North America Dairy Based Beverages Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 6.23 % |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

North America Dairy Based Beverages Market Analysis

North America dairy beverages market is expected to register a CAGR of 6.23%, during the forecast period of 2020-2025.

- The demand of new flavored and nutrition rich dairy product gaining popularity, as the consumers are shifting to the vegan diet to fulfill their nutrition needs. The market of flavored milk is the major focus for increasing the growth in this sector.

- Increasing consumer awareness, especially for functional foods and dietary supplements, has been a majorfactor for market development in recent times.

North America Dairy Based Beverages Market Trends

This section covers the major market trends shaping the North America Dairy Based Beverages Market according to our research experts:

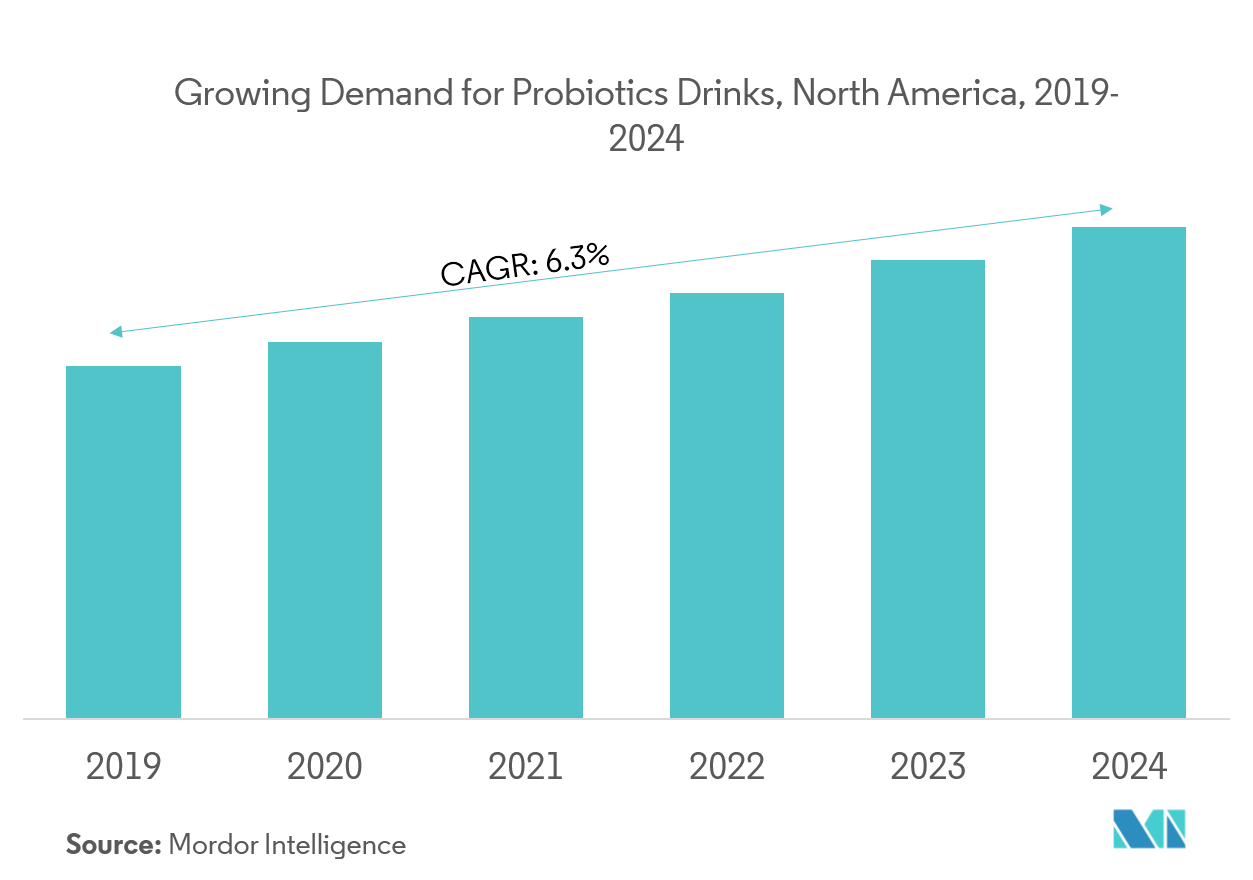

Growing Demand for Probiotic Beverages

Consumers are looking for beverages that give an additional benefit other than quenching their thirst. The increasing amount of health conscious population is the major factor boosting the growth of the dairy-based probiotic beverage market. Probiotic beverages have additional nutritional benefits that may help to maintain the balance of the body, especially the gut. Many fruit and beverages companies are extending their product line by adding probiotic beverages to their portfolio, which includes functional beverages. Functional foods and probiotic drinks are a trending food habit all over the world.

