MEA Food Sweetener Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 3.92 % |

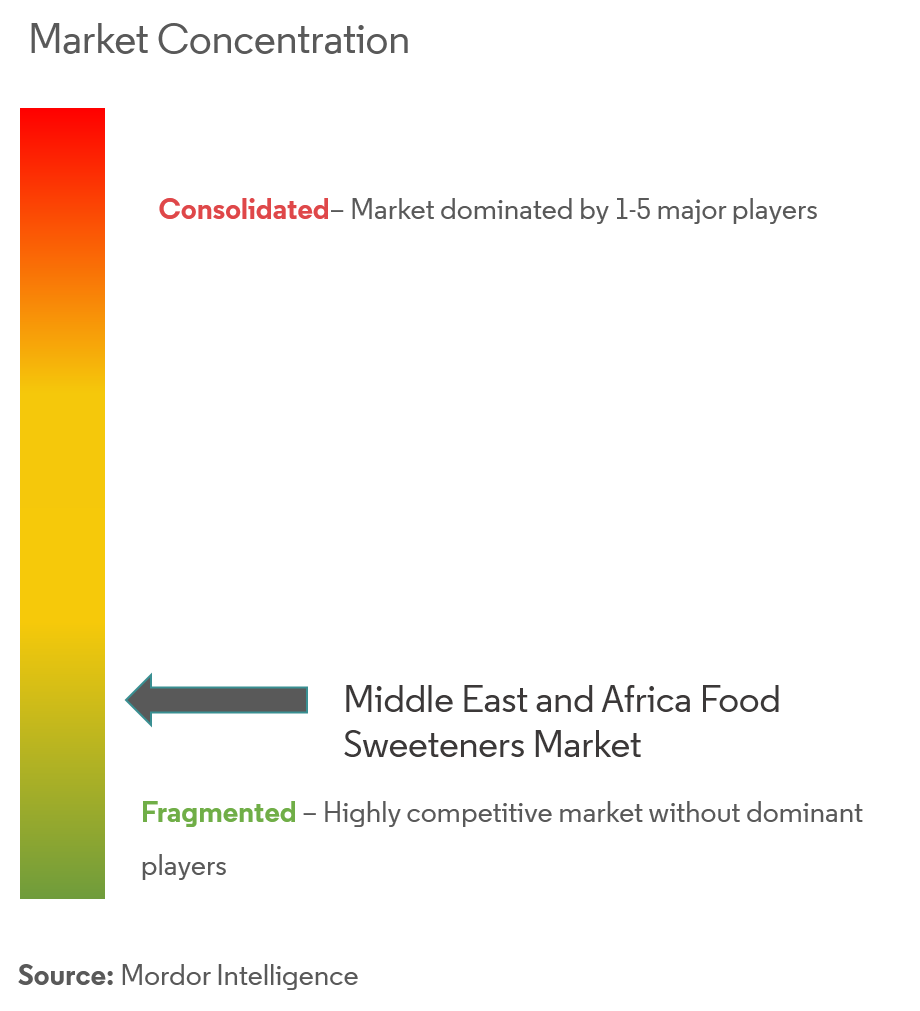

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

MEA Food Sweetener Market Analysis

Middle East and Africa Sweetener Market is projected to grow at a CAGR of 3.92% during the forecast period.

- The sweetener market in Middle East and Africa is still in its growing stagedue to the high costs involved in the processing of local food and poor infrastructure.

- Change in the trend with rising incomes, growing consumer awareness over food safety and dietary quality, an increase in the health conscious population and rising demand for higher quality products are driving the market.

- Local producers are concentrating on improving products in order to meet the changing market place. International players have also increased investments in the sector during the past ten years.

