Mycotoxin Testing Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 11.70 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

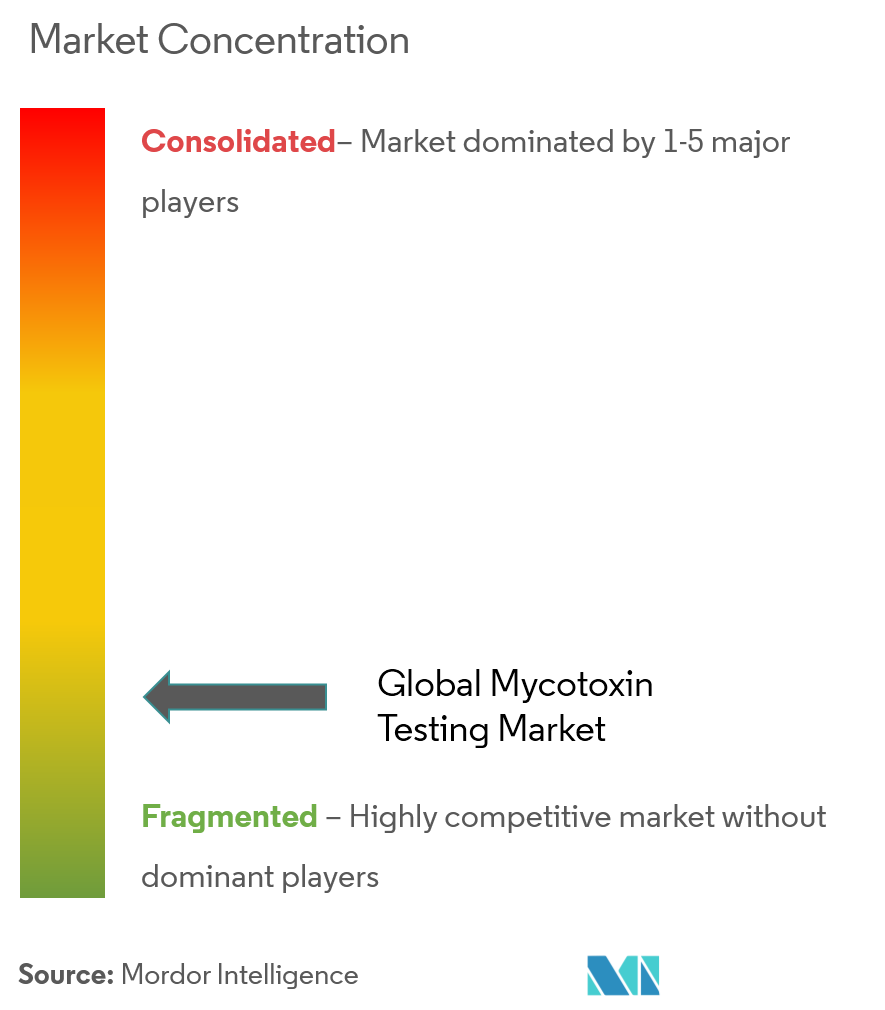

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Mycotoxin Testing Market Analysis

The global mycotoxin testing market is projected to grow at a CAGR of 11.7% during the forecast period.

- The mycotoxin testing ensures that the products are carcinogenic-free, and complies with the International regulation standards. Mycotoxins are toxic chemical compounds produced by a fungus, which can lead to various diseases and even death.

- Cereals and grains are the products that get affected by the fungus, during storage. Therefore, mycotoxin testing becomes necessary for such products, to eliminate the risk of health hazards.

- Fusarium mycotoxins likely to hold a major portion of the global mycotoxin testing market share.

Impact of COVID-19 on the Market:

- The distorting effect of the virus in the region was majorly attributed to bad health profiles and low immunity, majorly contributed by the prevalence of unhealthy eating habits and lack of physical activities practiced by consumers. Europeans are now expected to be extra conscious about their food choices, with more focus toward health-building supplements, functional foods, and juices. This depicts promising applications for food safety testing services in the future.

- Despite no evidences being found on the spread of virus through food and its packaging, food manufacturers in the region are constantly looking for a double check, in terms of providing safe food to consumers.

- Considering the possible contingencies of food manufacturers to offer virus-proof food products to consumers and gain a competitive edge over other market players, the demand for Mycotoxin testing may be moderately uplifted in 2020 and in the following years.

Mycotoxin Testing Market Trends

This section covers the major market trends shaping the Mycotoxin Testing Market according to our research experts:

Immunoassay-based is the Fastest Growing Mycotoxin Testing Technology

ELISA (enzyme-linked immunosorbent assay) is one of the most popular immunologically-based methods used in test kits for the analysis of mycotoxins in foods and feeds. ELISA method for detection of mycotoxins has been used by a number of food safety manufacturers and has been available for a decade now. The method is based on the ability of a specific antibody to distinguish the three-dimensional structure of a specific mycotoxin.

