Nano Paints & Coatings Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| CAGR | 4.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

Major Players*Disclaimer: Major Players sorted in no particular order |

Nano Paints & Coatings Market Analysis

The market for nano paints & coatings market is expected to expand at a CAGR of more than 4% during the forecast period. The major factor driving the market studied is thegrowing demand from the aerospace & defense industry.

- Increasing demandsfromvarious end-user industriesare likely to act as an opportunity in the future.

- Asia-Pacific dominated the market across the globe with the largest consumption in countries such as China, India, etc.

Nano Paints & Coatings Market Trends

This section covers the major market trends shaping the Nano Paints & Coatings Market according to our research experts:

Graphene to Dominate the Market

- Graphene nanoplatelets, due to their excellent properties, such as high thermal and electrical conductivity, stability, increased stiffness and strength, and surface hardness, are used in a wide range of applications. Moreover, it is flame retardant and also reduces the component mass and improves the appearance of the surface.

- The higher efficiency of graphene has supported its growing usage by replacing carbon fiber, nano-clays, carbon nanotubes, and other composite materials in various applications.

- These properties have increased the usage of graphene nanoplatelets in polymeric materials, including thermoset and thermoplastic materials & elastomers, natural & synthetic rubbers, and paints & coatings.

- Graphene enables a wide range of functional paints, for many potential applications. These applications include high-performance adhesives enabled by graphene's high adhesion property, solar paints, anti-bacterial coatings, anti-fog paints, anti-rust coatings, and UV ray blockers, among others.

- The usage of these nanoplatelets has increased in various applications, due to the cost effectiveness and better physical and mechanical properties.

- The market for graphene nanoplatelets is expected to grow at a very high rate, due to the increased demand in a wide range of applications, such as aerospace, electronics, transportation, paints and coatings, sports equipment and biomedical & healthcare, among others.

China to Dominate the Asia-Pacific Region

- The Chinese manufacturing industry is currently the largest in the world. The manufacturing industry in the country was supported by low labor and material costs, during its initial growing phase, and is being supported by better infrastructure and favorable policies in the recent times.

- The growth in technology and increase in investments in R&D with government support has driven the market for nano paints & coatings, with increasing usage in various applications. China has increased its investment budget in recent years for nanotechnology, with more research papers published.

- China’s domestic air passenger market experienced the biggest incremental rise in terms of number of journeys made by passengers in previous year.

- The increase in the numbers of passengers encourages the government to invest more, in green signaling additional flights, which, in turn, may help to increase the usage of nano paints & coatings.

- The Chinese automotive manufacturing industry is the largest in the world. The automotive industry is growing rapidly, with the increasing automobile production and sales.

- Overall, the growing demand from various end-user industries is likely to increase the consumption of nano paints & coatings in the country during the forecast period.

