Motor Insurance Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| CAGR | 5.03 % |

| Fastest Growing Market | Asia |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Motor Insurance Market Analysis

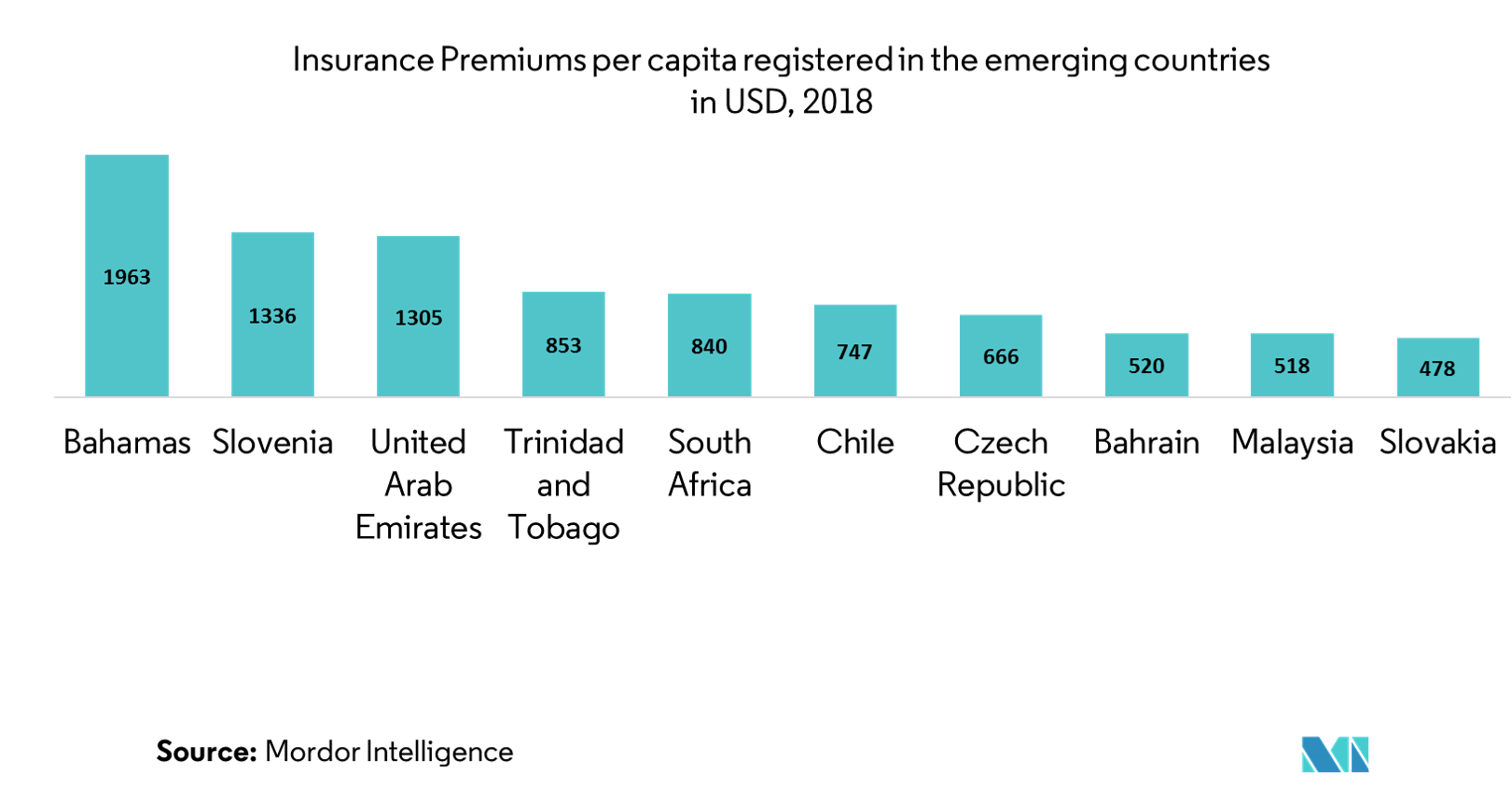

The Motor Insurance market is expected to register a CAGR of 5.03% during the forecast period, 2018-2024. Motor insurance represented 42% of all non-life gross premiums of the overall property and casualty insurance market in 2017. Motor and other traditional P&C lines, both personal and commercial,are likely to face sluggish growth in the coming years.Motor insurance premium growth has been diverging in the developing markets over the last decade. Premium growth in themature markets has stagnated, while motor insurance has expanded rapidly in the emerging markets. The outlook for advanced economies, however, is improvingand is expected to pick up, in line with economic growth over the forecast period.