ELISA mycotoxin tests are considered as high throughput assays with low sample volume requirements and often less sample extract clean-up procedures in comparison to the conventional methods, such as TLC and HPLC. ELISA detection method is reliable, rapid, specific, sensitive, easier, and portable for use in the field for the detection of mycotoxins in foods and feeds.

Europe Held the Highest Share in Mycotoxin Testing Market

Aflatoxin contamination of agricultural commodities poses considerable risk to human and livestock health and economic losses. Exposure of human to aflatoxin leads to several health-related conditions, including acute and chronic aflatoxicosis, immune suppression, liver cancer, liver cirrhosis, stunted growth in children, and many others. Aflatoxins are detected in several crops, especially in maize and groundnuts. Aflatoxin is the most important contaminant on the Rapid Alert System for Food and Feed (RASFF) of the European Union. In 2008, aflatoxins alone were responsible for almost 30% of all the notifications to the RASFF system (902 notifications). Fumonisins FB1 and FB2 have been found in rural areas of South Africa, in homegrown corn produced and consumed by the people living in those areas. Commercial corn-based human food products from retail outlets in several countries contain fumonisins

Mycotoxin Testing Industry Overview

Global mycotoxin testing market is highly competitive with the presence of few major players SGS S.A., Bureau Veritas S.A., Intertek Group Plc, Als Limited, Eurofins Scientific, Dts Laboratories, Ils Limited, Covance Inc., Silliker, Inc., and Asurequality Limited.

Mycotoxin Testing Market Leaders

-

Eurofins Scientific

-

Intertek Group plc

-

SGS SA

-

Bureau Veritas S.A.

-

ALS Limited

*Disclaimer: Major Players sorted in no particular order

Mycotoxin Testing Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables and Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Technology

- 5.1.1 HPLC-based

- 5.1.2 LC-MS/MS-based

- 5.1.3 Immunoassay-based

- 5.1.4 Other Technologies

-

5.2 By Pathogen Type

- 5.2.1 Aflatoxins

- 5.2.2 Ochratoxin A

- 5.2.3 Patulin

- 5.2.4 Fusarium Toxins

- 5.2.5 Other Mycotoxins

-

5.3 By Type

- 5.3.1 Beverage

- 5.3.2 Food

- 5.3.2.1 Meat and Poultry

- 5.3.2.2 Dairy

- 5.3.2.3 Fruits and Vegetables

- 5.3.2.4 Processed Food

- 5.3.2.5 Other Food

-

5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Australia

- 5.4.3.4 Japan

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Positioning Analysis

-

6.4 Company Profiles

- 6.4.1 Eurofins Scientific

- 6.4.2 Intertek Group plc

- 6.4.3 SGS SA

- 6.4.4 Bureau Veritas S.A.

- 6.4.5 ALS Limited

- 6.4.6 Symbio Laboratories

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. IMPACT OF COVID-19 ON THE MARKET

** Subject To AvailablityMycotoxin Testing Industry Segmentation

The global mycotoxin testing market is segmented by technology into HPLC-based, LC-MS/MS-based, Immunoassay-based, and Other Technologies. By pathogen type into Aflatoxins, Ochratoxin A, Patulin, Fusarium Toxins, Other Mycotoxins. By application into beverages and foods. By geography, the scope includes North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

| By Technology | HPLC-based | |

| LC-MS/MS-based | ||

| Immunoassay-based | ||

| Other Technologies | ||

| By Pathogen Type | Aflatoxins | |

| Ochratoxin A | ||

| Patulin | ||

| Fusarium Toxins | ||

| Other Mycotoxins | ||

| By Type | Beverage | |

| Food | Meat and Poultry | |

| Dairy | ||

| Fruits and Vegetables | ||

| Processed Food | ||

| Other Food | ||

| By Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| By Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Russia | ||

| Spain | ||

| Rest of Europe | ||

| By Geography | Asia-Pacific | India |

| China | ||

| Australia | ||

| Japan | ||

| Rest of Asia-Pacific | ||

| By Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| By Geography | Middle East & Africa | South Africa |

| Saudi Arabia | ||

| Rest of Middle East & Africa |

Mycotoxin Testing Market Research FAQs

What is the current Mycotoxin Testing Market size?

The Mycotoxin Testing Market is projected to register a CAGR of 11.70% during the forecast period (2024-2029)

Who are the key players in Mycotoxin Testing Market?

Eurofins Scientific, Intertek Group plc, SGS SA, Bureau Veritas S.A. and ALS Limited are the major companies operating in the Mycotoxin Testing Market.

Which is the fastest growing region in Mycotoxin Testing Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Mycotoxin Testing Market?

In 2024, the North America accounts for the largest market share in Mycotoxin Testing Market.

What years does this Mycotoxin Testing Market cover?

The report covers the Mycotoxin Testing Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Mycotoxin Testing Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Mycotoxins Testing Industry Report

Statistics for the 2024 Mycotoxins Testing market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Mycotoxins Testing analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.