Mobile Phone Protective Cover Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 26 Billion |

| Market Size (2029) | USD 33.70 Billion |

| CAGR (2024 - 2029) | 5.33 % |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Asia-Pacific |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Mobile Phone Protective Cover Market Analysis

The Mobile Protective Cases Market size is estimated at USD 26 billion in 2024, and is expected to reach USD 33.70 billion by 2029, growing at a CAGR of 5.33% during the forecast period (2024-2029).

Innovation in the product line in terms of extra protective features such as shockproof cases is anticipated to create an opportunity for the global market in the future. Rising demand from youth for mobile cases and covers with striking designs is a key factor fueling demand in the market. Many smartphone brands are focusing on design features with high protective strength as millennials are more attracted to design covers. In Asian countries like China, Japan, and India, customized cases are in vogue. The market players are launching cases according to consumer requirements. For instance, in April 2022, OtterBox launched new cases for the iPad Air (5th generation). The cases were introduced as part of the Symmetry Series 360 Elite.The cases were made of spring-inspired colors like orange and pink.

The market is being driven by a big drop in the average selling price of smartphones, which gives consumers more options in the form of different smartphone models in different price ranges. Furthermore, due to the adoption of an open-source operating system (OS) by mobile phone makers, competitors are reducing their prices to gain sales. With a low selling price, more customers are being influenced to purchase a phone, eventually increasing the sale of protective covers. Furthermore, online websites like Amazon, Flipkart, Yahoo, and many other shopping sites also have multiple options for mobile cases, as well as discounts and offers on the products, which is why people are buying the cases at cheap prices with good quality material.

Mobile Phone Protective Cover Market Trends

Rugged Case to Witness a Significant Demand

With the increasing adoption of smartphones, rugged phone cases that can help protect the handset from knocks and bumps and also prevent a cracked screen are currently in higher demand. With the increase in sales of smartphones in the United States, the demand for rugged cases for mobile protection is increasing, especially for iPhone users, and many iPhone case manufacturers offer a rugged case series with 360 degrees of defense. One of these cases may include air-cushioned corners, resilient outer layers of plastic, and a clear, touch-sensitive screen protector. For instance, in November 2022, OtterBox launched waterproof cases for the iPhone for the first time, which are from the Fre Series, the no. 1 waterproof case series in the United States. The Fr Series covers your phone on all sides, keeps up with every activity, and survives hard falls along the way. The Fr Series has waterproof, drop-proof, dust-proof, and dirt-proof protection to keep iPhones in pristine condition. It is water-tested to two meters (6.6 feet) for up to an hour, drop-proof to two meters, and completely sealed from dust, dirt, and snow.

Asia-Pacific Poised for a Significant Market Growth

Due to an ever-increasing mobile device user base and a substantial growth in the adoption of smartphones and tablets in the Asia-Pacific region, the mobile protective case market offers a huge opportunity to the manufacturers of such devices. The rate of smartphone adoption is expanding across countries such as China, Indonesia, and India, and this is associated with increasing internet penetration and the popularity of social networking in these countries, along with increasing disposable income and the growing global population. Due to rising disposable income, consumer demand for high-quality mobile cases is increasing. The market players are launching new mobile cases across the region. In June 2022, CG Mobile Brand and Company launched cases for iPhones, iPads, and Macbooks in India. The company is licensed for luxury brands like Ferrari, Mercedes-Benz, BMW, Mini Cooper, Guess, Karl Lagerfeld, Lacoste, and the U.S. Polo Assn.

