Mobile Content Delivery Network (CDN) Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 35.46 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Mobile Content Delivery Network (CDN) Market Analysis

The mobile content delivery network (mobile CDN) market is expected to register a CAGR of 35.46%, over the forecast period (2021-2026). A mobile CDN is used to enhance data transfer on any mobile network or wireless network or a smart device, such as Android-based smartphones, Windows-based smartphones, iPods, iPads, iPhones, laptops, tablets, smart watches, and others.

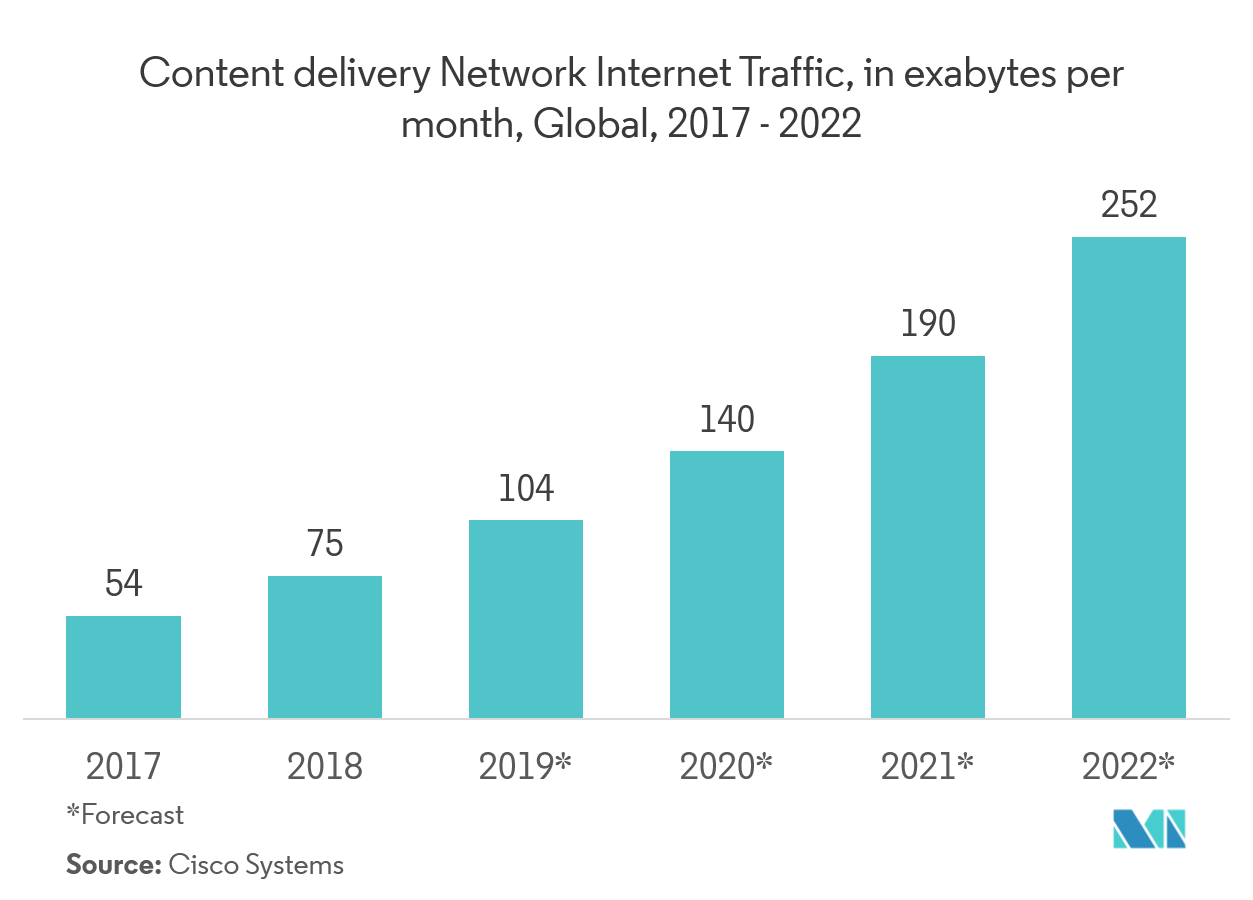

- The increasing demand for mobile computation devices, coupled with advanced network technologies, due to the increasing development of digitalization, is a key factor stimulating the demand, in the mobile CDN market, at an exponential rate. Moreover, the increasing adoption of Bring Your Own Device (BYOD), across industry verticals, and the proliferation of rich media content are increasing demand.

- Factors, such as enhancing the data content, optimizing the bandwidth, providing greater resilience, achieving earlier delivery of content, as well as the reduction in mobile data traffic, are driving the market. Further, it helps in reduction of excessive information, increasing the demand for high-quality content over the internet at the consumer end, reduction of buffer and load times to improve the end-user experience, and traffic management during peak times.

- However, constant monetization of mobile sites and unreliable connectivity and latency issues are some factors restraining the market. Delivering Quality of Service (QoS) and increasing pricing pressure are challenging market growth.