Technology plays a major role in the new motor insurance market. The market is changing with the integration of new technology, like automation, tracking, and IoT technology. Major players, like Allianz, PICC, and PING AN, are integrating technology with motor insurance to create lucrative policies and options for the younger consumers that are flooding the automotive industry.

For instance, Allianz Insurance and Marmalade have extended their partnership with Allianz Insurance now becoming a telematics service provider for these young driver offerings. The Allianz Connected Car platform is already live in multiple countries with over 14 billion km of driving knowledge already collected. This knowledge enables Allianz Insurance to support Marmalade in offering the best products and services to itscustomers.

Motor Insurance Market Trends

This section covers the major market trends shaping the Motor Insurance Market according to our research experts:

Emerging Countries Driving the Market Growth

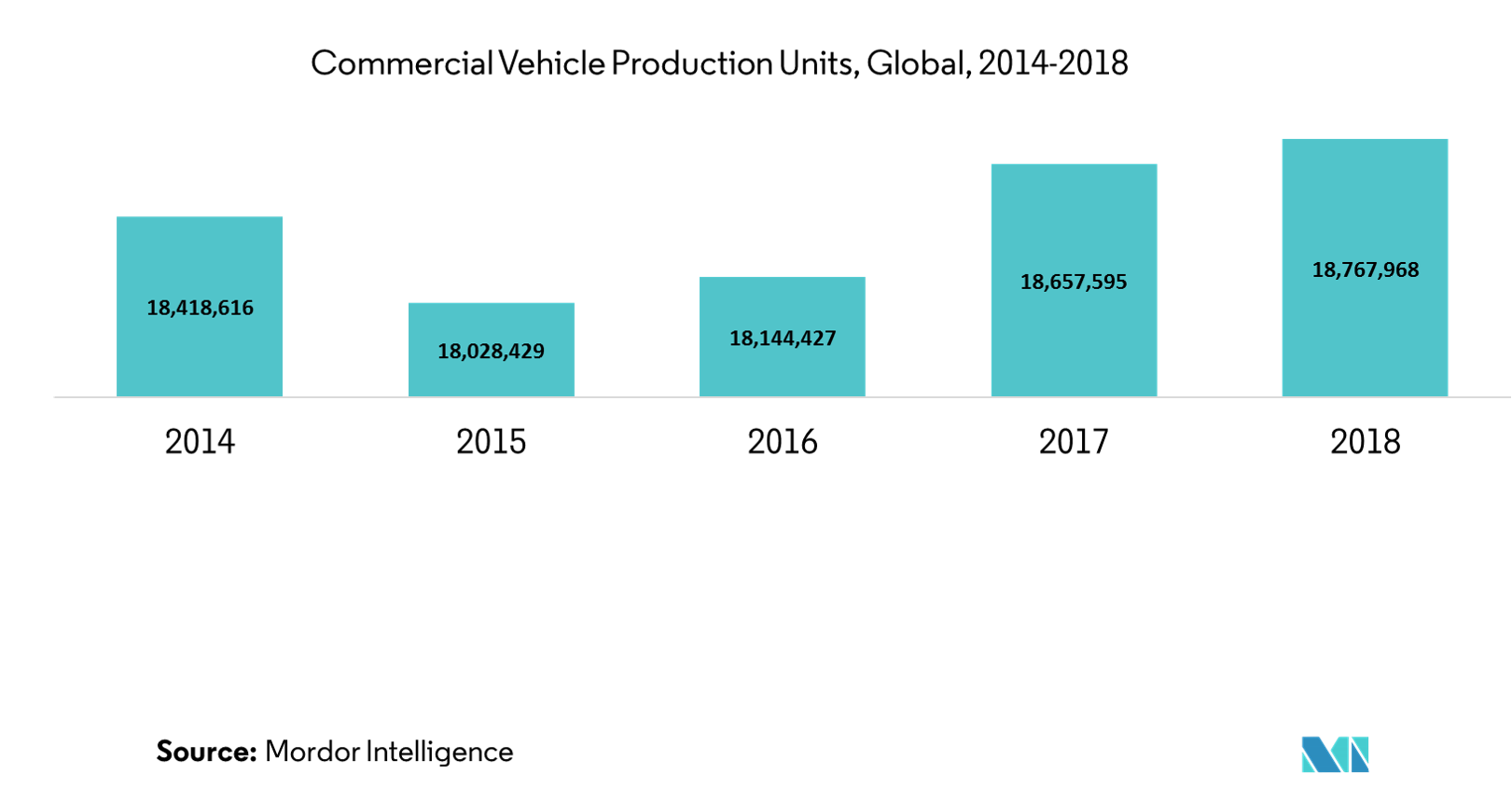

Growth opportunities in the Commercial Fleet Market

- Commercial vehicle sales in China were down 13%, reflecting 351,000 units, according to the China Association of Automobile Manufacturers (CAAM). Meanwhile, commercial vehicle production was also down: 8.8% month over month and down 8.5% year-over-year.

- The number of commercial vehicles sold in South Korea rose steadily from 2012 to 2015 (from 234,000 to 262,000) but took a slight dip in 2016 to 256,000. That number rose again in 2017 to 263,000 and was tracked at 60,000 vehicles, in March 2018.

- Commercial fleet registrations in Germany increased by 14.9% in July and also helped the new passenger car segment achieve its best month since 2009.

- Registrations of light commercial vehicles (LCVs) in Brazil were up 15.6% in May 2019, compared to the same time last year, and were also up by 9.9%, year-to-date. Truck registrations were also up significantly, comparing the numbers in May 2019 to the same time last year, up by 62.2%. Registrations for this segment were also up, year-to-date, 48.5%. When broken down by fuel type, sales of flexible-fuel vehicles were up 21.6%, year-over-year, and diesel vehicles were up 21.5% from a year ago. Hybrid and electric vehicles increased by 18.2% to 357 units, while, gasoline vehicles decreased 16% to 6,196 units.

It was observed that, globally, the fleet sizes and sales fluctuated in 2018 and 2019. But due to the increasing technology integration in commercial fleets insurance, the market has witnessed positive growth.

