Morocco Bottled Water Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 2.73 % |

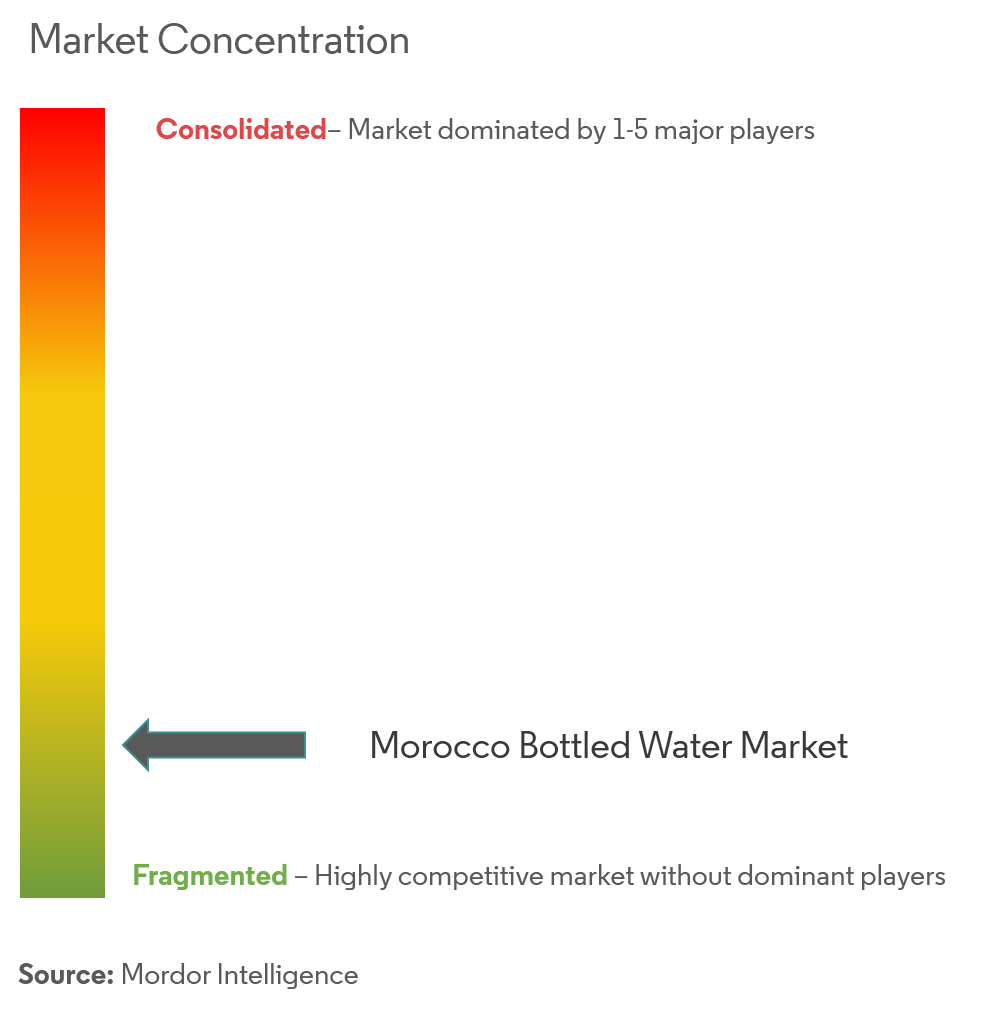

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Morocco Bottled Water Market Analysis

Morocco Bottled Water is forecasted to witness a CAGR of 2.73% during the forecast period (2020-2025).

- The Moroccan bottled water market is experiencing a steady growth rate since 2015, with an increasing awareness on the low quality tap water in Morocco. But, in 2018, the market is expected to witness a drop in prices of bottled water due to the boycott of major brands like Sidi Ali in April 2018.

- The still water segment held a notable market share willcontinue to hold the highest market share during the forecast period.On-trade sales channels play a prominent role in the sales of bottled water in Morocco, as the product’s price is high.

Morocco Bottled Water Market Trends

Increasing Demand for Still Water

The people of Morocco are expected to consume more still water, as compared to carbonated water, due to the increasing health awareness and related health issues pertaining to the consumption of Sparkling Water. The demand for still water is expected to keep growing on a consistent basis, due to the increasing population growth in Morocco. Mineral water is available in both still, as well as, the sparkling segment, but due to low prices of the still water, and its increasing application in the household, consumers prefer still mineral water.