Mobile Content Delivery Network (CDN) Market Trends

This section covers the major market trends shaping the Mobile Content Delivery Network Market according to our research experts:

Media and Entertainment to Hold the Highest Market Share

- In this highly connected world, optimal bandwidth is an issue, especially with user experience for fast, reliable, and engaging mobile experiences increasing. Content providers, like Netflix, Amazon Prime, are offering rich and engaging content, along with offering premium subscription content and value-added services.

- Further, as a part of the entertainment industry, gaming is also attracting popularity due to the new technology in the market. As the size of game downloads increase at an exponential rate and the internet speed improves, game developers and publishers face challenges to deliver online games successfully. Mobile CDNs help companies in this industry to overcome these obstacles, by improving the speed and performance and enhancing the efficiency in customer experience.

- Factors, such as the increasing number of new applications being launched, live streaming of videos to a mass audience in real time, huge workloads at peak time, etc., are stimulating the growth of the market. Moreover, mobile internet networks are now much easier to deploy across large areas. User demand for online video and streaming services continues to proliferate the demand for mobile CDN solutions.

- Companies are continuously working toward providing solutions to meet peak traffic conditions, lowering the cost of operating a mobile CDN, and ensuring the content reaches the widest audience possible. Also, the OTT platform provider ensures that content can be delivered across different geographical locations, as mobile viewers often consume content from a variety of places like work, vacation, etc.

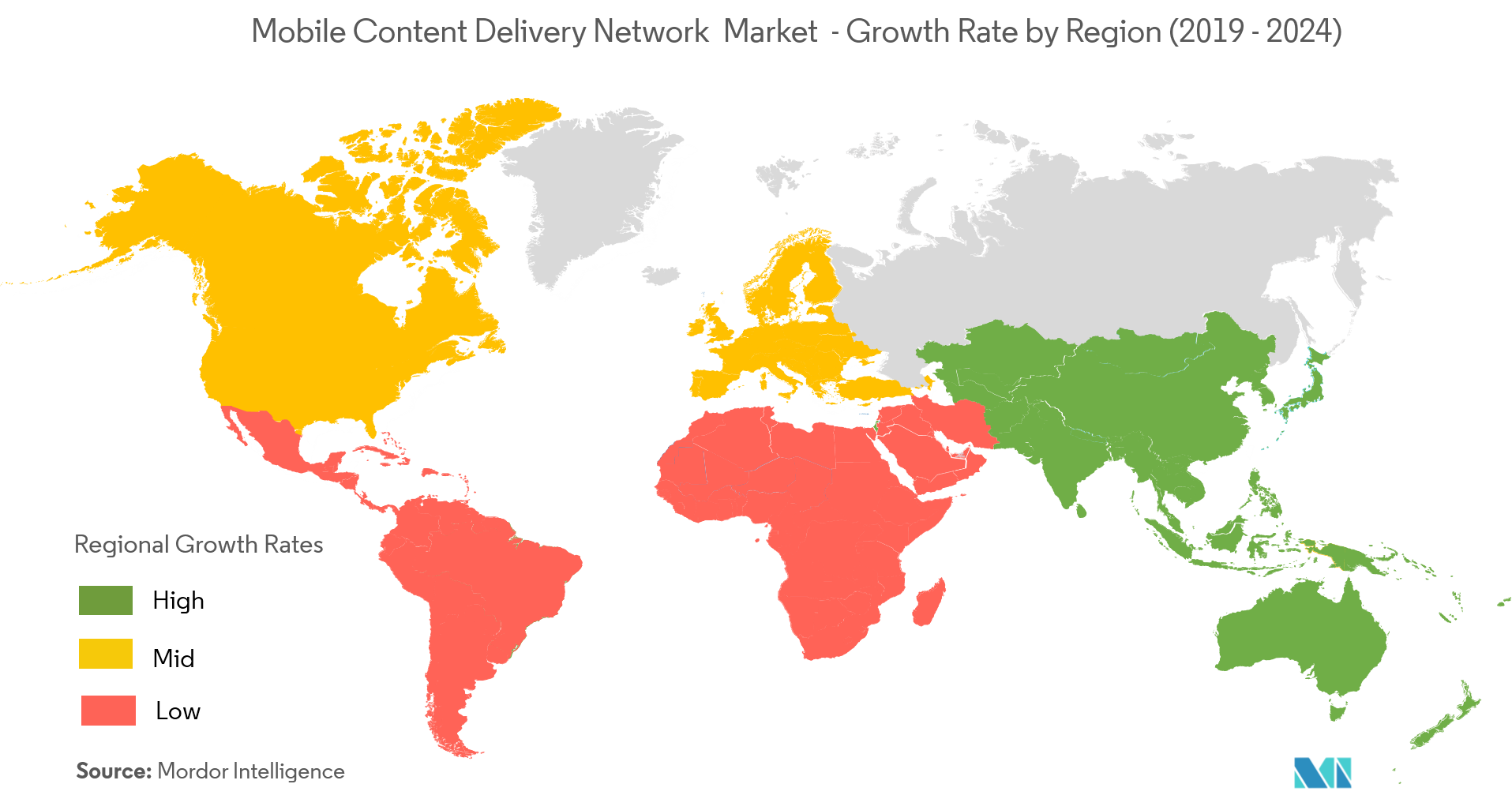

North America Expected to Dominate the Market

- The North American region is expected to hold the highest market share in the mobile CDN market. North America has a high internet penetration rate, along with an increasing number of viewers for online gaming, mobile video streaming, etc. These factors are substantially aiding market growth in the region.

