Network Forensics Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 14.90 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

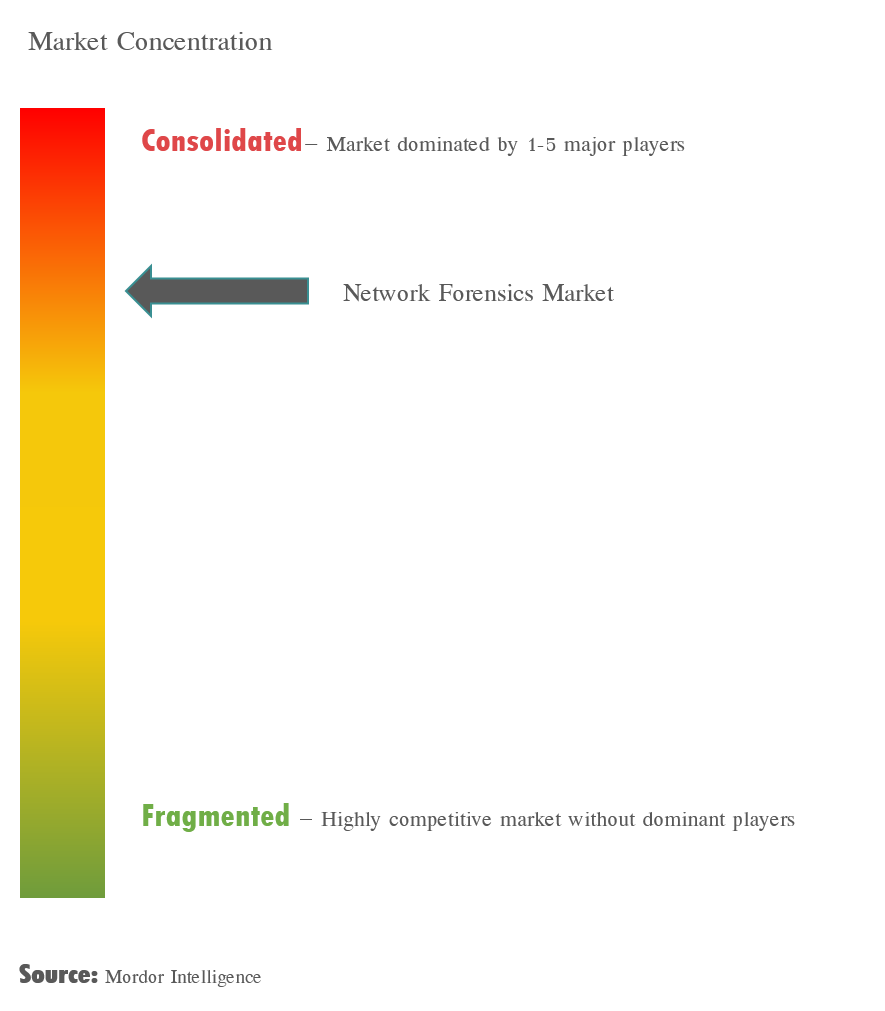

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Network Forensics Market Analysis

The Network Forensics Market was valued at USD 2.13 billion in 2020 and is expected to reach USD 4.84 billion by 2026 and grow at a CAGR of 14.9% over the forecast period (2021-2026).

- As enterprises are continuously being targeted by hackers, and the malware are circumventing existing security systems and not triggering alarms on traditional security information and event management (SIEM) tools. Network forensics is enabling companies to better protect data and realize vulnerabilities in the system. With the increasing investments in security in the technological landscape, network forensics is emerging as one of the leading solutions in the industry.

- Increasing trends of BYOD and remote computing are creating a need for technologies that can be deployed instantly and scaled without the need for additional infrastructure. Additionally, with industries shifting most of the computing needs to cloud, the need for security in this application is on a rise. Due to companies offering flexible pricing and demand-based models, cloud-based models are witnessing an accelerated growth in the market, which is anticipated to continue during the forecast period.

- Small and medium businesses, which are more prone to attacks, find the need to deploy better security systems, however, the affordability comes into play to hire in-house full-time security professional. Therefore, most of the business coming from SMBs is through managed services.

Network Forensics Market Trends

This section covers the major market trends shaping the Network Forensics Market according to our research experts:

IT and Telecom Sector to Account for a Significant Share

- IT and telecom companies form a major segment in the critical infrastructure of any country, and multiple industries depend on their network for being operational. Therefore, the impact of a network attack can be vast and far-reaching, if it impacts the IT and telecom industry. Even a minor attack, or claims of an attack, can lead a company to shut down the critical services that the consumers and businesses rely upon.

- The sector is also booming with opportunities for network operators to transform their revenue models, through the development of advanced and innovative digital services, related to IoT, 5G, e-commerce, OTT communications, and mobile payments or managed services.