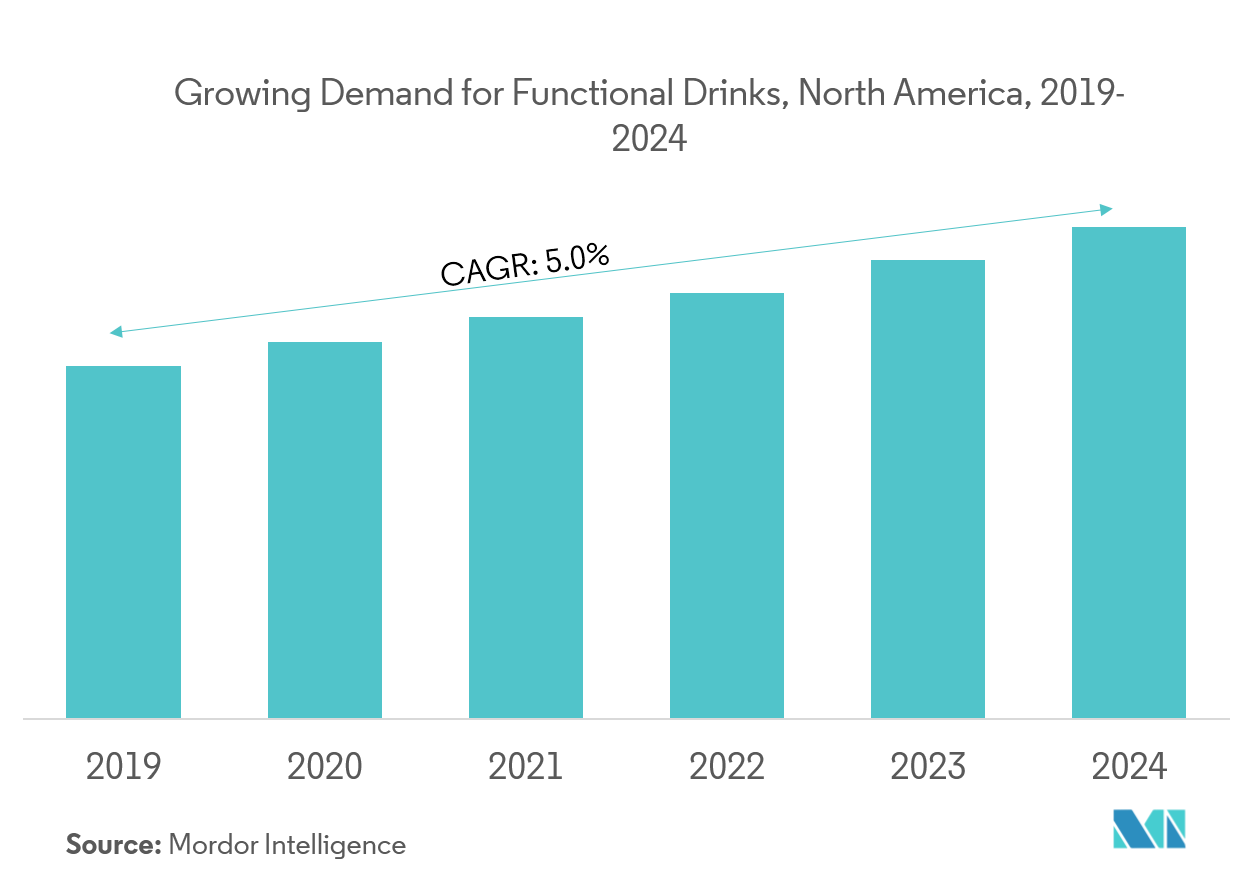

Growing Demand for Functional Beverages

The market for dairy based beverage is increasing very rapidly, as consumers are paying more attention to health and well-being. In North American, beverages are no longer viewed solely as a quick refreshment. However, they have become more convenient nutrient and food supplement products. The region is strongly influenced by consumer focus on gut health augmenting the probiotic and functional drinks market. Dairy beverage manufacturers are marketing various probiotic and functional drinks by emphasizing on their good health benefits, greater accessibility, and the availability of multiple flavors. The consumer segments driving the growth of the market include ageing consumers looking for vitality, millennials who are willing to try new products with wellness benefits, and busy consumers seeking for ‘quick health’.

North America Dairy Based Beverages Industry Overview

Some of the major players in the North America dairy beverages market are Arla foods, BASF, Blue Diamond Growers Inc, Kroger, Living Harvest Foods Inc, Nestle, Chr. Hansen, Dean Foods, and Danone, among others.

North America Dairy Based Beverages Market Leaders

-

Blue Diamond Growers Inc.

-

Kroger Company

-

Living Harvest Foods Inc.

-

BASF

-

Nestle

*Disclaimer: Major Players sorted in no particular order

North America Dairy Based Beverages Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Standard White Milk

- 5.1.2 Flavored Milk

- 5.1.3 Drinking Yoghurt

- 5.1.4 Functional Milk

- 5.1.5 Others

-

5.2 By Packaging

- 5.2.1 Canned

- 5.2.2 Bottle

- 5.2.3 Pouch

- 5.2.4 Others

-

5.3 By Distribution Channel

- 5.3.1 Convenience stores

- 5.3.2 Supermarkets/hypermarkets

- 5.3.3 Grocery Stores

- 5.3.4 Online Retailer

- 5.3.5 Others

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Mexico

- 5.4.1.3 Canada

- 5.4.1.4 Reat of North America

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Blue Diamond Growers Inc.

- 6.4.2 Kroger Company

- 6.4.3 Eden Foods Inc

- 6.4.4 Nestle

- 6.4.5 Arla Foods

- 6.4.6 Chr. Hansen

- 6.4.7 Dean Foods

- 6.4.8 Danone

- 6.4.9 Organic Valley