MEA Food Sweetener Market Trends

This section covers the major market trends shaping the MEA Food Sweetener Market according to our research experts:

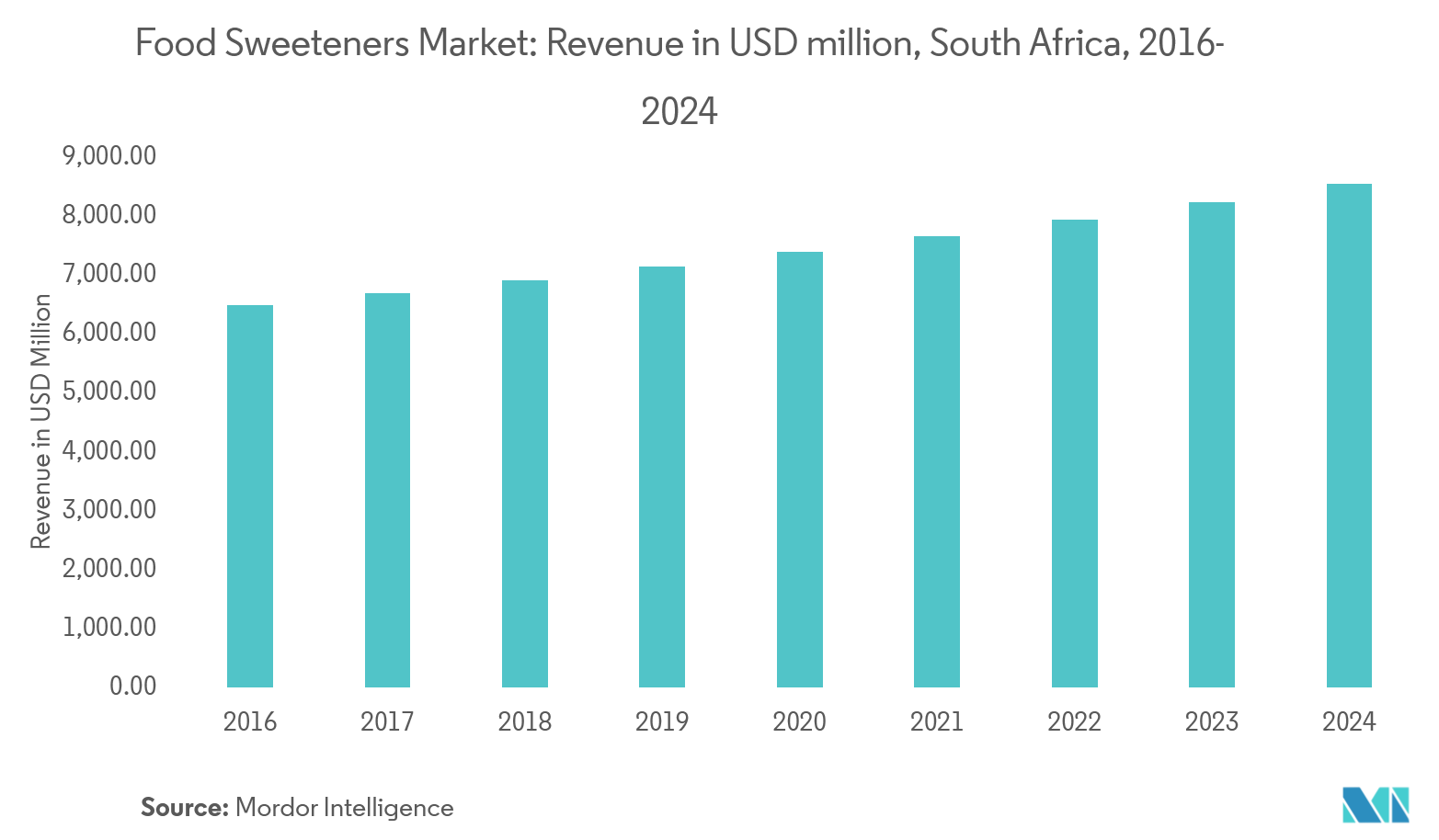

South Africa is one of the Largest Market

The South African sweeteners market is dominated by sugar, and it continues to progress, in line with the GDP and expanding population. Uncertain regulations and prohibitive legislation in the country are affecting the profits of sugar substitutes and forcing manufacturers to go back to sugar or more natural sweeteners. Stevia, the natural, healthy alternative to sugar, has been approved for use in South Africa with the recent promulgation of new sweetener regulations. The plant is currently not commercially grown in Southern Africa, with the main international producers being China and India.