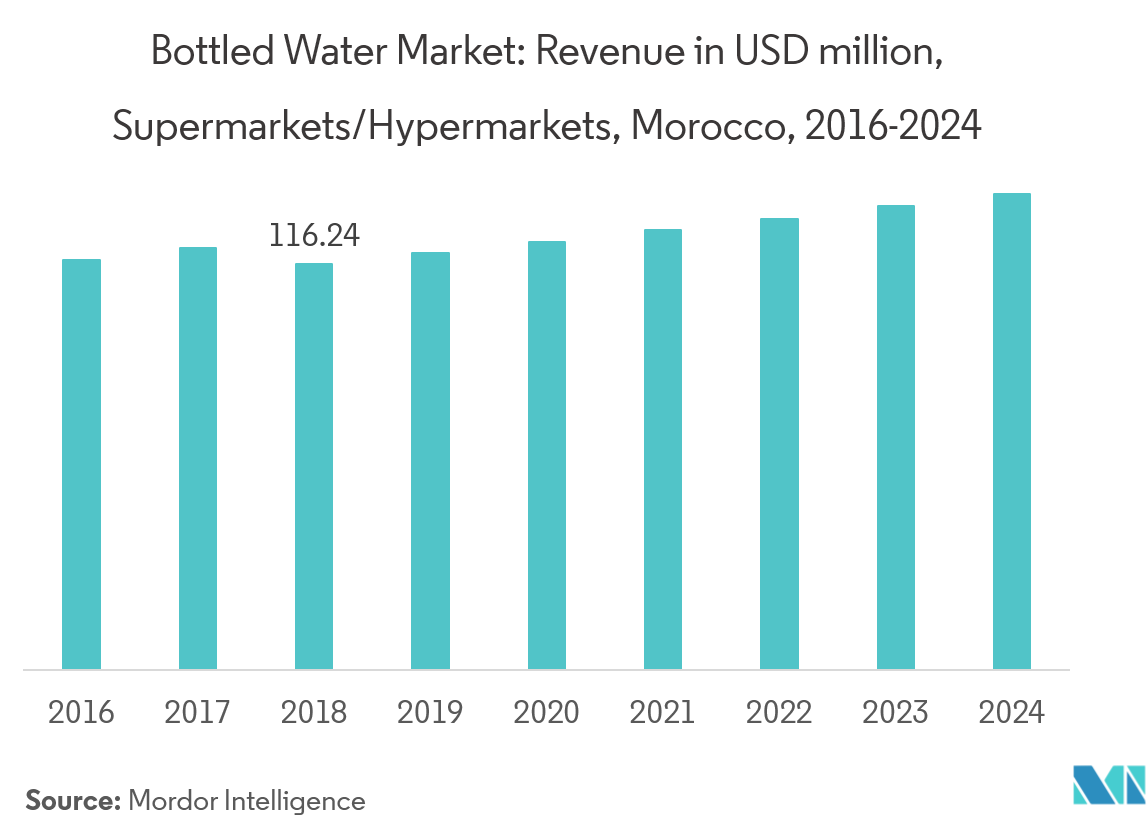

Hypermarket/Supermarket is the Fastest Growing Segment

The availability of bottled water in supermarkets and hypermarkets leads to one-stop shopping, which drives the demand for such products. The supermarkets in Morocco are the local way to go for bottled water and other basic food supplies. With the increasing presence of supermarkets in Morocco, they are estimated to make up the largest single market for the sale of bottled water. There is an increasing number of small grocers, in Morocco, that is converting to independent supermarkets and self-service convenience stores and are offering bulk quantities of bottled water to the public.

Morocco Bottled Water Industry Overview

The bottled water market in Morocco is a moderately fragmented market. Some of the prominent global players in Morocco include Oulmes , Coca-Cola, Nestle, Fiji Water Company LLC. and Danone. Oulmes holds a prominent market share followed by other international palyers. Though the bottled water market does not have much product innovation involved, companies are trying new product launch as the next strategy to strengthen their market dominance, especially in the flavored and functional bottled water market.

Morocco Bottled Water Market Leaders

-

Oulmes

-

THE COCA-COLA COMPANY

-

FIJI Water Company LLC.

-

Nestle

-

Danone

*Disclaimer: Major Players sorted in no particular order

Morocco Bottled Water Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Research Phases

- 1.2 Study Deliverables

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Degree of Competition

5. MARKET SEGMENTATION

-

5.1 Type

- 5.1.1 Still Water

- 5.1.2 Sparkling Water

- 5.1.3 Functional Water

-

5.2 Distribution Channel

- 5.2.1 Supermarkets and Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Online Retailers

- 5.2.4 On-Trade

- 5.2.5 Other Distribution Channels

6. COMPETITIVE LANDSCAPE

- 6.1 Strategies adopted by Key players

- 6.2 Most Active Companies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Oulmes

- 6.4.2 THE COCA-COLA COMPANY

- 6.4.3 FIJI Water Company LLC.

- 6.4.4 Nestle

- 6.4.5 Danone

- 6.4.6 Voss Water

- 6.4.7 Pepsico, Inc.

- 6.4.8 Penta Water.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityMorocco Bottled Water Industry Segmentation

Morocco Bottled Water is segmented by Type into Still Water, Sparkling Water, Functional Water and Others; By Distribution Channel into On-trade, Supermarkets/Hypermarkets, Online Retailers and Convenience Stores.

| Type | Still Water |

| Sparkling Water | |

| Functional Water | |

| Distribution Channel | Supermarkets and Hypermarkets |

| Convenience Stores | |

| Online Retailers | |

| On-Trade | |

| Other Distribution Channels |

Morocco Bottled Water Market Research FAQs

What is the current Morocco Bottled Water Market size?

The Morocco Bottled Water Market is projected to register a CAGR of 2.73% during the forecast period (2024-2029)

Who are the key players in Morocco Bottled Water Market?

Oulmes, THE COCA-COLA COMPANY, FIJI Water Company LLC., Nestle and Danone are the major companies operating in the Morocco Bottled Water Market.

What years does this Morocco Bottled Water Market cover?

The report covers the Morocco Bottled Water Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Morocco Bottled Water Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Bottled Water in Morocco Industry Report

Statistics for the 2024 Bottled Water in Morocco market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Bottled Water in Morocco analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.