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityNorth America Dairy Based Beverages Industry Segmentation

North America dairy beverage market is segmented by type, packaging, and distribution channels. By type the dairy beverage market is segmented into standard white milk, flavored milk, drinking yoghurt, functional milk, and others. Standard white milk holds the highest share in the global dairy beverage market. By packaging type, the dairy based beverage market has been categorized into can, bottle, pouch, and others. On the basis of distribution channel, the market is segmented into convenience stores, supermarkets/hypermarkets, grocery stores, online, and others. Also, the study provides an analysis of the dairy beverages market in the emerging and established markets across the region, including United States, Mexico, Canada, and rest of the North America.

| By Type | Standard White Milk | |

| Flavored Milk | ||

| Drinking Yoghurt | ||

| Functional Milk | ||

| Others | ||

| By Packaging | Canned | |

| Bottle | ||

| Pouch | ||

| Others | ||

| By Distribution Channel | Convenience stores | |

| Supermarkets/hypermarkets | ||

| Grocery Stores | ||

| Online Retailer | ||

| Others | ||

| Geography | North America | United States |

| Mexico | ||

| Canada | ||

| Reat of North America |

North America Dairy Based Beverages Market Research FAQs

What is the current North America Dairy Beverages Market size?

The North America Dairy Beverages Market is projected to register a CAGR of 6.23% during the forecast period (2024-2029)

Who are the key players in North America Dairy Beverages Market?

Blue Diamond Growers Inc., Kroger Company, Living Harvest Foods Inc., BASF and Nestle are the major companies operating in the North America Dairy Beverages Market.

What years does this North America Dairy Beverages Market cover?

The report covers the North America Dairy Beverages Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the North America Dairy Beverages Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

North America Dairy Beverages Industry Report

Statistics for the 2024 North America Dairy Beverages market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Dairy Beverages analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.