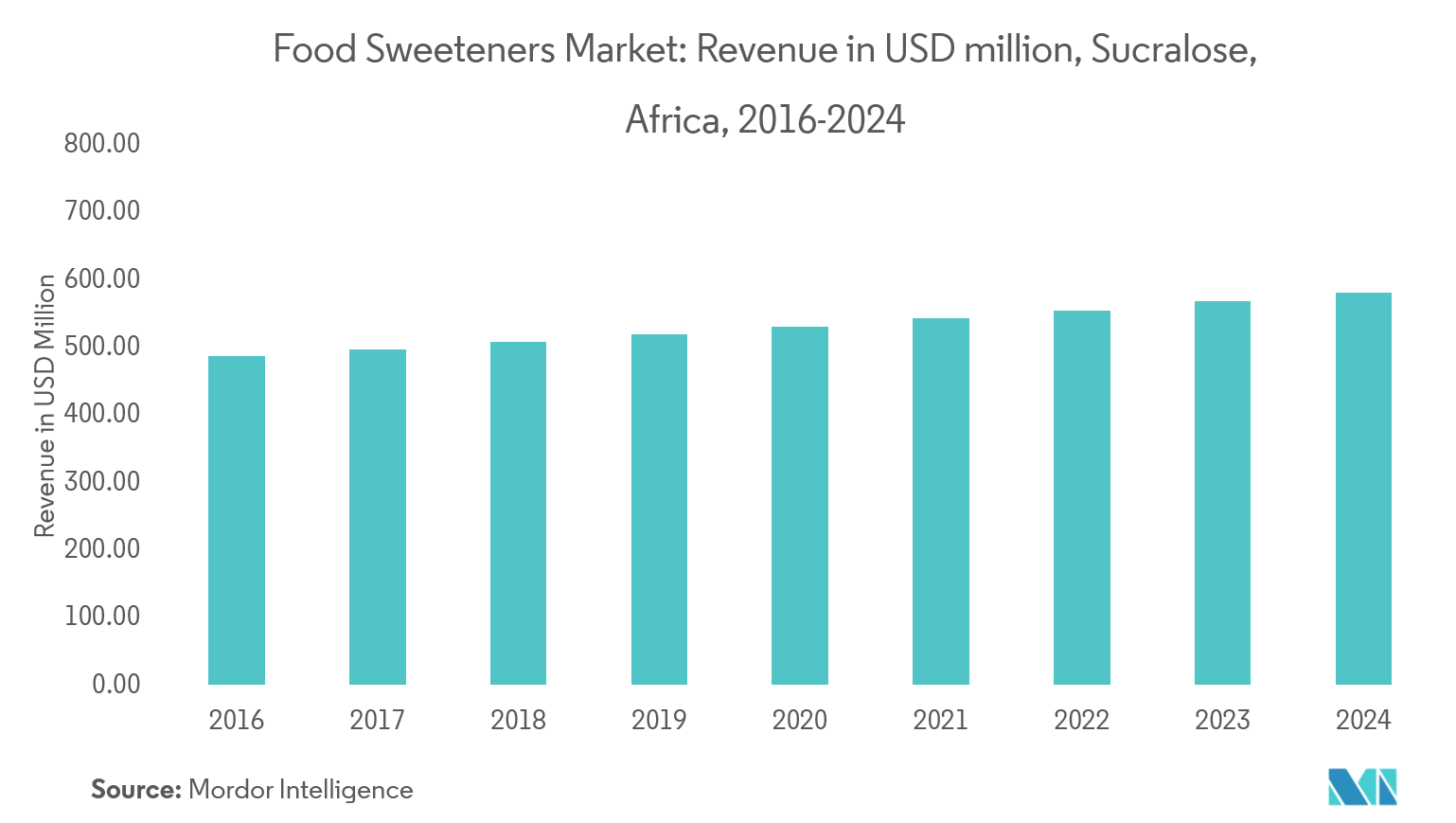

Sucrose is the Dominating Bulk Sweetener

Sucralose is a zero-calorie artificial sweetener, and Splenda is the most common sucralose-based product. Sucralose is made from sugar, that has been chemically altered to make it calorie free. A major trend being observed in the sucralose market, has been the drastic price reduction due to excessive supply. In the food and beverage industry, sucralose has its maximum usage; it is used as artificial sweetener products in confectionery, baked foods, and fizzy drinks. The sucralose market is expected to grow in the future, due to increasing number of health conscious people who prefer calorie-free sweetener. High blood sugar and diabetes patients prefer a calorie-free sweetener for use that fuels up the demand in the growth of sucralose consumption market.

