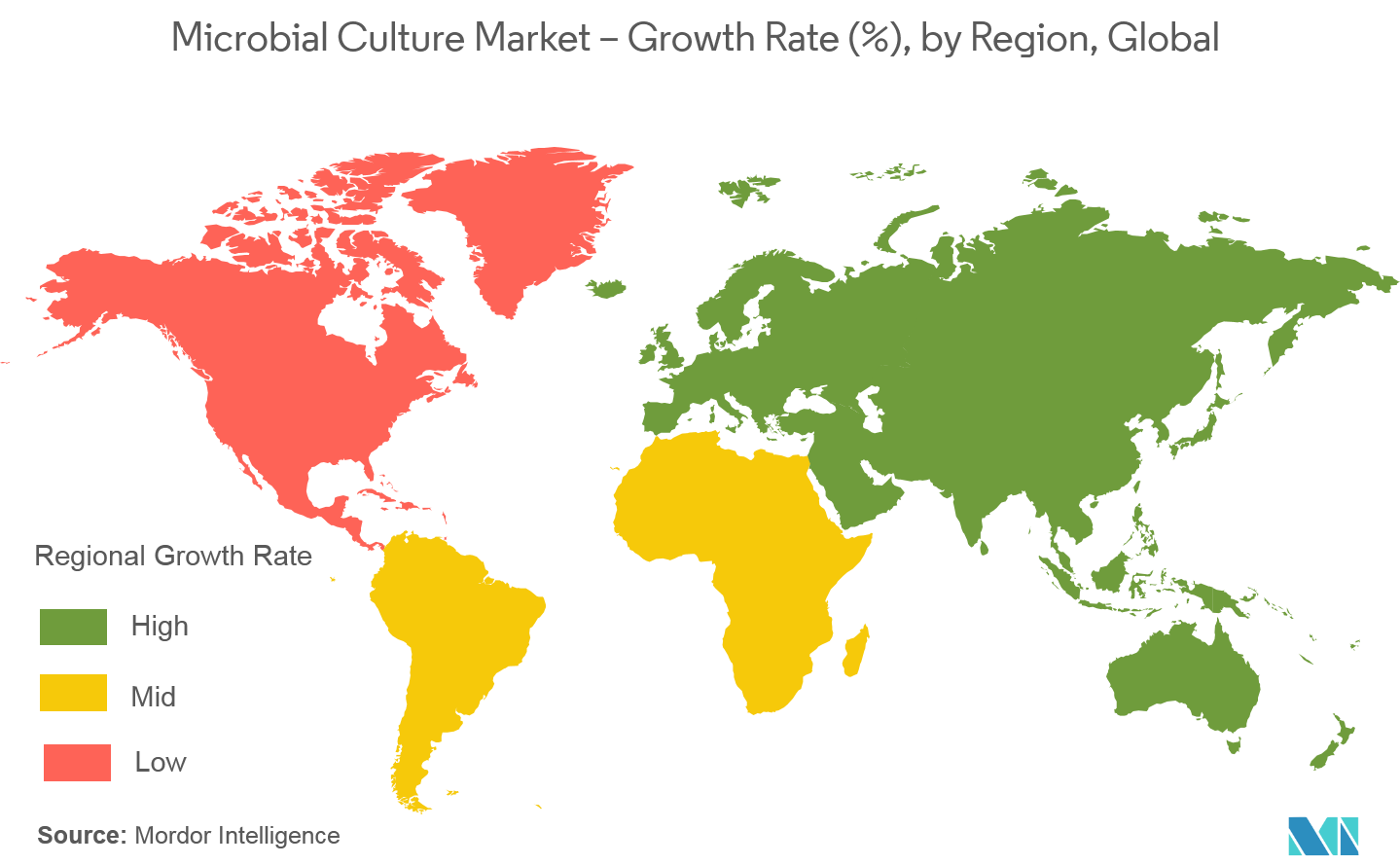

Asia-Pacific Emerges as the Fastest Growing Market

Asia-Pacific remains the fastest-growing market for microbial cultures in 2018 owing to strong demand surge from developed countries such as China. The manufacturers are eyeing on this potential region and heavily investing to bring the latest innovations and increase production capacity in order to address the growing demand in the region. For instance, in 2017, the US-based ingredient manufacturer Dupont, expanded their Beijing based plant capacity by 115% to supplement the production of microbial food cultures.