Mobile Phone Protective Cover Industry Overview

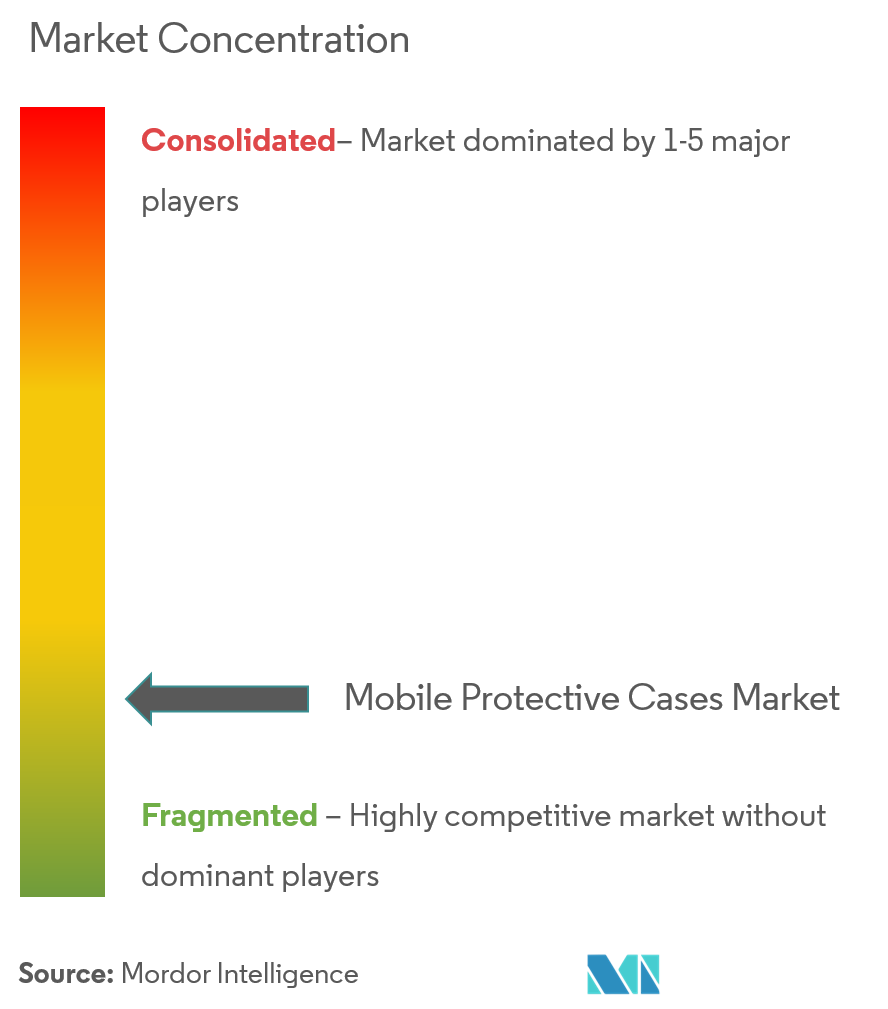

The mobile protective case market is highly fragmented in nature, and there are a large number of players present in mature and emerging regional markets, which shows intense rivalry in the market. Key players in the market include Spigen Inc., Urban Armor Gear, OtterBox, Incipio LLC, and Griffin Technology. Research and development are also critical sources of competitive advantage in the smartphone industry. Therefore, key players are investing heavily in R&D activities to meet customer demand. Major players in the market are focused on enhancing their presence and expanding their market share through diverse mergers and acquisitions.

Mobile Phone Protective Cover Market Leaders

-

Spigen Inc.

-

Urban Armor Gear

-

OtterBox

-

Incipio, LLC

-

Griffin Technology

*Disclaimer: Major Players sorted in no particular order

Mobile Phone Protective Cover Market News

- February 2022: Atom Studios launched a new case for Samsung phones following the success of its Apple range. The new Samsung case, called Touch, is available for the S22 and S22+ Samsung Galaxy models and is designed with tactility in mind. The soft, soft-touch silicon outer chosen by Atmos Studios was designated to be touched and feels ultra-soft in hand.

- September 2021: CLCKR, the mobile accessory company, announced a new line-up of multi-functional stands, mobile cases, and grips for the iPhone 13, 13 Pro, and 13 Pro Max. New designs include color match options for the iPhone's 13 colors, holographic designs, and collaborations with Richmond and Finch.

- January 2021: Incipio Inc. launched protective cases for the Samsung Galaxy S21 lineup, including the S21 5G, S21+ 5G, and S21 Ultra 5G devices. The cases have been certified to meet Samsung performance standards through the Samsung Mobile Accessory Partnership Program (SMAPP).

Mobile Phone Protective Cover Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Product Type

- 5.1.1 Black Plate Cases

- 5.1.2 Folio Cases

- 5.1.3 Other Case Types

-

5.2 Category

- 5.2.1 Mass

- 5.2.2 Premium

-

5.3 Distribution Channel

- 5.3.1 Online Retail

- 5.3.2 Offline Retail

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adapted Stratagies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Spigen Inc.

- 6.3.2 Urban Armor Gear LLC

- 6.3.3 OtterBox Holdings Inc.

- 6.3.4 Incipio LLC

- 6.3.5 Griffin Technology Inc.

- 6.3.6 Reiko Wireless Inc.

- 6.3.7 Moshi Group

- 6.3.8 Belkin International Inc.

- 6.3.9 Ringke Inc.

- 6.3.10 Poetic Cases LLC

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityMobile Phone Protective Cover Industry Segmentation

Mobile phone protective cases are designed to attach to or grip a mobile phone and are well-accepted and fashionable accessories for various phones (including smartphones). The mobile protective cases market is segmented by product type into black plate cases, folio cases, and other case types; by category into mass and premium; by distribution channel into online retail and offline retail; and by geography into North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. For each segment, the market sizing and forecasts have been done on the basis of value (in USD billion).

| Product Type | Black Plate Cases | |

| Folio Cases | ||

| Other Case Types | ||

| Category | Mass | |

| Premium | ||

| Distribution Channel | Online Retail | |

| Offline Retail | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Russia | ||

| Spain | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | India |

| China | ||

| Japan | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | United Arab Emirates |

| South Africa | ||

| Rest of Middle East and Africa |

Mobile Phone Protective Cover Market Research FAQs

How big is the Mobile Protective Cases Market?

The Mobile Protective Cases Market size is expected to reach USD 26 billion in 2024 and grow at a CAGR of 5.33% to reach USD 33.70 billion by 2029.

What is the current Mobile Protective Cases Market size?

In 2024, the Mobile Protective Cases Market size is expected to reach USD 26 billion.

Who are the key players in Mobile Protective Cases Market?

Spigen Inc., Urban Armor Gear, OtterBox, Incipio, LLC and Griffin Technology are the major companies operating in the Mobile Protective Cases Market.

Which is the fastest growing region in Mobile Protective Cases Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Mobile Protective Cases Market?

In 2024, the Asia-Pacific accounts for the largest market share in Mobile Protective Cases Market.

Protective Phone Cases Industry Report

Statistics for the 2024 Mobile Protective Cases market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Mobile Protective Cases analysis includes a market forecast outlook to for 2024 to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.