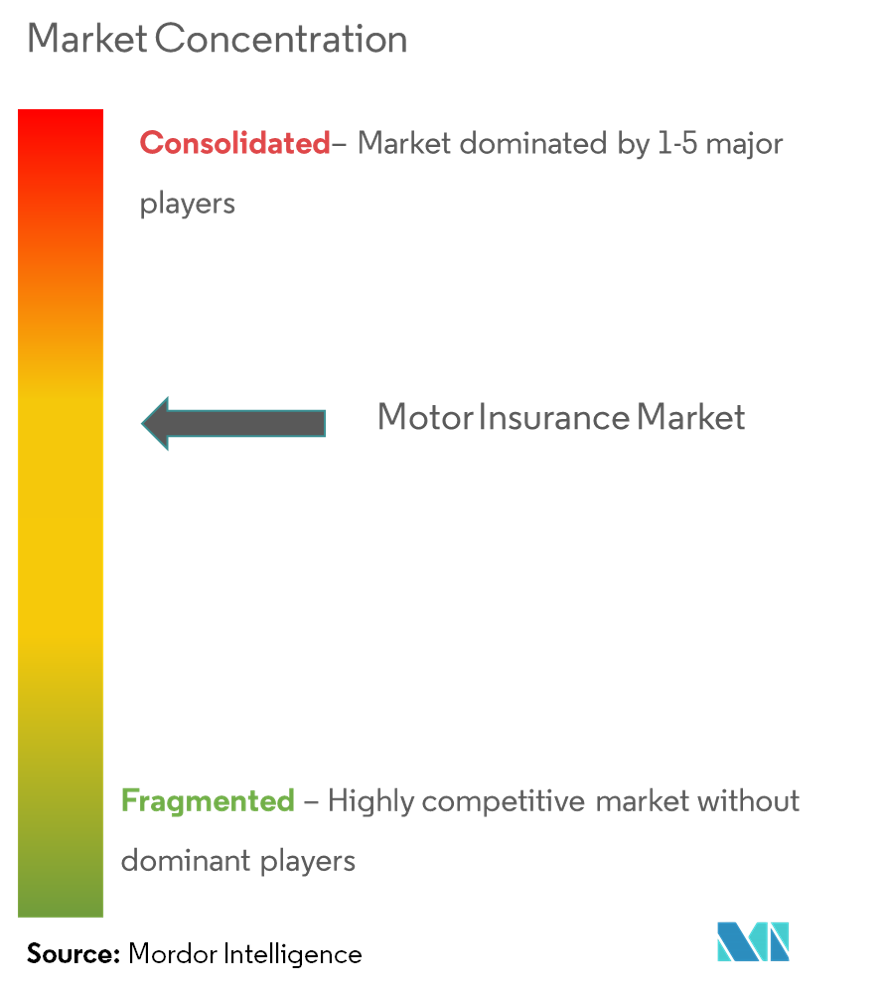

Motor Insurance Industry Overview

Motor Insurance Market Leaders

-

Allianz SE

-

Ping An Insurance (Group) Co of China Ltd

-

ICICI Lombard General Insurance Co Ltd

-

Sompo Holdings Inc

-

Aviva Plc

*Disclaimer: Major Players sorted in no particular order

Motor Insurance Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Growth Drivers

- 4.3 Market Challenges

- 4.4 Value Chain / Supply Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Government Regulations

- 4.7 Insights on InsurTech

- 4.8 Insights on the Global Economy

- 4.9 Insights on Global Vehicle Demand

- 4.10 Effects of Global Demographics on the Market

- 4.11 Insights on Distribution of the Market between the Passenger Vehicle and Commercial Vehicle Lines

- 4.12 Insights and Trends on Fleet Insurance

5. MARKET SEGMENTATION

-

5.1 Geography

- 5.1.1 North America

- 5.1.2 Europe

- 5.1.3 Asia-Pacific

- 5.1.4 Middle East & Africa

- 5.1.5 Latin America

-

5.2 Policy Type

- 5.2.1 Third-party Liability

- 5.2.2 Third-party Fire and Theft

- 5.2.3 Comprehensive

6. COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

-

6.2 Company Profiles

- 6.2.1 Allianz SE

- 6.2.2 PICC Property and Casualty Co Ltd

- 6.2.3 Ping An Insurance (Group) Co of China Ltd

- 6.2.4 ICICI Lombard General Insurance Co Ltd

- 6.2.5 Sompo Holdings Inc

- 6.2.6 Samsung Fire and Marine Insurance Co Ltd

- 6.2.7 Aviva Plc

- 6.2.8 State Farm Mutual Automobile Insurance Company

- 6.2.9 GEICO

- 6.2.10 Porto Seguro S.A*

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. DISCLAIMER

** Subject To AvailablityMotor Insurance Industry Segmentation

The Motor Insurance Market report covers the global picture of motor insurance market by emphasizing Net and Gross premiums collected across the major parts of the world. The reportindividually captures the different regions like North and Latin Americas, Europe, Middle East & Africa and Asia- Pacific regions. The report further segmented by policy types like Third Party Liability, Third Party Fire and Theft, and Comprehensive Insurance.

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Middle East & Africa | |

| Latin America | |

| Policy Type | Third-party Liability |

| Third-party Fire and Theft | |

| Comprehensive |

Motor Insurance Market Research FAQs

What is the current Motor Insurance Market size?

The Motor Insurance Market is projected to register a CAGR of 5.03% during the forecast period (2024-2029)

Who are the key players in Motor Insurance Market?

Allianz SE, Ping An Insurance (Group) Co of China Ltd, ICICI Lombard General Insurance Co Ltd, Sompo Holdings Inc and Aviva Plc are the major companies operating in the Motor Insurance Market.

Which is the fastest growing region in Motor Insurance Market?

Asia is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Motor Insurance Market?

In 2024, the North America accounts for the largest market share in Motor Insurance Market.

What years does this Motor Insurance Market cover?

The report covers the Motor Insurance Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Motor Insurance Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Motor Insurance Industry Report

Statistics for the 2024 Motor Insurance market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Motor Insurance analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.