- Moreover, the presence of the market leaders and the early adoption of technologies across various end-user verticals, are some more factors that resulted in the emergence of the region as the market leader. Gaming video content is growing, along with the number of online content providers, like Netflix and Amazon Prime, which is further contributing to the growth of mobile CDN in the region.

Mobile Content Delivery Network (CDN) Industry Overview

The competitive landscape of the mobile CDN market is fragmented due to the presence of several vendors. The companies are consistently innovating for new solutions, to improve customer experience.

- February 2018: Reliance Jio and Cisco entered into a strategic partnership to create the ‘all-IP network’, as both companies are expecting to observe ‘tremendous growth’ in the network size. Cisco and Reliance Jio plan to create a mobile content delivery network (CDN).

- January 2018: Vecima Networks Inc. recently closed its acquisition of the assets of the Content Delivery and Storage Business of Concurrent Computer Corporation, a US-based software and solutions company that is a leader in the Video on Demand (VoD) and IP Video Content Delivery space, providing breakthrough technologies in the storage, protection, transformation, and delivery of video assets.

Mobile Content Delivery Network (CDN) Market Leaders

-

Akamai Technologies

-

AT&T Inc.

-

Ericsson AB

-

ChinaCache

-

Amazon Web Services Inc.

*Disclaimer: Major Players sorted in no particular order

Mobile Content Delivery Network (CDN) Market Report - Table of Contents

1. INTRODUCTION

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Solutions

- 5.1.1 Data Security

- 5.1.2 Network Acceleration

- 5.1.3 Reporting, Analysis, and Monitoring

- 5.1.4 Traffic Management

- 5.1.5 Transcoding and Digital Rights Management

-

5.2 By Service

- 5.2.1 Professional Service

- 5.2.2 Support and Maintenance Service

-

5.3 By Type

- 5.3.1 Video CDN

- 5.3.2 Non-video CDN

-

5.4 By End-user Industry

- 5.4.1 Media and Entertainment

- 5.4.2 Ecommerce

- 5.4.3 Healthcare

- 5.4.4 Government

- 5.4.5 Telecom

- 5.4.6 BFSI

- 5.4.7 Other End-user Industry

-

5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Latin America

- 5.5.4.2 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Akamai Technologies

- 6.1.2 AT&T Inc.

- 6.1.3 Ericsson AB

- 6.1.4 Internap Corporation

- 6.1.5 ChinaCache

- 6.1.6 Limelight Networks

- 6.1.7 Swarmify Inc.

- 6.1.8 Microsoft Corporation

- 6.1.9 Amazon Web Services Inc.

- 6.1.10 KeyCDN LLC

- 6.1.11 Cloud Flare Inc.

- 6.1.12 Rackspace Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityMobile Content Delivery Network (CDN) Industry Segmentation

A mobile content delivery network (CDN) is a network of servers, systems, computers, or devices, across the Internet, delivered on mobile devices or any wireless network. The purpose of the mobile CDN market is to improve the end-user experience by enhancing the efficiency of content delivery.

| By Solutions | Data Security | |

| Network Acceleration | ||

| Reporting, Analysis, and Monitoring | ||

| Traffic Management | ||

| Transcoding and Digital Rights Management | ||

| By Service | Professional Service | |

| Support and Maintenance Service | ||

| By Type | Video CDN | |

| Non-video CDN | ||

| By End-user Industry | Media and Entertainment | |

| Ecommerce | ||

| Healthcare | ||

| Government | ||

| Telecom | ||

| BFSI | ||

| Other End-user Industry | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| South Korea | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle-East & Africa |

Mobile Content Delivery Network (CDN) Market Research FAQs

What is the current Mobile Content Delivery Network Market size?

The Mobile Content Delivery Network Market is projected to register a CAGR of 35.46% during the forecast period (2024-2029)

Who are the key players in Mobile Content Delivery Network Market?

Akamai Technologies, AT&T Inc., Ericsson AB, ChinaCache and Amazon Web Services Inc. are the major companies operating in the Mobile Content Delivery Network Market.

Which is the fastest growing region in Mobile Content Delivery Network Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Mobile Content Delivery Network Market?

In 2024, the North America accounts for the largest market share in Mobile Content Delivery Network Market.

What years does this Mobile Content Delivery Network Market cover?

The report covers the Mobile Content Delivery Network Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Mobile Content Delivery Network Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Mobile CDN Industry Report

Statistics for the 2023 Mobile CDN market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Mobile CDN analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.