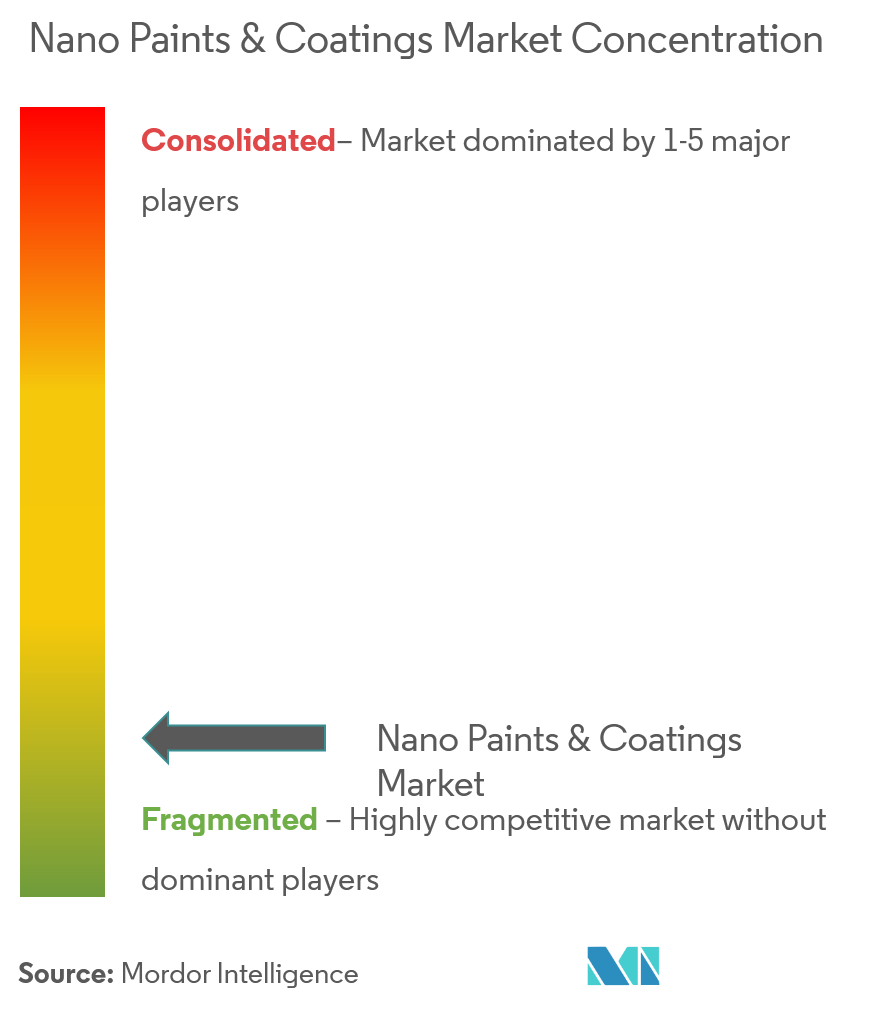

Nano Paints & Coatings Industry Overview

The nano paints & coatings market is fragmented. The major companies include Evonik Industries AG, Henkel AG & Co. KGaA, PPG Industries Inc., Nanovere Technologies LLC, NanoShine LTD, etc.

Nano Paints & Coatings Market Leaders

-

Evonik Industries AG

-

Henkel AG & Co. KGaA

-

PPG Industries, Inc

-

Nanovere Technologies LLC,

-

NanoShine LTD

*Disclaimer: Major Players sorted in no particular order

Nano Paints & Coatings Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

-

4.1 Drivers

- 4.1.1 Growing Demand from the Aerospace & Defense Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.3 Industry Value-Chain Analysis

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5. MARKET SEGMENTATION

-

5.1 Resin Type

- 5.1.1 Graphene

- 5.1.2 Carbon Nanotubes

- 5.1.3 Nano-SiO2 (Silicon Dioxide)

- 5.1.4 Nano Silver

- 5.1.5 Nano-TiO2 (Titanium Dioxide)

- 5.1.6 Nano-ZNO

-

5.2 Method

- 5.2.1 Electrospray and Electro Spinning

- 5.2.2 Chemical Vapor Deposition (CVD)

- 5.2.3 Physical Vapor Deposition (PVD)

- 5.2.4 Atomic Layer Deposition (ALD)

- 5.2.5 Aerosol Coating

- 5.2.6 Self-assembly

- 5.2.7 Sol-gel

-

5.3 End-user Industry

- 5.3.1 Biomedical

- 5.3.2 Food & Packaging

- 5.3.3 Aerospace & Defense

- 5.3.4 Marine

- 5.3.5 Electronics & Optics

- 5.3.6 Automobile

- 5.3.7 Oil & Gas

- 5.3.8 Others

-

5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

-

6.4 Company Profiles

- 6.4.1 Artekya Teknoloji

- 6.4.2 CTC Nanotechnology GmbH

- 6.4.3 Evonik Industries AG

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 icannanopaints.com ( Innovation Center for Applied Nanotechnology)

- 6.4.6 NanoShine Ltd

- 6.4.7 Nanovere Technologies LLC

- 6.4.8 Nano-Z Coating Ltd

- 6.4.9 Pearl Nano LLC

- 6.4.10 PPG Industries Inc.

- 6.4.11 Starshield Technologies Pvt Ltd

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase Demand from Various End-User Industries

Nano Paints & Coatings Industry Segmentation

The nano paints & coatings market report includes:

| Resin Type | Graphene | |

| Carbon Nanotubes | ||

| Nano-SiO2 (Silicon Dioxide) | ||

| Nano Silver | ||

| Nano-TiO2 (Titanium Dioxide) | ||

| Nano-ZNO | ||

| Method | Electrospray and Electro Spinning | |

| Chemical Vapor Deposition (CVD) | ||

| Physical Vapor Deposition (PVD) | ||

| Atomic Layer Deposition (ALD) | ||

| Aerosol Coating | ||

| Self-assembly | ||

| Sol-gel | ||

| End-user Industry | Biomedical | |

| Food & Packaging | ||

| Aerospace & Defense | ||

| Marine | ||

| Electronics & Optics | ||

| Automobile | ||

| Oil & Gas | ||

| Others | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| Italy | ||

| France | ||

| Rest of Europe | ||

| Geography | Rest of the World | South America |

| Middle East & Africa |

Nano Paints & Coatings Market Research FAQs

What is the current Nano Paints & Coatings Market size?

The Nano Paints & Coatings Market is projected to register a CAGR of greater than 4% during the forecast period (2024-2029)

Who are the key players in Nano Paints & Coatings Market?

Evonik Industries AG, Henkel AG & Co. KGaA, PPG Industries, Inc, Nanovere Technologies LLC, and NanoShine LTD are the major companies operating in the Nano Paints & Coatings Market.

Which is the fastest growing region in Nano Paints & Coatings Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Nano Paints & Coatings Market?

In 2024, the Asia Pacific accounts for the largest market share in Nano Paints & Coatings Market.

What years does this Nano Paints & Coatings Market cover?

The report covers the Nano Paints & Coatings Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Nano Paints & Coatings Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Nano Paints & Coatings Industry Report

Statistics for the 2024 Nano Paints & Coatings market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Nano Paints & Coatings analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.