- At the same time, offering an enhanced network experience and implementing innovative and customized services are essential to driving up revenue.

- These factors are also motivating the studied market vendors to innovate their product offering, targeting these customers.

- Leading organizations have been attacked by phishers. Therefore, proper cyber security skills are especially important when it comes to security analytics and operations, according to the vendors in the market.

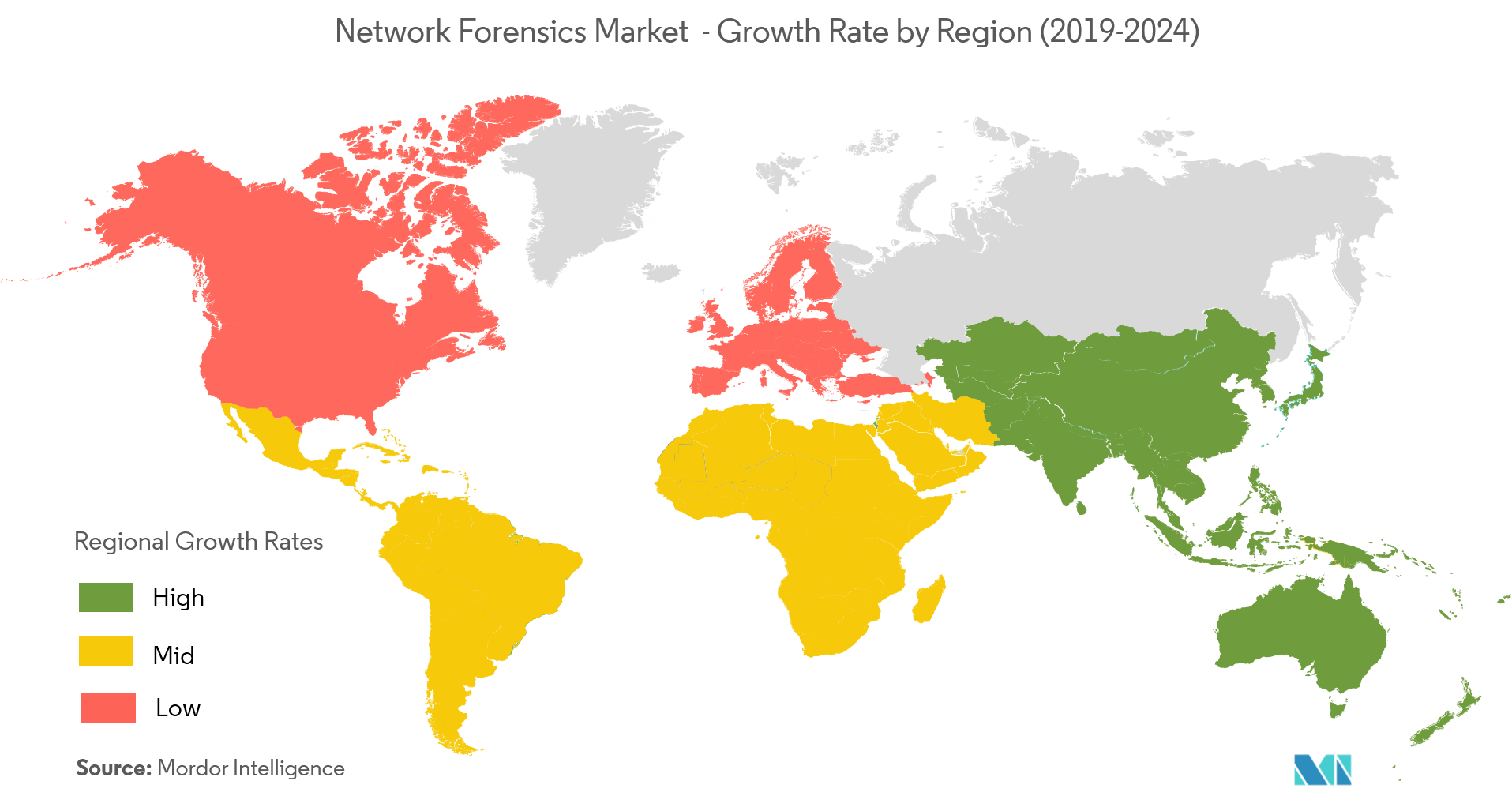

North America to Dominate the Market

- North America, among the lead innovators and pioneers, in terms of adoption of network forensics solutions, is one of the largest markets. Moreover, the region has a strong foothold of vendors in the market.