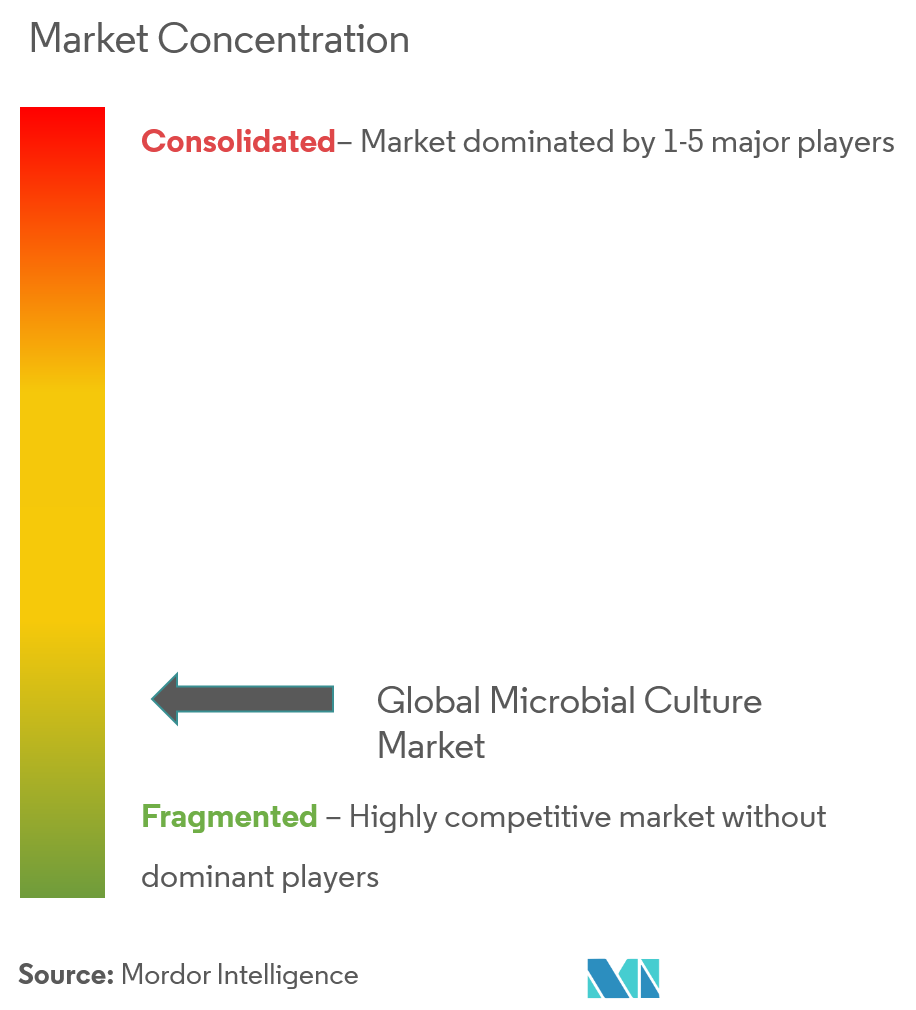

Microbial Culture Industry Overview

Global microbial food culture market is highly competitive and is dominated by several local and international players which leads in a fragmented and unorganised market at the global level. Major players in the market include Chr. Hansen A/S, DuPont, Koninklijke DSM N.V., and Kerry Group among others. Major players are focusing on product innovation in the market to expand their presence, to enhance their brand portfolio, and to cater to various preferences of product manufacturers.

Microbial Culture Market Leaders

-

Chr. Hansen Holding A/S

-

DuPont

-

Koninklijke DSM N.V.

-

Kerry Group

*Disclaimer: Major Players sorted in no particular order

Microbial Culture Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Starter Cultures

- 5.1.2 Adjunct and Aroma Cultures

- 5.1.3 Probiotics

-

5.2 By End-user Industry

- 5.2.1 Bakery and Confectionery

- 5.2.2 Dairy

- 5.2.3 Fruits and Vegetables

- 5.2.4 Beverages

- 5.2.5 Other End-user Industries

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Most Active Companies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Chr. Hansen

- 6.4.2 DuPont De Numors Inc.

- 6.4.3 Koninklijke DSM NV

- 6.4.4 Mediterranea Biotecnologie SRL

- 6.4.5 Himedia Laboratories

- 6.4.6 Ingredion Incorporated

- 6.4.7 Kerry Group

- 6.4.8 Givaudan SA (Naturex)

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityMicrobial Culture Industry Segmentation

Global microbial culture market offers a wide range of products including starter cultures, adjunct and aroma cultures, and probiotics, applicable to bakery and confectionery, dairy, fruits and vegetables, beverages, and other end-user industries. The report further analyses the global scenario of the market in the regions of North America, Europe, Asia-Pacific, South America and, Middle East and Africa.

| By Type | Starter Cultures | |

| Adjunct and Aroma Cultures | ||

| Probiotics | ||

| By End-user Industry | Bakery and Confectionery | |

| Dairy | ||

| Fruits and Vegetables | ||

| Beverages | ||

| Other End-user Industries | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | South Africa |

| United Arab Emirates | ||

| Rest of Middle East and Africa |

Microbial Culture Market Research FAQs

How big is the Microbial Culture Market?

The Microbial Culture Market size is expected to reach USD 2.07 billion in 2024 and grow at a CAGR of 4.73% to reach USD 2.62 billion by 2029.

What is the current Microbial Culture Market size?

In 2024, the Microbial Culture Market size is expected to reach USD 2.07 billion.

Who are the key players in Microbial Culture Market?

Chr. Hansen Holding A/S, DuPont, Koninklijke DSM N.V. and Kerry Group are the major companies operating in the Microbial Culture Market.

Which is the fastest growing region in Microbial Culture Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Microbial Culture Market?

In 2024, the Europe accounts for the largest market share in Microbial Culture Market.

What years does this Microbial Culture Market cover, and what was the market size in 2023?

In 2023, the Microbial Culture Market size was estimated at USD 1.98 billion. The report covers the Microbial Culture Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Microbial Culture Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Microbial Culture Industry Report

Statistics for the 2024 Microbial Culture market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Microbial Culture analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.