MEA Food Sweetener Industry Overview

Middle East and Africa Food Sweetener market is a fragmented market with the presence of various local and major players. The changing needs of the consumers for nutrition enabled products (which addresses health problems like diabetes), natural ingredient-based products are experiencing an increased demand. Rising disposable incomes have increased the consumer expenditure on healthy and nutritious foods, and in turn, is helping the sweetener market to progress.

MEA Food Sweetener Market Leaders

-

Tate & Lyle

-

Cargill

-

Ingredion

-

ADM

*Disclaimer: Major Players sorted in no particular order

MEA Food Sweetener Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Sucrose (Common Sugar)

- 5.1.2 Starch Sweeteners and Sugar Alcohols

- 5.1.2.1 Dextrose

- 5.1.2.2 High Fructose Corn Syrup (HFCS)

- 5.1.2.3 Maltodextrin

- 5.1.2.4 Sorbitol

- 5.1.2.5 Xylitol

- 5.1.2.6 Others

- 5.1.3 High Intensity Sweeteners (HIS)

- 5.1.3.1 Sucralose

- 5.1.3.2 Aspartame

- 5.1.3.3 Saccharin

- 5.1.3.4 Cyclamate

- 5.1.3.5 Ace-K

- 5.1.3.6 Neotame

- 5.1.3.7 Stevia

- 5.1.3.8 Others

-

5.2 By Application

- 5.2.1 Dairy

- 5.2.2 Bakery

- 5.2.3 Soups, Sauces and Dressings

- 5.2.4 Confectionery

- 5.2.5 Beverages

- 5.2.6 Others

-

5.3 By Geography

- 5.3.1 South Africa

- 5.3.2 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Tate & Lyle PLC

- 6.4.2 Cargill Incorporated

- 6.4.3 Archer Daniels Midland Company

- 6.4.4 Ingredion Incorporated

- 6.4.5 Ajinomoto Co., Inc.

- 6.4.6 PureCircle Limited

- 6.4.7 GLG Life Tech Corporation

- 6.4.8 Tereos S.A.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityMEA Food Sweetener Industry Segmentation

Middle East and African food sweetener market is segmented by type into sucrose, starch sweeteners and sugar alcohols and high intensity sweeteners. By application the market is segmented into dairy, bakery, soups, sauces and dressings, confectionery, beverages and others. The geographical analysis of the market is also been included.

| By Product Type | Sucrose (Common Sugar) | |

| Starch Sweeteners and Sugar Alcohols | Dextrose | |

| High Fructose Corn Syrup (HFCS) | ||

| Maltodextrin | ||

| Sorbitol | ||

| Xylitol | ||

| Others | ||

| High Intensity Sweeteners (HIS) | Sucralose | |

| Aspartame | ||

| Saccharin | ||

| Cyclamate | ||

| Ace-K | ||

| Neotame | ||

| Stevia | ||

| Others | ||

| By Application | Dairy | |

| Bakery | ||

| Soups, Sauces and Dressings | ||

| Confectionery | ||

| Beverages | ||

| Others | ||

| By Geography | South Africa | |

| Rest of Middle East and Africa |

MEA Food Sweetener Market Research FAQs

What is the current Middle East and Africa Food Sweetener Market size?

The Middle East and Africa Food Sweetener Market is projected to register a CAGR of 3.92% during the forecast period (2024-2029)

Who are the key players in Middle East and Africa Food Sweetener Market?

Tate & Lyle, Cargill, Ingredion and ADM are the major companies operating in the Middle East and Africa Food Sweetener Market.

What years does this Middle East and Africa Food Sweetener Market cover?

The report covers the Middle East and Africa Food Sweetener Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Middle East and Africa Food Sweetener Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

MEA Food Sweeteners Industry Report

Statistics for the 2024 MEA Food Sweeteners market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. MEA Food Sweeteners analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.