- The increasing use of the internet and digital communications systems, especially in the shape of the Internet of things (IoT), leads to the increasing demand for competence in network forensics

- The growing popularity of IoT and BYOD trends has also resulted in the growth of cyber-crimes, forcing organizations to use network security solutions. The rise in connected devices in the region has made enterprise networks more complex. The evolving network landscape has generated the need among enterprises to reassess their network security infrastructure and adopt robust network solutions.

- The US Department of Defense has invested a massive amount in modernizing their infrastructure in the past. In April 2018, the Defense Systems Information Agency (DISA) of DoD announced their plan to upgrade the Defense Information Systems Network (DISN) with 10 gigabits per second (Gbps) transport speeds to a 100 Gbps packet-optical transport system.

Network Forensics Industry Overview

Some of the key players are Symantec Corporation, Cisco Systems Inc., IBM Corporation, Netscout Systems Inc., Viavi Solutions Inc., Fireeye Inc., RSA Security LLC, FireEye Inc., and NIKSUN Incorporated, among others. This market is characterized by growing levels of product penetration, moderate product differentiation, and high levels of competition. Vendors in the market are exhibiting acquisitions as a core strategy, in order, to increase their portfolio. Most of these startups have been acquired by market incumbents.Therefore, the emergence of security firms by acquisitions of businesses specializing in network forensics intensifies the competitive rivalry further. Hence, the market is consolidated.

- February 2019 -IBM announced a new portfolio of Internet of Things (IoT) solutions, which team artificial intelligence (AI) and advanced analytics designed to help asset intensive organizations, like theMetropolitan Atlanta Rapid Transit Authority (MARTA), to improve maintenance strategies.

- February 2019 - IBM developed a new technology to predict and monitor when and where trees and vegetation threaten the power lines, which may help improve power supply operations and reduce outages.

Network Forensics Market Leaders

-

Broadcom Inc. (Symantec Corporation)

-

Cisco Systems Inc.

-

IBM Corporation

-

Netscout Systems Inc.

-

Valvi Solutions Inc.

*Disclaimer: Major Players sorted in no particular order

Network Forensics Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Scope of the Study

- 1.3 Study Assumptions

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Adoption of Cloud and Network Technologies

- 4.3.2 Increasing Cases of Cyberattacks

-

4.4 Market Restraints

- 4.4.1 Lack of Skilled Professionals

-

4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Value Chain Analysis

5. MARKET SEGMENTATION

-

5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

-

5.2 By Size of Enterprise

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

-

5.3 By End-user Industry

- 5.3.1 IT and Telecom

- 5.3.2 BFSI

- 5.3.3 Retail

- 5.3.4 Government

- 5.3.5 Healthcare

- 5.3.6 Manufacturing

- 5.3.7 Other End-user Industries

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Australia

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Latin America

- 5.4.4.2 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Broadcom Inc. (Symantec Corporation)

- 6.1.2 Cisco Systems Inc.

- 6.1.3 IBM Corporation

- 6.1.4 Netscout Systems Inc.

- 6.1.5 Fireye Inc.

- 6.1.6 EMC RSA

- 6.1.7 AccessData Group

- 6.1.8 Logrhythm Inc.

- 6.1.9 LiveAction Inc.

- 6.1.10 Valvi Solutions Inc.

- 6.1.11 Niksun Inc.

- 6.1.12 Cyber Diligence Inc.

- 6.1.13 Netfort (Rapid7 Inc.)

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityNetwork Forensics Industry Segmentation

Network security has become one of the most important aspects in the current connected landscape, with the amount of data traffic handled by network infrastructures increasing at an unprecedented rate. Network forensics is enabling companies to better protect data and realize vulnerabilities in the system. With the increasing investments in security in the technological landscape, network forensics is emerging as one of the leading solutions in the industry.

| By Component | Solutions | |

| Services | ||

| By Size of Enterprise | Small and Medium Enterprises | |

| Large Enterprises | ||

| By End-user Industry | IT and Telecom | |

| BFSI | ||

| Retail | ||

| Government | ||

| Healthcare | ||

| Manufacturing | ||

| Other End-user Industries | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle-East & Africa |

Network Forensics Market Research FAQs

What is the current Network Forensics Market size?

The Network Forensics Market is projected to register a CAGR of 14.90% during the forecast period (2024-2029)

Who are the key players in Network Forensics Market?

Broadcom Inc. (Symantec Corporation), Cisco Systems Inc., IBM Corporation, Netscout Systems Inc. and Valvi Solutions Inc. are the major companies operating in the Network Forensics Market.

Which is the fastest growing region in Network Forensics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Network Forensics Market?

In 2024, the North America accounts for the largest market share in Network Forensics Market.

What years does this Network Forensics Market cover?

The report covers the Network Forensics Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Network Forensics Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Network Forensics Industry Report

Statistics for the 2024 Network Forensics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Network Forensics analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.